The Current State of the Crypto Market: How Is Industry Evolving and What Should Your Business Do?

Intro: Many terms such as the ‘crypto winter’ are being thrown around, especially in light of the fact that Bitcoin, the flagship of digital currencies, has famously dropped more than 60% from its all-time-high in November of 2021. Indeed, the total crypto market capitalisation has fallen from a high of almost 3 trillion to around 850 billion as of Q4 2022. However, despite the falling value of the industry, the number of both individuals and businesses interacting with crypto and using crypto payment gateway services on a daily basis is skyrocketing.

In today’s article we will focus on the overview of the crypto market in 2022: its current state, challenges, and prospects. We will also cover the top global crypto trends, so you can stay abreast of today’s changing economy.

Cryptocurrency Market 2022 Overview

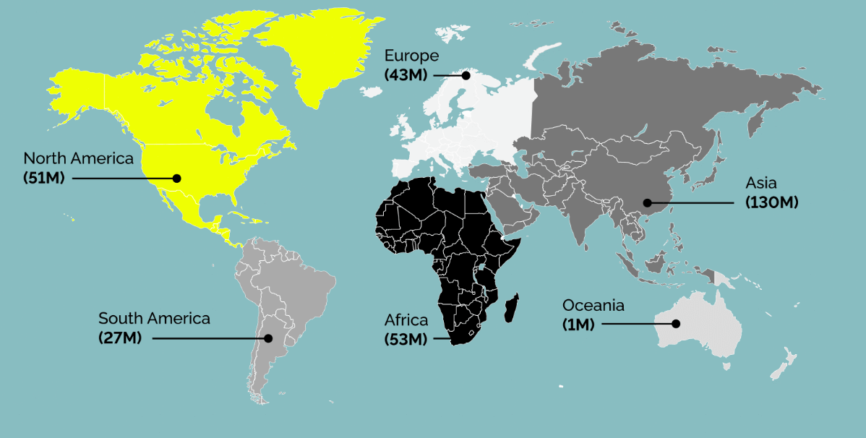

Whereas the current estimation of the crypto owners number is 320 million people globally, analysts predict that this number will surpass 1 billion by the end of 2022. According to the latest data by Bloomberg, the population who regularly make transactions with digital assets is in the region of 900 million people.

With this information, we can very confidently state that we are in the midst of a bear market – not a crypto apocalypse. The fallout of the Covid-19 pandemic is having a lingering effect on aggregate demand. There’s a general slump in the global economy and this is magnified when it comes to crypto, which is much more of a reactive financial substance.

The dramatic decrease in Bitcoin’s rate put immense pressure on the entire crypto community, including major players. Companies that made billions and billions of dollars during the bull run were no longer able to sustain their business models, which are increasingly often referred to as “Ponzi” in the media.

Indeed, first we witnessed the so-called ‘Luna Apocalypse’, in which Terra’s LUNA, an algorithmic “stablecoin” practically disintegrated before the eyes of its investors. Naturally, the entire stablecoins market took the hit. However, were you aware that UST relied on a swap function to maintain its peg to the US dollar by contracting the supply of UST when it fell below the 1 dollar line while expanding LUNA, and vice versa when it was above the line? This was never a reliable system, and it’s not a surprise that it crashed.

“Real” stablecoins, on the other hand, are much more solid than one might think. USDT is backed by 85% cash and cash equivalent reserves, short-term deposits, and commercial paper, while USDC has 100% of its reserves in cash and cash equivalents including USD deposits in banks and short-term highly liquid investments.

As a leading crypto payment processor in the industry, we are seeing a growth in demand for stablecoins as a means of settling for business transactions. Although Bitcoin and Ethereim remain the leading digital assets in the payment industry, our clients tend to include stablecoins such as USDC into their offerings as well.

In light of the aforementioned — we are in a bear market, with global economic hardship lighting red candles in the crypto ice-rink. Nevertheless, the increasing rates of adoption around the world pose somewhat of a curious juxtaposition. As such, it’s worth taking a look at a range of changes manifesting behind the curtain to better understand the forces behind the current state of the crypto market.

