Cryptocurrency Payment API

Table of content

For a business, accepting crypto payments comes with a lot of complexity around different assets, networks, and wallet addresses. Coins and tokens are managed differently, and the initial architecture requires significant investment and decision-making. A crypto payment API abstracts away all that complexity into predictable requests and callbacks, so your team can ship a crypto checkout without running blockchain infrastructure on your own.

Your website keeps a familiar flow: create a payment request, show the customer what to pay, then mark the order paid when the status is confirmed. In this guide, we’ll explore how a cryptocurrency payment API works, what you can build with it, and where CoinsPaid’s crypto payment gateway API fits in your security and compliance model.

What is a crypto payment API

A cryptocurrency payment API is a software interface that lets a business accept and manage payments in coins and tokens from your website or application.

Blockchains do not behave like card rails. Payments arrive asynchronously, confirmations vary by network, and some assets require extra attention. With an API, your backend automatically sends requests to create payment data, then receives callbacks when the transaction status changes. Your payment gateway provider tracks blockchain activity, applies confirmation rules, and returns structured updates back to your system.

In short, a crypto payment gateway API:

- Creates invoices and generates deposit addresses.

- Shows the customer what to pay and where to pay it.

- Handles callbacks (webhooks) as the transaction moves from detected to settled.

Your app talks to the gateway, and everything else happens in the background. This way, crypto payments fit into the same architecture as credit cards, bank transfers, or any other payment rail you’re already used to.

What can businesses do with a crypto payment API?

A crypto API for business usually covers the entire payment lifecycle from invoicing to settlement. Here are some core functions you can expect, with practical notes that help your tech lead plan the integration:

- Accept crypto payments programmatically. Your backend requests a payment destination. The user pays. Your backend receives a callback with the payment status and transaction details. This removes the need to monitor chains directly, and it keeps your order system as the source of truth.

- Automate payment processing and state changes. Example states: created → pending → confirmed → settled, plus exception states like expired or failed. The API supplies the blockchain tracking and sends status changes via callbacks. Your system records each change and applies any logic you need to your transaction IDs.

- Create invoices and hosted payment pages. Invoices fit fixed-price checkouts. The API returns a hosted page URL, a time window, and payment parameters. Your frontend redirects the user and waits for the callback before finishing the checkout or providing access to a subscription. With an API for crypto, merchants can launch quickly without building a custom UI.

- Manage wallets, balances, and conversion rules. Many businesses do not want treasury exposure to crypto volatility. A provider can help manage crypto wallets and convert incoming coins to a chosen settlement currency at payment time, usually stablecoins. Your checkout still offers crypto to the user, and your finance team receives predictable accounting with USD, EUR, or other traditional currencies.

- Run payouts, withdrawals, and refunds. Marketplaces and platforms need outbound flows. A crypto payment processing API can cover withdrawals to user wallets, vendor settlements, and operational transfers, with the same callback pattern for status and reconciliation.

- Track transactions and settlements. The API payloads and reporting offer an audit trail that finance teams need. A good integration will create: provider transaction ID, your order ID, amount, currency, network, wallet address, tx hash, timestamps, and final status. Crypto turns into a predictable stream in your payment flow.

Why choose a crypto payment gateway API instead of building on-chain

Building a direct on-chain flow can work for a small pilot. It becomes risky once you need customer support, accounting, and compliance at scale. There are a few reasons for this:

- Logic and payment rules. API publishes status definitions and helps separate confirmed and unconfirmed payments. It’s easy to place alongside your existing rules at checkout or subscription.

- Pricing and maintenance. Building your own system means integrating different blockchains and creating respective infrastructure for it. In other words, you’ll have to use an API either way, but instead of a single payment gateway, you’ll end up with an expensive system of different tools.

- Conversion options. With automation, you can accept crypto and settle in fiat, or receive coins like BTC from your users and immediately convert them to stablecoins like USDC.

- Compliance inputs. Regulations in some jurisdictions require sender and receiver data for KYC. Working with a licensed provider helps handle transaction risk scoring and manage compliance.

How CoinsPaid crypto payment API works

CoinsPaid developed a powerful crypto payment processing API called CryptoProcessing. It’s fast, secure, and easy to integrate thanks to our detailed technical documentation. Following integration, your backend stays in charge of order status and crediting user balances. CoinsPaid handles blockchain monitoring, confirmation logic, and payment-level risk controls.

