What are crypto mass payouts?

Table of contents:

Crypto mass payments for business are a way to send money to many people at the same time using digital currencies. Instead of making separate transfers one by one, your company can upload one file with all payment details and process up to a hundred transactions in just a few minutes.

These crypto mass payouts are similar to bank transfers, but are faster, cheaper, and most importantly automated.

This solution is especially useful for businesses that choose to pay employees with crypto, or regularly send money to freelancers, partners, and customers. They can complete payroll, send mass payments for business suppliers, or refunds with almost no extra effort. Your company sends the total amount in crypto, and the system distributes it to each recipient.

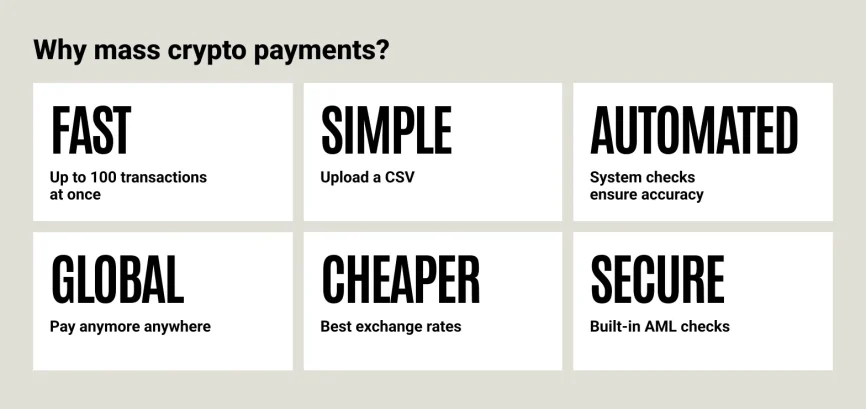

Key benefits of using crypto for mass payments

Using crypto mass payments for business is a faster, cheaper, and more secure way to manage international transfers compared to traditional methods. Below are the most important advantages that make Mass Payouts feature an efficient solution for companies.

- Speed: Processes up to 100 transactions within minutes, so payments are completed much faster.

- Simplicity: You just need to upload a CSV file with payment details. No technical knowledge or coding skills are required.

- Accuracy: The system automatically checks wallet addresses and converts currencies, reducing errors and saving time.

- Global reach: Send payments in 20+ cryptocurrencies or 40+ fiat currencies, making it easy to pay people around the world.

- Low costs & no volatility risk: The exchange rate is locked during the payment process with an instant conversion into fiat, protecting you from price swings and high fees.

- Security & compliance: AML/KYB compliance, blockchain monitoring, and regular independent audits keep every transaction safe and transparent.

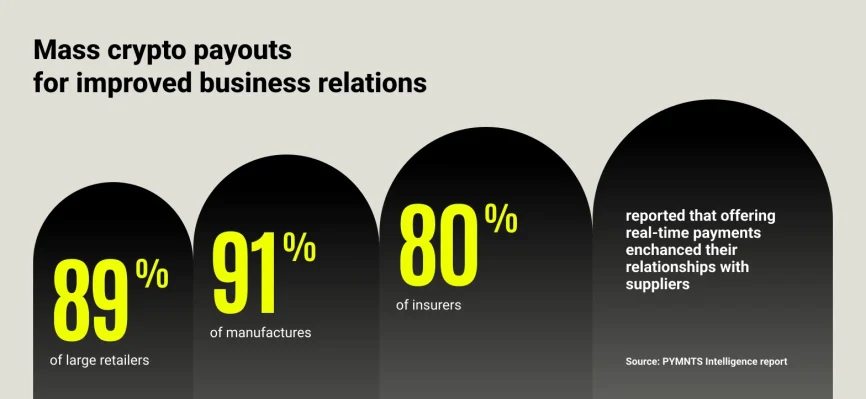

Real-world payments for everyday businesses

A PYMNTS Intelligence report found that real-time transfers can help companies manage cash flow, reduce delays and enhance B2B connections.

Moreover, CoinsPaid Crypto + Influencer & Affiliate Payouts in 2025: Market Report showcases that in industries where affiliates are global and payouts are frequent (software referral programs and e-commerce platforms), crypto mass payouts can solve many problems.

