Cryptocurrency Mass Payouts for Freelancers & Remote Teams

- What are mass crypto payouts?

- Why companies use crypto for freelancer and remote team payments

- How crypto mass payouts with CoinsPaid work

- Real-world use cases: who uses crypto mass payouts

- On-chain vs off-chain mass payouts

- Is it legal and compliant?

- How to start using crypto mass payouts with CoinsPaid

- FAQ: Crypto Mass Payouts for Companies

Remote teams stopped being the exception after the 2020 pandemic reshaped how companies operate. According to the Hybrid Work Adoption Survey 2024 by McKinsey & Company, around 55% of companies now work with distributed teams across borders by implementing a hybrid work model. Many of those teams rely on freelance talent. In digital industries, freelancers now account for nearly half of the workforce located in different parts of the world.

For businesses, managing cross-border payouts can be real pressure. Traditional systems often lead to delays and high transaction costs. In many cases, companies may spend up to 5% more per payment due to fees and currency conversion.

Crypto payouts are designed to cope with this challenge. With over 560 million users holding crypto worldwide in 2024, digital assets are becoming part of the global payment toolkit. Companies can send funds directly to multiple freelancers in different countries.

This article explains how crypto mass payouts work, where they fit, and what businesses should consider when using them.

What are mass crypto payouts?

Crypto mass payouts allow companies to send digital assets to multiple recipients in one action. This method helps manage high-volume transfers without repeating the same steps for each individual. It’s used by businesses paying freelancers, contractors, or remote teams almost around the world.

Unlike single crypto transfers, mass payouts are automated. The sender uploads a file, uses an API, or inputs data through a dashboard. The system processes all transactions at once. Each recipient gets the selected currency, BTC, ETH, USDC, or tokens, delivered directly to their wallet.

This structure avoids possible delays common with traditional methods. There’s no hold from banks. Reduced conversion costs. Minimized reliance on local banking infrastructure. Payments reach freelancers or teams without passing through multiple middle layers.

Crypto mass payouts can now support regular payroll, project fees, performance bonuses, and partner commissions. With automated tools, companies reduce workload and gain traceability and audit-ready records.

Disclaimer: Crypto mass payouts are subject to local laws, and businesses must assess compliance based on the recipient’s jurisdiction.

Why companies use crypto for freelancer and remote team payments

Paying international teams has never been straightforward. Traditional systems can charge higher fees, impose delays, and often require manual oversight. For companies working with freelancers and contractors across time zones, it can lead to lost time and rising costs.

Mass crypto payments offer a practical alternative.

Low-fee crypto payments

Each cross-border transaction through traditional systems may include a processing fee, an exchange rate markup, and receiving charges. Depending on the country and system, these costs can lead to losses of up to 5% for merchants.

For example, Payoneer applies up to 3.99% on credit card payments, a 1% fee on ACH transfers, and a currency conversion markup of up to 3.5%.

These fees add up quickly, especially for businesses managing recurring payments to multiple international freelancers.

In contrast, crypto transaction fees are typically under 1.5%, depending on the network and provider. Transfers settle quickly, and many platforms offer built-in tools to convert crypto into fiat. Besides, it’s possible to pay in stablecoins to protect both sender and recipient from price volatility while keeping transaction costs low.

International reach

Not every freelancer has access to global accounts or local payment gateways. In regions with unstable financial infrastructure, crypto serves to provide a more stable option. A crypto wallet is all the recipient needs. Funds arrive directly, without additional checks or delays. It broadens the hiring pool and reduces payment friction in emerging markets.

Fast settlement

Traditional cross-border transfers often involve long delays. According to data from Stripe, international wire payments can take 1 to 5 business days to clear, depending on the banks and countries involved.

To picture this, let’s consider an example. Western Union transaction takes up to 5 days if the funds are sent to Argentina or China, while more often it takes 1-2 business days to other regions.

By contrast, automated mass payouts in crypto are processed in almost real-time. High-speed networks like TRC-20 and Polygon settle transactions in under 2 minutes under normal load. Even Ethereum, despite heavier usage, clears most transfers within 5 to 15 minutes, depending on gas fees and congestion.

Finance teams no longer need to wait for end-of-day batches or account for weekend delays. Scheduled or on-demand mass crypto payments let businesses pay remote contributors promptly regardless of location or time zone.

