How to attract more investors using cryptocurrency in real estate in 2025

The use of cryptocurrency for real estate transactions is becoming a powerful tool for developers, agencies, and investors alike. In fact, a recent study showed that 61% of real estate firms have either already integrated crypto or are at various stages of exploration and implementation.

With digital currencies now offering more than just a payment option, they are reinventing the way properties are purchased, sold, and marketed globally.

From tokenized fractional ownership to blockchain-driven cost savings, the advantages of crypto real estate investing extend far beyond mere convenience.

In this article, we explore how opening up your real estate business to the blockchain, by accepting cryptocurrency payments and more, opens doors to new investment opportunities, enhances cash flow, and improves transaction efficiency for businesses.

Download Free Report ↓

What’s Inside:

- Crypto & Real Estate Trends 2025

- Key Insights on Real Estate and Crypto

- Case Studies

- Practical Benefits for Businesses

- Action Steps for Implementation

Why cryptocurrency appeals to investors

In recent years, the integration of cryptocurrency into the real estate sector has garnered significant attention from investors. Here are the advantages at work powering this trend:

1. Enhanced liquidity through tokenization

Traditionally, real estate investments are known for their illiquidity, often requiring substantial capital and lengthy transaction processes.

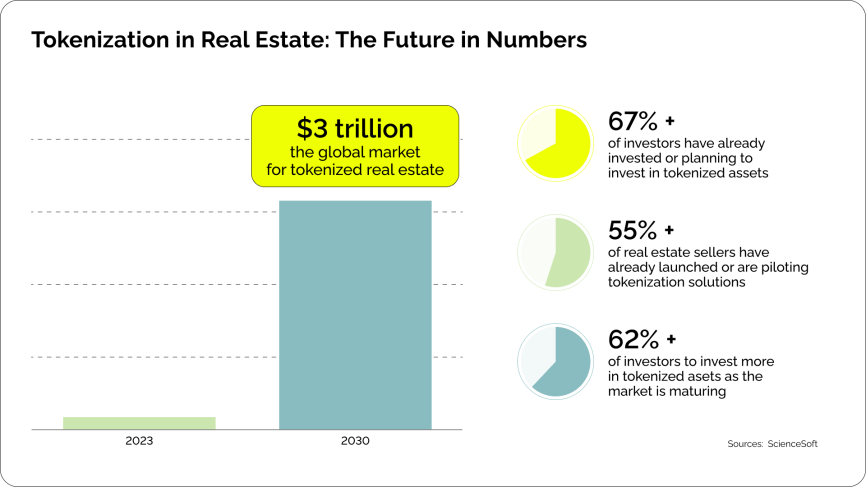

Cryptocurrency addresses this challenge through the tokenization of assets. By converting property ownership into digital tokens on a blockchain, assets can be divided into smaller, tradable units. This fractional ownership model lowers the entry barrier for investors and facilitates easier buying and selling of property shares, thereby increasing market liquidity.

Deloitte predicts that tokenization could unlock up to $4 trillion in real estate value globally by 2035, highlighting the enormous potential of this investment model.

2. Increased transparency and security

Blockchain technology, the backbone of cryptocurrencies, offers a decentralized and immutable ledger for all transactions. This ensures that property records, ownership details, and transaction histories are transparent and tamper-proof. Such transparency reduces the risk of fraud and provides investors with greater confidence.

3. Cost efficiency and reduced transaction fees

The traditional real estate transaction process involves multiple intermediaries, including brokers, banks, and legal advisors, each adding to the overall cost through fees and commissions.

Cryptocurrency transactions can streamline this process by enabling peer-to-peer interactions and utilizing smart contracts to automate agreements. This automation reduces the need for intermediaries, thereby lowering transaction fees and accelerating the settlement process.

4. Global accessibility and cross-border transactions

Cryptocurrencies are inherently borderless, allowing investors from around the world to participate in real estate markets without the complications associated with currency exchange rates or international banking regulations.