- Payrolls | Pay employees with crypto or reimburse contractors quickly, without waiting for slow bank transfers.

- Partner payments | Easily send commissions or rewards to affiliates and business partners.

- Supplier payments | Make sure your vendors are paid on time and in their preferred currency, reducing delays.

- Customer refunds | Process refunds instantly and securely, improving customer trust and satisfaction.

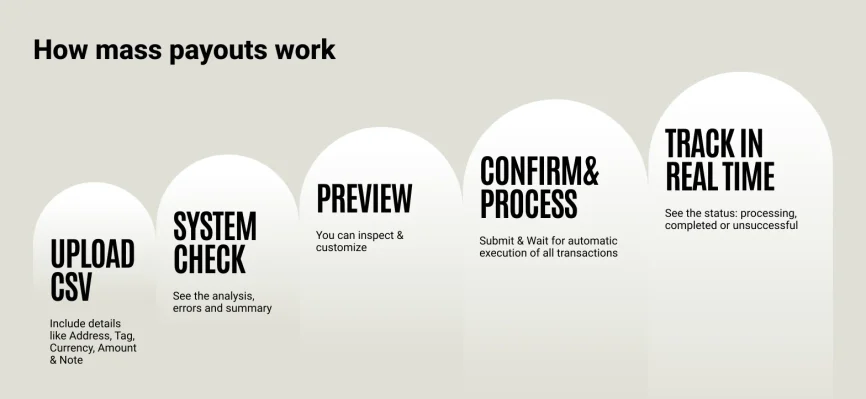

How crypto mass payouts work with CoinsPaid

Sending large-scale payouts with CoinsPaid is designed to be simple and user-friendly. Getting started requires no technical skills. You can begin quickly by uploading a basic CSV file with payment details.

This section outlines the process step by step, starting with a quick overview, then a detailed look at each stage so that you can decide if that is the right fit for your business.

Overview

- Upload CSV file: Prepare a CSV file with payment details and upload it to the Mass Payouts tab in your Back Office.

- System check: Our system analyzes the file, identifies potential errors, and provides a clear summary for your review.

- Customize: Set up either sender or receiver currencies as needed, down to individual payments. Check and confirm your final payout breakdown.

- Submit & process: Submit your mass payout – the system will automatically execute all transactions and currency exchanges.

- Track payments: Monitor the status of each transaction in real time through the Mass Payouts tab for complete transparency.

Step-by-step guide

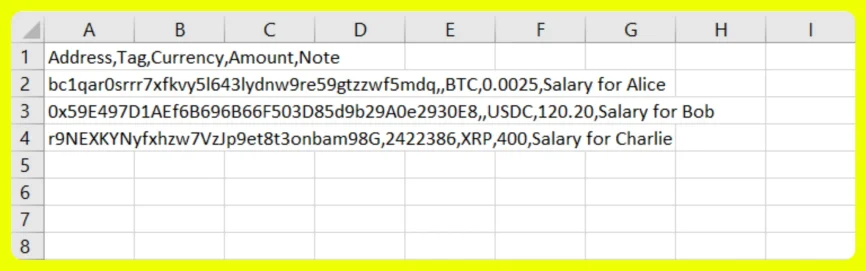

1. Prepare & upload your CSV file

- Decide whether you need a standard payout (crypto to crypto) or one with conversion (fiat to crypto).