A simple crypto API integration plan

Step 1. Ensure feasibility

Assess the expected geography of your crypto payments, currencies you’re interested in, and estimated transaction volumes. Your legal and compliance teams can use our handy FAQ to cover common questions around different currencies, supported flows, and operational rules.

Technical onboarding with CoinsPaid includes complete integration support. Our team helps implement and test your payment flow to ensure you have all the resources you need to succeed with crypto payments.

Step 2. Set up authentication and payment flows

Before you start making API requests: get your API keys, enable the currencies you plan to accept, and set a callback URL. For extra security, whitelist IP addresses for your API key.

Your backend signs each API request, and it verifies each callback signature before saving the event. Essentially, signature verification is your first line of defense. Reject unsigned or mismatched requests, then log the attempt for review.

Step 3. Pick the right payment flow for each product screen

CoinsPaid supports two common patterns that cover most checkout scenarios.

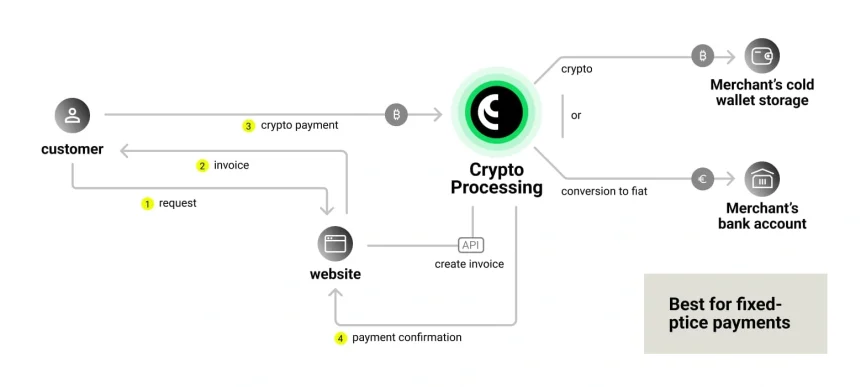

A) Invoices for fixed-price payments

This flow helps you create invoices and link them to your orders via specific identifiers that then redirect them to a hosted payment page. The API is flexible and can also help handle partial payments in multiple installments or refund instructions.

Example business use cases:

- Ticket purchases, real estate transactions, etc.

- E-commerce carts and checkout flows for online stores.

- SaaS subscriptions or service payments.

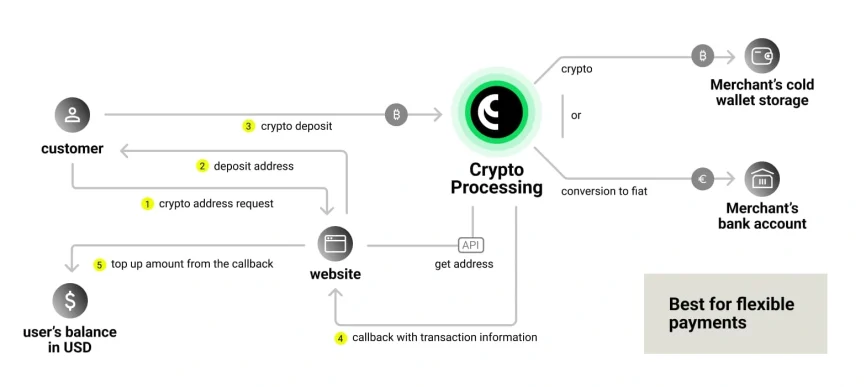

B) Address-based deposits (Channels)

In this flow, you can receive crypto deposits and credit your users’ in-app balances. Your backend requests a deposit address for a selected asset and network, then your UI displays the address along with any required fields, such as an XRP tag for Ripple tokens.

Example business use cases:

- A gaming platform that lets users top up balances in crypto.

- Pay-as-you-go advertising or media buying platform.

- Freelance marketplace with internal digital wallets.

Step 4. Customize your checkout UI or payment forms

A safe crypto checkout separates coin and network in the UI. It shows the full payment context every time, along with a fiat equivalent for convenience.

- Display the asset and network as two fields for users to customize.

- Show address and QR code along with a tag or memo fields if the asset requires them.

- Add copy actions and checksum-style previews, so users spot mistakes easily.

You can find some best practices for creating forms in our crypto API documentation. We also offer preset solutions for your convenience. Our crypto checkout supports popular wallets like Trust and MetaMask, so your users can autofill payment information without the risk of making mistakes.

