Crypto Market Update – August 2024

Welcome back to the monthly Crypto Payments Market Update! Here, you’ll find the most important crypto events of August 2024 and get a rundown of industry trends. As always, a monthly dose of memes is waiting at the end.

Key Points

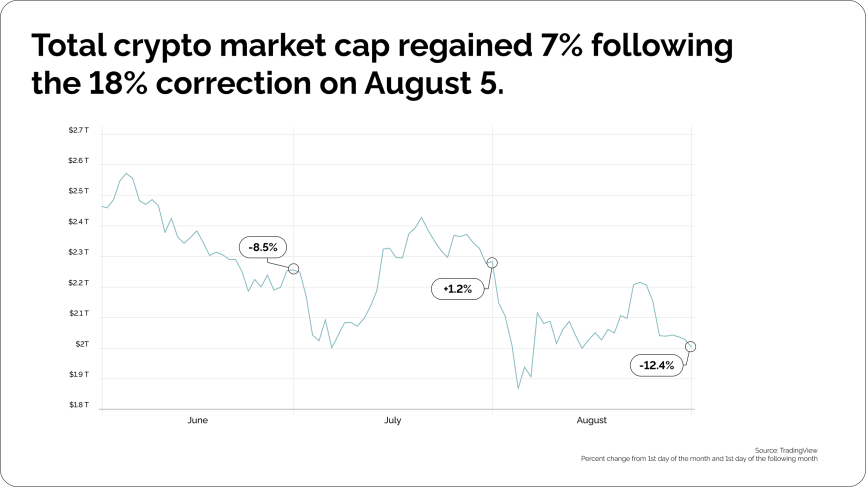

- The crypto market experienced a sharp correction in early August but showed signs of recovery by mid-month.

- Apple’s decision to open its NFC chips to third-party developers could introduce direct crypto payments on iPhones.

- PayPal is primed to introduce PYUSD rewards, while MetaMask is releasing its own crypto card, signaling how crypto is merging with established payment methods.

- Large banks like Banca Sella and RAKBANK are increasingly recognizing the potential of crypto, offering trading and investment services to their customers.

- New stablecoins are emerging in the UAE, EU, and Brazil, highlighting the increasing demand for stable digital currencies.

Crypto Market In August 2024

August kicked off with a dramatic market correction on the 5th, sending shockwaves through the global economy. Key Wall Street indices, commodities, and stocks all experienced steep declines. Crypto wasn’t an exception:

Experts attributed this to factors like the Bank of Japan’s interest rate hike and the U.S. Federal Reserve’s decision to maintain current interest rates which were covered in our previous update.

However, the market showed resilience and began to stabilize by mid-August. JPMorgan highlighted the demand from institutional investors as a key driver of this recovery.

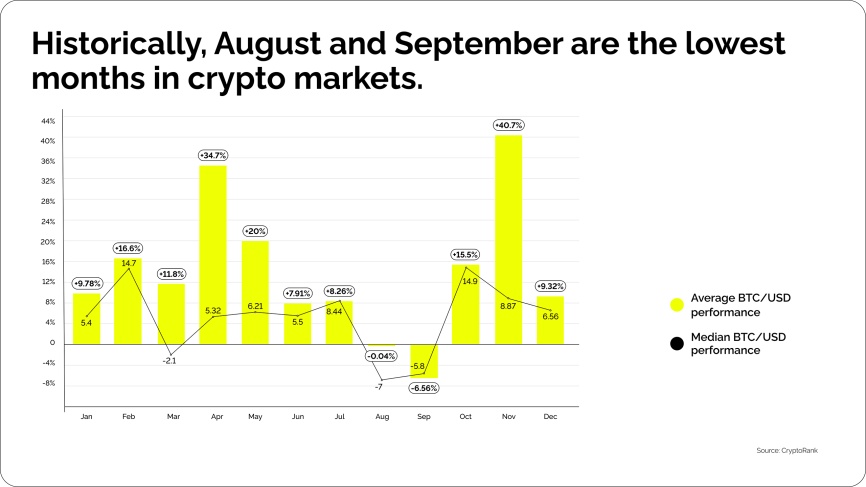

Despite the initial turbulence, Bitcoin’s price movement remained consistent with its historical pattern between halving events. August and September are typically weaker months for BTC, with a potential “Santa Rally” towards the end of the year.

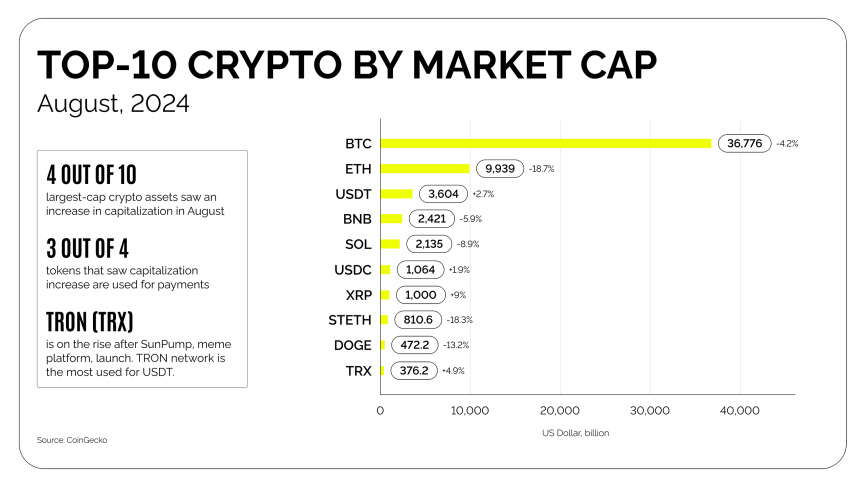

Checking in on the best-performing coins this month:

Despite recent challenges with MiCA compliance in the EU, Tether USDT is doing as well as ever, remaining the dominant stablecoin. In fact, most tokens that are on the rise at this time are used for payments. TRON saw an increase due to the SunPump meme coin platform launch, which aims to replicate the success of Solana’s Pump.Fun.

