10 Examples of Digital Assets on Blockchain

Table of contents:

Digital assets on a blockchain

Digital assets on a blockchain are real or virtual assets that can be bought, sold, transferred, or modified using blockchain technology or smart contracts. Their main advantage for businesses is transparency and automation, which can reduce costs, cut out intermediaries, and speed up transactions.

1. Stablecoins

Type of asset: digital currency

Application: business payments, payroll, invoicing, cross-border transfers

Why are stablecoins important for businesses?

Stablecoins are a type of digital assets that hold a fixed value, usually tied to fiat currencies like USD or EUR, commodities, or backed by reserves held by financial institutions. This stability helps companies avoid price swings common to other cryptocurrencies. USDC and EURC are issued by regulated entities and backed by reserves.

Businesses use them for crypto payments, on-chain record-keeping, and international transactions. They reduce the need for currency conversion and lower transaction friction. Stablecoins offer a practical way to cut costs in cross-border payments. Juniper Research estimates that businesses could save $26 billion by 2028 by using stablecoins and removing intermediaries.

"In times of economic uncertainty, businesses are increasingly looking for low-risk paths to crypto investment. Stablecoins, due to their price stability and resilience in volatile markets, are seeing a growing demand."

2. NFT (Non-Fungible Token)

Type of asset: unique digital assets

Application: licensing, product verification, digital rights, tokenization of physical and digital products

Why are NFTs important for businesses?

NFTs are unique blockchain-based digital assets. Each token is distinct, making it impossible to duplicate. Businesses apply these types of digital assets to verify product origin, license software via blockchain-based certificates, and tokenize intellectual property. They also serve as digital passes for content or service access, ensuring clear ownership and audit-ready records.

3. Utility tokens

Type of asset: user tokens

Application: service access, governance, resource allocation, platform features

Why are utility tokens important for businesses?

Utility tokens allow users to access features inside a blockchain application. They can unlock services, allocate computing or storage power, or enable participation in governance. FIL and GLM are examples of these digital assets. Tokens like FIL provide access to decentralized storage. GLM gives users computing resources through a peer network.

Companies that run blockchain-based platforms use utility tokens to manage service access, automate internal processes, or create user-level permissions.

4. Security tokens

Type of asset: digital asset representing ownership

Application: equity, real estate, venture capital, digital investment funds

Why are security tokens important for businesses?

Security tokens record ownership in assets such as shares, real estate, or digital funds. Each token is linked to a blockchain address and carries rights like dividends or profit claims. For example, SPiCE VC issues SPICE tokens that grant holders a pro rata share of returns from its venture investments.

Businesses can use security tokens to digitize asset ownership, reduce manual processing, and offer fractional access to investment products.

5. Governance tokens

Type of asset: blockchain-based voting token

Application: protocol upgrades, DAO proposals, treasury use, system settings

Why are governance tokens important for businesses?

Governance tokens allow holders to vote on protocol decisions such as upgrades, funding proposals, and system parameters. Businesses holding these tokens can influence decisions in the DAOs they rely on. For example, UNI holders vote on Uniswap protocol changes, CRV governs fee structures in Curve, COMP adjusts lending terms in Compound, and MKR manages collateral and stability in the DAI protocol.

Holding governance tokens gives companies a say in how platforms operate. It can be useful when those platforms play a role in business infrastructure or financial strategy.

6. IP-NFTs (Intellectual Property NFTs)

Type of asset: tokenized legal rights for creative or scientific work

Application: patent licensing, R&D funding, media rights, controlled data access

Why are IP-NFTs important for businesses?

IP-NFTs represent ownership of patents, research data, inventions, or original content. Each token includes legal terms and smart contract logic for royalties, licensing, or controlled access. Businesses use them to streamline patent licensing, monetize creative or scientific outputs, and reduce manual interventions.

Tokens of this type can support fractional ownership, enforce programmable terms, and keep audit-ready records of transfers and usage. They help reduce legal overhead and unlock new funding options for early-stage projects.

7. Cryptocurrency

Type of asset: decentralized digital currency

Application: payments, cross-border transfers, payment gateways, rewards, asset storage, eCommerce

Why are cryptocurrencies important for businesses?

Cryptocurrency is a blockchain-based form of money. It enables direct transactions without central intermediaries. All transfers are recorded on a public ledger, which supports traceability and speed. Businesses can accept crypto as payment for goods or services, pay suppliers, or distribute rewards to users.

Using crypto allows access to a global customer base and may reduce costs tied to cross-border transfers. It also supports automation through smart contracts and integrates well with blockchain-based platforms.

8. Loyalty tokens

Type of asset: incentive-based digital token

Application: customer retention, referrals, branded rewards, cross-platform campaigns

Why are loyalty and reward tokens important for businesses?

Loyalty tokens reward customers for actions like purchases, referrals, or content sharing. They are stored on blockchain networks. They can be used within a brand’s system or redeemed through supported platforms. Businesses use them to offer discounts, unlock features, or enable reward trading across partner networks.

