Who’s using cryptocurrency in 2025?

The world of crypto has experienced a seismic shift in recent years, as digital currencies have become increasingly mainstream and widely accepted. With Bitcoin leading the charge, the cryptoсurrency market has attracted millions of users worldwide, leading to increased adoption of crypto payment gateway services among businesses along the way as well.

In this article, we delve into the demographics of crypto users, explore their occupations and education levels, and examine the industries where crypto adoption is gaining momentum. By understanding who’s using digital currencies and where they are being utilised, we gain valuable insights into the growing influence and impact of cryptocurrencies in today’s society.

Who uses crypto

According to Statista, the number of cryptocurrency users worldwide exceeded 650 million in December 2024. Despite market fluctuations and global economic crises, the steady rise in crypto users demonstrates the increasing mass adoption of digital currencies. Today, almost 15,000 companies worldwide accept Bitcoin as a form of payment.

According to the Global Crypto Adoption Report 2025 by CoinPedia, 60% of crypto users are under the age of 34, and 68% of cryptocurrency retail investors are male. Furthermore, over 68% of crypto users in the 25-34 age group are male, 70% in the 18-24 age group are male as well. This data paints a picture of the average crypto user as a young male.

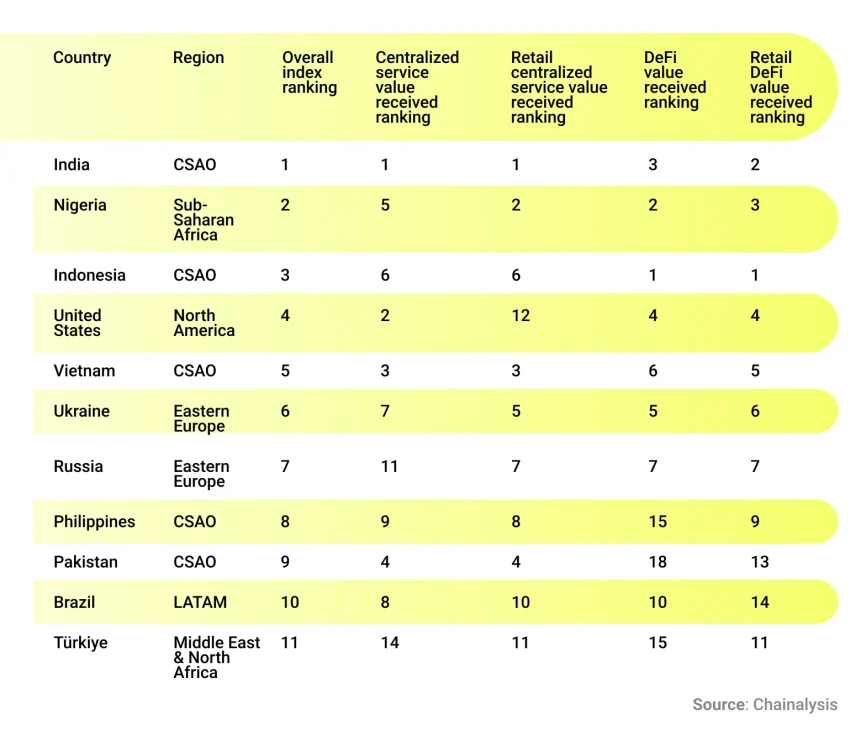

Crypto adoption is global, but certain countries have emerged as front runners. As Chainalysis reveals, India, Nigeria, and Indonesia have witnessed significant crypto adoption, particularly in the context of unstable national currencies. The stability offered by cryptocurrencies has attracted individuals in these countries.

Occupation and income of crypto users

While the stereotype suggests that the average crypto user is an IT professional, the landscape is evolving. The most common employment sectors among crypto users include:

- Software

- Finance

- Electronics

- IT

However, there is a noticeable reduction in concentration, with sectors like construction, arts, entertainment, and education gaining traction. The finance sector has seen a significant 33% increase in participation, indicating a changing demographic as crypto becomes more widespread. It is reasonable to assume that by 2025-2027, people from various occupations and backgrounds will own and use digital assets.

"Crypto adoption is growing beyond tech and finance. People from all industries are now seeing its value, and we’re seeing it impact more sectors than ever."

