Real estate and crypto payments in 2025

Crypto is already a powerful dimension in the global economy, with its influence now reaching industries like real estate.

By January 2025, the total market capitalization of cryptocurrencies surpassed $3.5 trillion, with Bitcoin hitting an all-time high of $109,100.

While the crypto market’s volatility is evident – as shown by the 12% dip in early February 2025 – the payments market is far more stable.

Stablecoins have a part to play in this, which now account for over 91% of daily market volume. These digital currencies, pegged to traditional assets like the US dollar, offer the stability needed for smoother transactions during times of uncertainty.

In this article, we’ll dive into the specific impact of this crypto-sirocco on real estate, where exciting new opportunities for crypto-based transactions are emerging.

Current trends in corporate crypto payments

As demand grows, supply follows.

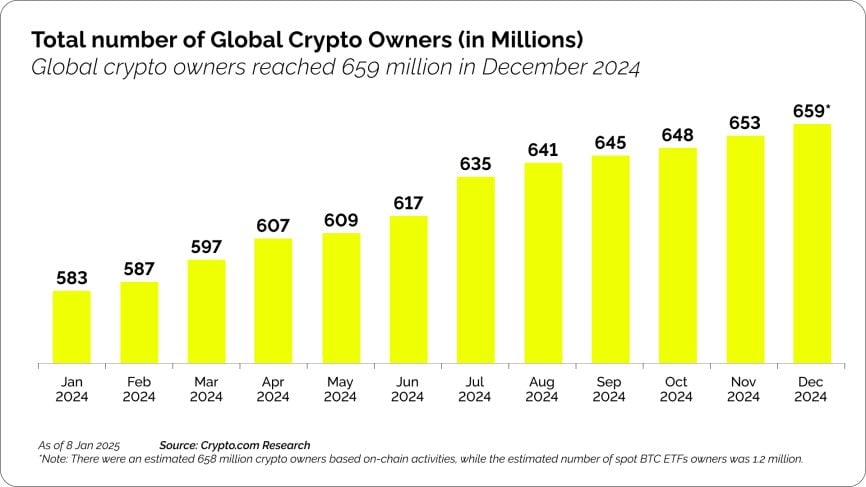

Cryptocurrency’s global user base has experienced significant growth in recent years. As of 2025, over 659 million people worldwide – roughly 1 in 13 individuals – are using cryptocurrency.

As such, it’s no surprise that 85% of companies with annual sales exceeding $1 billion are now using crypto to innovate and attract new customer payments.

Stablecoins are becoming commonplace, particularly in the payments and remittances sector, due to the blockchain’s fast, low-fee, and cross-border capabilities without the volatility associated with Bitcoin and altcoins like XRP.

In fact, in Q2 2024 alone, stablecoin transactions totaled an impressive $8.5 trillion – more than double Visa’s transaction volume.

The real estate industry is one where this trend is especially noticeable. Transactions often involve incredibly large sums, making payments in volatile currencies like Bitcoin risky due to potential slippage. Here, stablecoins such as USDC serve as the ideal medium of exchange, being pegged to fiat currencies such as the US dollar.

This doesn’t mean that companies can’t accept Bitcoin and altcoins without risk. Merchants using payment processors like CoinsPaid can benefit from guaranteed exchange rates and automatic fiat conversion, eliminating concerns about the types of currencies they accept. In fact, the data may simply reflect a growing consumer preference for paying with stablecoins.

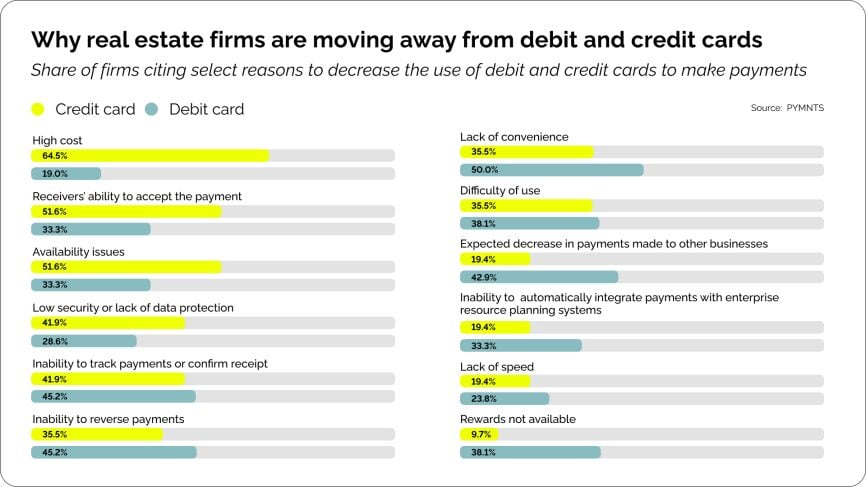

There are also push factors influencing this trend towards accepting crypto. Real estate firms in particular have cited issues such as ‘high costs’ and ‘lack of convenience’ as reasons for reducing the use of debit and credit cards when it comes to making payments.