Crypto is no longer a tool for the dark web

Many that aren’t that familiar with crypto may still be stuck to the idea that it’s only used by criminals to purchase drugs, guns and other illicit goods on the dark web. And indeed, there have been loud cases when digital assets have been used for such purposes. However, it has never been the main use case for cryptocurrencies. According to Checkout’, whereas crypto used to be associated with transactions on the dark web, it’s losing that reputation fast.

In developed European economies, we’re seeing fewer than 5% of people using crypto for dark web purchases. As the world of blockchain becomes more efficient and accessible, ordinary people are beginning to get hold of digital assets through usual means. Freelance copywriters, developers and advisors are now being paid in cryptocurrency. Gamers are now engaging with Play-to-earn mechanics which let them earn cryptocurrency from simply playing. Even content platforms such as Coub are beginning to implement ‘watch-to-earn’ mechanics where users will be paid in crypto simply to watch content. With ordinary, KYC’d people being gradually introduced to the blockchain, criminal activity in crypto is being diluted massively.

Moreover, reliable cryptocurrency companies are going out of their way to provide the most secure and transparent environment for their customers, especially after the FTX exchange collapse. Notably, CoinsPaid is an EU-licensed crypto services provider, compliant with all European AML and KYB regulations. On top of that, we have integrated 2 independent blockchain scoring systems to detect any suspicious transactions. Cold storages are used to store customer funds.

And most importantly, reliable crypto providers do not lose billions in customer funds on risky trades or token pumping schemes. Unlike FTX, CoinsPaid never uses clients’ money for any type of operations. Cold storages are used to store customer funds, and our merchants retain full control over their funds, available for withdrawal at any time.

Bitcoin is no longer king

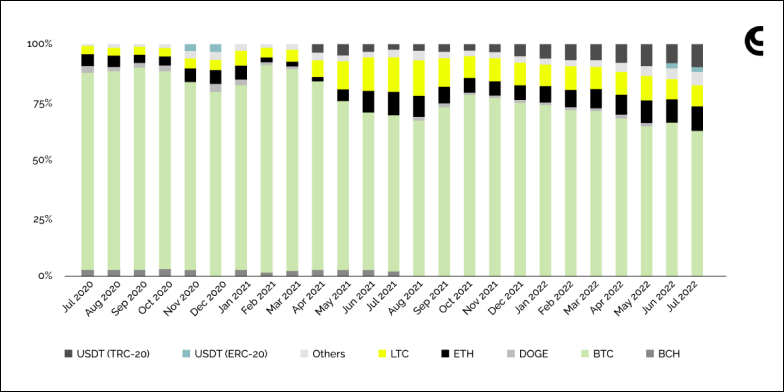

As we have previously established, Stablecoins such as USDT, backed by cold-hard collateral, are bringing the benefits of the blockchain without the volatility. Indeed, our in-house statistics also show that USDT transactions have overtaken Bitcoin transactions and are still skyrocketing. For example, in Q2 of 2021, USDT made up around 37.85% of the transaction volume on our platform CryptoProcessing.com. This is compared to Bitcoin’s 33.58%. In Q2 of 2022, USDT made up 43.60% of the total transaction volume. This is compared to Bitcoin’s 22.99%.

Cryptocurrency payments remain unaffected by the bears

Despite the unstable economic situation all across the globe putting immense pressure on the financial markets, the cryptocurrency payment industry remains largely unaffected. That is because there is no need to store crypto to pay in crypto. In fact, businesses and individuals can just benefit from the lower fees, global nature and swiftness of crypto payments, and simply convert tokens into regular fiat currencies such as USD or EUR in the end.

For instance, CoinsPaid provides instant conversion of cryptocurrency into fiat, while also taking all the volatility risks upon itself. This allows our customers to have zero background in crypto and continue operating their funds as usual in local currency.

