The CoinsPaid payments solution

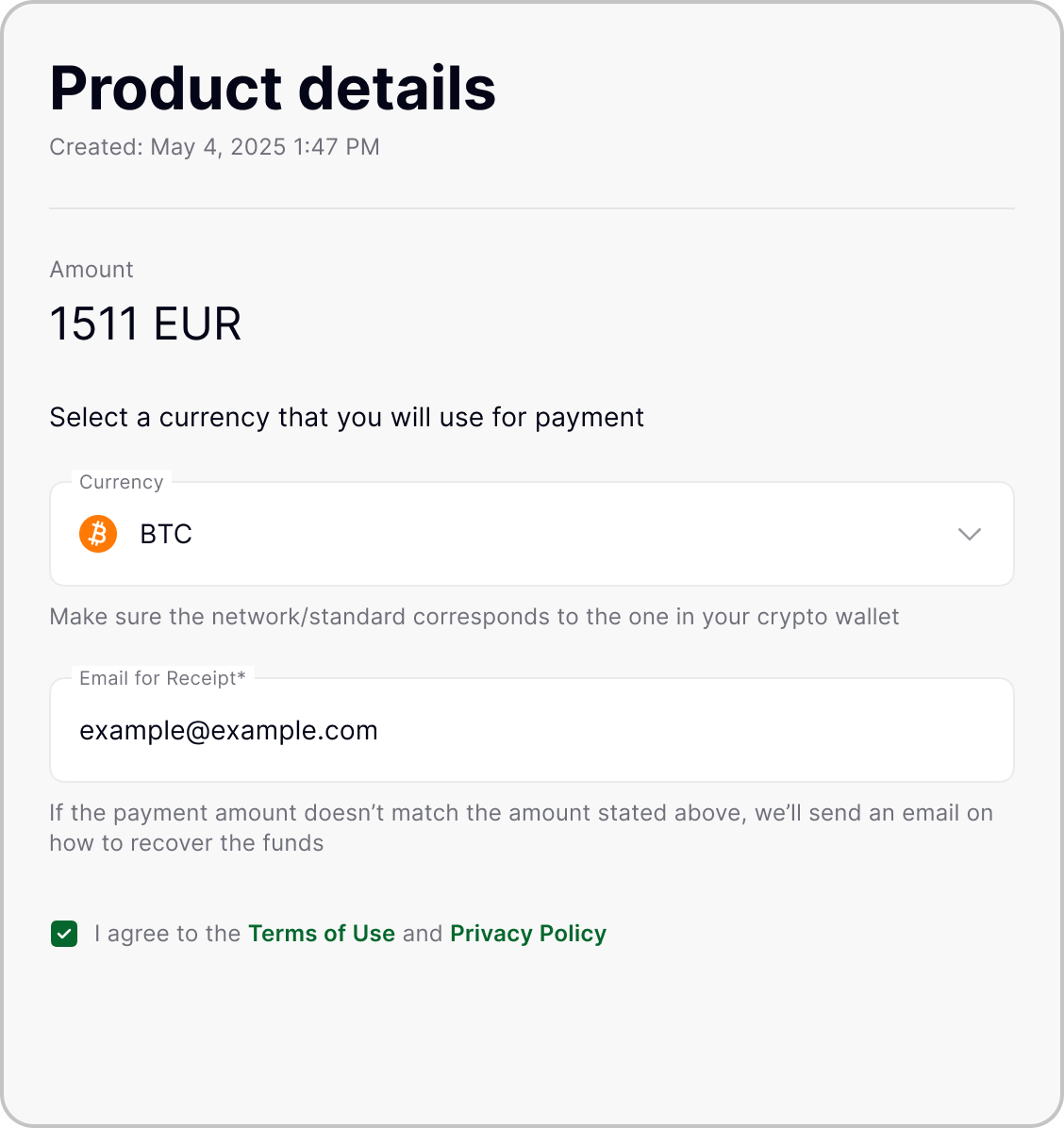

Create one-time, fixed-amount requests with a clear due window. Add success/fail URLs and automatic callbacks to keep your CRM or billing in sync – ideal for e-commerce orders and B2B quotes.

- Fixed-amount crypto request pegged to a fiat sum

- Automatic confirmations via webhooks/callbacks

- Works for large international payments with fiat settlement options

Let customers top up any amount, anytime – perfect for balances, pay-as-you-go, and accept subscription global payments. Funds can be auto-converted and credited in real time.

- Not tied to a specific fiat amount; supports partial and repeated payments

- Real-time crediting with on-the-fly conversion

Add crypto at checkout with ready-made extensions for WooCommerce, accept global payments on Magento (Magento 2), PrestaShop, and OpenCart, all with detailed step-by-step setup guides.

