What is Price Volatility?

Price volatility is a metric that shows how much the price of an asset fluctuates over time. It reflects both the frequency and the scale of price changes, whether upward or downward.

Table of contents:

High volatility means prices move sharply in short periods.

Low volatility indicates more stable price behavior.

The concept of volatility dates back to the 1950s with the development of the idea that increased risk is usually matched by the opportunity for greater upside. It became essential for assessing market risk and comparing the stability of different assets.

Historical volatility is typically calculated as the standard deviation (σ) of an asset’s returns over a set period. To compare volatility across different timeframes, it is often scaled using the formula:

Volatility = σ√T

Where:

σ = standard deviation of returns

T = number of time periods (e.g., days, months, years)

This formula helps translate raw price movements into a single, comparable risk metric. A higher value points to greater unpredictability, while a lower value signals more consistent performance. Volatility plays a key role in pricing models, portfolio construction, and strategic decision-making across markets.

What does Cryptocurrency Price Volatility Mean?

Cryptocurrency price volatility refers to the speed and scale of price changes in digital assets over short timeframes. These movements can be sharp, sudden, and unpredictable. Sometimes, crypto holders experience price swings of 10–20% within a single day. It makes digital assets among the most volatile instruments in global markets.

Unlike traditional assets, cryptocurrencies trade around the clock. There are no market opening or closing hours. With constant trading across global platforms, prices can respond instantly to market shifts and events in the world.

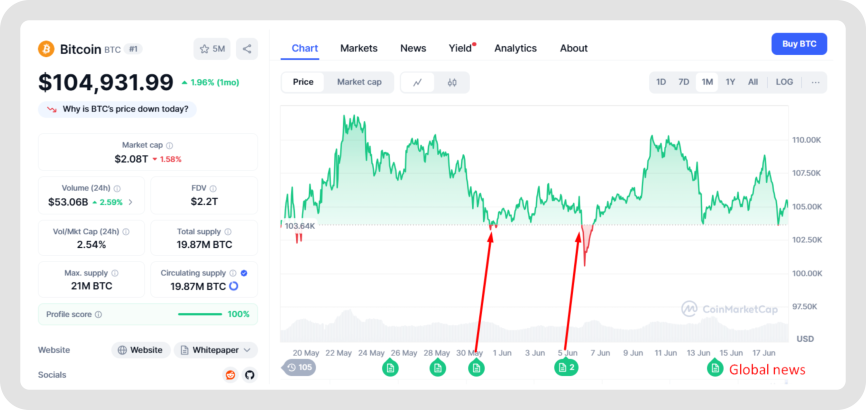

Here’s a clear example of how quickly the market reacts to global news, causing a sharp drop in Bitcoin’s price (June 18, 2025):

Volatility in crypto is typically measured using annualized standard deviation of returns, which shows how much a coin’s price deviates from its average over time. In some cases, implied volatility from crypto derivatives markets gives insight into expected future price swings.

Why does Volatility Matter in Crypto?

Price volatility affects nearly every part of the crypto ecosystem:

- Token pricing. Volatile assets present challenges for fair token valuation during fundraising, trading, or reward distribution, especially since many lack a clear peg or baseline value.

- Treasury management. Corporate treasuries and DAOs must account for wide token fluctuations. Crypto assets hold significant risk for liquidity and require specific hedging strategies.

- Payments and commerce. Merchants accepting crypto must contend with instant price changes. Crypto payment gateways often offer real-time conversion tools to shield merchants from extreme volatility.

- Trading infrastructure. Exchanges and liquidity providers face challenges like liquidation cascades and slippage during sharp price moves.

Historical Examples of Crypto Volatility

Volatility in crypto is well-documented across nearly every market cycle. Several key events illustrate just how unpredictable and fast-moving these markets can be:

- Bitcoin in 2017–2018. Bitcoin traded below $1,000 at the start of 2017. By December, it surged to nearly $20,000. Within the following year, it dropped by more than 80%, reaching lows around $3,200 in December 2018. It was one of the first major boom-and-bust cycles that brought global attention to crypto market volatility.