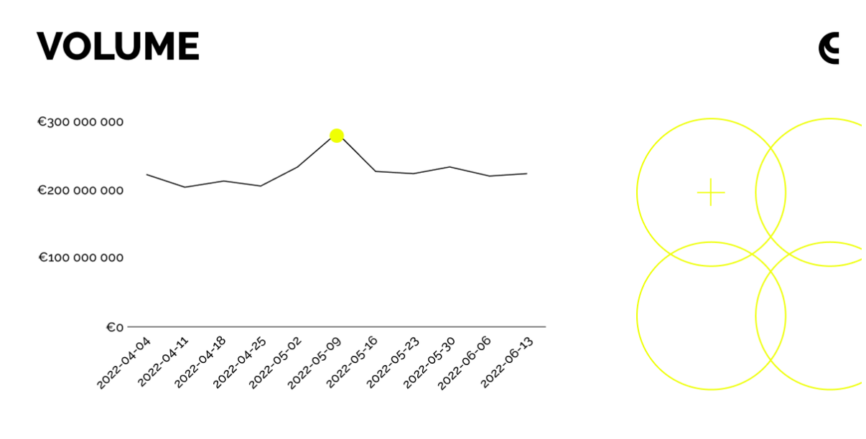

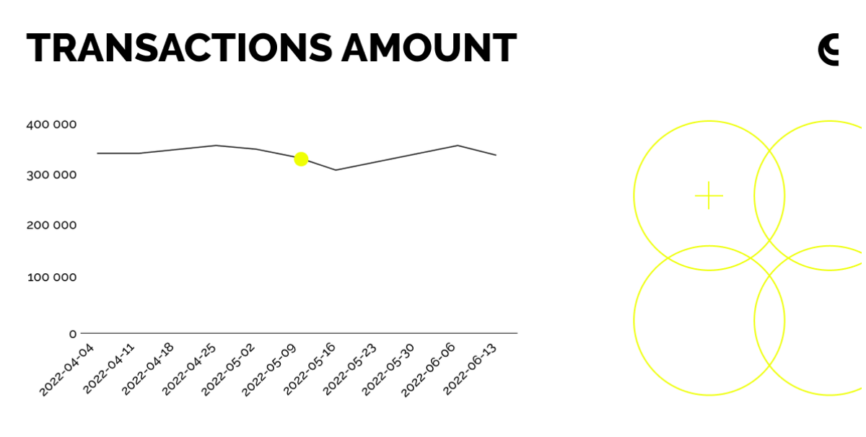

According to our internal data, even the most negative events in the crypto market in 2022 did not significantly influence the processed volumes. Check out the chart below which shows the transaction amount and volume before, during and after the Terra Luna Crisis.

The education gap is closing

In another survey by Checkout.com’s ‘demystifying crypto report’ it was found that currently, around half of all 18-35 year olds responded ‘I don’t know’ to the following statements: “Blockchain technologies will make payments faster” and ‘Stablecoins carry less volatility risk than non-pegged crypto”.

Moreover, half of the surveyed population believe that all forms of crypto are ‘risky’. Just think about that for a minute. Every second person in that survey pool thinks that storing your money with a centralised bank, that at any moment can choose to close your account or prevent actions such as withdrawals, is safer than storing your money in a place where you have complete control.

There is an education gap when it comes to crypto. What’s also apparent is that this education gap is closing, fast. The 2022 Crypto Literacy Survey saw the number of passing scores double over a one year period. Moreover, crypto ownership in the U.S. increased 88% from 17% in 2021 to 32% in 2022. More and more people are learning about the benefits of crypto, and with regulators showing up at the party, more trust is coming with it.

Regulation is coming

In Singapore, exchanges and other crypto businesses were brought into the scope of domestic regulation by the Payment Services Act 2019.41. Moreover, the UAE recently announced a new regime and regulator for virtual assets in March. This is without mentioning the EU’s Markets in Crypto Assets (also known as MiCA) which is coming into force very soon. This will forge a regulatory stance on crypto in its 27 member states and will bring a degree of welcome certainty when finalised. In fact, due to the MiCA, some of the largest crypto exchanges worldwide, notably KuCoin, are investing heavily in their EU presence.

