05.01.2026

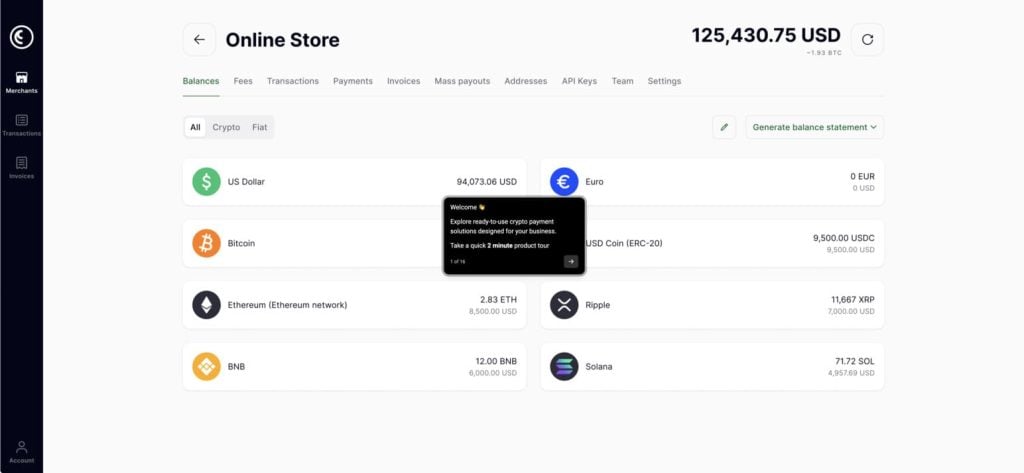

The target was to streamline the financial reconciliation process.

A workforce management company teamed up with CoinsPaid to introduce real-time exchange rate tracking and automated chargeback reconciliation. With rising transaction volumes, the company needed a faster, more accurate way to manage financial reporting.