Crypto vs PayPal: What Businesses Need to Know

Table of contents:

- What businesses expect from a payment system

- PayPal and Crypto payments: strengths and limitations

- Crypto vs PayPal: comparison table

- Stablecoins: the practical alternative to PayPal

- Why businesses choose CoinsPaid as their crypto infrastructure

- Use cases for Crypto vs PayPal in B2B scenarios

- Risks and how CoinsPaid mitigates them

- Conclusion

In 2026, PayPal still dominates online payments with more than 430 million active accounts and a presence in over 200 markets. However, crypto ownership rose to over 713 million last year, and the debate between PayPal vs crypto payments is still open. Many merchants are wondering how crypto payments for business vs PayPal compare when it comes to costs, payout speed, and access to customers.

This article will compare crypto vs PayPal from a business angle, delving into PayPal’s offering and the alternative presented by the business crypto gateway CryptoProcessing by CoinsPaid.

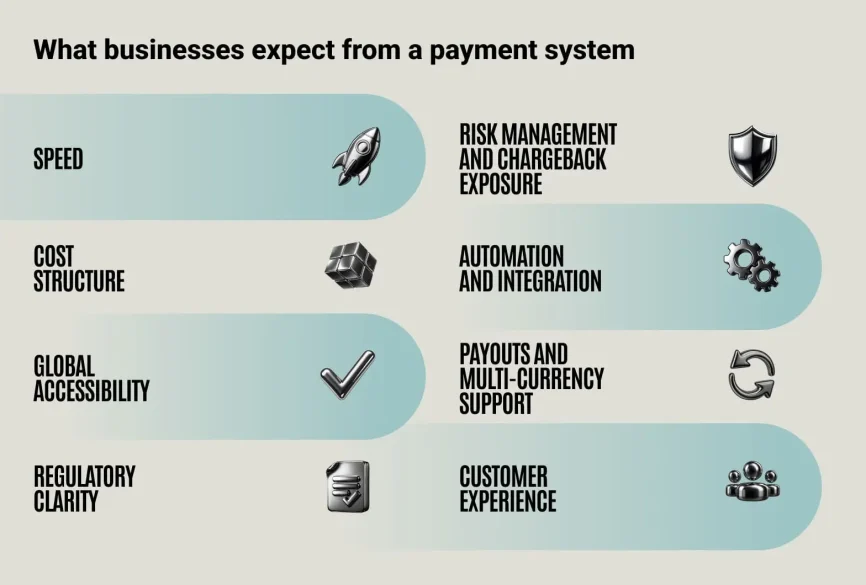

What businesses expect from a payment system

To understand why businesses choose crypto over PayPal or vice versa, we need to first create an evaluation grid with all the important parameters of a modern payment stack.

1. Speed

Time-to-money currently sits at the core of many business models. Payments support payroll, marketplace settlement, refunds, payouts, and more. Flows can break if funds take too long to arrive or if a platform is unreliable in any way.

2. Cost structure

Finance teams track the full cost of each payment rail. That cost includes percentage fees, fixed fees per transaction, cross-border surcharges, FX spreads, dispute fees, and any reserves that reduce available cash.

3. Global accessibility

A payment method that works across markets still falls short if contractors or suppliers in key corridors cannot receive funds, cash out, or use local stable infrastructure. Enterprises need workable coverage across both carded and underbanked regions.

4. Regulatory clarity

Compliance teams want a clear rulebook. That includes licenses, reporting standards, sanctions screening, and risk scoring that match internal policies. Enterprise crypto payments and PayPal both fall under financial regulation, but with different scopes and reporting lines.

5. Risk management and chargeback exposure

Risk teams focus on two core questions. First, what is the fraud and chargeback profile of the payment rail? Second, who carries that risk in practice? Chargebacks incur direct fees and indirect costs, including dispute handling, write-offs, and increased reserves.

6. Automation and integration

Developers look for clean APIs, webhooks, and sandbox environments for testing. Enterprise buyers care about documentation quality and the ability to plug into existing ERP, payroll, and billing systems.

7. Payouts and multi-currency support

Global businesses need bulk payouts, support for multiple currencies, and transparent FX rates. That applies to both card rails and stablecoins.

8. Customer experience

End customers judge a payment rail through ease of checkout, local currency support, and trust in brand and buyer protection tools.

PayPal and Crypto payments: strengths and limitations

PayPal’s strengths for online commerce

PayPal is a leading online wallet for global consumers. It processed over 25 billion transactions and actively serves over 430 million user accounts. Key strengths include:

- Brand recognition and trust. Consumers are familiar with PayPal, and many already store their cards and bank details within the platform. That trust supports higher conversion in some markets.

