Ethereum Proof-of-Stake

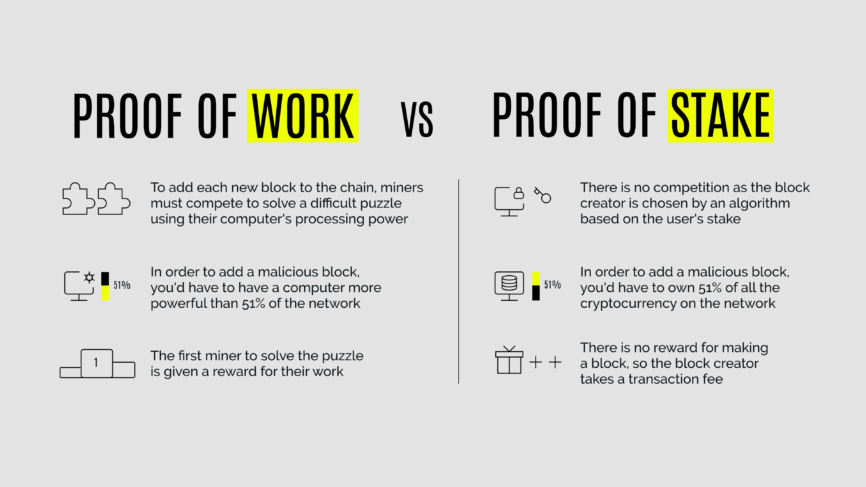

The Hummer, much like Proof of Work (PoW), represents blockchain’s early reliance on raw computational power. Success depended on solving complex puzzles faster than anyone else, but this came at a steep price: enormous energy use and environmental impact. Ethereum’s Proof of Stake (PoS) flips that model. Validators, like the electric motors of a Cybertruck, secure the network by staking ETH. The system is cleaner and more efficient, relying on economic commitment rather than brute computational strength to validate transactions and create new blocks.

While PoS is widely adopted today, it still faces scrutiny. Questions around potential centralization, validator requirements, and system complexity remain. Yet, these challenges are part of a broader narrative: blockchain is no longer an experimental frontier.

For businesses integrating crypto payment gateways, efficiency, sustainability, and accessibility have become standard expectations. Ethereum’s PoS transition reflects not just a technological upgrade, but a shift in how blockchain interacts with the real world.

Defining Ethereum PoS

Ethereum’s Proof of Stake (PoS) mechanism is a radical departure from the traditional Proof of Work (PoW) system that came before it (the one that Bitcoin still uses, by the way). In PoS, the security and integrity of the blockchain are maintained not through computational work but through economic stakes. Validators, instead of miners, are the key players in this system. They stake a certain amount of Ethereum’s native cryptocurrency, Ether (ETH), as a form of collateral in a dedicated smart contract on the Ethereum blockchain.

"Ethereum's shift to Proof of Stake was a major step towards a more sustainable and scalable blockchain. While it introduced new complexities, Vitalik totally made the right choice; he knew what he was doing."

The staked ETH serves as a security deposit. If validators act honestly and follow the protocol, they are rewarded. However, if they act maliciously—for instance, by proposing multiple conflicting blocks or sending conflicting attestations—they risk losing a portion or all of their staked ETH.

This punitive measure is a crucial deterrent against dishonest behaviour and is known as slashing. Slashing ensures that validators have a substantial economic incentive to maintain the network’s integrity. On the topic of deterrents, the system also employs a ‘correlation penalty’ to discourage coordinated attacks, making such attempts economically unfeasible.

Key Components of Ethereum PoS

Naturally, validators are at the heart of Ethereum’s PoS mechanism. However, to become a validator, an individual must stake 32 ETH. This high entry threshold ensures that validators have a significant financial investment in the network, aligning their interests with its overall health and security. Indeed, running a validator in Ethereum PoS is a commitment that involves maintaining hardware and network connectivity.

However, by 2024, the number of Ethereum validators surpassed 1 million with 32 million ETH staked, including participation through services like Lido and EigenLayer.

Validators are required to run three distinct software components:

- The Execution Client processes transactions and maintains the Ethereum state;

- The Consensus Client is responsible for the PoS-related activities, including the creation of new blocks and communication with other validators;

- The Validator Client acts as the interface for the validator, managing the staking, proposing, and attesting of blocks.

There’s also an activation queue at play – a mechanism designed to control the rate at which new validators join the network. This ensures a steady and manageable growth of the network, preventing sudden surges that could destabilise the system.

