How to Expand Business online with Crypto

Table of contents:

In 2025, more businesses are turning to crypto than ever. From travel agencies to tech retailers, companies are using blockchain payments to reach new customers, streamline transactions, and cut costs.

The results speak for themselves – crypto transactions in the travel sector alone jumped 38% year-on-year, and by the end of 2024, more than 6,000 businesses worldwide accepted Bitcoin.

The Bitcoin payment ecosystem, in particular, is expected to grow at a 15.5% CAGR through 2029.

In 2024, crypto stablecoin transactions outperformed Visa and Mastercard combined.

From boutique hotels to e-commerce platforms, companies are using crypto adoption to expand business globally, opening doors to customers who prefer fast, low-fee digital payments.

Governments are paying attention too. As central banks test out CBDCs like a digital dollar or euro, crypto’s role in the future of international transactions and financial inclusion is becoming increasingly hard to ignore.

What are cryptocurrency payments?

At their core, crypto payments are digital transactions secured by blockchain. The most common coins – Bitcoin (BTC) and Ethereum (ETH) – are decentralized and widely accepted. Recent surveys show that 74% of crypto holders own Bitcoin, while 49% hold Ethereum.

But, for business payments, stablecoins like USDC or USDT are often preferred. They’re pegged to fiat currencies and don’t swing wildly in value – making them perfect for everyday use. In fact, over two-thirds of global crypto transaction volume is now handled in stablecoins such as USDC or USDT, according to Chainalysis.

Most modern payment gateways support multiple digital assets and offer instant conversion to fiat, so businesses don’t need to deal with volatility or wallets.

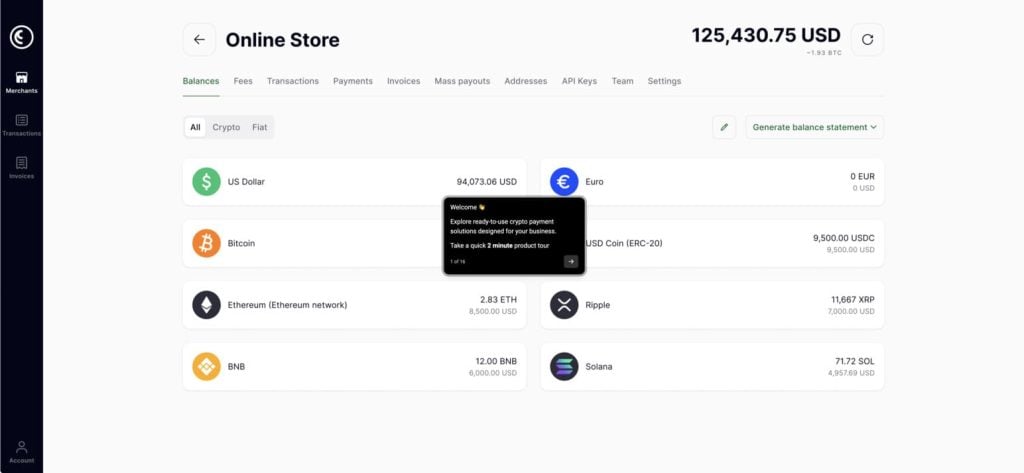

CoinsPaid, for one, offers a plug-and-play crypto gateway that handles everything – from acceptance to fiat conversion. With built-in KYC/AML compliance, onboarding is straightforward and secure.

Why more businesses are offering blockchain payments

The main reasons companies are embracing crypto payments in 2025:

1. Expand business globally

Crypto is global by design. No banks, no borders, no credit card restrictions. This opens the door to markets with limited access to traditional payment systems – especially among Millennials and Gen Z, who are driving much of today’s crypto adoption.

One survey found that 85% of merchants see crypto as a tool for reaching new customers, and CoinsPaid has seen crypto use surge among digital nomads and international travelers.

Even central banks are exploring crypto’s potential – CBDCs are being developed specifically to enable smoother cross-border payments and financial access in underserved regions.