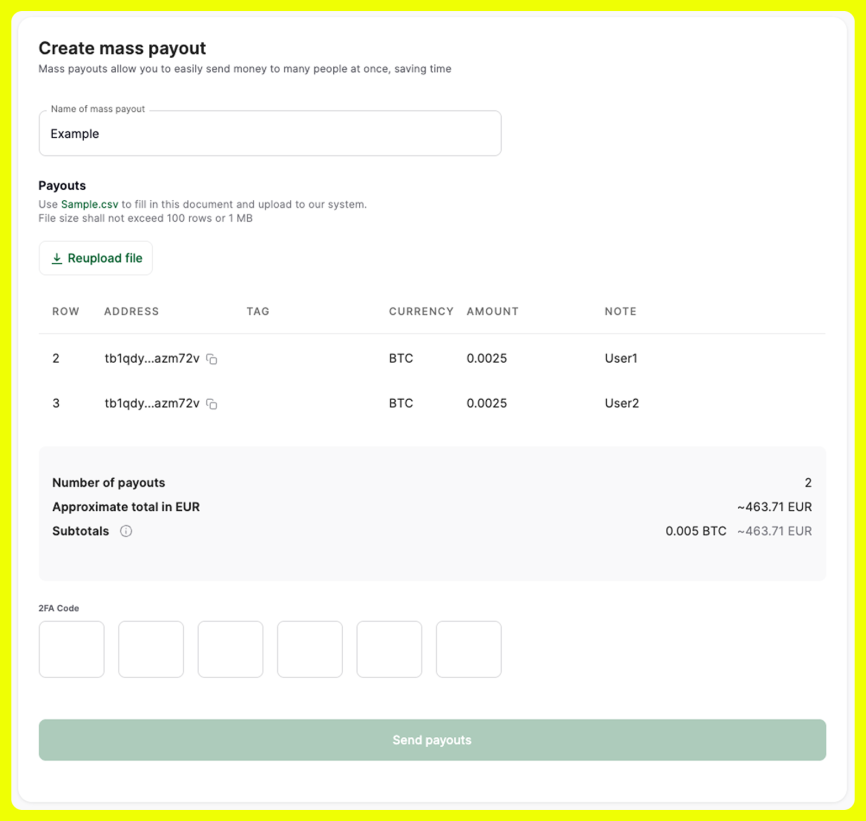

- Use the proper format: up to 100 rows, ≤ 1 MB, with a header row. Data rows have specific columns depending on payout type.

2. Fill in the details in the CSV

- Standard payout: include Address, Tag (if needed), Currency (ISO code), Amount, Note.

- With conversion: from Currency, Amount to Send OR Amount to Receive, Address, Tag, To Currency, Note.

3. Upload & review

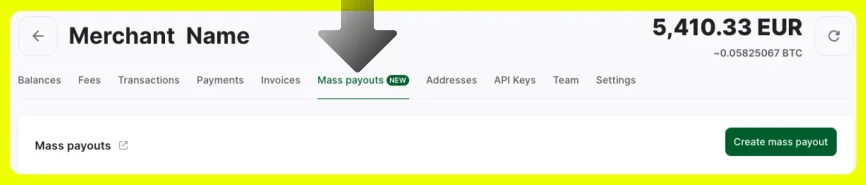

- Go to the Mass Payouts tab → click Create mass payout.

- Choose payout type (standard or with conversion), give it a name, upload your CSV.

- Check the preview table; fix any critical errors (invalid rows are flagged).

- Review total estimates: sums in cryptocurrency + equivalent fiat, per-currency subtotals.

- Use 2-factor authentication (2FA) to confirm, then send the payouts.

4. Confirm & send

5. Track & retry in case of failure

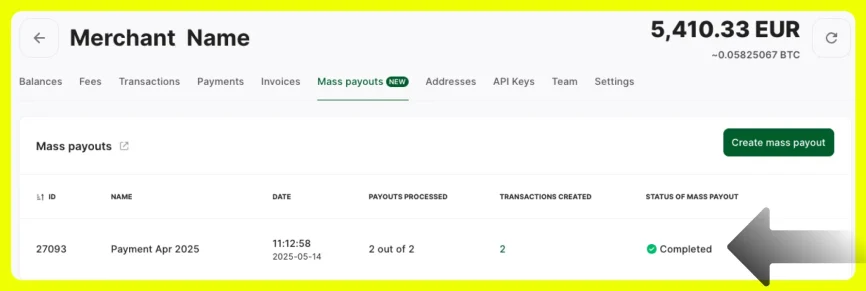

- On the Mass Payouts page, you can see the status of each payout: how many of the rows are processed, how many transactions created, which ones failed.

- If there are failures or items not created, you can export those rows (with error details), correct the issues, and re-upload them as a new mass payout.

In case you need even more information, this page can help you.

Crypto payments vs. traditional payments

Cryptocurrency payments offer a faster, more cost-efficient, and globally accessible alternative to traditional payment systems. Unlike bank transfers, which can take several days and often involve high fees, crypto transactions settle within minutes and bypass costly intermediaries. They’re borderless, support multiple digital currencies, and run 24/7 without being tied to banking hours. While volatility is a consideration, stablecoins and instant conversions help manage that risk. Both systems provide security and compliance measures, but crypto adds extra transparency through blockchain tracking. Integration is also typically simpler and quicker compared to the lengthy processes of traditional banking.