Crypto-friendly professionals

Freelancers in tech, design, marketing, and blockchain sectors increasingly prefer crypto compensation. Many use digital assets as part of their daily workflow. Offering mass crypto payments helps companies meet that expectation. It also positions the business as modern, accessible, and compatible with decentralized work norms.

See the table below to compare traditional payments with crypto mass payouts.

| Feature | Traditional payments | Crypto mass payouts |

|---|---|---|

| Speed | 1-5 days | Minutes to hours |

| Fees | High bank and intermediary fees | Lower network and processing fees |

| International reach | Limited by banking networks | International coverage |

| Transparency | May be limited, depending on bank records | Full transaction history on the blockchain |

| Security | Subject to banking protocols | Decentralized security and multi-level control |

| Reporting | Often manual and slow | Automated, with exportable, detailed logs |

"Crypto payments are changing the game for businesses. Beyond saving on fees, blockchain brings speed, security, and transparency that traditional systems just can’t match."

How crypto mass payouts with CoinsPaid work

Sending payouts to multiple recipients can be done in a few steps with CoinsPaid. The system supports bulk crypto payments.

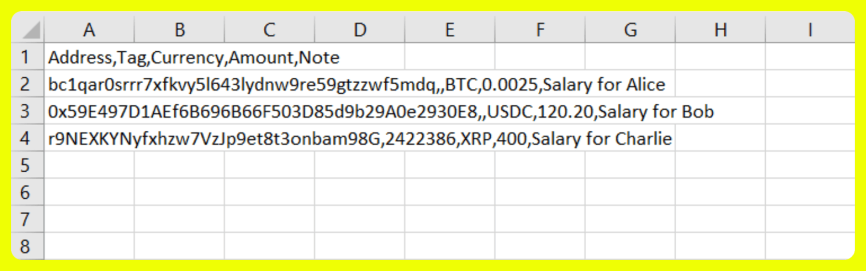

CoinsPaid mass payouts are based on CSV uploads. Each row in the file represents one transaction and includes the recipient’s wallet address, the amount, the currency, and an optional note or tag. After the file is uploaded, the system processes each transaction automatically.

The platform can handle up to 100 payments per batch, with real-time error detection before confirmation. This helps teams fix issues like missing tags or insufficient funds before any assets are moved.

Once confirmed, each transaction is sent individually but managed as part of one batch. You can monitor the progress of the full payout on one dashboard.

CoinsPaid supports mass payouts in over 20 popular crypto assets.

Businesses can pay in stablecoins like USDC to avoid price volatility or use native crypto depending on the recipient’s preference.

Transactions that exceed limits may require multi-user confirmation, adding a layer of control and security.

Real-world use cases: who uses crypto mass payouts

Companies across various sectors are already using crypto mass payouts to solve key operational issues. Here’s how each type of business benefits:

IT and outsourcing companies

These firms often engage distributed developers, testers, marketing, and support teams. Traditional payouts come with slow transfers and variable fees per country. Crypto payments can eliminate these issues. Immediate payouts reduce contractor churn and keep projects on schedule.

DAOs and Web3 startups

For decentralized teams, crypto can be a native way to send payments. DAOs use mass payouts to reward contributors, distribute grants, and pay moderators. Startups in Web3 often offer stablecoins or cryptocurrency, such as ETH, to onboard global talent quickly.

Design and production studios

Creative agencies and studios hire freelancers across motion design, video, UX/UI, and 3D. These teams often work on short cycles and switch collaborators often. Paying in crypto keeps the process flexible and avoids invoicing friction with international banks.

HR agencies with global reach

Recruitment firms pay contractors across continents from Eastern Europe to Southeast Asia. Some recipients can lack local bank access or face long payment clearing times. Crypto mass payouts use wallet-based delivery, requiring only a phone and internet. It expands hiring pools and lowers onboarding friction.

Finance and CFOs

They manage liquidity across wallets, track outgoing payments, and integrate payout data into accounting systems. Reconciliation and reporting are key parts of their role.

Platforms and service providers

These include marketplaces, affiliate networks, or digital platforms that automate high-frequency, low-value payouts to vendors or partners.