Crypto News Rundown

In general, the market appears to be buckling up for expected September lows, depending on another upcoming rate decision of the US Fed and its meaning for the USD. Let’s delve into the most important events of August to get some perspective:

PayPal Partners with Anchorage to Offer PYUSD Rewards

In a significant move for the crypto payments landscape, PayPal has partnered with Anchorage Digital to introduce stablecoin rewards in PayPal USD (PYUSD). This collaboration will allow PYUSD holders to earn stablecoin rewards on-chain without involving rehypothecation, staking, or lending.

This development highlights the growing link between traditional finance and the crypto world. As major players like PayPal embrace crypto payments, they lead the way for wider acceptance and adoption of digital assets in everyday financial transactions.

MetaMask Launches Its Own Card

The most popular Ethereum wallet, MetaMask, is launching a Mastercard payment card that enables direct access to crypto. It also allows instant crypto conversion to fiat at the point of sale and supports Apple Pay and Google Pay, making it even more convenient for everyday use.

By providing a seamless way to spend crypto directly from their wallets, MetaMask continues the trend for crypto payment cards we discussed in July. The card will initially be available for a limited number of users in the UK and the EU, further strengthening the use of crypto payments in these markets.

Developers to Capitalize on Apple’s NFC Opening

Earlier in August, Apple announced that it would allow third-party developers to utilize the NFC chips and Secure Element (SE) in its devices. This opens up new possibilities for crypto developers to integrate blockchain-based payment systems and wallets directly into Apple devices.

Circle’s CEO, Jeremy Allaire, was quick to respond. He hinted that “tap-to-pay” payments on iPhones using the USDC stablecoin will soon be introduced. This integration could change how users interact with cryptocurrencies, making payments as seamless as everyday credit card transactions.

New Stablecoins Coming to Market

Tether has announced its plans to launch a new stablecoin in partnership with the UAE. The upcoming AEDT will be pegged to the United Arab Emirates dirham (AED). Interestingly, the dirham itself is pegged to the USD at around a 3,6 rate.

The new stablecoin is expected to provide a seamless on-and-off ramp for the dirham. AEDT is poised to play a crucial role in facilitating cross-border transactions and enhancing financial inclusion in the region.

In a similar vein, the Latin American e-commerce giant MercadoLibre is launching its own stablecoin, MercadoLibre Dollar (Meli). The stablecoin, pegged to the USD, is introduced to the native Mercado Pago App’s potential 20 million users in Brazil.

Meli will be used for various purposes within the MercadoLibre ecosystem, including purchases, sales, and investments. Introducing a stablecoin by a major e-commerce platform like this could have a ripple effect on adopting crypto payments in the region and beyond.

Traditional Institutions Recognize Crypto

Banca Sella, the second-oldest bank in Italy, has announced its plans to offer Bitcoin trading to its over 1.3 million customers. The Bitcoin offering will be provided through the platform Hype, making it easily accessible to the average customer.

This move signifies a growing trend of traditional institutions embracing cryptocurrencies. It’s far from the only one, though. Earlier that month, one of the largest government-owned banks in the UAE, RAKBANK, partnered with Bitpanda to launch a digital asset management platform for the country’s residents.

The Dubai Court of First Instance already recognized crypto as a valid salary payment in its ruling, so it looks like the use of crypto in place of traditional salary slips comes hand-in-hand with its adoption by major banks.

The Regulatory Landscape in August-September

In the US, the upcoming election is still the main conversation. Kamala Harris and Donald Trump have both expressed positions on the crypto market. Harris is in support of measures to boost the crypto industry in the country with the help of regulatory safeguards.

Trump seems to have more of a deregulation-focused approach. He vowed to block the digital dollar launch if he becomes president and claimed he would never allow the launch of CBDC in the US due to privacy reasons.

In the EU, the stablecoin market surged following MiCa. In one example, a French fintech Next Generation collaborates with Irish Decta to introduce a Euro-backed stablecoin on Stellar. Circle continues to issue its newly compliant tokens, while GWS, a German financial giant, plans the launch of its own euro-backed coin in 2025.

These developments underscore the effect of MiCa. While restrictive for some, they foster others to join the newly regulated market of digital currencies. Analysts are expecting to see the same effect with the EU AI act, which will industry-shaping for the digital economy.

What’s next for Crypto?

In crypto trends, the market remains volatile as it navigates the impact of macroeconomic factors and regulatory developments. The upcoming Fed’s rate decision on September 17-18 will be a key event to watch, as it could significantly impact the USD and, consequently, the crypto market. However, the long-term outlook for crypto remains positive, with growing institutional interest and increasing adoption by major brands.

In the realm of crypto payments, we can expect further innovation and integration with traditional financial systems. The launch of MetaMask’s card and the potential for tap-to-pay payments on iPhones using USDC are just a couple of examples. New stablecoins announced in different markets show a trend for further use of crypto as a form of cash.

Particularly important events are unfolding in Wyoming, where the Chairman of the Stable Token commission stated they are working on backing state stablecoin tokens with US Treasury bills and repurchase agreements. An entire state embracing crypto payments would be a worthy story to follow.

Why not join early to reap the benefits of timely adoption?

The Mandatory Meme Section

Classic meme to celebrate the market dip every single time it inevitably comes about. This is for August 5:

Since we mentioned EU regulators looking at AI as the next big thing, this one about investors is quite apt as well:

And, of course, the usual crypto cycle meme in preparation for whatever may be coming in September: