Stablecoins vs. bank transfers: which is better for business in 2025?

Table of contents:- What are stablecoins?

- Why stablecoins work well for cross-border payments

- The advantages of stablecoins

- The limitations of stablecoins to consider

- When are bank transfers still a better option?

- Real-world use cases

- Stablecoin vs. savings account

- Will stablecoin cross-border payments become the new norm?

You’ve got an invoice to pay. Nothing unusual until the bank transfer you sent a couple of days ago gets stuck. Five business days in processing limbo. An unexpected intermediary fee. The payment does arrive, eventually, but not without frustration.

Now, imaging the same transaction completed in under ten minutes. It’s settled in a stablecoin, a type of cryptocurrency and the protagonist of today’s article. Designed to maintain a 1:1 peg to real-world assets like the dollar, stablecoins offer a new way for businesses to move money: fast, cheap, and (almost) without borders.

But how do stablecoins vs traditional remittances compare for business needs? And what do you give up — or gain — when you switch?

What are stablecoins?

A stablecoin is a digital token that’s pegged to the value of a real-world asset. The idea is simple: you get the benefits of cryptocurrency without the volatility.

The most common type is a fiat-backed stablecoin, like USDC, where each token is supposedly backed by an equivalent amount of fiat held in reserve. USDC remains one of the dominant stablecoins, accounting for around 24% of the market. The 1:1 peg is what gives stablecoins price stability.

Why stablecoins work well for cross-border payments

They skip middlemen.

When you send money abroad using a bank or a remittance provider, your funds often pass through a chain of correspondent banks. With stablecoins, the transfer happens directly on a blockchain. You don’t need matching infrastructure on both ends. The recipient doesn’t even need a bank account or access to a local financial system — just a smartphone and a wallet app.

That’s one reason stablecoins cross border payments have become an increasingly attractive solution in regions with limited or unreliable banking access.

The advantages of stablecoins over traditional remittances

By 2024, the total transfer volume of stablecoins exceeded $27.6 trillion. As the State of Stablecoins 2025 report highlights, 48% of the surveyed choose stablecoins due to their fast settlements.

It’s not just speed, although that is a major advantage. To understand where each option fits best, let’s look at the factors that usually matter for businesses: time, cost, accessibility, and regulation.

| Stablecoins | Bank transfers | |

|---|---|---|

| Settlement time | Seconds to minutes; 24/7 | 1-5 business days |

| Transaction cost | Often under 1,5% | 6.2% global average |

| Accessibility | Anyone with a wallet app | Requires a bank account |

1. Settlement time

Traditional bank transfers, especially cross-border ones, can take anywhere from one to five business days. It takes longer if intermediaries are involved. Delays happen, and there’s rarely any real-time visibility.

Stablecoin cross-border payments, on the other hand, typically settle in the span of minutes, sometimes even seconds, regardless of time zones or banking hours. That’s a considerable advantage for businesses dealing with global teams, partners, or suppliers.

2. Transaction cost

When comparing stablecoins vs traditional remittances, the difference in fees can be quite striking. According to the World Bank, the global average cost for sending a $200 remittance sits around 6.2%. For businesses moving large volumes, these fees add up fast. But even for smaller payments, the costs can feel wildly disproportionate. To put it into perspective: sending $500 from the U.S. to Mexico (the world’s largest remittance corridor) costs around $15.13 on average.

Stablecoins tell a different story. They run on blockchain networks with no intermediaries involved, and transaction processing fees typically make up a fraction of the processing cost associated with traditional transfers. Even on the more expensive Ethereum network, sending USDC might cost a few dollars in gas fees during congestion — still significantly cheaper than traditional remittances. On other networks like Tron or Polygon, fees often come down to a fractions of a cent.

3. Accessibility & financial Inclusion

Bank transfers assume both sender and receiver have access to a banking system. But that’s not a given. In 2024, 1.4 billion people remained unbanked, meaning they were either excluded or underserved by the formal banking system. Many more don’t simply trust banks to protect their money.

Stablecoins, in turn, can be received by anyone with a smartphone and a wallet app. No bank account, credit check, or local infrastructure are required. That makes them especially valuable for freelancers, digital nomads, or small businesses working across borders, which gives them a slight edge in the stablecoin vs. traditional remittances battle.

That said, stablecoins aren’t a silver bullet. Like any payment tool, they come with trade-offs, and it’s worth understanding their limitations.

The limitations of stablecoins to consider

| Stablecoins | Bank transfers | |

|---|---|---|

| Regulation | Still evolving; varies by region | Well-established |

| Counterparty risk | Moderate. Depends on the trustworthiness of the issuer | Low. Deposits are usually insured and backed by strong banking infrastructure |

| Buyer protection | Transactions are irreversible | Reversible in some cases |

| Learning curve | May be seen as steep, though flattened out by modern providers | Familiar and widely understood |

1. Regulation & compliance

This is where things get more complex. Traditional bank transfers are governed by long-established KYC/AML regulations and global financial standards. They’re slow for a reason: compliance takes time.

Stablecoins, in turn, operate in an evolving regulatory environment.

The European Union has been proactive, adopting the MiCA regulation in 2023 with immediate consequences. MiCA enforces strict rules for stablecoin reserves and prohibits interest payments. Non-compliant tokens are already being delisted by major exchanges including Kraken, Coinbase, and Crypto.com. Affected issuers like Tether are exiting the market altogether and investing in compliant alternatives, for example, StablR.

Meanwhile, in the US, federal legislation for stablecoins is still in progress. The GENIUS Act, which passed the Senate in June 2025, and the STABLE Act, pending in the House, aim to establish a national licensing framework for stablecoin issuers. Oversight is currently handled at the state level, with stablecoin issuers subject to money transmitter laws, AML/CFT rules, and Treasury registration. But without a unified framework, regulation remains unclear.

For businesses, patchy regulation can feel unsettling, but in practice, the risks are manageable. When payments are handled by a licensed provider like CoinSpaid, stablecoin cross-border payments can be secure and compliant. We stay on top of evolving legislation and ensure our services align with both local and international standards. In other words, you don’t need to navigate the regulatory maze alone.

2. Counterparty risk

Holding a stablecoin means trusting the issuer to properly manage reserves, maintain audits, and stay compliant with regulation. If they don’t, you could be left holding an illiquid or a delisted asset.

This risk became very real in early 2024, when regulators began cracking down on non-compliant stablecoins in the EU. Businesses that didn’t adapt quickly saw tokens like Tether removed from major exchanges.

Fortunately, this risk can be largely mitigated. Most of our clients don’t hold stablecoins — they simply transact in them. Once the payment is received, the funds are settled in fiat. Even if you do decide to retain a portion of your assets in stablecoins, choosing those issued by licensed entities that publish regular audits and comply with strict reserve requirements keeps the risk to a minimum.

3. Limited buyer protection

Stablecoin transactions are irreversible by nature. For businesses, this means no risk of chargebacks. However, it also means there’s no “undo” button if funds are sent to the wrong address. Unlike banks, blockchains don’t offer dispute resolution, and that can be a concern for businesses used to consumer safeguards.

While not entirely avoidable, the limitation can be managed. One common method is address whitelisting — a feature that restricts outgoing payments to a list of pre-approved wallet addresses. Transaction previews and confirmations are common and offered by most platforms offering strablecoin cross-border payments, too.

4. Perceived learning curve

For many businesses, the idea of using stablecoins sounds like a technical leap: setting up accounts, managing wallets, finding a custody provider, adjusting internal processes. But in reality, it’s far more straightforward.

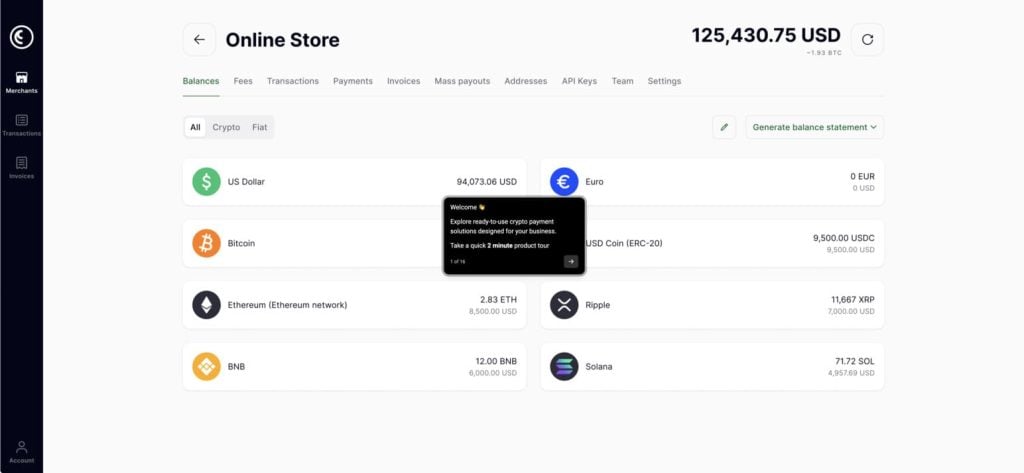

With CoinsPaid, onboarding is fast and secure. Wallets are set up with personal support, and custody can be handled by your team or delegated to us. You don’t even have to hold crypto — we convert stablecoins to fiat instantly and deposit it straight into your business bank account. As for accounting, we provide all the necessary documentation to make sure stablecoin transactions are treated just like fiat.

Most challenges typically associated with stablecoins can be managed with the right tools and partners. Still, there are scenarios where the traditional banking system remains the better option.

When are bank transfers still a better option?