Each use case shows how crypto mass payouts tackle real challenges:

| Pain point | Crypto solution |

|---|---|

| Slow cross-border fees | Near-instant settlement, low-cost network fees |

| Payment predictability | Transparent per-transaction logs, no hidden markups |

| Global access gaps | Wallet-based payments bypass local banking needs |

| Talent retention | Fast, flexible payments improve engagement |

These examples illustrate why mass crypto payouts have gained popularity.

On-chain vs off-chain mass payouts

Understanding the difference between on-chain and off-chain mass payouts helps businesses choose a more suitable approach for their needs.

On-chain transactions are recorded directly on a public blockchain. Each payout is confirmed via consensus, logged in immutable blocks. Security is high, transparency is full.

Off-chain transactions are made through private settlement systems that record transactions outside the blockchain. They are fast and cost-effective but rely on trusted intermediaries.

| Feature | On-chain mass payouts | Off-chain mass payouts |

|---|---|---|

| Speed | 5-15 min (varies by network load) | Under 1 minute for dot-ledger booking |

| Fees | Vary by congestion; can be 1-3 USD+ | Fixed and lower per payout |

| Security | Immutable, decentralized | Trusted provider needed for accuracy |

| Transparency | Visible on public ledger | Private within the platform |

| Scalability | Can slow during peak periods | Highly scalable with batch settlement |

| Use case | Large transfers needing proof | Routine payroll for frequent small payouts |

Is it legal and compliant?

CoinsPaid follows strict compliance standards that align with international anti-money laundering (AML) and know-your-business (KYB) requirements. All clients must complete identity verification. Risk levels are assessed, and daily monitoring helps detect unusual or high-risk activity. Enhanced checks apply when necessary.

The company is a licensed service provider, registered in Estonia. The license requires regular audits, adequate capital reserves, and enforced compliance procedures.

When coming to mass payouts, each one includes a full transaction log, address, amount, currency, date, and unique payout ID. These records are available for export via CSV or API, allowing finance, HR, and audit teams to align payouts with internal accounting and reporting systems.

CoinsPaid aims to enable companies to run crypto payouts legally and with full reporting transparency.

How to start using crypto mass payouts with CoinsPaid

It usually takes three steps to start global contractor payouts via crypto solution by CoinsPaid:

Step 1. Sign in

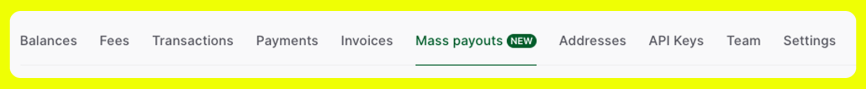

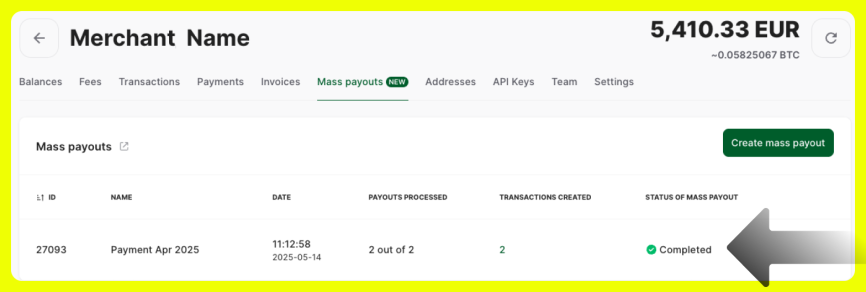

Provided that you have a CoinsPaid account and use its solution, you are to sign in and click the “Mass payouts” tab.

Step 2. Upload payout file

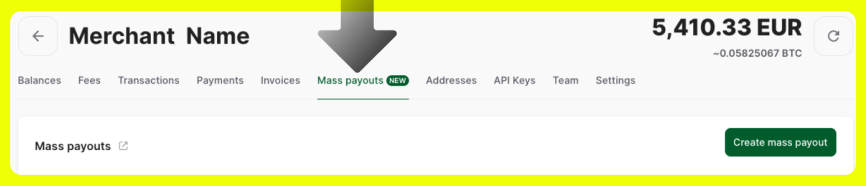

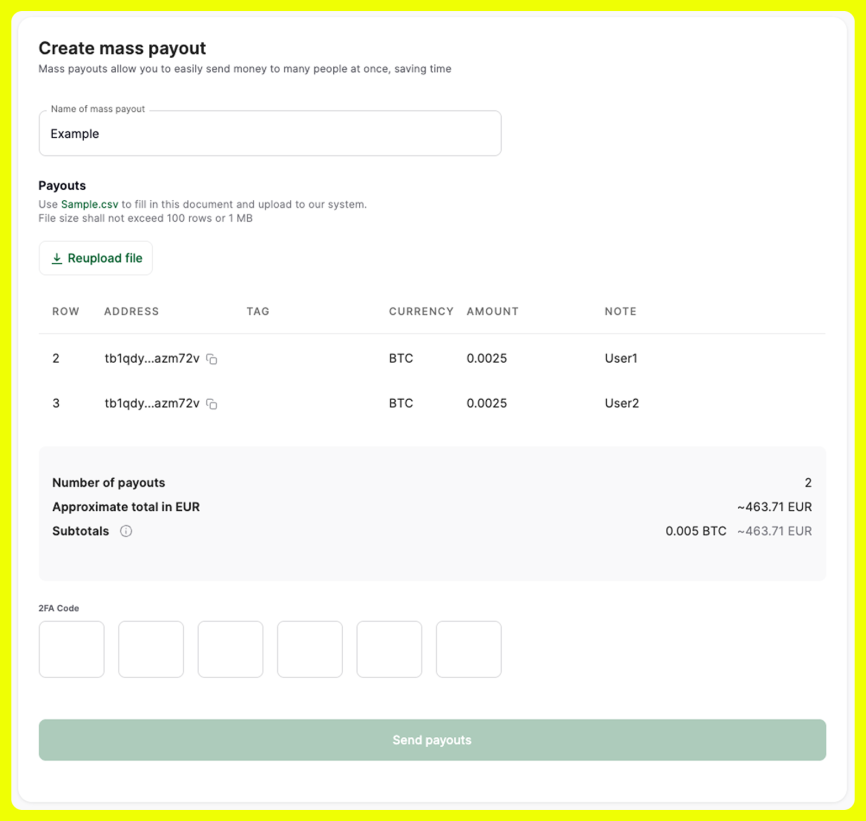

To send a mass payout, on the Mass payouts tab click Create mass payout. Name your batch and upload a CSV file.

The preview table will highlight any critical errors with an exclamation mark, hover to see details. Fix the file, re-upload, and check the total amount and per-currency subtotals before proceeding.

Step 3. Send funds

After validating your file, check the estimated totals at the bottom of the table. These include the full withdrawal amount and per-currency subtotals, shown both in crypto and in fiat equivalents. Keep in mind that final costs may vary due to processing and network fees applied after confirmation.

To proceed, enter your 2FA code and click Send payouts. Each transaction will then be created and processed according to your withdrawal limits.

You can monitor progress live in the Mass payouts table.

FAQ: Crypto Mass Payouts for Companies

Crypto payouts are permitted in many jurisdictions. Companies can use them to pay freelancers with crypto. However, businesses must check local rules in each country before proceeding.

Yes. USDC payroll for remote teams is widely used, as USDC is a stablecoin pegged to the US dollar, which is convenient for freelancers and remote workers.

Crypto payouts are treated as crypto transactions and may trigger taxable events. Employers should keep detailed records. Contractors and employees must report income in line with local tax laws.

Yes. Recipients must have a compatible crypto wallet. It can be a standalone wallet or one linked via email or ID. No bank account is needed. They can convert crypto to fiat through exchanges or on/off-ramp services.

Crypto payouts usually settle in minutes. The speed depends on the network and congestion. Stablecoins like USDC settle almost instantly. Ethereum transactions take about 5-15 minutes, depending on congestion.

Ready to start? Join 800+ companies using CoinsPaid

Trusted by businesses in different parts of the world, CoinsPaid makes it easy to send crypto payments to remote teams and freelancers around the world. Our platform reduces errors, speeds up mass payouts, and gives you full control over every transaction.

What you get:

- Support for 20+ cryptocurrencies

- Fast conversion to 40+ fiat currencies

- Regular security audits

- Free setup and integration

- Fast settlements with low fees below 1.5%