In crypto-friendly markets such as the UAE, Portugal, Turkey, and El Salvador, buyers can use Bitcoin, Ethereum, or stablecoins to purchase property directly or through licensed intermediaries. In others, including the U.S., Cyprus, and Thailand, crypto is accepted but usually converted to local currency during the transaction.

Tax rules vary. Some jurisdictions exempt long-term holdings, while others apply capital gains, but in all cases, legal compliance and anti-money laundering checks are required.

5. Diversification of investment portfolios

Incorporating cryptocurrency into real estate investments provides an opportunity for portfolio diversification. Investors can benefit from the potential appreciation of digital assets while also gaining exposure to the relatively stable and tangible value of real estate. This combination can enhance the overall risk-adjusted returns of an investment portfolio.

6. Innovative financing opportunities

The advent of Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) has introduced new methods for raising capital in the real estate industry. Property developers can issue tokens backed by real estate assets, providing investors with a more flexible and efficient way to invest in property projects.

Cryptocurrency as a competitive advantage: attract solvent clients

Aside from the general advantages that crypto brings to the real estate sector, merchants that are accepting it as a form of payment in 2025 are able to generate a significant competitive edge, particularly in attracting high-net-worth individuals (HNWIs) and tech-savvy investors.

Recent data underscores the growing affluence within the crypto community, presenting a lucrative opportunity for real estate businesses.

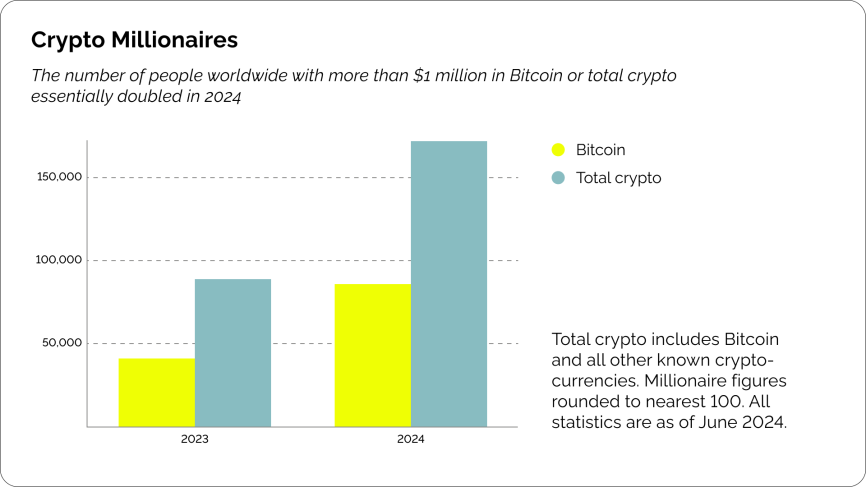

According to the Crypto Wealth Report 2024 by Henley & Partners, the number of crypto millionaires worldwide has surged by 95% over the past year, totaling 172,300 individuals. Notably, Bitcoin millionaires have seen an even more dramatic increase, rising by 111% to 85,400.

Between January 20 and July 20, 2025, nearly 16,000 individuals holding Bitcoin reached millionaire status, Finbold reports. This surge of 15,841 people pushes the total count of Bitcoin millionaires to 192,205, marking a 9% rise in only half a year, or roughly 88 new millionaires each day.

This new wealth within the crypto space indicates a substantial pool of potential investors seeking avenues to diversify their portfolios. By accepting cryptocurrency payments, real estate businesses make themselves accessible to this affluent demographic.

Key steps to attract more investors with cryptocurrency in 2025

As we’ve explored, integrating cryptocurrency into your real estate business can significantly broaden your investor base and enhance transaction efficiency. Here are four ways that you can achieve this.