Based on the 2025 report by the National Cryptocurrency Association, 64% of crypto users in the US earn less than $75,000-500,000 per year. Comparing this figure to the global average income of approximately $14,000 per year, it positions crypto users in the upper-middle-class range. This indicates that crypto users are not necessarily millionaires, but rather individuals with above-average earnings.

The average crypto user tends to be educated. While the median education level among crypto users is equivalent to a high school degree, more than a quarter hold a university degree. The complexity and learning curve associated with crypto contribute to the preference for educated users in the space.

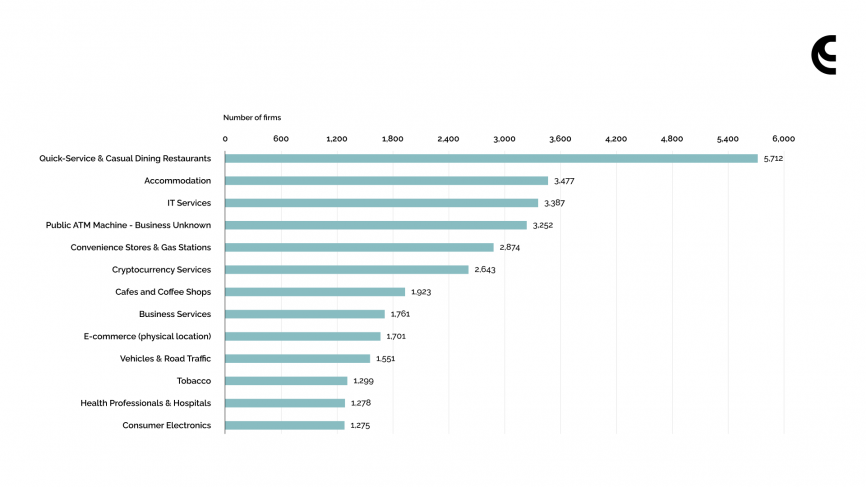

Crypto adoption by industry

In 2023, the iGaming industry was the most correlated industry with the crypto market. This correlation stems from the numerous perks and advantages that arise when online gambling meets digital assets. The ability to facilitate instant and borderless transactions allows users to conveniently participate in iGaming activities regardless of their geographical location. Cryptocurrency payments offer lower fees (around 1.5%) and enable users to avoid the restrictions often imposed by traditional banking systems.

For instance, in countries where fiat deposits on casino websites are prohibited, using cryptocurrencies becomes a viable solution. Moreover, crypto provides those who earn crypto through gambling with an opportunity to avoid taxes on their gambling profits.

Сryptocurrencies are also gaining traction in various sectors, prompting businesses to integrate crypto payments. E-commerce follows closely behind, driven by the chargeback-smashing potential of crypto as a payment medium. The speed and low fees associated with cryptocurrencies make them attractive in the realms of finance and real estate.

Additionally, the Travel industry has seen notable growth with companies like Mirai Flights, a private jet chartering agency, experiencing a 30% increase in profits after integrating crypto processing.

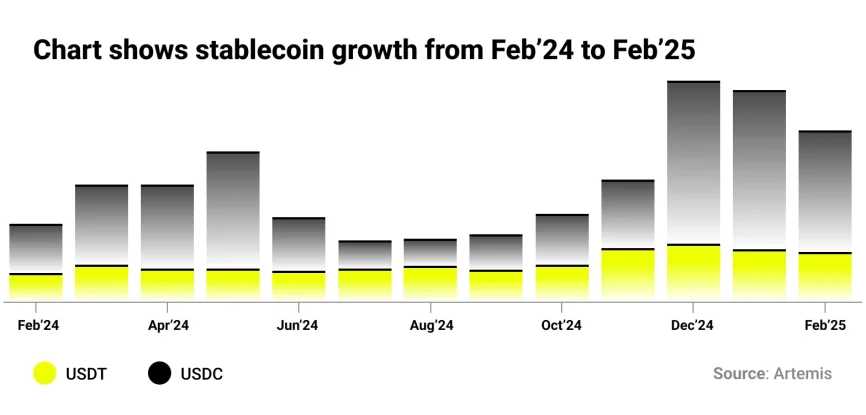

This broader adoption is reinforced by the growing number of people actively using stablecoins. Active stablecoin wallets rose from 19.6 million in February 2024 to over 30 million by February 2025, which is a 53% increase in just one year. It points to deeper user engagement and a stronger role for stablecoins in global digital finance, especially for users seeking reliable, non-volatile crypto payment options.