2. Lower fees, better margins

Traditional card fees can range from 3–5%. Crypto transfers, especially with stablecoins, can cost a fraction of that. One luxury jet company, with the help of CoinsPaid, reportedly cut fees by 75% after switching to crypto.

77% of merchants surveyed by Deloitte cited lower transaction costs as a top reason for accepting crypto.

3. Faster settlement times

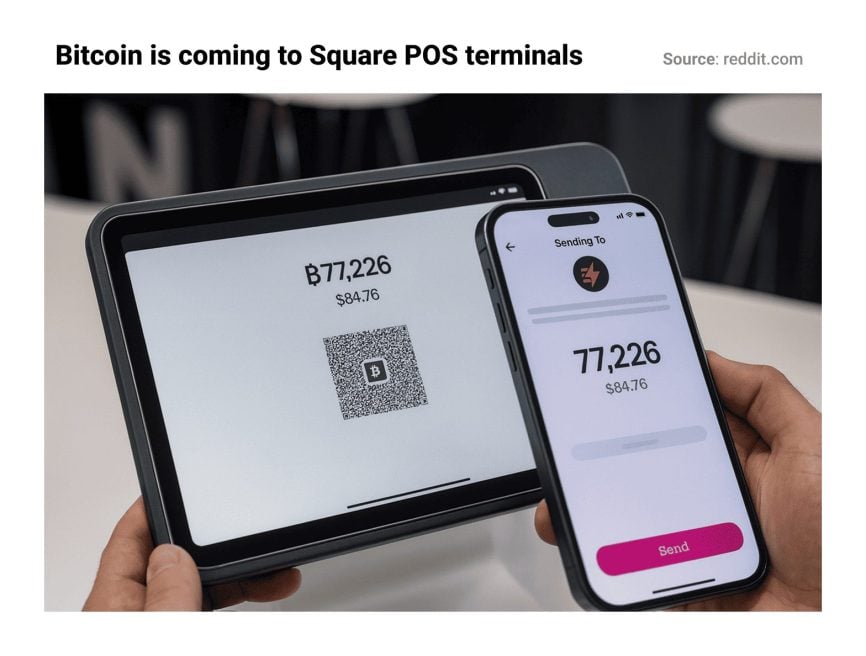

Waiting days for payments to clear? Not with crypto. Payments using blockchain – especially protocols such as the Lightning Network that scale the speed of currencies like Bitcoin even further – settle in seconds or minutes, not days. This improves cash flow and helps businesses operate more smoothly, with less reliance on bank float.

4. Improved security and fraud prevention

Crypto payments are cryptographically secure and irreversible, meaning no chargebacks or disputes. Transactions are recorded on a tamper-proof blockchain, and most crypto gateways include built-in fraud detection and regulatory compliance tools like KYC/AML.

For merchants, this means fewer fraud headaches and greater peace of mind – especially for high-value business payments.

5. Liquidity and treasury flexibility

Accepting crypto can also serve as a treasury diversification tool. Businesses can hold crypto as a hedge against inflation, use programmable tokens for automated payouts, or manage supplier payments and payroll in crypto for international teams.

Blockchain’s transparency and efficiency also unlock new liquidity management options, enabling peer-to-peer transfers without intermediaries.

6. Boosting brand image

Lastly, accepting crypto shows your business is forward-thinking. It signals innovation – and can be a differentiator in competitive markets. In fact, research from Forrester found that merchants accepting crypto gained 40% more new customers, who spent nearly twice as much per transaction.

Collectively, these advantages help expand your business online and globally – all while cutting costs, speeding up transactions, and reaching an increasingly crypto-native audience.

“In 2025, the idea that crypto can help grow your business isn’t new. What’s changing is that it’s no longer just a nice-to-have – it’s quickly becoming something that, if you don’t adopt, could leave you behind.”

Who accepts cryptocurrency? Real-world examples of businesses embracing crypto payments

As touched upon, crypto payments are already in action across multiple industries.

Retail and services

Block (formerly Square) has enabled Bitcoin payments across all Square PoS terminals. According to their team, it lets small businesses “get paid faster” and “keep more of their revenue.”

Big names like AMC Theatres, Shopify, Newegg, and Rakuten Japan also accept crypto at checkout.