Why turn to crypto for real estate?

The real estate industry is increasingly turning to cryptocurrency for several compelling reasons, with transaction efficiency being one of the key drivers.

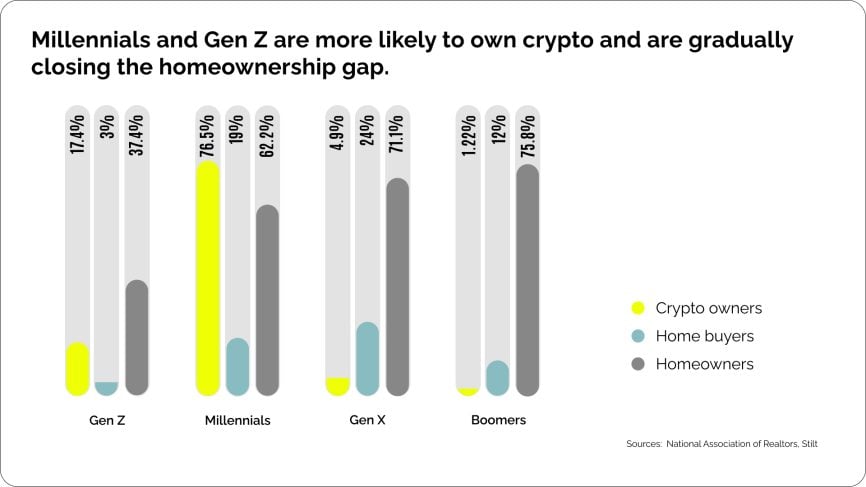

Younger demographic demand: Over 94% of cryptocurrency users are millennials and Gen Z, who are also major participants in the first-time homebuyer market and prefer crypto-friendly payment options for property purchases.

Reduced transaction fees: Traditional payment methods often involve fees ranging from 2-5% for international wire transfers. Cryptocurrency transactions typically cost around 1% or less, providing a cost-effective alternative for buyers and sellers.

Faster cross-border payments: Crypto enables quicker international transactions, which can be completed in minutes, compared to the several days required by traditional methods involving banks or intermediaries.

Enhanced security: The transparency and tamper-proof nature of blockchain ensures secure, unalterable transaction records, crucial in real estate where large sums of money and clear documentation are essential.

"As real estate transactions become more global and digital, cryptocurrencies provide an efficient, secure alternative to traditional payment methods. They offer faster, cheaper, and more transparent processes that meet the needs of today’s tech-savvy buyers."

Geography of crypto and real estate Markets

Various countries around the world are embracing crypto payments in property transactions.

- United States: Miami, for instance,has seen a significant increase in crypto real estate transactions, with a notable example being the $22.5 million penthouse bought entirely with Bitcoin, signaling strong crypto adoption in the luxury property market.

- Europe: Countries like Spain, Germany, and Portugal are experiencing rising crypto adoption, with Spain’s coastal properties attracting international crypto investors seeking real estate opportunities.

- UAE: Dubai is emerging as a global crypto hub, with developers increasingly accepting crypto payments for luxury properties. The city’s progressive regulatory approach to blockchain and digital assets is fostering this growth.

As crypto payments become more widely accepted, early-adopting regions are both seeing growth in property transactions and attracting global investors.

Crypto for luxury real estate

Cryptocurrency is increasingly making its mark in the luxury real estate sector, and several key factors are contributing to this shift.

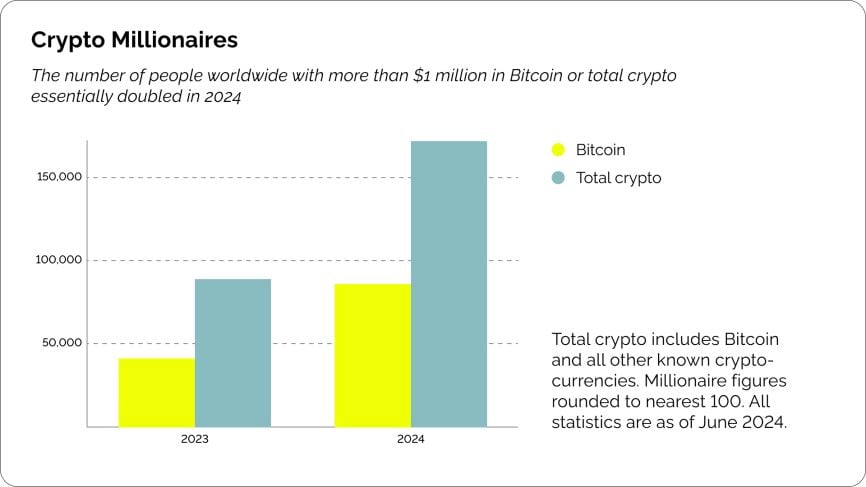

One of the driving forces behind this trend is the rising number of crypto millionaires.

