Crypto Market Update – July 2024

Welcome back to our monthly Crypto Payments Market Update! We’re excited to share the most important crypto events of July 2024 and delve into industry trends. As always, there’s a meme treat for you at the end!

Key Points

- The total crypto market cap is rebounding, with Solana showing a particularly impressive rally.

- Spot Ethereum ETFs launch with solid results, generating significant trading volume of $4.05 billion during the first week.

- Major automotive brands like Ferrari and Toyota are exploring and expanding crypto involvement.

- Tether announces a new open-source project to contribute to their ecosystem.

- Tangem introduces a combined crypto Visa card and wallet, signaling another opportunity to streamline crypto payments.

- MiCA compliance remains a focus in the EU, with Tether yet to be registered under the new regulations.

Crypto Market In July 2024

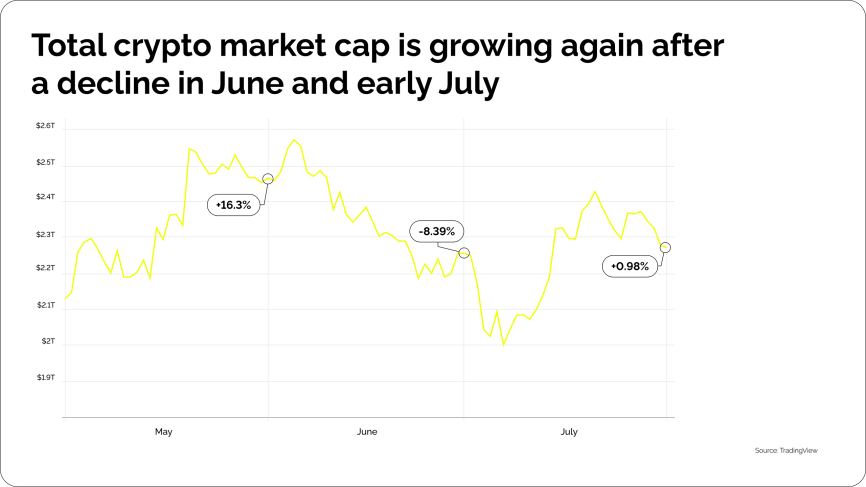

The total crypto market cap shows signs of recovery after a decline in June. However, the trend is not strong yet and could go either way. Let’s take a look at it in more detail:

One notable event that affected the price of Bitcoin and, consequently, crypto was the German government’s massive transfer of 16,309 Bitcoin to exchanges. The move is in line with a significant selling spree that started earlier this year.

July 30th-31st also marked the Federal Reserve’s interest rate discussion followed by a decision to keep interest rates in the 5.25%-5.50% range. This event usually influences crypto prices, and the Fed’s holding steady is a change of pace compared to 11 hikes in 2022 and 2023. This could also explain a slight dip in the crypto market following the decision, contrasting to a slight USD rally and sharp rise of U.S. stocks.

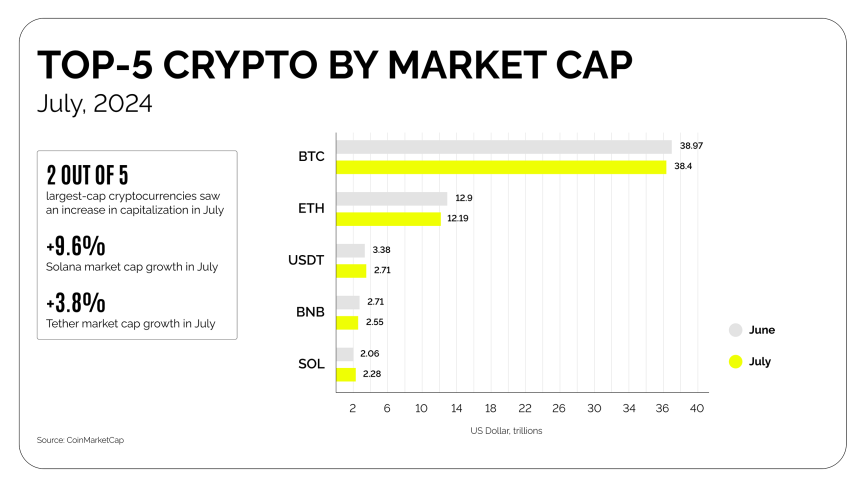

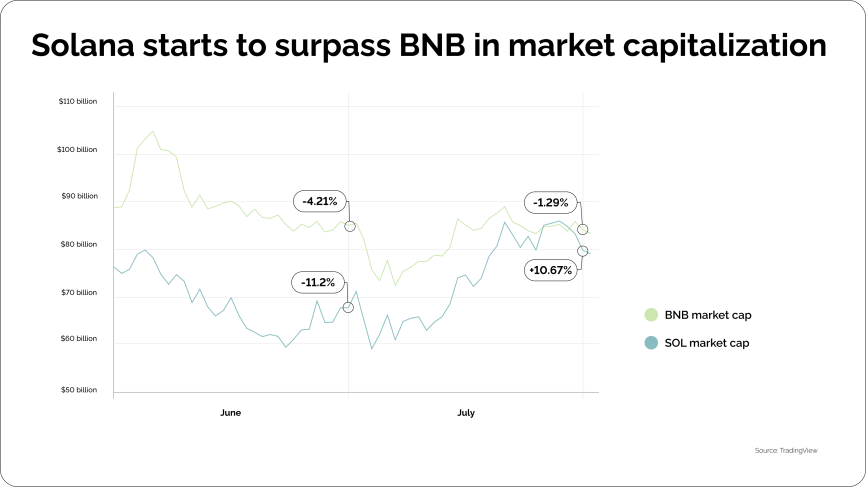

Checking in on top performers this month:

Interestingly, Solana surpassed BNB to become the fourth-largest cryptocurrency by market cap, only going back to fifth place at the end of the month. This showing indicates growing confidence in the platform. A particularly impressive rally was between July 25th and July 29th, with a nearly 16% upward surge. It may be tied to a general increase in network use and active monthly addresses.