Step 5. Add withdrawals and exchange rules

CoinsPaid supports outbound flows and conversion operations through the same request-and-callback model.

- Use withdrawals for vendor payouts, user cashouts, and operational transfers as necessary. For example, you can automatically send out payroll with the help of API payments.

- Use exchanges when you prefer a specific currency over what’s coming in. For example, you might want to convert all BTC or ETH payments into USDC to hold US dollar equivalents of your assets.

Putting it together: a marketing business can accept Ripple from its customers, automatically convert it into USDC, then send a portion of the payment to the affiliate that brought the customer in.

Step 6. Test crypto payments in the sandbox before launch

CoinsPaid provides a test environment separate from a production environment. Your team can test requests and callback handling without risking any live funds.

Key features of CoinsPaid crypto payment API

Our crypto payment gateway API is created from the ground up for enterprise use. We understand that merchants need specific features that help put crypto payments in line with traditional flows:

Multi-currency support

CoinsPaid supports 20+ popular cryptocurrencies and stablecoins for different use cases, plus broad coverage of 40+ fiat currencies for conversion. With this, you can have a flexible payment policy in different regions aligned with your user preferences at checkout.

Multiple blockchain networks. Tokens and stablecoins live on different networks, each with different addresses and fees. Our ability to streamline and abstract this process reduces wrong-chain deposits and creates an overall better experience for your customers.

Webhooks and callbacks for real payment logic. Callbacks turn blockchain confirmations into a reliable payment event stream. CoinsPaid also documents retries and delivers detailed history, which helps teams debug incidents and prove what happened in a dispute or audit.

Invoice and payment creation flows. Invoices can easily fit into your existing checkout structure, even if it’s very complex and layered. In addition, payment requests can be redirected to a hosted page to keep sensitive checkout flow handling on our side.

Security and encryption. CoinsPaid API offers signature-based authentication. We also have ISO/IEC 27001 certification, proving our ability to manage sensitive data according to international best practices – along with independent security audits as part of our posture.

Comparison: choosing a provider for a crypto payment gateway API

Contrary to popular belief, deciding on a crypto payment API is not the sole responsibility of your CTO or tech team. It affects compliance, finance operations, support load, and even user acquisition.

There are several important factors to consider during the process:

Custodial vs non-custodial

| Custodial model | Non-custodial model |

|---|---|

| The provider manages wallet infrastructure and operational security controls. This often simplifies integration and support. It also changes compliance scope and the way funds are handled. | The merchant controls private keys and wallet infrastructure. Increases engineering burden and security responsibility but provides greater control over assets. It may fit teams with in-house custody expertise. |

Settlement options

Decide what assets you want to hold and which you’d rather trade on the spot. Look for these features:

- Direct crypto-to-crypto exchange without large mark-ups.

- Conversion to fiat or stablecoins at payment time

- Withdrawals to bank rails where supported

At CoinsPaid, we lock the exchange rates at the time of conversion to reduce exposure to volatility and provide access to easy fiat withdrawals in 40+ currencies.

KYC, KYB, and compliance tooling

For safe processing of digital assets, your provider shouldn’t pose a compliance risk in the region where your business operates.

It’s important to verify:

- KYB onboarding requirements and typical review steps

- The presence of AML controls and sanctions screening

- Transaction monitoring and risk flags

- Required sender data fields for regulated flows, plus how they appear in API payloads

- Reporting outputs your finance team needs for audits and reconciliations

- Restrictions by country, industry, and risk level are documented and predictable

To summarize, your crypto payment processing API provider should be able to explain what gets blocked, why it gets blocked, and how to handle transaction risks.

Development expertise

APIs are not created equal. Running a short production test during evaluation can be invaluable for your business. Some real callbacks, retry scenarios, and reconciliation exports will teach your team more than sales calls and demos.

Some providers charge integration fees or monthly subscriptions. At CoinsPaid, we’re committed to helping you achieve the best possible results with crypto payments and don’t charge any integration fees or monthly subscription – only a small percentage of processed transactions, well below the rates of traditional payments.

Is a crypto payment API safe and compliant?

A business can accept crypto via API without understanding blockchain internals when two things are true:

- Your provider enforces security controls, so your payment surface stays protected

- Your provider runs compliance checks, so payments follow regulated workflows

An API is safe when it blocks tampering, limits access, and produces a clean audit trail. It is compliant when it collects the right data at the right time, and gives your team the evidence regulators and auditors ask for. Things like:

- Signed requests and signed callbacks. A gateway should sign every request and every callback. We do this with processing keys and signatures, where the signature is an HMAC-SHA512 of the request body. See authorise your requests in the documentation.Verify the callback signature before storing the event or changing any balances. Log failures and return a non-200 response.