Unlike internal point systems, blockchain-based tokens are portable, traceable, and programmable. It gives companies more control over how rewards are issued and redeemed.

9. CBDCs (Central Bank Digital Currencies)

Type of asset: digitized national currency

Application: retail payments, B2B transfers, payroll, government disbursements

Why are CBDCs important for businesses?

CBDCs are government-issued regulated digital assets managed by central banks. They combine the reliability of fiat with the transaction speed of digital payments. Companies can use CBDCs to pay suppliers, process payroll, or receive retail payments with less risk to crypto price volatility.

Examples include Nigeria’s eNaira and Jamaica’s JAM-DEX. As more countries launch CBDCs, businesses must ensure crypto wallet compatibility and system integration.

10. Exchange tokens

Type of asset: token issued by cryptocurrency exchanges

Application: trading fee discounts, liquidity rewards, staking, platform services

Why are exchange tokens important for businesses?

Exchange tokens are issued by centralized crypto platforms and can be used for fee adjustments and participation in platform-specific programs, depending on exchange policies and market conditions. Tokens like BNB (Binance), OKB (OKX), and HT (Huobi) reward trading activity and support liquidity by offering tier-based incentives.

Businesses involved in trading, brokerage, or treasury operations often use these tokens to reduce costs and participate in reward structures tied to usage volume.

How businesses can use digital assets

Businesses are starting to use digital assets across several core operations. This shift aligns with the growing adoption of crypto worldwide, as 659 million people held crypto as of December 2024. As a result, more companies are integrating crypto technologies into their workflows.

However, crypto activities are subject to legal and regulatory requirements that vary by jurisdiction. Always seek legal counsel and verify local compliance obligations before launching.

Crypto payments

Businesses accept crypto through invoices, payment links, checkout pages, and even PoS terminals. Many integrate crypto payments into their existing systems via API.

Stablecoins like USDC are preferred for pricing stability in invoicing, payroll, and cross-border deals.

BTC and ETH are often used in treasury, settlements with crypto-native clients, or in regions with limited banking access.

Crypto lending services may be restricted or regulated in some jurisdictions. Businesses should review local laws and compliance requirements before using or offering such services.

Digital asset storage and multisignature wallets

For managing large amounts of digital funds, businesses rely on hot wallets for everyday operations and cold wallets with multisignature (multisig) security for long-term storage.

In a multisig setup, multiple parties must approve a transaction before it proceeds, reducing the risk of theft or internal fraud. This is common in companies that need joint control over treasury operations, such as trading desks, payment processors, or crypto-native startups.

Business wallets may also support whitelisting, spending limits, and role-based access for compliance and operational safety. There can be different multisig setups (2-of-3, 3-of-5, 5-of-7).

The example of a 2-of-3 multisig transaction

Even if one key is stolen, no one can move the funds alone. At least two out of three keys are needed to approve a transaction.

B2B payments

According to the GoodFirms survey, 82.2% of businesses have adopted cryptocurrency for B2B payments, driven by growing global acceptance. Digital assets can speed up cross-border B2B payments and reduce costs. Companies often use stablecoins like USDC to pay suppliers directly, avoiding bank delays and currency conversions. It is common in manufacturing, logistics, and IT services.

Employee compensation

Some companies pay contractors or staff partly or fully in crypto, which is especially useful for international teams. Instead of traditional payroll, businesses send digital assets directly to employee wallets. Crypto payments speed up payouts and reduce compliance hurdles for remote teams. However, it’s always necessary to keep in mind that crypto activities are subject to legal and regulatory requirements that vary by jurisdiction.

As mentioned on the Riseworks platform, the 2023 Deloitte study found 56% of millennial and Gen Z workers prefer employers offering cryptocurrency compensation, showing growing demand among younger employees. It makes cryptocurrency payroll a valuable tool for attracting and retaining talent.

Some firms also offer equity-like tokens or tokenized bonuses as part of compensation packages.

Web3 monetization

Digital assets create new revenue streams. Platforms use tokens for paid access, tipping, and digital collectibles. Some businesses monetize by selling tokens, offering staking rewards, or charging fees in crypto.

Web3 digital asset payments let users pay directly with tokens using wallets often without intermediaries. It is useful for decentralized platforms and services with an international reach.

For example, a data provider might require token payments for API access, while marketplaces use tokens for listing fees and loyalty rewards. This model is growing among SaaS, content, and fintech companies targeting Web3 users.

CoinsPaid as an infrastructure for digital assets

SaaS – crypto payment business under your brand

CoinsPaid provides ready-made crypto payment software under a SaaS model. You get a copy of the CoinsPaid gateway with full tech support while you handle marketing, legal, and business growth. Invoices, payment links, and channel-based flows are included. It can be suitable for companies with active clients and a clear growth plan.

