Adskeeper partnered with CoinsPaid to implement crypto payment capabilities, supporting their global operations.

With growing global demand, the company needed a solution to support partners across multiple regions efficiently.

Crypto payment integration options for eCommerce

Perfect for:

- Subscriptions

- Online platforms with memberships

- Pay-per-use digital services

- Account top-ups for customers

- Control over payments with automated processing

- Updates on transactions in real time

- Smooth checkout experience for merchants and buyers

Perfect for:

- Online stores of any size

- Digital product sellers

- Merchants

Compatible with platforms:

- Setup of crypto payments without coding

- Integration with existing cart and checkout system

- Support from experts during installation

Perfect for:

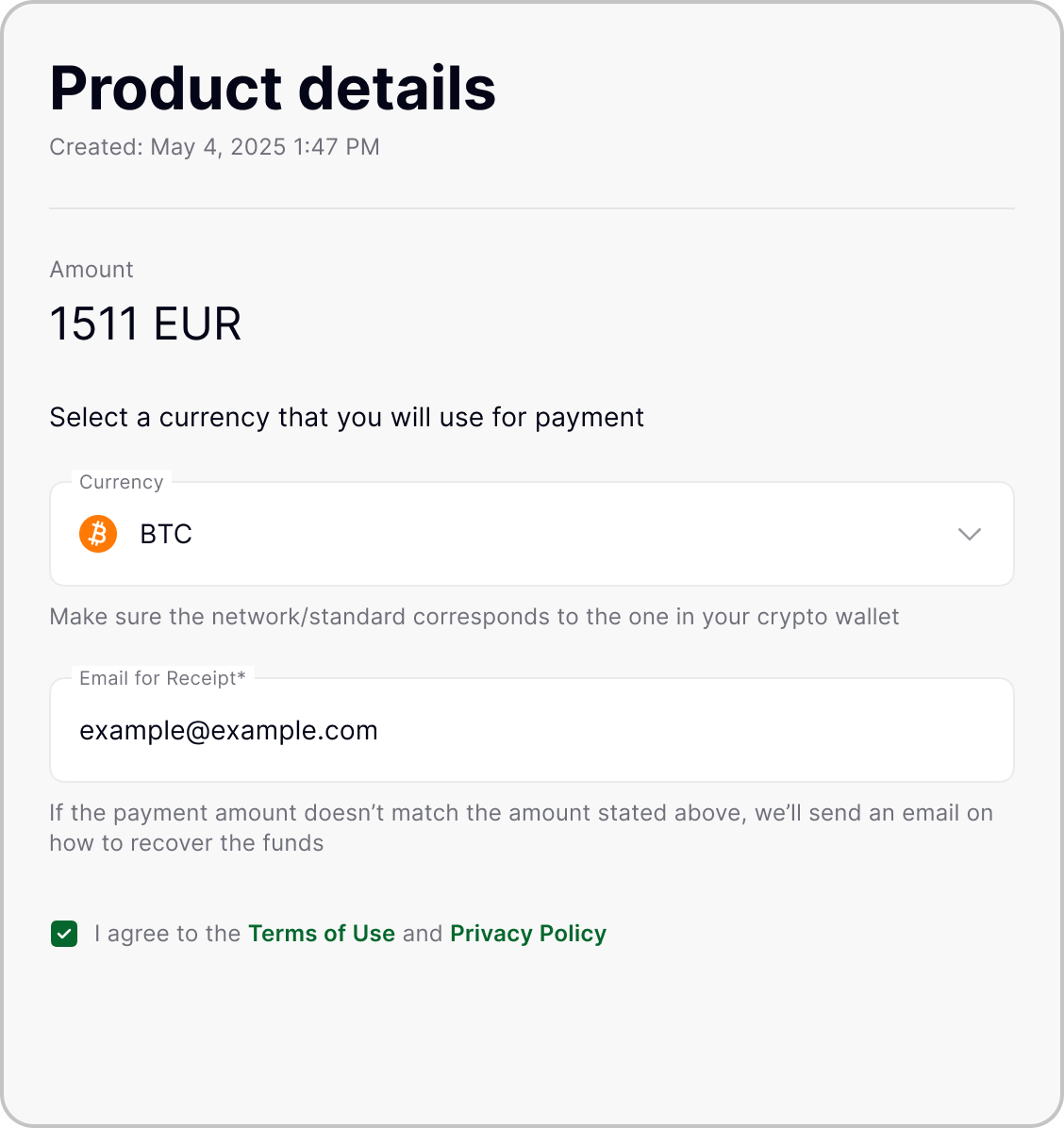

- One-time product sales

- Pre-orders in online shops

- Special promotions or limited offers

- Predefined amounts for fast checkout

- Exchange rate lock to protect payment value

- No full website integration required

- Payment details included in each invoice

Ready-made plugins to accept crypto on your eCommerce platform

We offer

- No monthly fees

- Transparent pricing

- Smooth onboarding

- Competitive market rates with zero markups

- Exchange-rate lock

- Flexible withdrawals

- 20+ top cryptocurrencies supported, including Bitcoin, Ethereum, Solana, and USDC

- 40+ local fiat currencies, such as USD, EUR, and others

Reach

more buyers

with crypto

Accept crypto on eCommerce platform in a few steps

-

Submit your request

Share your contact details and company website, and we’ll get in touch without delay to arrange a call.

-

Choose an integration method

Select between ready-to-use plugins for popular CMS platforms or a custom API integration tailored to your business needs.

-

Complete KYC verification

Provide the required company documents and ownership details to comply with international AML/KYC standards.

-

Get onboarded

Our team will guide you through the setup process and connect your business to the CoinsPaid ecosystem.

-

Configure payment preferences

Set up supported cryptocurrencies, automatic fiat conversions, and settlement rules according to your business model.

-

Test in sandbox mode

Run test transactions in a secure environment to ensure everything works smoothly before launch.

-

Go live & start accepting crypto

Enable crypto payments on your platform and start receiving transactions from customers.

Customer success stories powered by our crypto solutions