- Buyer protection. PayPal offers dispute resolution and buyer protection that feels familiar to shoppers used to card chargebacks.

- Integration coverage. Major eCommerce platforms, SaaS tools, and marketplaces support PayPal out of the box. Merchants can add it as a checkout option with limited development work.

- Multi-currency reach. PayPal supports 25 currencies and runs in more than 200 markets, which simplifies cross-border consumer sales.

PayPal has recently entered the crypto space

The company issues its own US dollar stablecoin, PYUSD, and in mid-2025, launched a “Pay with Crypto” checkout feature for US merchants. This feature routes payments from crypto wallets and charges a flat 0.99% fee, which includes an additional exchange rate margin and tiered fees for cryptocurrencies other than PYUSD.

PayPal’s crypto offering may look lucrative in PYUSD, but exchanging this stablecoin into other assets quickly eats at the margin. The feature is also only available in the US, making it rather limited for global merchants. Since the offer isn’t yet mature and widely available, it will not be extensively featured in this article.

PayPal limitations and restrictions for merchants

PayPal’s design suits retail buyers first. That creates friction once a company scales cross-border volume or builds complex payout flows.

Fee stack for business payments

PayPal business fees consist of a percentage fee, a fixed fee per transaction, and extra charges for cross border and FX. In the United States, many online commercial transactions carry a base rate near 2.99% of the transaction value plus a fixed $0.49 fee for USD receipts. International online payments then add a cross-border surcharge around 0.5% above the domestic rate and a currency conversion margin near 2.5% above the mid-market FX rate.

Payout timing

PayPal balance updates quickly when a customer pays. Moving that balance to a bank account still takes time. In many markets, withdrawal to a bank account takes one to three business days, and longer where local banking rails are less developed. Combined with reserves, this delays contractor payroll, supplier settlements, or affiliate commissions.

Chargebacks and dispute fees

PayPal supports both card network chargebacks and internal disputes. When a buyer opens a dispute, PayPal charges a dispute fee that ranges roughly from $8 to $30 depending on the merchant’s dispute rate and risk profile. Card chargebacks usually add another $20 fee per case. These fees apply even when the merchant wins in many scenarios. Over thousands of transactions, this becomes a material line in the PnL.

Account limitations

PayPal’s risk systems can limit accounts or block specific payments when they flag unusual activity, compliance concerns, or higher dispute rates. When this happens, merchants face PayPal blocked transactions and delays in withdrawing funds. Additionally, Merchants report rolling reserves between 10 and 20% of volume in higher-risk verticals.

Cross-border payments

When put together with the FX fees, the effective cost for a cross-border PayPal business transaction can reach 4% or more after all line items are combined. For high‑volume merchants, ‘how to avoid high PayPal fees’ is a constant question, especially on thin margins. Typical levers include optimising dispute ratios, negotiating enterprise pricing, and shifting some traffic to alternative rails.

PayPal international transfer limits

For verified accounts, PayPal states that users can send up to $60,000 in a single transfer, although practical limits for many currencies often sit closer to $10,000 per transaction. That range covers most retail payments but can be restrictive for B2B settlements, especially in high‑value industries like luxury products.

Enterprise crypto payments: strengths

Crypto payments cut out card networks and many intermediaries. When comparing crypto, and in particular stablecoin payments vs PayPal, several structural differences stand out.

Near-instant settlement and 24×7 availability

On modern blockchains, settlement finality often takes seconds to minutes. A recent a16z report shows that leading blockchains grew 100x+ in terms of handling per second transactions compared to five years ago. Payments can settle at any hour, including weekends and holidays.

Lower and more predictable fees

Fees at a business crypto payment gateway are at 1.5% or below without any flat extras. The price is the same even for cross-border payments, since geographic distance does not change on-chain fees. For high volume merchants used to 3 to 7% card and PayPal charges, this difference releases margins for marketing, loyalty programs, or reinvestment.

No technical chargebacks

Cryptocurrency transactions on public blockchains are irreversible after confirmation. Payment processors can help mediate disputes and support refunds, yet no entity can take back a transaction in digital assets. This mitigates so-called friendly fraud, though merchants still need refund policies at the protocol level.

Global reach

Anyone with a wallet and internet connection can send or receive a crypto payment, they’re legal in 100+ countries. That list includes contractors and partners in countries with weaker card penetration or stricter capital controls. Stablecoins in particular support global transfers where traditional rails are slow or costly.

Easy fit for payouts

For many finance teams, crypto vs PayPal fees create a clear gap, especially on cross‑border flows. Crypto mass payouts work for contractor payroll and affiliate payments without extra FX fees, provided the crypto processing provider is licensed and local rules allow such flows. This flexibility often turns crypto payments into a global payments alternative to PayPal, particularly for B2B and high‑risk sectors.

