What is FUD in Crypto?

FUD in crypto stands for Fear, Uncertainty, and Doubt. It refers to the deliberate spread of negative or misleading information intended to influence sentiment and disrupt market activity. In the digital asset space, FUD often appears during periods of high volatility, where emotional responses can lead to rapid price shifts.

Table of contents:

FUD is a psychological tactic. It injects fear into discussions around cryptocurrencies, often without factual backing. Whether it’s a headline, a piece of news, a tweet, or a rumor, the goal remains the same: to disturb confidence and create doubt around a token, coin, or the crypto market as a whole.

| FUD Category | Description |

|---|---|

| Common FUD | Common FUD involves claims that a cryptocurrency lacks value, is unstable, or only serves illicit purposes. Such statements often ignore blockchain adoption, real-world use cases like crypto payment gateways integration by businesses, and long-term developments in the sector. |

| Technology FUD | Technology FUD contains concerns about slow transaction speeds, energy consumption, or security flaws. While these issues exist, they’re often presented without context. Technological advancements, such as proof-of-stake, scalability upgrades, and renewable energy solutions, continue to address them. |

| Regulatory FUD | Regulatory FUD is connected with stories about potential government bans or new tax laws, which fuel uncertainty. Such fears may cause immediate sell-offs, but in many cases, legal clarity later supports broader adoption. |

| Miscellaneous FUD | Miscellaneous FUD includes celebrity manipulation, threats from quantum computing, or global internet outages. While some topics reflect possible risks, they rarely hold weight in daily market behavior. |

An important note is that FUD is not always based on lies. However, the selective use of facts or emotionally charged language often amplifies the effect. Just think, a 2024 survey by Kraken revealed that 81% of U.S. crypto holders admitted to making investment decisions influenced by FUD. Additionally, 63% acknowledged that such emotional decisions had negatively affected their portfolios.

Why FUD Is Common in Crypto Markets

The cryptocurrency market is highly responsive to sentiment. A single event or headline can trigger large-scale reactions. Combined with limited oversight and global access, it makes crypto a good environment for FUD.

FUD can arise from real-world events and deliberate manipulation.

- Natural FUD stems from real developments. Issues like lawsuits, exchange failures, or security breaches can spark genuine concern. A legitimate problem can trigger a chain of fear-driven reactions, especially if the event receives extensive media attention.

- Artificial FUD is strategic. It often involves coordinated efforts to manipulate perception. Large entities may use media outlets, social platforms, or influencer networks to push damaging narratives. Once market prices fall, these same players may quietly accumulate assets at a discount.

Why FUD Works: Key Market Forces

Several forces explain why FUD spreads so quickly in crypto:

- Market disruption: Certain groups benefit from sharp price drops. Generating negative sentiment can create better entry points.

- Project rivalry: Competing platforms sometimes use FUD to divert attention or erode trust in challengers.

- Unclear regulation: Regulatory shifts – especially if vague or speculative – fuel market stress. The absence of consistent policy adds to the fear.

The Impact of FUD on Market Behavior

FUD often triggers strong emotional responses. Even solid projects can experience sudden downturns when exposed to coordinated doubt.

Here’s what typically happens:

- Panic prompts fast exits and price drops.

- Uncertainty drives erratic decision-making.

- Negative sentiment can ripple across unrelated assets.

- Short-term thinking replaces strategic planning.

Here are several notable examples of FUD incidents in the crypto environment:

- Event: China’s cryptocurrency exchange ban in 2017

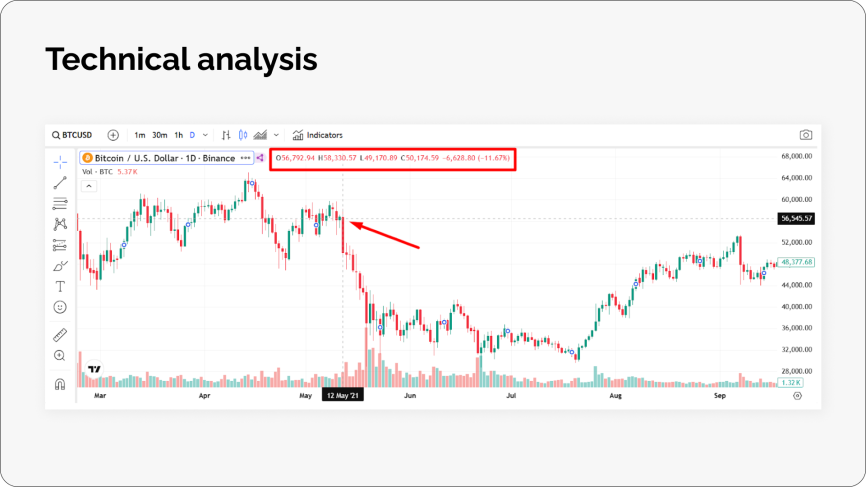

Result: Bitcoin’s price dropped by over 8% in a single day following the announcement. - Event: Tesla’s decision to stop accepting Bitcoin in 2021

Result: A tweet from Elon Musk led to an immediate 12% drop in Bitcoin’s price.

- Event: FTX collapse in 2022

Result: The bankruptcy of FTX, a major crypto exchange, caused significant market turmoil, with Bitcoin reaching its lowest price in two years. - Event: $LIBRA token incident in 2025

Result: Promoted by Argentine President Javier Milei, the token’s value surged from $0.000001 to $5.20 within 40 minutes, only to crash by 85% shortly after.

The real-world examples vividly show that when fear dominates, markets behave irrationally. Emotional responses overshadow logic. In these moments, even data-backed assets may suffer setbacks, regardless of fundamentals.

How FUD Spreads

FUD often begins with a single message – but within hours, it can shift global market sentiment.

It spreads across several channels:

- Public figures

Well-known personalities can shift sentiment instantly. A single quote or post may send the market into disarray. - Media headlines

News reports with dramatic titles can distort reality. Stories about bans, legal actions, or bankruptcies may lack nuance, yet still trigger large reactions. - Social platforms

Communities on X (formerly Twitter), Telegram, or crypto forums frequently amplify speculation. Unverified claims about token presales, hacks, or partnerships often shape early sentiment.

Recognizing FUD in the Market

Recognizing FUD helps understand market trends. It often follows a clear pattern:

- Sensational headlines dominate news cycles.

- Vague predictions replace verified facts.

- Emotion outweighs evidence in public discussion.

Platforms like CoinMarketCap provide a grounded view. They help separate short-term panic from meaningful developments.

Other Terms from the Crypto Industry