Crypto Market Update – September 2024

Welcome back to the monthly Crypto Payments Market Update! We’ll cover the most important happenings of September 2024, from industry trends to the regulatory landscape. Of course, the usual dose of crypto memes awaits you at the end.

Key Points

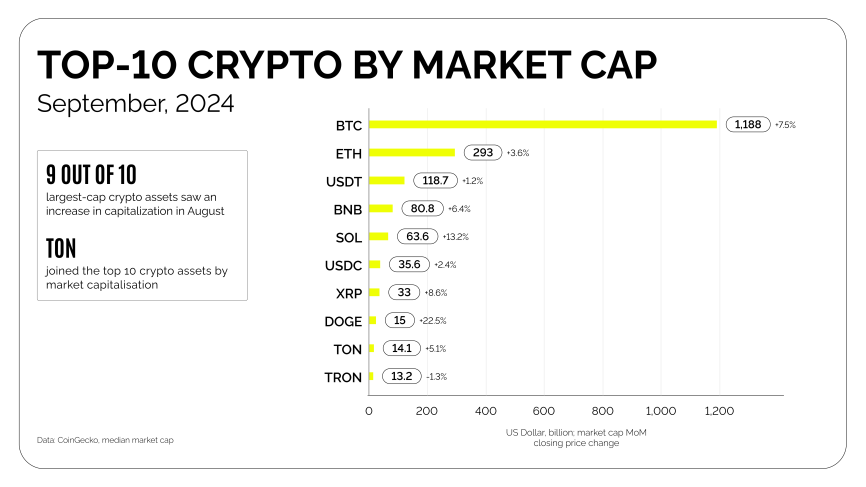

- The total crypto market cap is rebounding, with Solana showing a particularly impressive rally.

- TON entered the top 10 cryptocurrencies by market capitalization, highlighting its ecosystem’s growing prominence.

- Mastercard expands its crypto card program, enabling users to spend crypto directly from their wallets at over 100 million merchants.

- PayPal now allows U.S. merchants to buy, hold, and sell crypto, bridging the gap between traditional finance and digital assets.

- Circle expanded its stablecoins to Brazil and Mexico, while Revolut and Robinhood announced plans to launch their own stablecoins.

- The Swiss Stock Exchange is exploring the creation of a crypto trading platform, aiming to attract institutional investors.

Crypto Market In September 2024

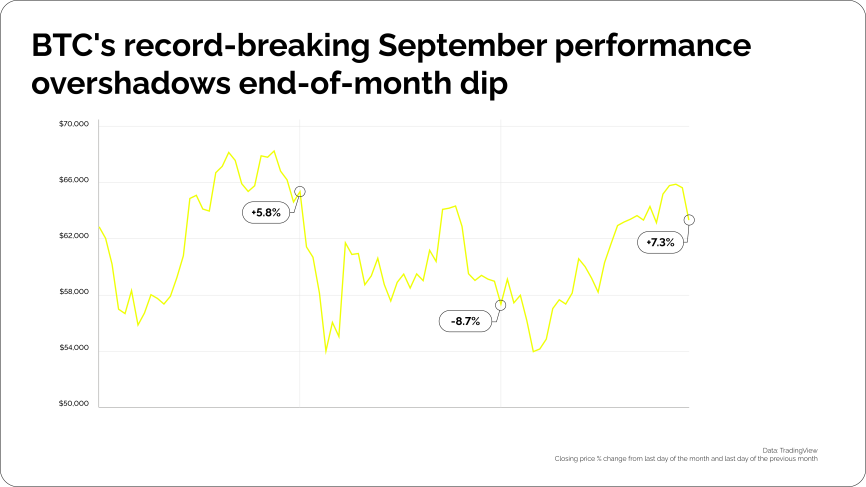

September proved to be a month of resilience and surprising strength for Bitcoin, defying historical trends. Despite a slight dip towards the end of the month, the coin concluded with a remarkable 7.3% gain, marking the best September performance in history for BTC. This came as a surprise to many, as August and September are usually weaker months for Bitcoin:

There are a few factors at play. First, market sentiment seems to have stabilized after the correction in early August. Additionally, the Fed’s aggressive commitment to an interest rate cut appears to have been the best-case scenario for crypto.

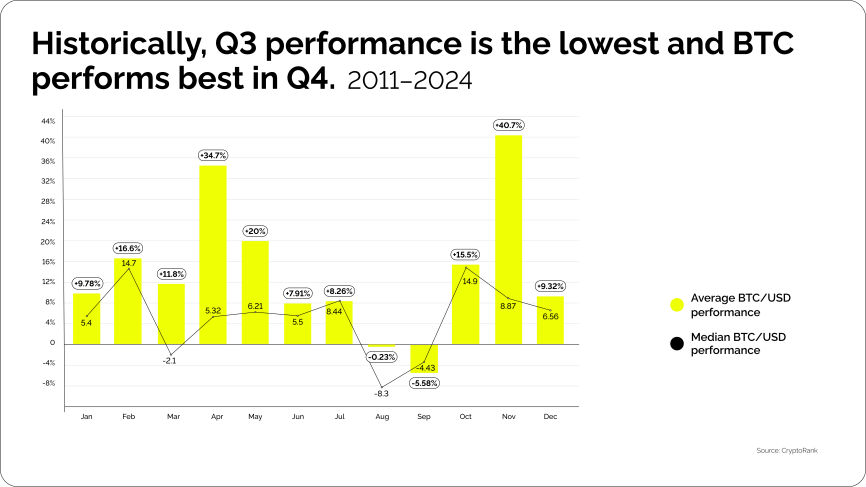

The coming months will be crucial in determining the overall trajectory of our industry as economies adjust to macroeconomic events like the US dock worker strike. On an optimistic note, historically, Q4 is the strongest period for BTC, so a “Santa Rally” may still be in the cards – depending on events in the world at large.