Accept popular cryptocurrencies on your website

Download the Report ↓

What’s Inside:

- Key market metrics and adoption trends

- Regional insights for strategic planning

- Benefits and risks of crypto payments

- How leading companies stay compliant and secure

FAQ

Cryptocurrency rules vary worldwide. Some countries allow it freely, others regulate it, and some restrict it. CoinsPaid is licensed in Estonia with KYB and AML compliance, but it doesn’t cover every jurisdiction. Merchants should check local rules before accepting crypto.

In many jurisdictions, merchants who accept cryptocurrency for goods and services may not require a separate license. However, licensing rules vary significantly by country, and merchants should confirm requirements under their local laws.

Transactions are verified on the blockchain. CoinsPaid uses encryption, fraud detection, and multiple layers of account protection. Two-factor authentication is supported for all accounts.

Our crypto solutions allow merchants to accept over 20 popular coins, including BTC, ETH, XRP, TRX, SOL, LTC, and DOGE.

Processing fees are typically under 1.5% per transaction, and CoinsPaid does not charge monthly fees. Exact fees may vary.

Yes. Payments in crypto can be converted automatically or manually into more than 40 fiat currencies, including USD, EUR, and GBP.

After KYB verification, merchants receive a plugin link. Enter your CoinsPaid API keys or account details according to the platform instructions. Integration usually takes a few steps. Support is available 24/7 if needed.

Yes. CoinsPaid manages KYC and AML checks on the backend. Merchants don’t need to verify buyers beyond local legal requirements. Accounting records are provided for every transaction.

Yes. You can price items in fiat. When customers pay with crypto, the system calculates the correct amount. Crypto payments can then be converted to fiat and sent to your bank via SEPA or SWIFT.

Merchants can configure withdrawal and payout limits through the API or platform interface. It’s possible to set a default limit and assign custom limits for specific currencies. Transactions that exceed these limits are marked as Pending. Users listed in the settings receive email notifications with a link to review these transactions. Approved transactions move to Processing, while declined transactions are marked Declined.

Do you have connections who would like to accept crypto? Join our partner program.

Do you have connections who would like to accept crypto? Join our partner program.

test new form