Accept cryptocurrency — expand your payment options

Naturally, by accepting cryptocurrencies like Bitcoin or Ethereum as payment with the help of a crypto payment processor such as CoinsPaid, you cater to a growing segment of investors who prefer digital assets.

Tokenization of real estate – fractional ownership opportunities

As briefly explored, tokenization involves converting property ownership into digital tokens on a blockchain, allowing for fractional ownership.

This method lowers the investment barrier, enabling a wider range of investors to participate in real estate markets with smaller capital commitments.

Platforms like RealT Lofty, and Propy have developed active tokenized real estate markets, allowing investors to acquire fractional ownership in properties with lower capital requirements.

Smart contracts for secure deals – enhancing trust through automation

Implementing smart contracts can automate and secure real estate transactions by executing agreements when predefined conditions are met.

Some platforms, such as RealOpen and Propy, offer crypto-backed mortgages and on-chain closings.

This reduces the need for intermediaries, minimizes errors, and ensures transparency, thereby building trust with investors. Blockchain technology’s decentralized ledger provides a tamper-proof record of all transactions, further enhancing security.

Marketing to crypto Investors – targeting high-net-worth individuals in the crypto space

Tailoring your marketing strategies to appeal to cryptocurrency investors can significantly expand your client base. Highlighting your acceptance of digital currencies and showcasing successful crypto-based transactions can attract the high-net-worth individuals we outlined earlier.

Specifically, those looking to diversify their portfolios into real estate.

Future trends and opportunities in cryptocurrency and real estate

Three emerging trends worth knowing about are poised to further integrate digital assets into the real estate sector.

1. Integration of artificial intelligence (AI) in real estate transactions

The convergence of AI and blockchain technology is creating innovative solutions in the real estate sector. AI can enhance smart contract functionality, optimize property management through predictive analytics, and improve customer experiences by personalizing services. This integration leads to more efficient, secure, and user-centric real estate transactions.

2. Growth of stablecoins as a preferred medium of exchange

Stablecoins, cryptocurrencies such as USD Coin (USDC) that are pegged to stable assets like the U.S. dollar, are gaining traction as a preferred medium of exchange in real estate transactions.

Their price stability, combined with the efficiency of blockchain technology, makes them an attractive option for buyers and sellers seeking to mitigate the volatility associated with other cryptocurrencies.

3. Emergence of decentralized autonomous organizations (DAOs) in property investment

DAOs are decentralized entities governed by smart contracts and community voting, enabling collective decision-making without centralized control. Despite their lack of success in DeFi, in the real estate context, DAOs can facilitate group investments, allowing individuals to pool resources to acquire properties. This model democratizes access to real estate investments and leverages blockchain transparency to build trust among participants.