Stablecoins growth (February 2024 - February 2025)

Final thoughts about crypto adoption

The emergence and rapid growth of cryptocurrencies have brought about a paradigm shift in the global financial landscape. As we have explored the demographics, occupations, and industries associated with crypto adoption, it is clear that digital currencies are no longer confined to a niche market. The increasing number of crypto users, especially among the younger generation, signifies a changing financial landscape driven by technological advancements.

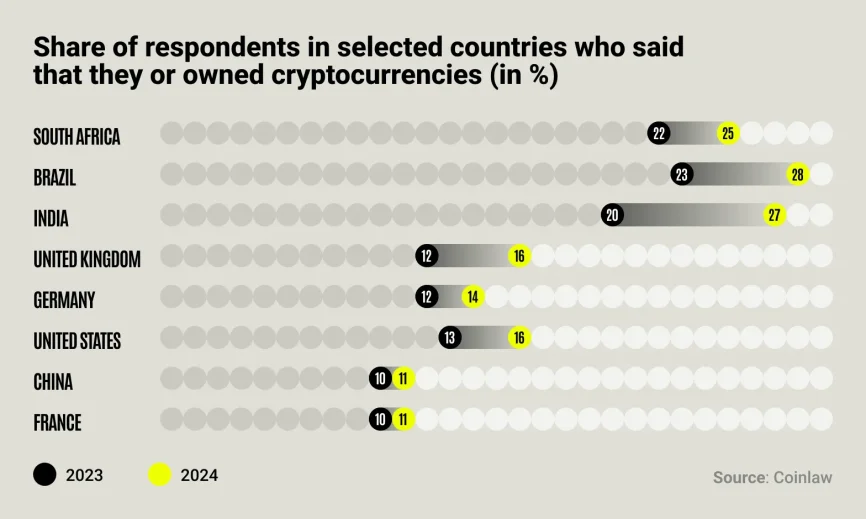

Between 2023 and 2025, countries like South Africa (from 22% to 25%), the United Kingdom (from 12% to 16%), and India (from 20% to 27%) have all shown clear upward trends in crypto usage. These shifts point to growing comfort with digital currencies beyond early adopters, and to wider financial participation at the individual level.

The integration of cryptocurrencies into various industries, such as iGaming, e-commerce, finance, and travel, highlights the versatility and advantages that digital currencies offer. From lower transaction fees to faster and borderless transactions, crypto payments provide tangible benefits for businesses and consumers alike. As the crypto market continues to evolve, we can expect further integration of cryptocurrencies into different sectors, as businesses recognize the value and potential of this innovative financial technology.

The journey of crypto adoption is far from over, and the continued growth and evolution of digital currencies will reshape the way we transact and conduct business. As more individuals and businesses embrace cryptocurrencies, the global financial landscape will undergo significant transformations, leading to a more inclusive and decentralised economy. The path forward is filled with possibilities, and the ongoing adoption of digital currencies paves the way for a future where financial transactions are more efficient, secure, and accessible to all.

Security remains at the core of sustainable adoption. Infrastructure built on licensed operations, routine third-party audits, and global standards creates the trust that both users and merchants rely on. CryptoProcessing, for instance, holds a digital currency license in Estonia and was recently named Europe’s Best Cryptocurrency Payment Gateway for 2025 by International Business Magazine.

The journey of crypto adoption is far from over, and the continued growth and evolution of digital currencies will reshape the way we transact and conduct business. As more individuals and businesses embrace cryptocurrencies, the global financial landscape will undergo significant transformations, leading to a more inclusive and decentralised economy. The path forward is filled with possibilities, and the ongoing adoption of digital currencies paves the way for a future where financial transactions are more efficient, secure, and accessible to all.

FAQ

In 2025, more than 15,000 companies accept cryptocurrencies, with about 2,300 retailers in the US. Among such companies are: Tesla, Microsoft, AY&T, PayPal, Rakuten, Shopify, and more.

The GENIUS Act, passed in June 2025, brings federal oversight to stablecoin payments for the first time. It introduces a licensing system for issuers and sets clear rules on reserves, audits, and redemption. Large issuers fall under federal regulators like the Fed or FDIC, while smaller ones can stay under state supervision. These steps aim to make stablecoin payments more reliable and widely accepted.

Sheetz now accepts crypto at all 750+ locations. Customers can pay for gas, snacks, and coffee using Bitcoin, Ethereum, and other digital currencies.