Other than that, top performers remain relatively in line with what we’ve seen earlier this summer.

Crypto News Rundown

The crypto payment market continues adapting to the European Union’s MiCA going into August. Let’s round up the events likely to influence the market most in the near future:

Ethereum Spot ETFs Go Live

In their first week, all the 9 newly launched spot Ethereum ETFs generated around 40% of what the combined Bitcoin ETFs gathered in January. Their net inflows of over $1 billion were dwarfed by over $1.5 billion outflows from Grayscale’s ETHE, which appears to be part of a similar strategy to their Bitcoin ETF, GBTC.

The spot ETH ETFs generated a cumulative $4.05 billion trading volume during the first week. Overall, crypto investment products for assets under management have reached $99.1 billion globally and are steadily becoming part of the mainstream markets.

Major Automotive Brands Exploring Crypto

Ferrari’s successful launch of crypto payments in the US led them to extend cryptocurrency payments to European dealers. Dealers are expected to adopt new payment systems and respond to the evolving needs of the luxury brand’s customers, who, it turns out, enjoy paying with crypto.

In non-payment news, the Japanese giant Toyota’s Blockchain Lab explores the potential of Ethereum-based standard ERC-4337 for introducing mobility to the public Blockchain. They’re interested in creating an architecture that would increase the transparency and accessibility of global infrastructure, connecting all sorts of services on and off the road.

Tether to Launch New Open-Source Project

Paolo Ardoino, the CEO of Tether, announced a new open-source project on X. It’s expected to be an important layer of their ecosystem. While details remain sparse, this is relevant in context to Circle, their main competitor, becoming the first MiCA-compliant stablecoin issuer in the EU. Stablecoin leaders are battling it out to see who can deliver more value to the growing market.

Crypto Continues to Gain Traction in Finance

On July 27th, Cantor Fitzgerald announced that the financial services giant, which has been operating since 1945, will launch a Bitcoin financing business. It’ll start at $2 billion to help BTC investors get leverage. The firm will partner with select custodians to make it happen.

In other financial news, Hamilton Lane became the first asset manager to start a private fund on the Solana Blockchain. Senior Credit Opportunities Fund, or SCOPE, is now accessible on the network. Accredited investors accessing private funds on different chains has become a growing trend, slowly changing how we think about traditional markets.

Crypto Visa Cards Coming to the Market

Early in July, Tangem announced a combined Visa payment card and crypto wallet, mixing crypto payments with the cards most consumers are used to. Tangem’s hardware wallets have always been rather innovative with, for example, a ring-shaped wearable wallet directly tied to crypto exchanges.

Combining a standard bank card with a self-custodial crypto wallet is another solution in the general trend of accessible crypto payments. As the market evolves, Blockchains are likely to be seamlessly integrated into our everyday payments.

The Regulatory Landscape in July-August

In the US, the upcoming election continues to dominate the conversation, and the market is waiting to see who will come out on top. Candidate Donald Trump positioned himself as a pro-Bitcoin candidate with softer enforcement, which led to a small BTC rally early in July.

However, it’s important to note that no major regulatory shifts took place this month, and upcoming decisions regarding the SEC and policy remain in the air.

In the EU, MiCA takes center stage, with markets aiming to meet policy requirements. One notable example is the Boerse Stuttgart Group (BSG), which will now include ESG data for cryptocurrencies with the Crypto Risk Metrics. Another example is OKX, one of the largest exchanges, selecting Malta as its MiCA hub to continue serving EU traders. July has mostly been about companies moving to compliance, with no serious changes on the horizon.

It’s worth noting that Tether is not yet registered under MiCA, leaving Circle and USDC/EURC as the major compliant stablecoin solution in the block.

What’s Next for Crypto?

In crypto at large, the market is slowly rebounding. The ETH ETF’s relative success and the ongoing crypto integration by major brands contribute to a generally positive sentiment. However, there are reasons to remain vigilant, as markets adapting to the Fed’s decision could introduce some volatility.

In the realm of crypto payments, focus will be on increasing adoption and convenience. New ideas like introducing crypto Visa cards point to a shift toward mainstream acceptance and usability. Additionally, the regulatory clarity provided by MiCA in the EU will further boost confidence in crypto payments and encourage companies to embrace this technology.

As more businesses explore crypto payment options, we can anticipate a wider range of services that cater to this growing demand. Why not get started early?

The Mandatory Meme Section

What meme section would this be without referencing regulation? It’s been one of the main conversation points in the industry for years, after all:

Since Solana made it into the top 4, this particular decision is becoming quite stressful for a lot of people:

Lastly, this is how a surprisingly large number of people feel about the situation as Bitcoin continues to be a major conversation point:

We’ll be back with another market update next month. We continue on our mission of making crypto payments mainstream for businesses, and there are many exciting opportunities to explore on that front.