- Install, connect API keys, and start accepting crypto at checkout

- Support for 20+ coins with auto-conversion to fiat

A powerful REST API for accepting global crypto payments, giving you full control to create invoices, generate unique deposit addresses, set custom success or failure redirects, and receive real-time callbacks for deposits, withdrawals, and exchanges.

- Secure invoice creation with HTTPS success/fail URLs

- Real-time status updates to your backend via callbacks

international payments at a glance

| Feature | Banks / Cards | Crypto Payments (via CoinsPaid) |

|---|---|---|

| Transfer time | International wires typically 1–5 business days (often longer by corridor). | Minutes, depending on blockchain confirmations and network conditions. |

| Fees | Cards often 2–4%+ with cross-border/FX markups; wires add bank fees and spreads. | Commonly 1–2% plus network fee; pricing tailored to the merchant and use case. |

| Cross-border access | Relies on correspondent banks, local rails, and risk policies – delays and extra costs are common. | Wallet-to-wallet; policy-based acceptance rather than rail-based. Suitable for many ways to accept international payments. |

| Chargebacks / reversals | Chargebacks and payment holds are a known risk. | No chargebacks – transactions are final once confirmed (refunds are merchant-initiated). |

| Availability | Often limited by banking hours and holidays (some services moving toward 24/7). | 24/7/365 settlement on public networks – useful for accepting international payments online at any time. |

Why CoinsPaid

Boost conversion on cross-border checkouts with a cryptocurrency payment gateway built for speed, security, and straightforward integration.

Built for businesses that need to accept global payments and accept international payments without relying on correspondent banking corridors.

Confirmations in minutes with fees typically lower than traditional providers; ideal for cross-border payments crypto use cases and accepting large international payments.

Let buyers pay with familiar assets (BTC, ETH, USDT, USDC and more) to lift checkout completion; perfect for merchants that accept cryptocurrency for business.

ISO-certified info-security practices plus KYC/KYB and AML monitoring help you meet policy and audit needs.

Plug in fast via CMS plugins (WooCommerce, accept global payments on Magento 2, PrestaShop, OpenCart) or build on the accept global payments API with webhooks and callbacks.

Accept 20+ cryptocurrencies with automatic exchange to fiat and bank withdrawals (SEPA/SWIFT).

Our clients’ case studies

Accept Bitcoin and other popular cryptocurrencies

How to start accepting crypto

Talk with a dedicated manager about your use case – B2C checkout, B2B invoices, or large international payments. You’ll complete KYB and choose the best path to accept global payments.

Plugins: WooCommerce, Magento 2 (accept global payments on Magento), PrestaShop, OpenCart.

Invoices & Payment Links: fixed-amount requests for fast remote collection.

Channels: ongoing top-ups and usage-based billing (ideal for accepting subscription global payments).

API: full control with sandbox – perfect when you need a custom accept global payments API flow.

Select the cryptocurrencies you’ll accept, enable auto-conversion to fiat, add bank details for SEPA/SWIFT withdrawals, then set success/fail URLs and callback endpoints for status updates.

Publish your checkout or send links. Your backend receives signed callbacks (amount, currency, status, fees) for straightforward reconciliation across your global payment processing solutions.

Frequently asked questions – accepting cryptocurrency payments

In most jurisdictions, yes – provided you follow local rules on payments, tax, and consumer protection. Merchants typically partner with a licensed provider that handles KYC/KYB and AML monitoring.

Use a regulated cryptocurrency payment gateway. Complete KYB, integrate via plugin or API, set supported coins and settlement rules, and align your policies with AML standards. This is a practical path for merchants asking how to accept international payments.

Often. Cards and cross-border services stack percentage fees and FX markups, while crypto processors typically charge a simple processing fee plus the network fee. Actual costs depend on your corridor, volumes, and risk profile.

Expect a processor fee (commonly around 1-2%) and a variable blockchain network fee. Pricing is customised after KYB so you can choose the best way to accept international payments for your business model.

Yes. A reputable provider applies KYC/KYB, AML/CTF monitoring, sanctions screening, and ongoing risk controls, and operates under the relevant licensing regime. This underpins secure global payment solutions for merchants.

Key risks include price volatility (mitigated by instant conversion to fiat), irreversibility of transactions, regulatory obligations, and operational factors like network congestion. Clear policies and a strong provider reduce these risks.

- Book a consultation and complete KYB.

- Pick your flow – CMS plugin (WooCommerce/Magento 2/PrestaShop/OpenCart), Invoices/Payment Links, Channels, or API.

- Configure coins, settlement (e.g., auto-convert to fiat), and webhooks.

- Test in sandbox and go live.

Tip: If you’re evaluating platforms like Shopify, ways to accept international payments include hosted payment links or a separate checkout flow managed by your crypto gateway.