Here is a detailed comparison table.

| Feature | Crypto | Traditional |

|---|---|---|

| Speed | Near-instant, often within minutes | Can take 1-5 business days (especially cross-border) |

| Cost | Lower fees, no intermediaries | Higher fees due to banks, payment processors, intermediaries |

| Global reach | Nearly borderless, available worldwide | Often limited by country, bank networks, and currency restrictions |

| Currency options | 20+ cryptocurrencies with instant conversions into fiat | Mainly local fiat currencies |

| Volatility risk | Mitigated by stablecoins or instant conversion | None. Fiat is stable, but subject to inflation |

| Accessibility | Available 24/7, only internet access required | Limited by bank working hours and holidays |

| Security | Secured by blockchain, on-chain monitoring, AML checks | Secured by banks, but subject to fraud and chargebacks |

| Transparency | Public blockchain records, real-time tracking | Opaque processes, settlement not always traceable |

| Compliance | AML, KYC, auditing supported | Regulated by banking and financial authorities |

“Crypto mass payments are changing the game for businesses. Beyond saving on fees, blockchain brings speed, security, and transparency that traditional systems just can’t match.”

Why businesses choose CoinsPaid for Crypto Mass Payouts

For large-scale payments, businesses need a solution that’s fast, reliable, compliant, and cost-efficient. CoinsPaid delivers with free setup, multi-asset support, seamless conversions, global withdrawals, and strict compliance backed by award-winning service.

Free setup & integration

|

Multi-asset support

|

Security & compliance

|

Industry awards

|

Automatic conversion

|

Dedicated support

|

Disclaimer: Cryptocurrency transactions are subject to regulatory restrictions in certain jurisdictions. CoinsPaid operates under Estonian licensing and only provides services in legally permissible territories. Users should consult legal professionals for advice specific to their jurisdiction.

Frequently Asked Questions

In many countries, cryptocurrency services are both legal and regulated, and CoinsPaid operates in full compliance with these frameworks through strict adherence to AML, KYB, and licensing requirements. As an Estonia-licensed cryptocurrency payment provider, our operations are governed by Estonian law.

We implement thorough customer verification procedures and carefully manage where our services are offered. In line with our AML, KYC, and geolocation policies, we do not operate in jurisdictions where cryptocurrency-related activities are restricted or where we lack the necessary legal authorization. All clients undergo identity verification, while risk levels are continuously assessed. Daily monitoring enables us to detect unusual or high-risk activity, with enhanced checks applied whenever required.

Our goal is to empower companies to process crypto payouts legally, securely, and with full reporting transparency.

When receiving money, CoinsPaid supports automatic fiat conversion and transfer of funds to the merchant’s account, with the option of automatic withdrawal to the merchant’s bank account. As soon as a customer pays in cryptocurrency, the amount is instantly converted to fiat and credited to the merchant’s account, with the option to be automatically withdrawn to their bank account. This ensures stability for accounting, predictability in settlements, and protects the business from cryptocurrency volatility risks.

When sending funds, businesses can pay in stablecoins like USDC to avoid price volatility or use native crypto depending on the recipient’s preference.

With regards to crypto mass payouts, we offer two modes: standard mass payouts (in crypto) and mass payouts with currency conversion – an option that can help reduce volatility risk.

Our mass payments software supports a wide range of 20+ popular cryptocurrencies, including options such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and stablecoin payments like USDC, along with many other digital currencies. You can find a full list in our documentation.

Crypto payouts usually settle in minutes. The speed depends on the network and congestion. Stablecoins like USDC settle almost instantly. Ethereum transactions take about 5-15 minutes, depending on congestion. Bank transfers can take several days and often involve high fees.

Crypto payments are borderless, support multiple digital currencies, and run 24/7 without being tied to banking hours.

Yes. Recipients must have a compatible crypto wallet. It can be a standalone wallet or one linked via email or ID. No bank account is needed. They can convert crypto to fiat through exchanges or on/off-ramp services.