Understanding Ethereum’s PoS Timing Mechanism

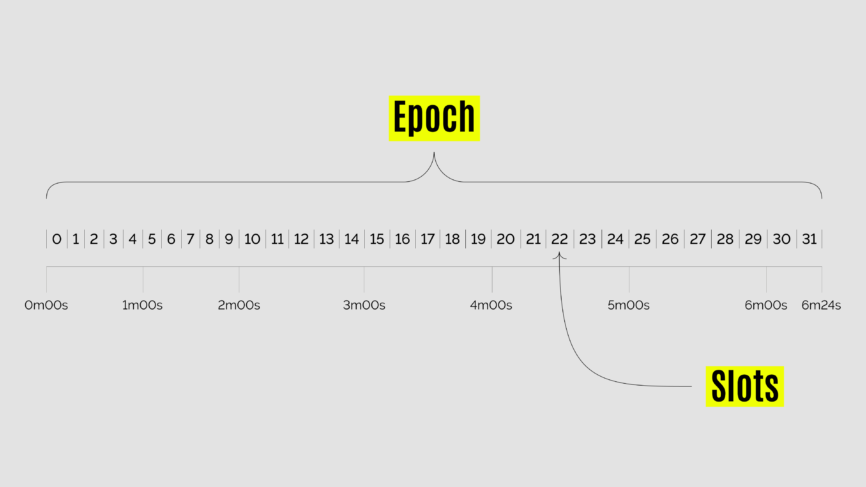

Importantly, Ethereum’s PoS introduces a structured timing mechanism, dividing time into slots and epochs. There are a number of benefits to this system, but the most notable regards the enhancement of network efficiency and security.

Slots are fixed 12-second intervals during which a validator is chosen to propose a new block. The selection process is pseudo-random, based on the amount of ETH staked and other factors, ensuring a fair and decentralised selection process.

An epoch consists of 32 slots and lasts approximately 6.4 minutes. At the start of each epoch, a group of randomly-selected validators is chosen to form a committee, whose purpose is to check the work of the block proposer and vote on the block’s validity.

Of course, by dividing the validator set into committees, Ethereum’s PoS reduces the workload on individual validators and ensures that every validator has the opportunity to participate in the consensus process regularly, but not necessarily in every slot. This efficient distribution of responsibilities enhances network scalability and performance.

Combining with PoS and Layer-2 solutions, Ethereum aims to enhance network throughput. These technologies are already adopted by major organizations, including JPMorgan and Microsoft.

Transaction Execution in Ethereum PoS

For the chronologists among us, the following section will be of great use. Indeed, a transaction in Ethereum PoS undergoes several steps, starting from its creation and signing by the user, through validation by an execution client, to its addition into the blockchain by a block proposer. The process is secured by Ethereum’s JSON-RPC API and involves various network layers for validation and attestation. Let’s delve deeper into each step:

- Creation and Signing of the Transaction: The process begins with the user creating a transaction. This typically involves specifying the recipient, the amount of Ether (ETH) to be transferred, and any data relevant to smart contract interactions. The user then signs the transaction using their private key. This signature is a critical security feature, as it verifies that the transaction was indeed initiated by the rightful owner of the funds.

- Submitting the Transaction: The signed transaction is submitted to the Ethereum network. This can be done using a variety of interfaces, such as a cryptocurrency wallet or a web interface that interacts with Ethereum nodes. At this stage, the user can specify the gas price they are willing to pay. The gas price is a fee paid to validators for processing the transaction. Higher gas prices can incentivize quicker validation by validators.

- Validation by an Execution Client: Upon receiving the transaction, an Ethereum execution client (formerly known as the Ethereum Virtual Machine or EVM) verifies its validity. This includes checking whether the transaction is correctly formed, the signature is valid, and the sender has sufficient balance to cover the transaction and the gas fees. If the transaction is valid, the execution client adds it to its local mempool, a pool of pending transactions.

- Broadcasting the Transaction: The transaction is then broadcast to other nodes in the Ethereum network. Each node that receives the transaction will also validate it and, if valid, add it to their local mempool.

- Selection by a Block Proposer: In each 12-second slot of the PoS mechanism, a validator is chosen at random to be the block proposer. This validator is responsible for creating a new block. The block proposer selects transactions from its mempool, including them in the new block. Transactions with higher gas fees are often chosen first, as they are more profitable for the validator.

- Execution and Validation of Transactions in the New Block: Once the block is proposed, it is distributed to other nodes. These nodes execute all the transactions in the block to verify their correctness and update their local copy of the blockchain state accordingly. Other validators in the network then attest to the validity of the new block. Their attestations are crucial for the block to be accepted into the blockchain.

- Finalisation of the Transaction: A transaction is considered finalised when it becomes part of a block that is deeply embedded in the blockchain and has received a sufficient number of attestations.