Payment processors like BitPay confirm the trend: merchants who accept crypto often see strong customer growth and no significant downsides. For retailers looking to expand business online, crypto offers a new, fast-growing revenue stream.

Travel and hospitality

The travel industry is charging full speed ahead with crypto. It’s not just CoinsPaid reporting a rise in crypto-based bookings – platforms like Travala.com processed over $100 million in travel payments last year, with 80% paid in cryptocurrency.

Luxury providers have taken note. Remembering that Mirai Flights (a private jet service) cut its transaction fees after adopting crypto, airlines and hotel groups are also testing crypto checkout options.

Automotive and more

Crypto is even creeping into the car market. While major automakers like Honda haven’t rolled out crypto acceptance directly, third-party platforms now enable customers to buy vehicles with Bitcoin and stablecoins.

Aside from standard industry benefits, there’s more to crypto. For instance, in regions with limited banking infrastructure, crypto acts as a digital dollar alternative – offering access where traditional systems fall short. For the unbanked, refugees, and remote users, crypto can be a lifeline.

Addressing common concerns

Despite its benefits, businesses often hesitate to adopt crypto because of perceived challenges. Here’s how those are being addressed:

Worried about volatility?

You don’t need to hold crypto to accept it. Modern crypto gateways (like CoinsPaid) auto-convert crypto to fiat the moment a transaction is made. That means you can accept Bitcoin or stablecoins, but still get paid in dollars, euros, or your local currency – instantly. It’s just like processing a card payment, without the price risk.

Concerned about safety and security?

The following graphic illustrates sentiment surrounding cryptocurrencies in 2025.

Transactions are immutable and irreversible, which helps eliminate chargeback fraud. Plus, top payment providers now include KYC/AML checks by default – helping you stay compliant with regulations and reduce fraud exposure.

In terms of regulations, the key is choosing a provider that meets bank-level security standards and integrates smoothly with your business, such as CoinsPaid.

Not sure your team or customers are ready?

Crypto might feel unfamiliar at first – but smart onboarding helps. Providers like CoinsPaid offer 24/7 support, simple dashboards, and full documentation to make things easy. They also provide tools for staff education and customer awareness.

As more platforms support crypto, familiarity grows – and the learning curve shrinks.

Crypto as a growth tool

As explored today, accepting crypto is a practical way to expand business globally, reduce payment friction, and attract new customers.

From retail to luxury travel, the advantages are already playing out:

- Lower transaction costs;

- Faster, 24/7 payments;

- Access to new international markets;

- Improved liquidity management;

- Stronger fraud prevention;

- Better treasury flexibility.

Moreover, thanks to solutions like instant fiat conversion, smart contracts, and stablecoin remittances, the risks are more manageable than ever.

Ready to explore how crypto payments can help you grow? CoinsPaid makes it easy to accept Bitcoin, Ethereum, stablecoins and more – without the complexity. Reach customers worldwide, improve your margins, and future-proof your business.

Summary

Key Takeaways:

- In 2025, businesses from travel and retail to luxury services are using crypto payments to expand globally and reduce transaction costs.

- Over 6,000 companies worldwide now accept Bitcoin, with crypto transactions in the travel sector growing 38% year-over-year.

- Stablecoins like USDC enable fast, low-fee cross-border payments that outperform traditional networks such as Visa and Mastercard in raw value transfers.

- Accepting crypto payments improves cash flow, reduces fraud, and helps brands reach 650M+ global crypto users.

- Providers like CoinsPaid offer compliant, plug-and-play crypto gateways with fiat conversions and 24/7 support.

What this means for your business

Adding a crypto payment option helps you reach new customers and cut processing costs. Travel, retail, and digital services are already moving to crypto checkouts and stablecoin settlements. It’s a competitive advantage that modernizes your payment ecosystem and offers a way to open new markets without banking delays.

CoinsPaid helps businesses accept crypto payments seamlessly and securely. With 20+ supported cryptocurrencies, conversion to 40+ fiat currencies, and a license in Estonia, CoinsPaid helps businesses cut costs and grow globally.