- Bitcoin in 2021. In April 2021, Bitcoin reached an all-time high of over $64,000. By July, it fell below $30,000, losing over half its value in less than three months. A partial recovery followed, with the price climbing above $68,000 in November. But by June 2022, Bitcoin again fell below $20,000, marking another steep correction.

- FTX collapse in 2022. In November 2022, the unexpected collapse of the FTX exchange triggered a market-wide selloff. Within days, over $200 billion in value was wiped from the global crypto market. As a result, Solana fell by over 50%.

These events reflect typical crypto price behavior.

Using the crypto payment solutions by CoinsPaid can help mitigate exposure to short-term price fluctuations by locking in exchange rates at the time of transaction.

What are Cryptocurrency Price Volatility Factors?

Several factors explain why crypto assets are more volatile than other financial instruments:

- Market maturity. The crypto space is still developing. Most digital assets have only existed for a few years. With fewer participants and limited institutional presence, the market remains thin. That makes prices more sensitive to large trades, external news, or shifts in sentiment.

- Liquidity constraints. Many cryptocurrencies, especially new or niche tokens, suffer from low trading volumes. When fewer buyers and sellers are available, even small transactions can move the market. Thin order books amplify price swings. A large buy or sell order can cause significant shifts almost instantly.

- Speculation-driven activity. Price movements in crypto often come from emotional or speculative trading. Social media trends, influencer opinions, or fear of missing out (FOMO) can drive prices up fast. Likewise, fear, uncertainty, or bad news can cause panic selling. There is often little connection between price movements and the underlying fundamentals of a project.

- Regulatory news and legal uncertainty. A new policy in one country can lead to a global sell-off or rally. Traders react quickly to headlines about government restrictions, tax policies, or court rulings. The absence of uniform regulation contributes to price instability.

- Technology developments and adoption trends. Changes in a project’s codebase, such as a network upgrade or security fix, can affect prices. So can broader adoption. Suppose a well-known company starts using a blockchain protocol, that can push prices up fast. On the other hand, technical failures or security breaches can trigger sharp declines. For example, Ethereum’s 2021 London hard fork introduced a fee-burning mechanism, which boosted the price by 18%.

These factors combine to make crypto an asset class defined by price unpredictability. For businesses operating in this space, price volatility presents both opportunity and risk. Strategic planning must take rapid market changes into account. Whether setting token prices, managing digital treasuries, or accepting crypto payments, understanding volatility is a must for any company.

A crypto wallet for business like CoinsPaid is designed to reduce exposure to volatility through near-instant crypto-to-fiat conversion, helping businesses manage price risk.

CoinsPaid does not provide investment or financial advice. The tools referenced are designed to assist in operational efficiency and transaction processing.

Volatility in Crypto (Video)

Start your crypto journey today. Watch the video and learn from CoinsPaid experts.

In this lesson, we explore the concept of volatility in the crypto market — what causes it, how it affects users and businesses, and how to manage it.

Discover the world of cryptocurrency with us. Watch the video and learn to build a successful business with CoinsPaid Crypto Academy.

Conclusion

Price volatility in crypto refers to how frequently and drastically the price of a digital asset changes over time. For businesses, traders, and investors alike, it’s a core indicator of risk and opportunity. In the crypto ecosystem, volatility is high due to factors like low liquidity, speculative trading, evolving regulations, and constant 24/7 global market activity. Understanding volatility is essential for:

- Making informed trading decisions

- Managing treasury risk

- Accepting crypto payments without losses

- Evaluating digital assets for investment or operational use

By recognizing historical patterns (like Bitcoin’s dramatic cycles or the FTX crash), users can better navigate the market. And with tools like CoinsPaid’s crypto-to-fiat conversion, businesses can hedge against price swings and ensure stable operations even in volatile conditions.

Other Terms from the Crypto Industry