Crypto Market Update – June 2024

Welcome back to the Crypto Payments Market Update – let’s round up all the most important crypto-happenings of June 2024 and discuss industry trends. As usual, there’s a mandatory meme section at the end!

Key Points

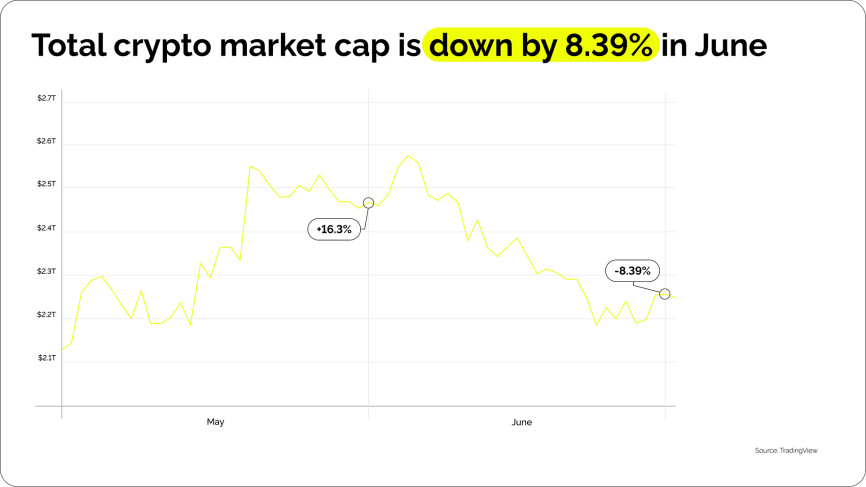

- The crypto market cap was down 8.39% in June, a slight downturn associated with general economic trends.

- Blackrock’s Bitcoin Spot ETF continues to climb and shows a $790 million growth despite BTC’s price falling by 7% in June.

- MiCA stablecoin requirements came into effect in the European Union, banning noncompliant stablecoins across its 27 countries.

- Circle, the issuer of USDC and EURC, first to attain the Electronic Money Institution (EMI) license in France – becoming the first MiCA-compliant stablecoin issuer.

- Hong Kong seeks crypto hotspot status with a new subcommittee created around the issue of Web3 and digital assets.

- Crypto ATM installations surge worldwide, showing a generally positive trend for crypto adoption.

Crypto Market In June 2024

The total crypto market cap is down by 8.39% in June. The ETH ETF optimism of May has faded, and the market is correcting itself. Let’s take a look at the market and explore the reasons for this decline:

One part of the decline may include an increase in bond yields associated with US Fed’s expectations of just a single rate cut – leading institutional investors to drop digital assets in favor of traditional ones.

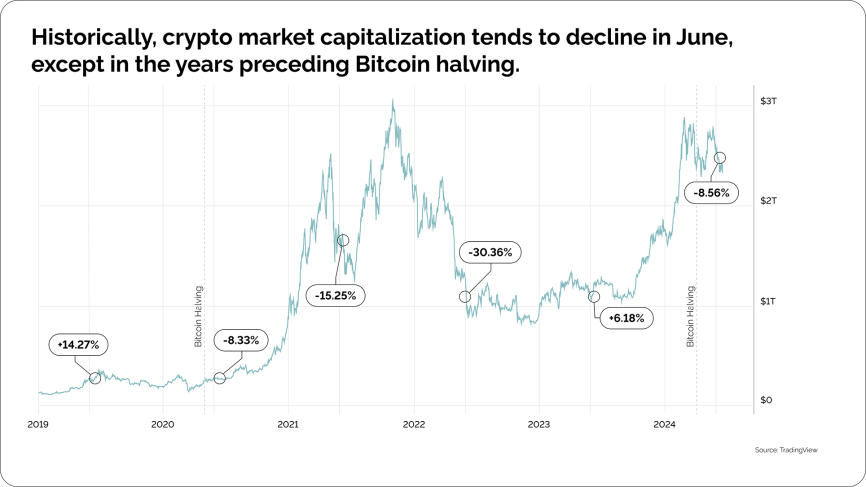

Additionally, there’s a consistent trend for June market capitalization to decline, except for the years preceding Bitcoin halving when the bear market ends. In this case, summer 2019 and 2023 are the only upswings in the otherwise consistent trend:

One major event the markets have been preparing for is MiCA going live in the EU. With this, USDT becomes a non-compliant stablecoin unless they soon manage to get a license. EU crypto traders were already urged to convert Tether to other currencies. These events started at the end of June, and we’ll undoubtedly see ripple effects throughout summer.

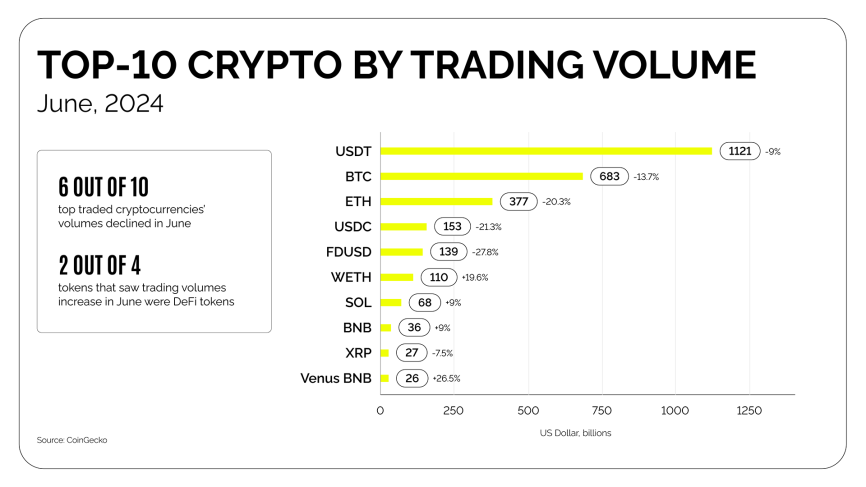

Before we delve deeper, let’s take a look at some of the top performers this month:

USDT, BTC, ETH, USDC, FDUSD, and SOL remain at the top with no major changes. BNB managed to climb two spots, while Doge, PEPE, and FLOKI were knocked off the top 10 and replaced by Venus BNB, WETH, and XRP.

