How to Increase Cross‑Border Sales

Table of Contents:

If you are someone dealing with cross-border commerce, you know firsthand how it often eats into your profit margins and many times you end up with frustrated customers. Luckily, cryptocurrency payments are emerging as a powerful remedy to these challenges.

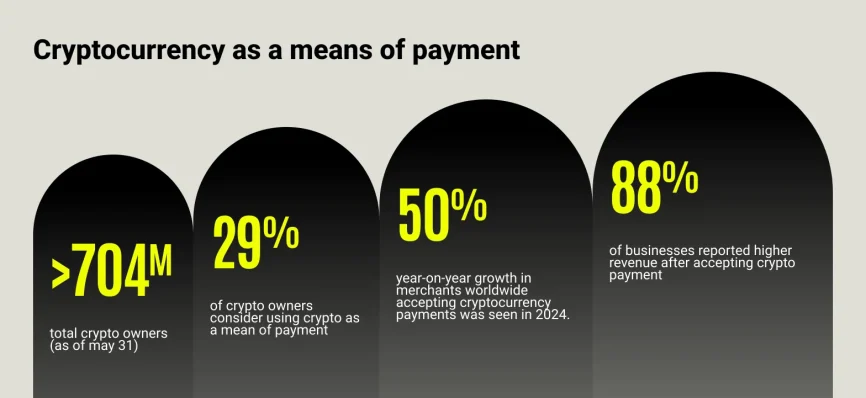

This might come as a surprise to many, however blockchain payments are already the reality of modern finance. Increasing use of cryptocurrency payment gateways is reshaping the global financial landscape. With digital assets becoming more widely used, businesses are adding crypto payment options to their platforms for secure transactions and reduced costs.

In fact, stats suggest that in 2023, the global market for crypto payment gateways was valued at USD1.2 billion and is projected to grow at a compound annual growth rate (CAGR) of over 15% from 2024 to 2032. Most importantly, in 2024, over 12,800 merchants worldwide were offering crypto checkouts – up 50% year over year – and 88% of them reported increased revenue after integrating crypto payments.

If you want to be part of this emerging trend, it’s time you consider offering this alternative to your clientele. Read on to learn how to boost business sales by accepting crypto transfers and digital payments. Why should you? Four main benefits of embracing payments in crypto are: lower costs, faster settlement, security, and global access.

How to Increase Cross-Border Sales with Crypto (Video)

Why crypto payments enable global growth

In today’s connected economy, much of your business sales depends on fixing the inefficiencies of international transactions. Traditional banking systems involve high fees, long settlement times, and complicated compliance, especially for cross-border business payments. But crypto is a game changer because it offers a faster, cheaper, and more inclusive solution.

- Cost reduction. Cross-border crypto payments cut costs because they involve no intermediaries, allowing businesses to transact directly with customers, vendors, or partners. With low fees, which are often under 1.5%, and no bank charges, businesses save money on supplier payments or doing their payroll in crypto.

- Speed & efficiency. Thanks to 24/7 availability, businesses can send and receive money across time zones without delays. Smart contracts automate payments and minimize manual errors. Faster settlement times and reduced transaction fees impact the liquidity management and improve resource utilization, allowing companies to become financially agile.

- Borderless access. International crypto payments help companies reach new markets posing less financial obstacles. From paying overseas partners to accepting payments in stablecoins or a digital dollar, crypto supports financial inclusion by offering services where traditional banking isn’t great enough.

- Enhanced security & transparency. Features supporting KYC & AML compliance are available to help businesses meet regulatory obligations. This can enhance security and build trust, aspects especially crucial in blockchain-based digital payments.

| Payment Type | Transaction Fee | Time to Settle | Notes |

|---|---|---|---|

| Credit Card Payment | 2–3% + $0.30 | Instant to Merchant | High fees for Merchant. Chargeback risk. |

| Debit Card Payment (Regulated) | Regulated: 0.05% + $0.21 Durbin Amendment: 0.9% + $0.15 | Instant to Merchant | Low fees, subject to Durbin Amendment caps |

| ACH Transfer | $0.20 – $1.50 | 3–5 Business Days | Limited to domestic transfers. Funding risk. |

| International Wire Transfer | $30 – $50 | 1–5 Business Days | High fees, exchange rate markups. |

| Remittance Service | 6.65% (for $200) | Minutes to Days | Varies by service and destination country. |

| Peer-to-Peer Payment App | Free (p2p) 1–3% (Business) | Instant to 1 Day | Fees apply for instant transfers, credit card use, and payments. |

| Stablecoin Transfer | <$0.01 | Seconds to Minutes | Global availability, minimal fees. |

If you’re exploring how to increase your sales or expand, crypto adoption isn’t just a trendy choice, it’s a tool for scalable, regulated, and reliable growth.

What are the real-world benefits

Unlike traditional fiat payments, which often involve high fees and delays, crypto offers a modern, borderless solution for settling business deals, paying suppliers, sending stablecoin remittances, and serving international customers efficiently.

eCommerce

Online retailers are increasingly turning to crypto payments to expand and reduce checkout friction. With instant settlement, low transaction fees, and no need for currency conversion, merchants can reach international customers who prefer to pay in crypto or stablecoins.

Popular platforms now offer crypto integrations, making it easier than ever to accept international crypto payments and increase cross-border conversions.

| Platform | How Crypto is Integrated |

|---|---|

| Shopify | Store owners can accept crypto through built-in integrations. It’s easy to enable crypto as a payment option. |

| WooCommerce | Supports crypto via plugins. Merchants can quickly add crypto checkout features. |

| Magento | Offers crypto support through enterprise-level extensions. Ideal for larger merchants. |

B2B & vendor payments

By using B2B crypto transfers, businesses can simplify vendor payments, improve liquidity management, and minimize delays. Many companies turn to payroll in crypto, particularly for remote or international contractors, for faster and cheaper cross-border payments.

