What are Futures in Crypto?

Futures in crypto are standardized financial contracts that obligate parties to buy or sell an asset at a predetermined date in the future and an agreed-upon price.

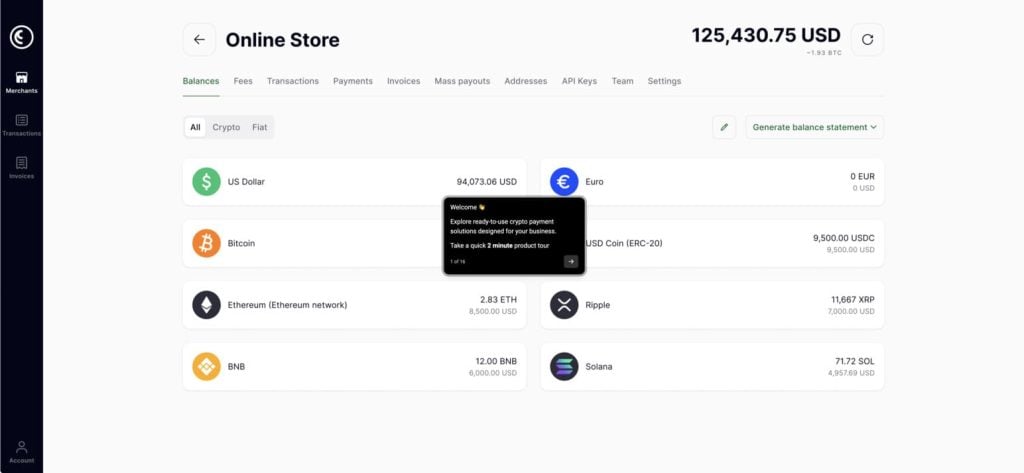

Futures in the crypto space function much like they do in the traditional market. These financial agreements imply a commitment between two parties to buy or sell an asset at a specific date in the future, with pre-determined terms and conditions, including price and quantity. Traded on organized exchanges with the use of a cryptocurrencies payment gateway, crypto futures allow market participants to hedge their investments against volatility, speculate on price changes and actively manage risk in dynamic cryptocurrency markets.

How do Futures Work?

Futures contracts, whether in traditional finance or cryptocurrency, operate based on standardized agreements that include important details such as the type of the traded asset, its quantity, the delivery date, and the agreed price. This standardization ensures consistency and transparency in the trading ecosystem and allows traders to make informed decisions.

Participation in crypto futures trading often involves the concept of margin. Traders are required to deposit a margin, which is a percentage of the contract value. It serves as a security deposit and helps reduce the risk of default. Cryptocurrency futures trading often utilizes leverage to allow traders to control larger positions with less capital.

The Pros and Cons of Crypto Futures Trading

Crypto futures trading, like any other financial activity, comes with its own set of advantages and disadvantages. On the positive side, futures provide a hedge against market volatility, allowing investors to protect their assets from unfavorable price fluctuations. Speculators can also use futures to capitalize on expected market trends.

However, the use of leverage, a common practice in futures trading, introduces heightened risk. The speculative nature of futures trading means that while leverage can increase potential profits, it also increases the risk of loss, which emphasizes the importance of sound risk management strategies.

Other Terms from the Crypto Industry