Crypto payment limitations

Crypto rails come with their own trade‑offs.

- Compliance onboarding. For compliant crypto payments, businesses need to pass KYB with a licensed provider that handles AML checks and on‑chain monitoring.

- Regulatory landscape. Laws differ across jurisdictions. Enterprises need providers that match their licensing footprint and have proven experience in their place of business.

- Integration work. Crypto gateways require API integration or plugin setup and testing. The work resembles card gateway integration, yet often involves new internal stakeholders.

- Volatility and accounting. Using volatile assets like BTC or ETH complicates accounting and risks loss during market swings. Most merchants opt to use stablecoins with clear fiat pegs and audit trails to avoid these challenges.

Crypto vs PayPal: comparison table

The table below summarises core differences between a typical PayPal setup and crypto payments processed through a licensed gateway such as CoinsPaid. Exact figures, such as crypto vs PayPal speed, will vary by country, plan, and network, so treat this as an analytical snapshot for 2026.

| Feature | PayPal | Crypto payments (via CoinsPaid) |

|---|---|---|

| Speed | Bank withdrawals take 1–3 business days; funds may be held up to 21 days for new or higher-risk sellers. | On-chain settlement in seconds or minutes, with near-instant credit after confirmations. |

| Availability | Available in 200+ markets, but features vary; some countries and industries face restrictions. | Operates globally; coverage depends on licensed providers and local laws. |

| Fees | Typically 2.9–3.49% plus fixed fees, with extra cross-border and FX charges. | Usually 1.5% or less; often significantly cheaper, with no flat fees. |

| Chargebacks | Full chargeback exposure plus dispute and chargeback fees. | No technical on-chain chargebacks; refunds remain under merchant control. |

| Account holds / freezes | Risk reviews may limit accounts, delay funds, or block transactions. | Strong KYB/AML at onboarding and per transaction; rolling holds are not standard. |

| FX conversion costs | FX spreads and cross-border fees can exceed 3%. | Stablecoins enable USD/EUR-equivalent transactions; fiat conversion is transparent. |

| Payouts | Payout tools exist but often include per-payment fees and country limits. | Mass payouts allow up to 100 payments at once with standard processing fees. |

| Business support | Standard support; dedicated account managers mainly for large enterprises. | 24/7 support with a dedicated account manager for all merchants. |

| Integration tooling | REST APIs, web SDKs, and plugins for card and wallet payments. | Full API, sandbox environment, and eCommerce plugins designed for crypto flows. |

Stablecoins: the practical alternative to PayPal

Stablecoins sit at the center of crypto vs PayPal discussions for business. They are designed to maintain a target value, often one dollar or one euro, and run on public blockchains, such as Ethereum or Solana.

In 2024, stablecoin transfer volumes reached about $27.6 trillion, slightly surpassing Visa and Mastercard’s combined transaction volume. A large share of this activity comes from trading and automated strategies, yet it shows that the rail can handle global scale traffic.

For business users, stablecoins vs PayPal come down to several points:

- Predictable value. Paying suppliers or staff in fiat-backed stablecoins keeps accounting simple to the US dollars, Euros, and other currencies people are already familiar with.

- Global accessibility. Stablecoins reach wallets in markets where PayPal has limited payout options and works for industries determined by PayPal to be high risk.

- Lower settlement cost. Moving stablecoins across borders usually costs 1.5% or less, far below the 6.4% global average remittance cost and below PayPal cross-border business fees.

- Speed. Stablecoin transfers clear in minutes, which fits just-in-time payouts for global teams.

We talk a lot about saving on fees, and they’re a key consideration, but I always stress that stablecoins also provide speed, security, and transparency that traditional systems just cannot match yet.

CoinsPaid supports leading stablecoins such as USDC, EURS, and USDG for merchant payments and payouts. Stablecoins in this setup feed into compliant crypto payments with KYB, AML checks, and automatic fiat conversion when needed.

For accounting and treasury teams, stablecoins can reduce FX risk and simplify reconciliation. They slot into existing reporting frameworks more easily than other digital assets.

Why businesses choose CoinsPaid as their crypto infrastructure

CoinsPaid occupies a different niche from PayPal. It does not try to replace cards or consumer wallets. It focuses on providing enterprise-grade crypto infrastructure that connects businesses to people who want to pay or get paid in digital assets.

Licensed and compliant ecosystem

CoinsPaid operates as a licensed crypto payment provider in Estonia and follows full KYB and AML procedures for each merchant. Its crypto payment gateway, CryptoProcessing, holds the ISO/IEC 27001 certification and has been independently audited by cybersecurity experts. This structure supports easy reporting and clear risk ownership for enterprise finance teams.