Gartner research points out that a rising trend among B2B buyers is opting for digital interactions and self-service over the traditional modes of interactions. This reinforces the urgency for businesses to adopt agile, digital-first solutions to meet buyer expectations and stay competitive in the B2B landscape.

| CoinsPaid feature | Benefit for B2B & vendor payments |

|---|---|

| Multi‑crypto support | Pay vendors or receive payments in tokens like BTC, USDC, etc. |

| Hands-off approach | Avoid volatility; receive reliable payouts |

| Low fees & no hidden charges | Cost-efficient at scale |

| Crypto invoices & payment links | Flexible for billing and vendor payouts |

| Mass payout capability | Pay many vendors or affiliates in one batch |

| Regulatory compliance | Maintains legal integrity across jurisdictions |

| Plugin/API integrations | Easy deployment into existing business workflows |

| 24/7 support + account manager | Simplifies partnership and technical onboarding |

Luxury & travel sectors

High-end industries like luxury goods, private aviation, and international travel are on the rise as cryptocurrencies help create a new class of high-net-worth individuals. Crypto millionaires surged by 95% in just one year, with 172,300 individuals now holding over USD 1 million in digital assets.

Meanwhile, a related global study by CellPoint Digital revealed that airlines face persistent payment challenges, ranging from the availability of alternative payment methods to struggles with dynamic currency conversion.

How to send & receive crypto payments across borders

Our solutions are designed to help businesses accept digital asset payments and connect with many more new customers. You gain access to everything you need in order to accept crypto, no matter the size of your business or the complexity of your payment flow. And it’s not just Bitcoin – we offer 20 top digital assets and 40 fiat currencies for maximum convenience.

Disclaimer: Cryptocurrency transactions are subject to regulatory restrictions in certain jurisdictions. CoinsPaid operates under Estonian licensing and only provides services in legally permissible territories. Users should consult legal professionals for advice specific to their jurisdiction.

Here is how you can do it!

Step 1: Request a consultation

Reach out to us, and within minutes, your dedicated account manager will be in touch to set up a meeting.

Step 2: Personalised offer

Your account manager will guide you through the platform and prepare a personalised offer based on your needs.

Step 3: Get on board

Once you’re ready, we’ll support you during the onboarding process, including KYB verification and integration.

Step 4: Welcome crypto users

Start accepting crypto payments from your customers and reach out to new ones.

Did you know that…

- Blockchain networks have cut transaction costs by around 60% since 2018, making them more viable for smaller players?

- Businesses save up to 80% on remittance fees compared to traditional methods?

- Average confirmation time for blockchain payments has dropped to ~27 seconds?

"Crypto isn’t the future - it’s the now. As a human-centred crypto-fintech company, we’re the bridge between forward-thinking businesses and the growing community of crypto users. With secure, scalable, and compliant solutions, we make modern finance widely accessible by being committed to legal, responsible, and user-friendly crypto adoption."

FAQ

Businesses can save up to 80% in processing fees by using cryptocurrency payments instead of traditional systems like SWIFT. Fees can be as low as 1.5% or less, compared with potentially much higher fees for SWIFT transfers which many times can cost several hundred dollars.

While we cannot single out any particular cryptocurrency as the top choice for international business payments, we focus on providing flexibility and support across a broad array of coins. We support 20+ leading cryptocurrencies – the most popular of which are Bitcoin, Ethereum, Litecoin, Solana and USDC – along with instant conversion to 40+ fiat currencies. With us you can rest assured that you have:

- Wide currency selection, giving businesses power to serve diverse use cases

- Near-instant fiat conversion, minimizing crypto exposure and operational hassle

- Regulatory compliance and security, with features like KYC/AML and risk scoring built-in

While rules vary in different jurisdictions, we remain committed to legitimate, regulated operations in the EU. We operate on a 100% legal basis and are licensed in Estonia. We implement KYB (Know Your Business), AML (Anti-Money Laundering) procedures, risk scoring, and ISO 27001 security standards to ensure legal compliance across jurisdictions. Moreover, we comply with all applicable laws and regulations and only operate in jurisdictions where we have proper legal authorization.

Important note: Our services are available only in jurisdictions where cryptocurrency payments are legally permitted and hence, they are not available in restricted countries (i.e. India, China, and others as per our policies). For more info, click here.

We employ a robust, multi-layered risk strategy. We leverage encryption inherent in blockchain transactions, plus internal systems like fraud protection, blockchain risk scoring, and cold storage to prevent data breaches and unauthorized transactions.

To eliminate volatility risk, we lock in exchange rates when the payment is made and protect merchants from crypto price fluctuations.

If you are skeptical about holding crypto, when customers pay in crypto, we convert it to fiat, and send it to your bank account.

Our platform is built to handle payments of all sizes, from small transactions to large-scale mass payouts. Whether you’re sending payments to a handful of recipients or managing high-volume transfers, our solution is scalable to meet your needs.

If you intend to send crypto payments to many recipients, contact our support team for help smoothing and automating this process.

Conclusion

Accepting payments in crypto reduces costs by eliminating intermediaries and streamlining fast transactions, making cross-border payments faster and cheaper. Digital currency transactions help companies accelerate growth by providing instant access to decentralized finance tools and global liquidity. Crypto opens up new markets by reaching people that traditional banking services cannot, and eventually enables seamless international commerce.

Our proposition is simple: millions of people worldwide already own cryptocurrency, and are looking for businesses that accept this method of payment.

Our payment gateway connects you to these people and makes accepting crypto as easy as pushing a button.