Wrapped Ethereum’s entry into the top 10 isn’t that surprising, considering the strong expectations of the ETH ETF. With that, a tokenized version of ETH climbing up the ranks is to be expected. Venus’ climb may show a renewed interest in DeFi for asset-backed currencies, as we find ourselves in the middle of a clash of stablecoin solutions.

Crypto News Rundown

The crypto payment market is responding to regulatory pressures and is preparing for an active summer. Let’s round up the events that will influence the market most in the near future:

Circle Becomes First MiCA-Compliant Stablecoin Issuer

In a surprising move, Circle secured the Electronic Money Institution (EMI) license required for MiCA compliance. This makes USDC and EURC the first and so far only top 10 stablecoins fully legal in the EU. As most stablecoin issuers face uncertainty and scramble to get licensed, Circle slots into the second largest economy in the world just one day after the rules come into effect.

As some exchanges are already delisting USDT and EURT in response to regulations, the question of EU compliance becomes especially relevant for Tether’s dominance. As more regulators introduce stablecoin-related rules, markets will likely shift and fracture even further.

Bitcoin ETF Continues to Climb Despite Downturn

Blackrock’s Spot Bitcoin ETFs are up $790 million despite the price of Bitcoin itself falling by 7%. While part of this is likely due to the optimism of the upcoming ETH ETF, the other is probably due to newfound optimism among generally older ETF investors.

There’s a trend for consolidation as traditional financial markets embrace digital assets. Bitcoin’s volatility has generally decreased since the initial introduction of the ETF, and the interplay between it and BTC’s price will be interesting to track throughout the years.

Hong Kong Aims for Crypto Hotspot Status

Johnny NG Kit-Chong, a member of the Hong Kong Legislative Council, announced that a new subcommittee had been formed to tackle the treatment of cryptocurrencies in the region. Earlier last year, they created a task force to promote Web3 development.

Hong Kong’s overall goal is to ensure investor protection and create a stable market for new technologies. The Hong Kong Securities and Futures Commission encourages platforms to submit applications for crypto licenses.

Crypto ATM Installations Surge Worldwide

We’re observing a near-record high of crypto ATM installations, as almost 6,000 machines were added in 11 months’ time. The US continues to stay at the top of the list, with a staggering 31,916 machines total – ten times more than Canada, the second most popular country, with 3,024 crypto ATMs on record.

The 2024 rise in crypto ATM installations can be connected to a market’s general growth and recovery.

The Regulatory Landscape in June-July

In the US, custodial brokers of digital assets will be required to report crypto transactions to the IRS. This rule will come into effect in 2026 for reporting sales and exchanges that occurred in calendar year 2025. Different regulations are in the works for decentralized and non-custodial brokers.

At the same time, President Biden’s veto of an attempt to repeal SAB121 threatens Wall Street’s $16-trillion push for tokenization. The bill itself was bipartisan, showing that the extent of the SEC’s guidance over digital assets isn’t just a matter of political lines being drawn in preparation for the upcoming election.

In the EU, stablecoin rules in accordance with Markets in Crypto Assets (MiCA) legislation come into effect. Starting June 30th, noncompliant stablecoins are banned from having over 1 million daily transactions settled on or off-chain. As mentioned earlier, Circle became the first compliant stablecoin issuer with USDC and EURC.

In general trends, elections in various EU countries may shake up the ecosystem again. The result of the EU Parliament elections saw some key lawmakers who helped shape EU crypto policy return to office—including Stefan Berger and Ondrej Kovarik, who helped author MiCA in the first place.

What’s Next for Crypto?

In crypto trends, markets still expect the Spot Ether ETF to come out in July or August, as the submission deadline ends on July 8th. Aside from that, the question of stablecoins and asset regulations continues to dominate the conversation.

For crypto payments, the rising adoption of digital assets and payments is evident. MiCA will significantly impact the market, with compliant payment gateways, such as CryptoProcessing, likely to advance in the European market.

July will continue to be hot as financial institutions continue to debate tokenization. The situation in the US, in particular, is worth watching because the developing election race, combined with a strong push for crypto-related bills from Wall Street, will significantly impact the market going forward.

The Mandatory Meme Section

Not too many new memes this month as regulations and MiCA dominate the discussion. Summer is shaping up to be this:

On that note, quite a few traders and Tether-enjoyers in the EU will definitely find this one relatable:

And since the IRS will soon require custodians to report crypto transactions, this is quite apt as well:

Finally, let’s get some solid perspective on Bitcoin price:

We’ll be back with another market update next month. We’re all excited to see what the future of stablecoins in the European Union looks like, and are ready to help our clients in that market and beyond adapt to the change in a secure and compliant fashion.