How we help businesses grow with us

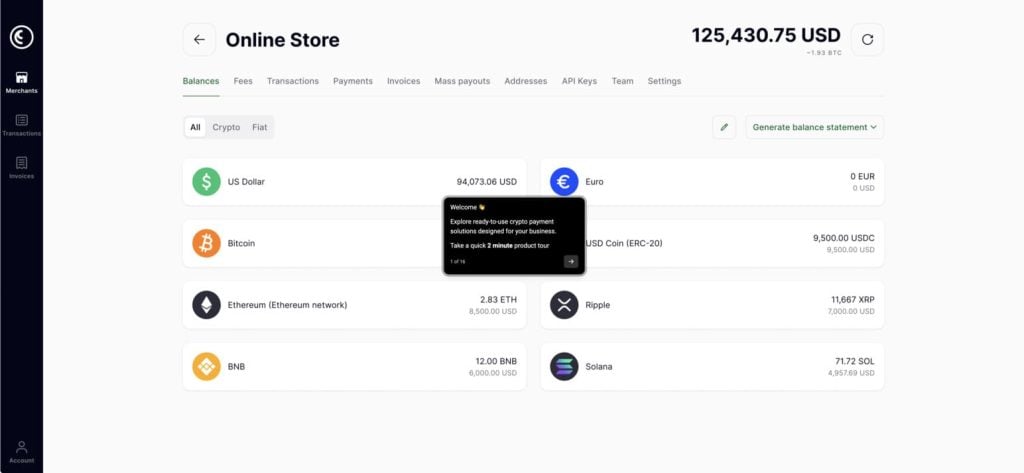

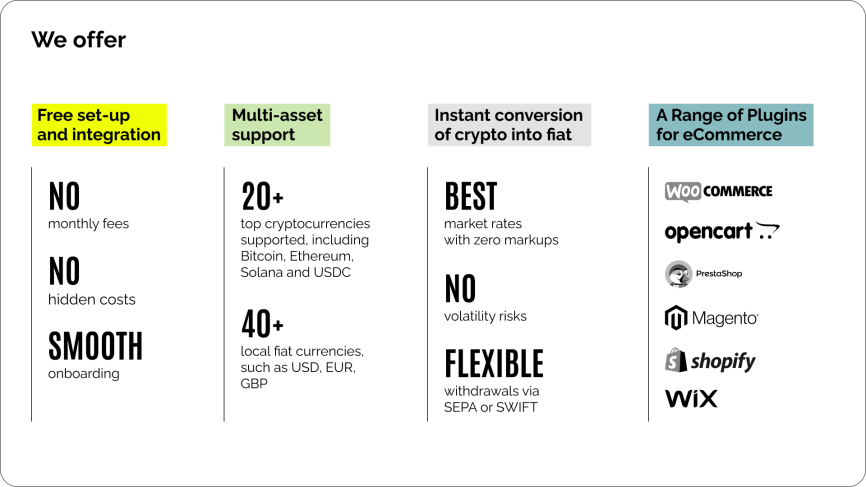

At CoinsPaid, we empower real estate businesses to seamlessly integrate cryptocurrency payments into their operations.

Our platform supports over 20 cryptocurrencies, including Bitcoin and Ethereum, enabling swift and secure transactions.

With competitive transaction fees often below 1% and no hidden charges, businesses can significantly reduce processing costs.

What you might not know, however, is that we offer automatic fiat conversion, meaning our merchants don’t have to keep crypto on their books. For those who do, we provide guaranteed exchange rates, minimizing the risk of slippage—an essential feature for large transactions.

By partnering with us, real estate professionals can attract a broader client base and stay ahead in the evolving digital economy.

Summary

Key Takeaways:

- 61% of real estate firms have already integrated or are exploring cryptocurrency solutions in 2025, marking a global shift toward blockchain-driven property transactions.

- Tokenization is improving liquidity by converting real estate into digital, tradable units – potentially unlocking up to $4 trillion in global real estate value by 2035.

- Crypto enables faster, borderless, and cost-efficient transactions, with fees typically under 1.5%, compared to traditional intermediaries charging 3–5%.

- Real estate businesses accepting cryptocurrency can now attract high-net-worth crypto investors — a group that grew by 95% year-on-year, reaching over 190,000 Bitcoin millionaires worldwide.

- Emerging trends like AI integration, stablecoin adoption, and real estate DAOs are redefining how investors participate in property markets.

- CoinsPaid provides a fully licensed, compliant infrastructure for crypto payments, featuring easy fiat conversion, robust automation, and over 20 supported cryptocurrencies.

What this means for your business

Developers and brokers can reach new markets by adding crypto payments. Tokenized models improve liquidity, while accepting assets like Bitcoin attracts the growing number of younger crypto-savvy buyers. Stablecoins and automated flows speed your closings and cut friction in cross-border deals. As regulation matures and market infrastructure strengthens, real estate firms that embrace crypto now will be positioned as leaders in innovation, efficiency, and investor inclusivity.

CoinsPaid helps real estate businesses securely accept crypto payments, streamline transactions, and integrate digital assets into your payment flow.