Throughout 2024, the number of individuals holding significant funds in cryptocurrencies has increased by 45%. This surge in crypto wealth is creating a new class of affluent buyers who are eager to invest in luxury properties, further fueling demand in high-end real estate markets.

Alongside this, institutional backing has been key in boosting digital asset confidence. Major cryptocurrencies such as Bitcoin and Ethereum are now widely supported by institutional investors, including large financial institutions and corporations.

This growing institutional interest has helped to legitimize crypto as a viable asset class, encouraging both individual investors and large-scale wealth managers to view digital currencies as a secure and valuable part of their portfolios. As a result, households are more inclined to invest in crypto, with many turning to the luxury real estate market as a way to diversify and protect their assets.

Finally, luxury real estate developers in crypto-friendly regions like Miami and Dubai are embracing digital currencies in their transactions. Both cities have become hubs for crypto investment, with developers increasingly accepting payments in Bitcoin and Ethereum for prime properties.

Download Free Report ↓

What’s Inside:

- Market overview

- Analytical insights

- Demand for crypto payments in travel

- Geography of the trend

- Benefits for travel businesses

- Practical steps for implementation

Why real estate companies choose CoinsPaid

CoinsPaid is a trusted provider in cryptocurrency payment solutions, with over a decade of industry experience. Our reputation is backed by prestigious industry awards, including the “Fintech & Payments Compliance” award at the ICA Compliance Awards 2024, which recognizes our development of an automated real-time risk assessment system that ensures financial safety for high-stakes industries like real estate.

Moreover, CoinsPaid holds an ISO/IEC 27001 certification, ensuring that sensitive property transaction data is protected by robust protocols, offering peace of mind to buyers, sellers, and real estate developers alike.

There are practical aspects of our solution at play, too. For businesses not looking to hold crypto on their books, we offer auto-fiat conversion, allowing them to accept payments in Bitcoin, Ethereum, and USDC while converting them directly to fiat.

For those that choose to hold crypto, whether for paying employees in their preferred currency or other purposes, we provide guaranteed exchange rates to minimize slippage.

Lastly, our platform integrates seamlessly into real estate businesses without any upfront costs. We handle the integration process, enabling property developers, agencies, and brokers to quickly start accepting global crypto payments while benefiting from lower transaction fees compared to traditional banking methods.

As one of the most cost-effective and trustworthy crypto processing solutions on the market, there’s no reason to settle for less than the best.

The future of real estate and crypto payments

The integration of cryptocurrency payments in the real estate sector is rapidly gaining momentum. By adopting crypto payments, businesses can attract a broader range of clients, including tech-savvy individuals and international investors who prefer digital assets.

Embracing crypto not only meets current market demands but also positions companies ahead of competitors, offering streamlined transaction processes and enhanced security. The widespread adoption of cryptocurrencies is appearing increasingly inevitable.

With services like CoinsPaid offering free integration of crypto payments, accepting crypto payments as a business is legal, easy, and cost-efficient. Fill out the form on our site, and our team will get back to you as soon as possible!

Summary

Key Takeaways:

- By January 2025, the crypto market exceeded $3.5 trillion in capitalization, with Bitcoin hitting $109,100, signaling maturity and confidence in digital assets.

- Stablecoins now represent over 91% of daily trading volume, offering price stability for large-value real estate transactions.

- Over 85% of billion-dollar companies already use crypto for payments or innovation, and 659 million global users hold digital currencies.

- Real estate developers and agencies benefit from lower transaction costs (≈1.5%), instant cross-border settlements, and enhanced transparency through blockchain.

- The luxury real estate segment is expanding rapidly as the number of crypto millionaires grew 45% in 2024, creating a strong pipeline of digital-wealth buyers.

- CoinsPaid, an award-winning and ISO/IEC 27001-certified provider, supports real estate payments in 20+ cryptocurrencies with auto-conversion to fiat.

What this means for your business

Crypto is now part of large property transactions actively used by developers, brokers, and agencies. Stablecoins make big payments predictable, allowing businesses that accept digital assets to attract tech-savvy and high-net-worth investors who own them. Faster settlements, lower costs, and transparent records are all major draws for real estate businesses embracing cryptocurrency payments.

CoinsPaid helps real estate businesses integrate secure, compliant, and fully automated crypto payments with ease. Process property sales, rental deposits, or developer payments with our powerful crypto payment gateway for the real estate industry: