How to implement crypto payments on your website

Table of contents:

To add crypto payments on your website, use CoinsPaid’s crypto processing gateway. You can integrate via ready CMS plugins (Shopify, WooCommerce, Magento) or a custom API. CoinsPaid automatically converts crypto into fiat, ensuring speed, compliance, and zero volatility risks.

This guide explains how to add crypto payments to your website with CoinsPaid (using ready CMS plugins or a custom API) while settling in fiat. It covers the business case (lower fees, faster settlement, no chargebacks), the main integration options, and a simple step-by-step setup. You’ll also find real-world use cases and clear answers to legal, security, and accounting FAQs.

Why should my business accept crypto payments?

There are plenty of reasons.

- To reach a growing audience: Millions hold crypto and want to spend it, typically a tech-savvy, solvent segment.

- Faster settlement: Payments confirm in minutes, 24/7, unlike bank transfers that can take days.

- Lower fees: Often under 1.5% versus 3-5% for cards.

- No chargebacks: Blockchain transactions are irreversible, reducing fraud risk.

- Brand lift: Positions your business as modern and forward-thinking.

So, as a broader answer to this question – there’s really no reason why one wouldn’t look to accept crypto payments.

How to accept crypto payments on your website

Adding cryptocurrency payments is now straightforward, and businesses have several options.

The most reliable way to implement crypto payments on your website is through a crypto payment gateway, such as CoinsPaid’s, but other methods exist depending on your needs.

Option 1 – Use a crypto payment gateway (recommended)

The easiest way to accept crypto on your website is by using a crypto payment gateway such as CoinsPaid.

A gateway lets customers pay in digital assets while you receive funds in your chosen currency (crypto or fiat). It handles blockchain verification, conversion, and compliance for you.

The setup is simple:

- Open a merchant account, integrate via API or plugin, and your checkout is ready.

- At payment, customers scan a QR code, and the gateway locks in the exchange rate to protect against volatility.

- Funds can then be settled directly to your bank account or wallet.

- Licensed providers like CoinsPaid also ensure compliance with KYB/AML rules.

This approach offers the smoothest crypto checkout solutions and an easy way to track payments, conversions, and payouts from a single dashboard. That’s why we recommend it.

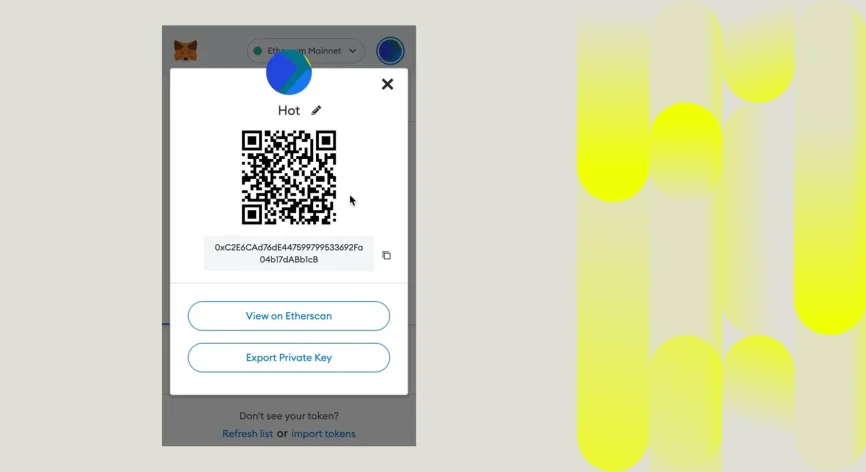

Option 2 – Accept direct wallet payments

You can also accept crypto directly by publishing a wallet address or QR code. While simple, this method creates challenges:

- Customers must send funds manually, increasing errors;

- Payments arrive in crypto only, exposing you to price swings until you convert;

- No built-in compliance or reporting tools;

- Scaling is difficult, since you’d need to track each order yourself.

This approach may work for freelancers or donations, but for growing businesses it’s not ideal compared to using a gateway.