- Network hardening and reliability. IP whitelisting is a good practice for API keys because it allows only your infrastructure to call the gateway. Going further, a safe system assumes webhooks can fail in transit. Your handler should return HTTP 200 only after it validates the signature and writes the event.

- Clear KYB and operating rules. You need predictable onboarding and clear restrictions by industry and geography. Treat this as part of vendor selection from the start, because onboarding can take longer depending on jurisdiction. It sets your go-live date more than any API endpoint.

- AML signals in the payment record. A compliant gateway should provide risk signals that your team can understand. Our callback payloads include a risk score, which is an important signal that helps uncover irregular behavior, AML risk, and so on.

Crypto regulations vary between countries, so exact requirements will depend on your jurisdiction.

Why choose CoinsPaid for crypto payment processing via API

We built CoinsPaid for teams that want crypto payments to run like a real payment rail alongside credit cards and bank wires. You get a clear integration path, strict event handling, and everything you need to safely use crypto payments.

- Launch faster with fewer moving parts. Add crypto payments without building blockchain infrastructure, running nodes, or managing wallet operations in-house. Our integration guide and documentation are easy for developers to follow.

- Fewer failed payments at checkout. Support network-specific rules, tags, and popular wallets. Users see the right fields at the right time, so fewer deposits go missing.

- Keep crypto treasury exposure under control. Accept crypto, then convert to a target currency when it fits your finance policy. Keep your revenue predictable by using stablecoins or fiat currency where applicable.

- Run compliance-ready operations. KYB onboarding, AML controls, and regulated invoice data flows support long-term operations across different markets.

- Get help from experts. Our team supports onboarding, integration reviews, and production rollout, so you can go live with fewer challenges and start getting paid faster.

FAQ

Laws vary by country and sector. CoinsPaid operates under an Estonian license and legally provides services in countries that aren’t on the restricted list according to our policy. Your business still needs local legal review for your own licensing, tax, and reporting duties.

Yes. We support assets like BTC, ETH, XRP, and USDC, and many others. You can find a full list of assets here. Some assets exist on multiple networks, and the API uses internal currency codes to distinguish them.

If you need a specific asset that is not in the list, you can also talk to our team to explore the possibility of integration.

We run KYB checks for merchants during onboarding. End-customer data requirements vary by flow and jurisdiction. In some invoice cases, we collect sender data to meet regulatory rules.

As a regulated service provider, we have compliance controls on our platform and apply AML policies to transactions. You own your local legal, tax, and reporting duties for your business.

The API follows a REST plus webhook model, so the integration follows a standard pattern for payments. Your backend signs requests and validates callbacks. We provide developer documentation with code samples, example payloads, and a sandbox environment for full end-to-end testing. Our custom solutions to accelerate integrations also include SDKs.

You need a backend service that can send HTTPS requests and compute HMAC signatures. You also need an HTTPS endpoint for callbacks and a database for payment events. Most stacks handle this with standard crypto libraries.

We send callbacks as the payment status changes. Use the final paid or confirmed status as your release point. Anchor idempotency to the provider transaction ID to prevent double credits.

We support 20+ major cryptocurrencies and stablecoins, and multiple networks. Coverage varies by asset – during onboarding, we help enable the set that matches your product and markets. You can always switch available assets around in the back-end.

Yes. Stablecoins work well for pricing and treasury policy. We also support conversion flows, so you can settle in your preferred currency.

We provide an API-based gateway where we handle the operational blockchain layer. You integrate endpoints and callbacks and keep your order system as the source of truth. This model fits teams that want crypto payments without running a complex custody infrastructure.

Conclusion

A crypto payment API should feel like any other payment method in your application. Your backend creates payment requests, your system trusts signed callbacks, and your ledger stays in control of credits, access, and payouts.

A good API creates the building blocks to run your flow at scale. You can support channel top-ups, fixed-price invoices, and partial payments through instalments, plus withdrawals and exchange flows when your finance policy needs them.

CoinsPaid API is the shortest path from “we should accept crypto” to “it’s live and stable” – try it out for yourself!

Compliance disclaimer

This content is provided for informational purposes only and does not constitute financial, legal, or investment advice. Cryptocurrency payments involve risk and are subject to regulatory requirements.