Full payment suite rather than a single feature

CoinsPaid offers an integrated ecosystem that includes a crypto payment gateway, a business wallet, mass payouts, OTC desk, and accounting tools. Businesses can:

- Accept crypto at checkout through API or plugins for major eCommerce platforms.

- Hold, convert, and withdraw funds through a business crypto wallet tailored for multi-user access and permission control.

- Run mass payouts to contractors, affiliates, or marketplace sellers from a single Back Office.

Lower fees and faster settlements

CoinsPaid prices merchant processing at 1.5% or lower in many cases, with no setup or monthly fees. Settlements arrive near instantly on supported networks, then convert to fiat or stablecoins at agreed rates. This structure cuts payment overhead compared with typical PayPal fee stacks for cross-border trade.

Enterprise support

CoinsPaid combines 24×7 support coverage with dedicated account managers for merchants. For enterprise clients, the team offers volume discounts, joint marketing efforts, and fine tuning of routing rules across coins, tokens, and networks.

Zero chargeback exposure at protocol level

Since blockchain transactions do not support chargebacks, merchants using CoinsPaid remove card-style chargeback fraud from their risk profile. Refunds, partial credits, and service recovery still operate just as easily through internal policies.

Use cases for Crypto vs PayPal in B2B scenarios

Enterprises rarely replace PayPal with crypto across every flow. They tend to match each rail to the job.

Where PayPal fits

- Low ticket consumer purchases where buyers value familiar brands and buyer protection.

- One-off digital goods and platforms with global hobbyist audiences.

- Merchants that sell primarily inside PayPal’s strongest markets and do not face high chargeback rates.

Where a business crypto gateway fits better

- International eCommerce buyers who pay in crypto or stablecoins and expect this option.

- High volume merchants in verticals that face high chargeback rates or rolling reserves.

- Digital marketplaces that pay out to creators, partners, or sellers in many countries.

- iGaming and online entertainment companies that need reliable, fast, and compliant payouts.

- SaaS and subscription providers with global development teams and contractor payroll in several regions.

In many of these cases, enterprises keep PayPal for front-end customer choice and add crypto payments in parallel. That mix lets buyers pick their rail and lets the business route high value or repeat payouts through crypto.

For payroll and affiliate payments, it’s hard to go wrong with offering more options. Weighing crypto payouts vs PayPal payouts, many partners and affiliates are likely to choose digital payments due to faster settlement speed alone.

Risks and how CoinsPaid mitigates them

Crypto and stablecoins introduce their own risk surface. A realistic comparison with PayPal needs to cover all related concepts.

Regulatory and compliance risk

Regulators track virtual asset service providers under AML and sanctions frameworks. Merchants need partners that apply KYB, sanctions screening, and ongoing transaction monitoring. CoinsPaid runs full KYB onboarding, maintains AML officers and an MLRO, and uses on-chain monitoring to screen funds.

Fraud and counterparty risk

Crypto transactions cannot be reversed at the protocol level, so misdirected payments and phishing create permanent loss. CoinsPaid reduces this exposure through whitelisting, multi-user permission controls in the merchant account, and clear approval flows for large payouts.

Security and custody risk

High profile exchange hacks show that custody requires strict controls. CoinsPaid pairs hot wallet infrastructure with multi-signature cold storage, regular security audits, and ISO/IEC 27001-backed information security management.

Market and stablecoin risk

Volatility in BTC or ETH does not fit many corporate treasuries. Some stablecoins have also lost their peg during stress events. Merchants that work with CoinsPaid can settle directly in fiat, hold only regulated stablecoins such as USDC, or split flows between stablecoins and bank withdrawals.

Operational risk

Shifting part of payments to crypto adds new tasks for finance, tax, and accounting. CoinsPaid supports this with audit-ready reports, transaction exports, and documentation aligned with EU and other regional standards.

With these controls in place, enterprises often treat CoinsPaid as a regulated crypto layer that complements, rather than completely replaces, their existing PayPal and card infrastructure.

Conclusion

For many businesses, crypto vs PayPal is not a winner-take-all decision. PayPal keeps its place as a familiar consumer checkout option with strong buyer trust. Crypto, and stablecoins in particular, offer faster global settlement, lower average fees, and relief from chargeback and reserve risk for many B2B and payout-heavy flows.

CoinsPaid provides licensed, audited crypto infrastructure for enterprises that want to add stablecoins and other digital assets to their payment stack without running their own wallets, nodes, or compliance teams. Merchants that compare PayPal vs crypto payments in detail often land on a hybrid strategy. They keep PayPal where it works best and route global payouts and stablecoin-heavy flows through a business crypto gateway.