The way ‘finality’ is structured in Ethereum’s PoS makes this an incredibly expensive attack vector for bad actors. Indeed, finality is achieved when a transaction becomes part of a block within a ‘supermajority link’ between two checkpoints. Checkpoints, occurring at the start of each epoch, are crucial for confirming the network’s consensus. An attack on this system would be costly, as it would require sacrificing a significant portion of staked ETH.

On the topic of security, Ethereum PoS uses the LMD-GHOST algorithm for fork choice, determining the chain’s head based on the weight of attestations. In addition, according to the Ethereum Service Level Agreements (SLAs), validators are incentivized to maintain high availability. Downtime can reduce rewards, encouraging robust network participation. This approach enhances the network’s security across the board.

Ethereum PoW vs. Ethereum PoS

What a budding blockchain enthusiast might find interesting, aside from the shiny new network design, is the reasoning behind Ethereum’s monumental shift. As such, let’s take a look at a number of factors that drove the move in an effort to uncover some of the benefits that this new network design brings.

Energy Consumption and Environmental Impact was likely one of the most widely discussed issues with PoW. Ethereum’s PoW, like Bitcoin’s, required vast amounts of computational power for mining activities, leading to high electricity usage and associated environmental concerns. Indeed, PoS dramatically reduces energy consumption, cutting Ethereum’s usage by over 99%. Validators in PoS only need to run a node, which requires significantly less power, thereby reducing the blockchain’s carbon footprint.

The Centralization of Mining Power was also an ongoing issue within Ethereum’s PoW system. This was due to economies of scale, where larger mining operations with more resources could achieve greater efficiencies, leading to a concentration of mining power in the hands of a few. PoS addresses this by eliminating the advantage of specialised mining hardware. Since block validation in PoS is based on staked ETH rather than computational power, it opens up the validation process to a broader base of participants, reducing the risk of centralization.

Security Vulnerabilities were also apparent in the old system. Notably, PoW systems are susceptible to a 51% attack, where an entity with more than 50% of the mining power could potentially take control of the network and manipulate it for their gain. While expensive and difficult, the risk remains a concern, especially for smaller PoW blockchains. In PoS, executing a 51% attack is not only more challenging but also more costly, as it would require control of a significant portion of the staked ETH. Moreover, the potential penalties and slashing in PoS create additional financial disincentives for such attacks.

Barriers to Entry, including the high cost of mining equipment and the technical know-how required for PoW mining, were known for limiting participation in the mining process to a relatively small group of individuals and organisations. As one can imagine from the aforementioned, PoS lowers these barriers by allowing more individuals to participate in the consensus process as validators, requiring a lower capital investment and technical threshold.

Delays in Transaction Processing should also be mentioned. In PoW, the time to create a new block can be variable and sometimes lengthy, leading to delays in transaction processing during times of high network congestion. With Ethereum’s PoS, the block time is more predictable and consistent, leading to more efficient transaction processing and an overall smoother experience for users.

What Could Go Wrong?

Having talked about the positives, it’s difficult to imagine that Ethereum’s PoS can do anything wrong. However, it is inherently more complex than its PoW counterpart. The added elements such as epochs, slots, validators, and various software clients contribute to this complexity. This increased complexity can make the system more challenging to understand and maintain, potentially leading to a higher risk of bugs or vulnerabilities.

Moreover, while PoS reduces the risk of mining centralization seen in PoW, there is still a concern about the centralization of staking power. Wealthier participants who can afford to stake more ETH have a higher chance of being chosen as validators, potentially leading to a concentration of power among the wealthy.

As the third con, we should cite the possibility that validators could form cartels to control decision-making processes or manipulate certain network outcomes. Although the design of Ethereum’s PoS includes mechanisms to prevent such scenarios, the risk cannot be entirely eliminated. Nevertheless, it’s certain that the benefits outweigh the downsides.

The Future Landscape of Blockchain Consensus

Of course, this evolution of Ethereum is significant. This transition highlights a growing trend towards more sustainable, efficient, and scalable consensus mechanisms within the blockchain ecosystem, even as challenges like validator concentration remain.

Institutional interest in Ethereum is also surging. Analysts on Wall Street, including Tom Lee of Fundstrat and Bitmine, see Ethereum as “dramatically undervalued,” with forecasts ranging from $4,000 in the near term to $10,000 or $15,000 by the end of the year.

Ethereum is widely used as a corporate tool. Enterprises leverage their infrastructure for tokenization and real-world asset management through the Enterprise Ethereum Alliance (EEA). Examples include SAP, Siemens, ABN Amro, and Visa’s Tokenized Asset Platform, highlighting Ethereum’s adoption in large-scale, regulated business environments. Beyond corporate use, Ethereum also leads the DeFi sector, holding nearly 60% of the market.

As mainstream finance converges with crypto, Ethereum is well-positioned to become the chain of choice for institutional adoption, signaling both technological and market confidence in its future.