What is KYB (Know Your Business)?

KYB (Know Your Business) is a verification process that confirms the legitimacy of companies in crypto transactions to ensure compliance with Anti-Money Laundering (AML) regulations.

Table of contents:

KYB, or Know Your Business, is a verification process that checks the legitimacy of companies involved in crypto transactions. It helps platforms confirm who they do business with and ensures those companies comply with Anti-Money Laundering (AML) regulations.

The EU’s 5th Anti-Money Laundering Directive (5AMLD) sets strict KYB requirements for certain business types. If a company operates in or with the crypto sector, it may fall under mandatory KYB obligations. It’s important to confirm whether your business falls under these rules. Regulatory obligations can differ by country, so businesses should review local compliance requirements as well.

Beyond Europe, other regions apply their own standards. In the United States, the Financial Crimes Enforcement Network (FinCEN) requires businesses to conduct KYB as part of broader AML and CFT rules, with oversight supported by the Office of Foreign Assets Control (OFAC). Singapore enforces KYB under the Payment Services Act through the Monetary Authority of Singapore (MAS), which makes it mandatory for firms offering digital payment token services. These variations highlight the need for companies to assess both domestic and international obligations when operating across jurisdictions.

Entities required to carry out KYB checks include:

- Financial institutions

- Credit institutions

- Online banking platforms

- Electronic payment services

- Crypto exchanges and marketplaces

- Accounting firms and audit providers

- External tax consultants

- Notaries and legal professionals

- Corporate trusts

- Real estate and estate agencies

- Gambling and betting operators

- Environmental and waste management companies

- Dealers in high-value and luxury goods

- Trust and company service providers (TCSPs)

How is KYB Different from KYC?

KYB focuses on verifying companies. In crypto, KYB checks confirm that business partners are legitimate and compliant.

In its turn, KYC, or Know Your Customer, verifies individual users. Both prevent illegal activities on crypto platforms.

The key difference is the verification target: KYC verifies people, while KYB verifies business entities. KYC builds user trust. KYB protects platforms from fake or high-risk companies.

The general goal is clear: prevent lawbreakers from using crypto platforms for illegal activities.

Why is KYB Especially Important in the Crypto Industry?

According to the Chainalysis 2025 Crypto Crime Report, in 2024, out of the $40.9 billion sent to illicit crypto addresses, $10.8 billion went to wallets linked to entities directly engaged in or enabling cybercrime, such as hacking, extortion, scams, and laundering-as-a-service operations.

It shows the urgent need for strong KYB checks. KYB helps crypto companies stay compliant, avoid penalties, and maintain clean ecosystems. It verifies company ownership, registration data, and legal status, stopping shell companies from hiding criminal behavior.

The problems KYB solves:

- Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT). KYB identifies and blocks businesses involved in money laundering or illegal funding. It gives access to crypto ecosystems for only legitimate companies.

- Compliance with regulatory requirements. Global regulators require strict verification. KYB crypto solutions automate compliance, reduce human error, and help platforms avoid fines or operational bans.

- Business fraud prevention. KYB detects shield companies, fake vendors, and high-risk entities before transactions. It can protect crypto firms from financial losses.

- Building trust with partners and clients. Verified business relationships show a commitment to transparency and integrity. Strong KYB practices boost confidence among users, partners, and regulators.

How KYB Works

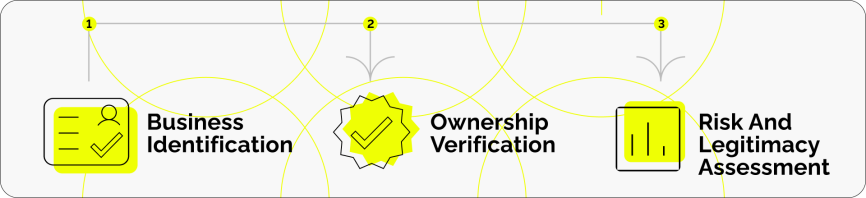

KYB in crypto follows a clear, step-by-step process to confirm the legitimacy of a business before entering any relationship. The common stages usually are:

- Business identification. The process begins by collecting and verifying basic details about the company. It may include its legal name, operating address, registration number, and legal status in official registries.

- Ownership verification. Next, KYB checks map out the full ownership structure. Crypto firms must identify and verify all ultimate beneficial owners (UBOs), typically those who hold 25% or more of the business. In some jurisdictions, such as the US, the threshold drops to 20%.

- Risk and legitimacy assessment. The final step reviews the company’s background to uncover red flags. It includes screening for sanctions, links to politically exposed persons (PEPs), adverse media coverage, and other indicators of financial or legal risk.

KYB is not a one-time check. Continuous monitoring is a must, especially for companies operating in or with high-risk jurisdictions. Business ownership, registration status, and risk exposure can change over time, so platforms need to re-verify partners regularly. Ongoing checks help catch new risks and keep compliance up to date.

How KYB Is Implemented in Crypto

KYB in crypto demands fast, data-driven processes. Manual checks are slow, costly, and prone to error. To meet compliance standards and scale securely, crypto firms turn to automation.

With API integrations, platforms link directly to official databases and third-party services. It provides instant access to verified business data, registration records, and UBO details. APIs support real-time monitoring and reduce manual workloads.

Automated checks help smart systems screen business entities against global sanctions lists, watchlists, and regulatory databases. High-risk entities are flagged in seconds, faster and more accurately than any manual review.

Integration with AML Platforms

Advanced KYB solutions integrate with AML platforms and trusted data providers. It gives crypto companies access to live data on sanctioned businesses, PEPs, and high-risk jurisdictions.

Real-time validation improves onboarding, ensures regulatory compliance, and strengthens defenses against financial crime. As business information changes, systems update automatically, flagging new risks and maintaining audit readiness.

Conclusion: why KYB is so important for crypto businesses

Unlike KYC, which checks individuals, KYB confirms the identity and ownership structure of business entities and their compliance with regulations.

For crypto platforms, strong KYB practices are designed to support compliance with AML and CFT rules, protect against fraud, and strengthen trust with users and regulators. By combining automated KYB tools with real-time data from registries and sanctions lists, platforms can speed up onboarding, cut down on errors, and stay prepared for audits as global rules change.

Benefits of KYB for crypto platforms:

- Better reputation through transparent business checks

- Lower operational risks by detecting high-risk or fake companies early

- Easier access to banking and financial services

- Stronger partnerships built on verified trust

In a market where regulation and oversight continue to expand, KYB gives crypto businesses a clear advantage.

Other Terms from the Crypto Industry