Stablecoins and cryptocurrencies

CoinsPaid supports major cryptocurrencies and stablecoins like USDC. It allows businesses to work with familiar assets that meet user demand and reduce volatility risks.

API for fast integration

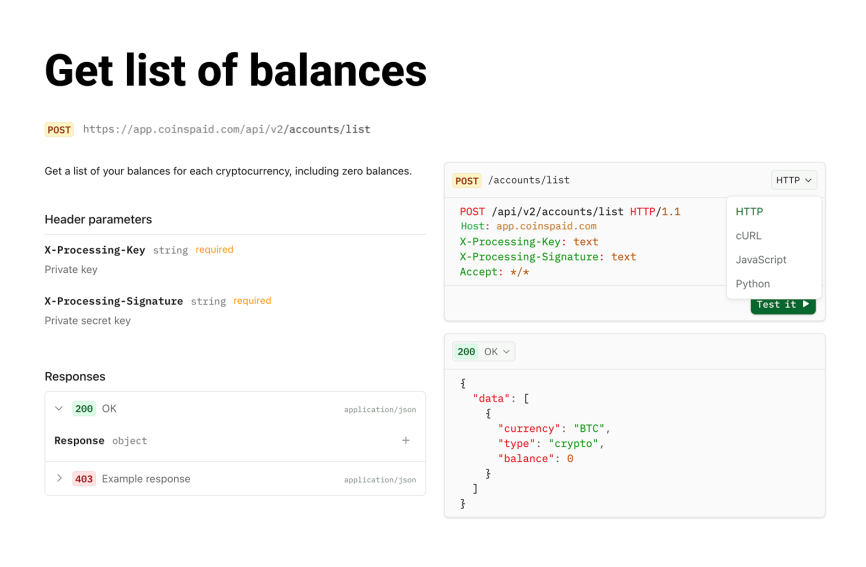

The platform provides a full-featured API that allows integration with third-party systems you already use. Businesses can automate payment handling, monitor balances, and manage digital asset flows programmatically. Code examples are available for HTTP, cURL, JavaScript, and Python.

A screenshot of a code snippet that shows the integration process

Fiat conversion

Crypto funds can be converted into over 40 fiat currencies. Businesses may enable auto-conversion, so payments in crypto (e.g., BTC) are instantly settled in fiat (e.g., EUR) without holding the digital asset.

Summary

Key Takeaways:

- Digital assets on blockchain include cryptocurrencies, NFTs, stablecoins, utility tokens, and CBDCs, all built for transparency, traceability, and automation.

- Businesses use them for payments, payroll, loyalty programs, digital rights management, and cross-border B2B transfers.

- Stablecoins alone could save companies up to $26 billion by 2028 through faster, cheaper international payments.

- NFTs, IP-NFTs, and security tokens are simplifying ownership and licensing by turning real-world or intellectual property rights into digital assets.

- Platforms like CoinsPaid provide compliant payment infrastructure, stablecoin support, and API integrations to help businesses manage these assets efficiently.

What this means for your business

Digital assets cover more than coins. Think NFTs for rights, stablecoins for treasury, marketing tokens for loyalty, and so on. Businesses can use crypto to lower payment costs, reduce fraud, and automate workflows. The key is to combine innovation with compliance – and to rely on a trusted provider that ensures both.

CoinsPaid helps companies adopt digital assets, providing a crypto payment gateway, stablecoin processing, and fiat conversion. With API integration, multi-asset wallets, and regulatory compliance, CoinsPaid delivers the infrastructure needed to move value securely across borders.

FAQ

A digital asset is any item that exists in digital form and holds value. It includes cryptocurrencies, NFTs, and even files like images or documents.

A tokenized asset is a digital representation of a real-world asset (like real estate, equity, or commodities) recorded on a blockchain.

All tokenized assets are digital assets, but not all digital assets are tokenized. The key difference is that tokenized assets are backed by physical or financial assets and often involve legal rights.

Yes, businesses can store NFTs in crypto wallets that support NFT standards like ERC-721 or ERC-1155. It’s important to use a secure wallet compatible with the blockchain where the NFT is issued. For added security, hardware or multisig wallets can be used. Cross-chain support is helpful if you handle NFTs on multiple blockchains, but it isn’t required if you operate on one network. Access control is also important to protect your digital assets from unauthorized use.

Yes. Stablecoins are digital assets. They run on blockchain and provide a stable medium for payments and transactions.

CoinsPaid provides a full crypto payment ecosystem, including a payment gateway, business and hot wallets, OTC desk, and SaaS solutions. It supports 20+ cryptocurrencies and converts them into over 40 fiat currencies, enabling businesses to efficiently manage digital asset flows, streamline payments, and access liquidity across multiple currencies.

Yes, if used properly. Blockchain can secure documents by making records tamper-evident and time-stamped. It’s useful for proving authenticity and tracking changes. Still, safety depends on how documents are stored (on-chain or off-chain), how access is controlled, and whether encryption is used. For sensitive files, key management is critical.