Checking in on the best-performing coins this month:

TON has entered the top 10 crypto assets by market capitalization, signaling a growing interest in this platform. The rise can be attributed to several factors, including its growing ecosystem, active development community, and increasing adoption of stablecoin transactions.

Crypto News Rundown

September saw significant developments in the crypto payments space, with major players bridging the gap between traditional finance and the crypto world. Let’s dive into the most impactful events.

Mastercard Expands Crypto Reach

Following its pilot with MetaMask in August, Mastercard has partnered with payments infrastructure provider Mercuryo to launch “Spend.” This Mastercard debit card lets users spend cryptocurrency directly from their self-custodial wallets at over 100 million merchants in the Mastercard network.

The card integrates seamlessly with Apple Pay and Google Pay, which makes it practically indistinguishable from cards most people are accustomed to. This move signifies a growing trend of traditional finance giants embracing cryptocurrencies.

Growing Accessibility of Crypto in Business

Several events fit the same theme here. First and foremost, PayPal has allowed U.S. merchants to buy, hold, and sell crypto directly from their business accounts. Businesses can also send and receive supported cryptocurrencies to and from external blockchain addresses, a move bound to increase adoption.

Secondly, Global travel service Skyscanner has integrated with the blockchain platform Travala, allowing users to book hotels using over 100 different cryptocurrencies. Travelers get newfound flexibility with the choice of paying in ways they find most convenient.

At the same time, the ride-hailing platform TADA launched a Telegram mini-app that allows users to pay in crypto. This integration leverages the TON blockchain for efficient transactions, offering users a convenient way to pay for their rides with TON or USDT.

Lastly, BNB Chain has integrated with the popular messaging app Telegram. The intention is to provide a streamlined experience for both users and developers, allowing them to seamlessly interact with the BNB Chain ecosystem. There’s a growing trend for easier access to wallets, exchanges, and Web3 apps in general.

Swiss & German Banks Also Turn to Crypto

Zurich Cantonal Bank (ZKB), the fourth-largest bank in Switzerland, has partnered with Crypto Finance to offer customers BTC & ETH trading and custody. Similarly, Commerzbank in Germany has also joined forces with Crypto Finance to provide its corporate clients with access to crypto assets.

These collaborations demonstrate traditional financial institutions’ growing recognition of cryptocurrencies, bridging the gap between conventional banking and the world of digital assets.

Stablecoins on the Rise

Like last month, stablecoins are at the forefront of most industry leaders’ minds. For example, Circle, the issuer of USDC, has announced the availability of its stablecoin in Brazil and Mexico through their respective national real-time payment systems. This is a bid to further Circle’s market share in emerging markets.

Additionally, Revolut and Robinhood both revealed plans to launch their own stablecoins. These established financial players have unique leverage during Tether’s ongoing struggle to regain footing following the situation with MiCa regulation in Europe.

In a similar vein, a recent Chainalysis report revealed that payments in Singapore using stablecoins reached a record high of nearly $1 billion in Q2 2024. This surge was primarily driven by transactions at merchant outlets, demonstrating the growing acceptance of stablecoins for everyday purchases.

The Regulatory Landscape in September-October

In the EU, the European Banking Authority (EBA) announced that approximately 15 technical standards related to MiCA, including those for stablecoin issuers, will likely become official before the end of 2024. The European crypto market continues to gain clarity as MiCa implements guidelines for investors and businesses.

In somewhat related news, the UK government introduced a bill to Parliament that describes the legal status of digital assets, including cryptocurrencies, NFTs, and tokenized real-world assets. This bill recognizes these assets as personal property under British law, suggesting new protection for crypto owners.

In the US, the state of North Carolina has overridden its governor’s veto to pass a bill banning a Federal CBDC. The governor was citing that it was too vague and proposed an ‘end result for a decision that hasn’t even been made yet.’ Debates around the digital dollar appear to be heating up once more.

Finally, in a significant development for the U.S. crypto market, the SEC has approved the listing of options on BlackRock’s spot Bitcoin ETF. This decision opens up new hedging opportunities for investors and further solidifies the status of crypto in institutional investments.

What’s Next for Crypto?

In the broader crypto landscape, the market is demonstrating resilience despite ongoing uncertainty. Interestingly, this year’s rate dynamics closely resemble those of 2016 and 2020, where Q4 proved to be a period of substantial growth for BTC (up 61% and 171%, respectively).

In the realm of crypto payments, we can expect further integration with traditional financial systems. Mastercard’s expansion of its crypto card program and PayPal’s propagation of crypto among merchants are strong signals. This, coupled with the growing interest from traditional banks like Zurich Cantonal Bank and Commerzbank, points to a future where crypto payments become a seamless part of everyday commerce.

Adding to this momentum, the Swiss Stock Exchange (SIX) is exploring the creation of a cryptocurrency trading platform in Europe. Leveraging Switzerland’s robust crypto regulations and SIX’s reputation, this platform could attract significant investment from institutions, further solidifying the use of digital assets in mainstream finance.

The rise of TON and the continued dominance of stablecoins suggest a strong interest in platforms that offer stable crypto processing. Integrating coins and tokens into everyday services, such as travel booking and ride-hailing, signals a shift towards adoption.

Why not join the growing ranks of crypto-friendly merchants?

The Mandatory Meme Section

Here we are in Q4. Quite a few people feel this way right about now:

This question is pretty much on everyone’s mind:

Fed’s decisions always bring quite a few great memes of their own. It’s practically a tradition at this point:

Let’s wrap up on this relatable bit of anxiety. We look forward to October’s dose of crypto payment developments, stories, and, of course, memes!