Crypto in Action: Who’s Using Digital Currencies and Where?

The world of crypto has experienced a seismic shift in recent years, as digital currencies have become increasingly mainstream and widely accepted. With Bitcoin leading the charge, the cryptoсurrency market has attracted millions of users worldwide, leading to increased adoption of crypto payment gateway services among businesses along the way as well.

In this article, we delve into the demographics of crypto users, explore their occupations and education levels, and examine the industries where crypto adoption is gaining momentum. By understanding who’s using digital currencies and where they are being utilised, we gain valuable insights into the growing influence and impact of cryptocurrencies in today’s society.

Demographics

According to Statista, the number of cryptocurrency users worldwide exceeded 400 million in November 2022. With the positive momentum of Bitcoin and the ongoing growth in 2023, it is estimated that the number of crypto users has reached approximately 450-500 million. Despite market fluctuations and global economic crises, the steady rise in crypto users demonstrates the increasing mass adoption of digital currencies. Today, almost 40,000 companies worldwide accept Bitcoin as a form of payment.

Research data reveals that over 50% of crypto users are under the age of 34, and 54% of cryptocurrency retail investors are male. Furthermore, over 40% of crypto users in the under-34 age group are male. This data paints a picture of the average crypto user as a young male.

Crypto adoption is global, but certain countries have emerged as front runners. Nigeria, Turkey, Indonesia, Brazil, and India have witnessed significant crypto adoption, particularly in the context of unstable national currencies. The stability offered by cryptocurrencies has attracted individuals in these countries.

Occupation and Income

While the stereotype suggests that the average crypto user is an IT professional, the landscape is evolving. The most common employment sectors among crypto users include:

- Software

- Finance

- Electronics

- IT

However, there is a noticeable reduction in concentration, with sectors like construction, arts, entertainment, and education gaining traction. The finance sector has seen a significant 33% increase in participation, indicating a changing demographic as crypto becomes more widespread. It is reasonable to assume that by 2025-2027, people from various occupations and backgrounds will own and use digital assets.

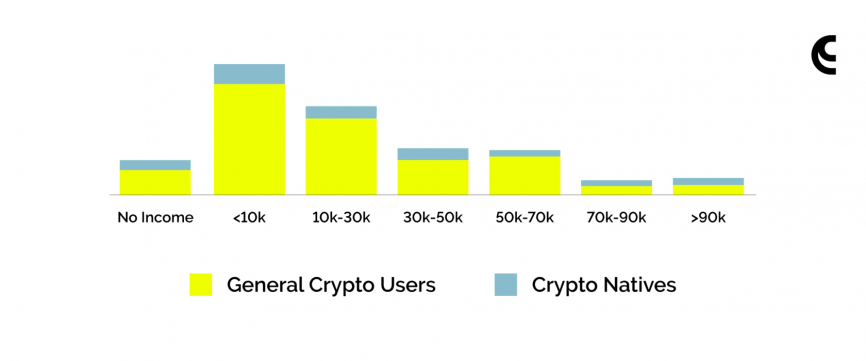

Based on Binance’s global crypto index, the average crypto user earns around $25,000 per year. Comparing this figure to the global average income of approximately $10,000 per year, it positions crypto users in the upper-middle-class range. This indicates that crypto users are not necessarily millionaires, but rather individuals with above-average earnings.

The average crypto user tends to be educated. While the median education level among crypto users is equivalent to a high school degree, more than a quarter hold a university degree. The complexity and learning curve associated with crypto contribute to the preference for educated users in the space.

Crypto adoption by industry

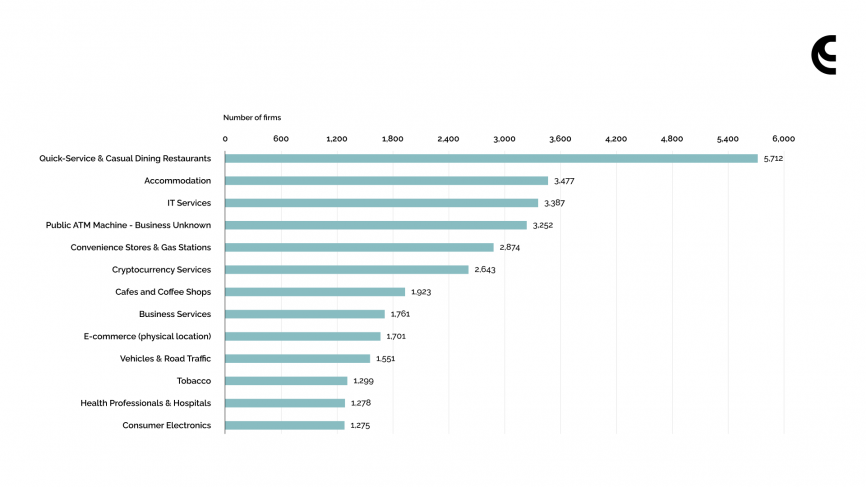

In 2023, the iGaming industry stands out as the most correlated industry with the crypto market. This correlation stems from the numerous perks and advantages that arise when online gambling meets digital assets. The ability to facilitate instant and borderless transactions allows users to conveniently participate in iGaming activities regardless of their geographical location. Cryptocurrency payments offer lower fees (around 0.8%) and enable users to avoid the restrictions often imposed by traditional banking systems.

For instance, in countries where fiat deposits on casino websites are prohibited, using cryptocurrencies becomes a viable solution. Moreover, crypto provides those who earn crypto through gambling with an opportunity to avoid taxes on their gambling profits.

Сryptocurrencies are also gaining traction in various sectors, prompting businesses to integrate crypto payments. E-commerce follows closely behind, driven by the chargeback-smashing potential of crypto as a payment medium. The speed and low fees associated with cryptocurrencies make them attractive in the realms of finance and real estate. Additionally, the Travel industry has seen notable growth with companies like Mirai flights, a private jet chartering agency, experiencing a 30% increase in profits after integrating crypto processing.

Final thoughts

The emergence and rapid growth of cryptocurrencies have brought about a paradigm shift in the global financial landscape. As we have explored the demographics, occupations, and industries associated with crypto adoption, it is clear that digital currencies are no longer confined to a niche market. The increasing number of crypto users, especially among the younger generation, signifies a changing financial landscape driven by technological advancements.

The integration of cryptocurrencies into various industries, such as iGaming, e-commerce, finance, and travel, highlights the versatility and advantages that digital currencies offer. From lower transaction fees to faster and borderless transactions, crypto payments provide tangible benefits for businesses and consumers alike. As the crypto market continues to evolve, we can expect further integration of cryptocurrencies into different sectors, as businesses recognize the value and potential of this innovative financial technology.

The journey of crypto adoption is far from over, and the continued growth and evolution of digital currencies will reshape the way we transact and conduct business. As more individuals and businesses embrace cryptocurrencies, the global financial landscape will undergo significant transformations, leading to a more inclusive and decentralised economy. The path forward is filled with possibilities, and the ongoing adoption of digital currencies paves the way for a future where financial transactions are more efficient, secure, and accessible to all.