One-off payments with no urgency

For non-recurring payments, especially between long-established business partners, the existing banking processes can still work just fine. If both parties are based in the same jurisdiction, processing is straightforward, and neither side minds the wait, there’s little reason to change what already works.

Jurisdictions with limited crypto infrastructure

Some regions still lack the necessary regulatory clarity or wallet penetration support to make stablecoin payments practical. If your counterparty can’t receive or cash out stablecoins easily, it’s often simpler to stick with a bank transfer.

Clients with strict internal policies

Not all companies are ready for crypto. Some businesses, especially in heavily regulated industries like healthcare, have strict compliance policies that limit the use of digital assets. If your client can’t accept stablecoins, the decision is made for you.

Real-world use cases for stablecoin remittances

While bank transfers still make sense in certain contexts, the demand for stablecoins is still difficult to ignore. Some of the world’s most established financial players are now integrating stablecoins into their core offerings.

B2B payments using stablecoins have reached $3 billion per month in 2025, a thirtyfold increase since 2023. Companies are increasingly using stablecoins for international supplier payments and treasury management.

Stripe lets customers pay US merchants with stablecoins and charges just half the fee of a card transaction. PayPal now offers 3.7% interest to users who hold its stablecoin, PYUSD. And Visa is building a platform for banks to issue tokenised versions of fiat currency.

But the most compelling use cases are happening elsewhere, in places where access to stable currency is nothing short of a struggle.

In countries like Argentina, Nigeria, and Turkey, local currencies have been hit by inflation, and traditional remittances often mean high fees and long waits. Stablecoins, especially dollar-pegged ones like USDC or USDT, offer a faster and more stable way to receive funds from abroad.

While stablecoins aren’t anonymous, their structure provides a certain layer of privacy. Transactions are publicly visible on-chain, but the identity behind a wallet isn’t always clear, which can protect users living under oppressive regimes.

Of course, the same feature creates space for abuse. Chainalysis estimates that in 2024, $25 to $32 billion worth of stablecoins were received by illicit actors, amounting to 12-16% of total market cap. But it’s important to keep in mind: like any financial tool, the impact of this asset class depends on how they’re used, and who’s using them.

Stablecoin vs. Savings Account: which is better for businesses?

So far, we’ve looked at stablecoins primarily as a payment and remittance tool. But there’s another use case — using stablecoins as an alternative to business savings accounts. So, how do the two stack up?

Liquidity & accessibility

Savings accounts are known for stability, but not speed. Cross-border transfers or currency conversions can take days, especially when dealing with intermediary banks or less common currencies.

Stablecoins offer high liquidity and 24/7 access. Funds can be moved globally in minutes and accessed anytime. For companies in fast-paced or international environments, this can be a major advantage.

Interest & yield opportunities

Most corporate savings accounts offer limited returns. In some countries, businesses even face maintenance fees or negative interest rates.

With stablecoins, yield opportunities are more diverse. Yields typically come from lending or staking mechanisms, often structured through licensed custodians or institutional DeFi platforms.

Risk and regulation

Bank deposits benefit from government guarantees. In the EU, for example, deposits of up to €100,000 per institution are eligible for protection.

Stablecoins don’t offer the same safety net. Their risk depends on the issuer’s financial health, the quality of reserves, and the regulatory framework they operate under.

This content is for informational purposes only and does not constitute financial or investment advice.

Will stablecoin cross-border payments become the new norm?

With established players like PayPal, Visa, and Stripe integrating stablecoin infrastructure into their products, it wouldn’t be a stretch to say that stablecoins have been slowly moving towards becoming part of the mainstream financial toolkit.

"We see it firsthand with our clients. When it comes to transactions, they overwhelmingly prefer stablecoins over other cryptocurrencies. But the next big leap in the wider adoption of stablecoins isn’t about technology or infrastructure anymore — it’s about regulatory clarit"

Regulators are catching up, too. MiCA is already reshaping the European landscape, while US legislation is moving forward to a more comprehensive framework. As compliance becomes clearer, stablecoins are likely to become even more embedded in global payment systems.

Will stablecoins fully replace traditional bank transfers? Probably not. So, to draw a line under today’s stablecoin vs traditional remittances debate, let’s say both have their place. For now, stablecoins are carving out a space where speed, flexibility, and accessibility do matter — across borders and in volatile markets.

Key takeaways

- Stablecoins offer speed and savings for cross-border transactions, particularly in remittance-heavy or inflation-prone regions.

- They’re gaining traction among both tech-savvy startups and legacy payment giants.

- The main risks, like counterparty exposure and irreversibility, are manageable with the right partner and processes in place.

- Stablecoins are not a one-size-fits-all solution. For regulated or one-off domestic payments, traditional methods may still win.

- But as regulation evolves and adoption grows, stablecoins may become a valuable tool in the standard business payments toolkit.