When we move across the pond to the US, we find that Joe Biden recently issued an executive order that aims to regulate the crypto industry; indeed, this order includes 18,142 different cryptocurrencies and 460 different crypto exchanges. This is really serving as a beacon in the US for legitimising crypto as a prime economic force. The FTX debacle is also putting unprecedented pressure for more regulation in the US.

Meanwhile, Brazil’s Chamber of Deputies approved a new regulatory framework—signed under code PL 4401/2021—that will include digital currencies under the definition of “payment agreements”. While they aren’t ‘legal tender’ yet, this is a fantastic step forward.

Every day, more and more countries are bringing cryptocurrencies under their regulatory scope. So much so, that the regulatory landscape for crypto is unrecognisable from ten years ago.

The Clock is Ticking for Businesses to Integrate Crypto

77% of merchants who support payments in crypto or stablecoins saw an increase in cross border sales. The reason for this overwhelming majority is simple — the amount of potential customers that have crypto and prefer to pay using it is high.

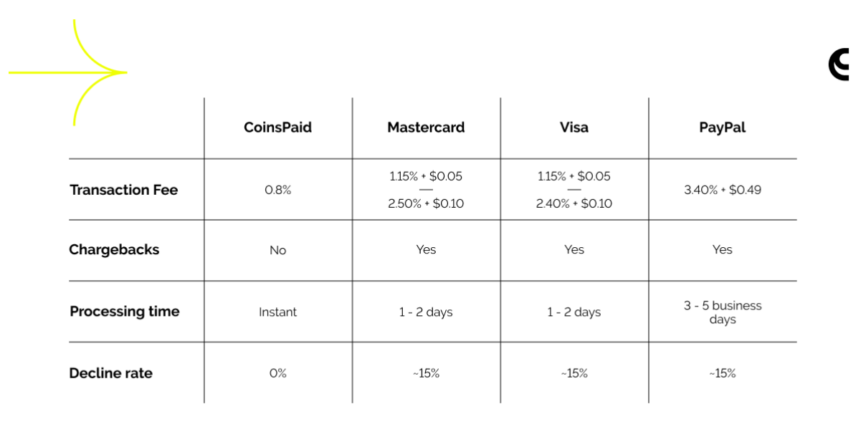

However, an increase in cross-border sales isn’t the only benefit. For example, it’s cheaper and quicker for merchants to process crypto transactions. Not only does the blockchain’s immunity to chargeback fraud lower the required rolling reserves, but with CryptoProcessing.com, 0.8% is as high as the fees go. When compared to the whopping 3.5% charged by some of the largest payment providers in the fiat world, it’s easy to see how much of a financial incentive there is to onboarding a crypto payments processor.

That’s why 23% of online businesses say that they are planning to offer crypto as a payment method by 2024. It can’t be ignored that large highstreet names are beginning to accept payment in cryptocurrencies. We’ve already covered the luxury segment, but you might be surprised to know that PayPal now accepts crypto payments. Starbucks, AT&T, AMC, Microsoft and WholeFoods are also among those who have recently taken the dip into crypto. As a matter of fact, almost 30,000 venues worldwide are now accepting crypto payments according to Coinmap.org.

"Despite the crypto market’s volatility, the adoption of digital assets is steadily rising. With more businesses and consumers embracing the efficiency, security, and lower costs of crypto payments, it’s clear that blockchain technology is here to stay, and now is the time for businesses to integrate crypto into their payment systems."

While the majority of these benefits, such as no chargebacks and rolling reserves, lower transaction fees and higher speed, will maintain their potency as time goes on, the ability to soak-up Web3 market demand in your niche will reduce as more and more of your competitors also break into the crypto payments arena.

It’s for that very reason that time is of the essence if you’re looking to grow your brand. Luckily, CoinsPais is on hand to prepare a personalised offer for integrating crypto payments and a wide range of services to choose from. If you want to learn more about how we can assist your business in a mutually beneficial way — contact our Sales team directly via Telegram for a swift response.