What is Capitulation in Crypto?

Capitulation in crypto refers to a sharp, emotion-driven sell-off that leads to a steep market drop. It typically signals the end of a downward trend, as panic replaces strategy and sentiment hits a low point.

Table of contents:

Capitulation is a defining moment in market cycles. It occurs when participants under heavy pressure exit their positions, often at a significant loss. This shift from hope to fear drives prices lower at an accelerated pace.

In cryptocurrency markets, capitulation can occur more rapidly than in traditional finance. With 24/7 trading, high volatility, and fewer regulatory protections, digital asset holders may respond quickly to negative triggers. The result is intense downward pressure that can wipe out weeks or months of gains in hours or days.

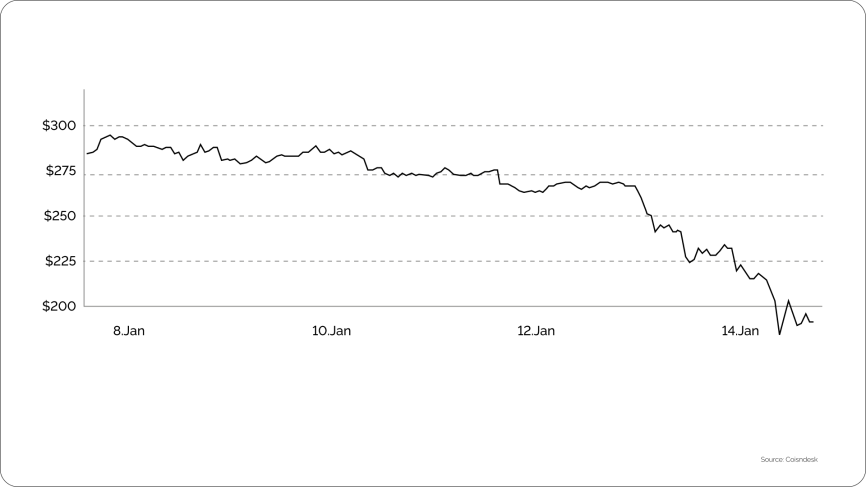

For example, Bitcoin plunged 50% in the first half of January 2015. A 24% single-day drop followed news of a major exchange hack involving 19,000 BTC. The selling intensified until liquidity dried up and price action began to stabilize.

The Role of Capitulation in Market Cycles in Crypto

Capitulation is not a failure. It is a structural feature of market psychology and part of the cycle. It marks a breaking point – where pressure forces mass selling and resets sentiment across the market.

In crypto, capitulation defines peak selling pressure. The sell-off forces out many participants and often signals a turning point. After this, the market usually calms down, with lower trading activity and slow signs of recovery.

How Capitulation Affects the Market

Capitulation changes behavior. It impacts short-term trading, long-term positioning, and overall sentiment. Each segment of the market responds differently under pressure.

- Capitulation deeply impacts market sentiment. As panic spreads, confidence breaks down across platforms and communities. Conversations about long-term potential fade or stop completely. Trading slows as fear takes over, and rebuilding trust takes time. The emotional toll often lingers long after prices begin to stabilize.

- For traders, capitulation creates extreme volatility. Sudden price swings increase both the chance for profit and the risk of loss. Many strategies fail as market momentum overrides planned moves. Stop-loss orders trigger in waves, causing sharper declines. Still, some market participants may see this chaos as an opening for high-risk, high-reward trades.

- Long-term holders also feel the pressure. Deep losses shake belief in the market’s future. Many crypto owners exit at a loss to avoid further decline, while others stay out entirely, uncertain about what comes next. During these moments, prices often fall well below what many consider fair value.

Capitulation doesn’t just move prices. In general, it reshapes narratives, shifts tone across media, and affects participation across the ecosystem.

How Capitulation Occurs in the Crypto Market

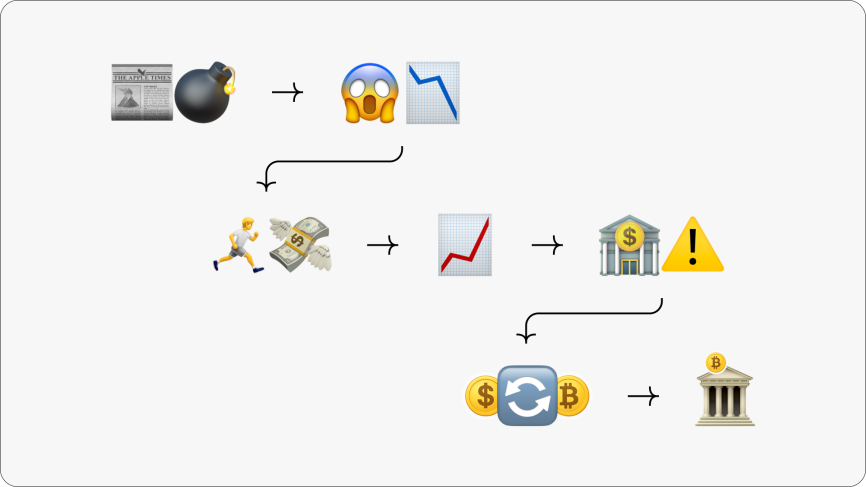

Capitulation in crypto typically follows a recognizable sequence. While not always identical, many events share common traits that build toward a full-blown sell-off.

- Initiating event. The decline usually begins with a major external shock. It could be the collapse of an exchange, a large-scale hack, unexpected regulatory news, or global economic stress. Prices can fall sharply – sometimes by 30% or more within hours.

- Selling. Fear takes over. Market participants rush to sell without a strategy, trying to cut losses. This panic triggers forced liquidations, which push prices even lower.

- Surge in trading volume. As the sell-off gains speed, trading activity increases. Large holders start to exit their positions. Liquidity thins out, and order books lose depth.

- High volatility. Price swings become more extreme. Algorithms and stop-loss orders activate in waves, creating sharp, unpredictable moves and reinforcing the downward pressure.

- Oversold conditions. Technical indicators like the Relative Strength Index (RSI) drop into deeply oversold territory. Despite the signals, most participants hesitate to buy, uncertain about where the bottom lies.

- Exhaustion point. The intensity fades. Most panic sellers are out. Short positions begin to close, and selective buying starts to reappear, though cautiously and in low volume.

- Early stabilization. Prices begin to settle. Trading slows, and while sentiment remains negative, the market starts to show signs of balance. The sharp sell-off ends and the groundwork for recovery is laid.

As the market stabilizes after capitulation, confidence can begin to return gradually. Businesses may resume activity, and services like a crypto payment gateway often see renewed interest as sentiment improves.

Conclusion: why understanding capitulation matters in crypto

Capitulation marks a turning point in market cycles. It shows when fear drives mass selling and forces the market to reset.

Spotting these phases can support better planning and risk awareness. Sharp drops in price or sudden spikes in volume often mark the start of recovery.

During capitulation, several forces shape the market:

- Confidence breaks down, and trust in the market weakens.

- Extreme volatility disrupts trading strategies.

- Long-term holders often exit at losses, pushing prices below fair value.

The ability to read these moments gives crypto holders and businesses a clearer view of both the risks and the potential that may follow.

Other Terms from the Crypto Industry