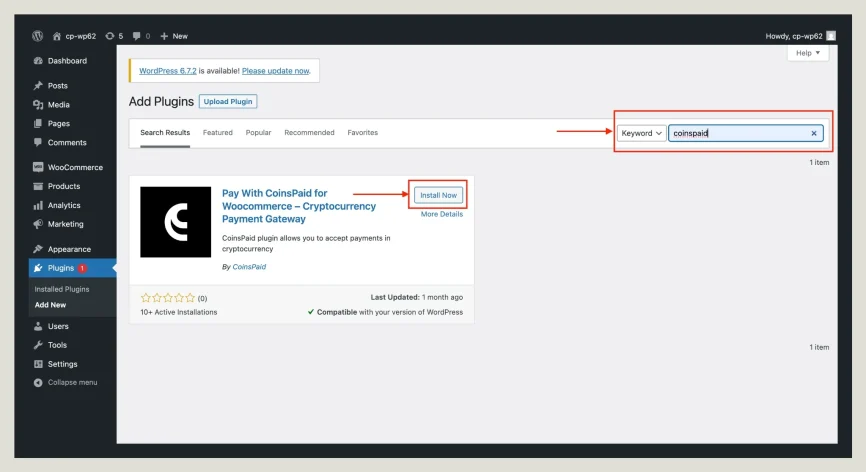

Option 3 – Use CMS crypto integration plugins (WooCommerce, Shopify, Magento, etc.)

If your site runs on a platform like WordPress, Shopify, or Magento, you can integrate crypto payments with ready-made plugins.

CoinsPaid offers modules for WooCommerce, PrestaShop, Joomla, OpenCart, and more.

Setup usually takes minutes: install the plugin, enter API keys, and “Pay with Crypto” appears at checkout.

Customers can pay in Bitcoin, Ethereum, stablecoins, and more, while you receive the exact amount converted into fiat instantly.

For those using CMS platforms, plugins are the most convenient way to integrate crypto for business websites without custom development.

Option 4 – Custom API integration

For enterprises with custom-built websites, a much more flexible way of integrating crypto payments is via an API.

Crypto payment gateways like CoinsPaid provide API endpoints that let you create payment requests, generate deposit addresses, track transaction status, and trigger automatic conversions.

Although API integration requires developer time, CoinsPaid offers detailed documentation, webhooks for real-time updates, and dedicated technical support. Once live, you gain complete control over the payment flows.

Benefits of CoinsPaid’s crypto payment solution

So far, we’ve focused on CoinsPaid. Among competitors like BitPay, Coinbase Commerce, and NOWPayments, it stands out for licensed operations, instant fiat conversion, and enterprise-grade support. Key advantages include:

- Easy CMS plugins: CoinsPaid offers ready-made plugins for WooCommerce, Shopify, Magento, Drupal, Joomla, OpenCart, and PrestaShop. Integration takes just a few clicks, so any online store can add a crypto checkout without coding.

- Flexible API for custom setups: For large or custom-built sites, CoinsPaid’s API allows for automatic processing of crypto payments.

- Automatic conversion to fiat: CoinsPaid protects businesses from volatility by instantly converting crypto payments into 40+ fiat currencies at the time of purchase. You always receive the exact amount you charged, making it as predictable as card payments.

- Broad currency support: The platform supports 20+ cryptocurrencies (BTC, ETH, LTC, USDС, SOL, and more) and settlements in 40+ fiat currencies. This flexibility ensures customers can pay how they want while you get paid in your preferred currency.

- Licensed and compliant: CoinsPaid is an Estonia-licensed legal crypto provider and follows strict KYC/AML standards. Transactions are monitored with blockchain analysis tools for transparency and security. It’s a safe and regulated environment to add bitcoin payments to your website.

- 24/7 support and dedicated manager: Every client gets a personal account manager plus round-the-clock support. From integration help or transaction questions, expert assistance is always available.

Next, we’ll provide an implementation tutorial for those wondering how to add bitcoin payment to a website.

How do I accept crypto payments on my website? A step-by-step guide

Here’s a no-fuss tutorial on how to implement crypto payments on your website:

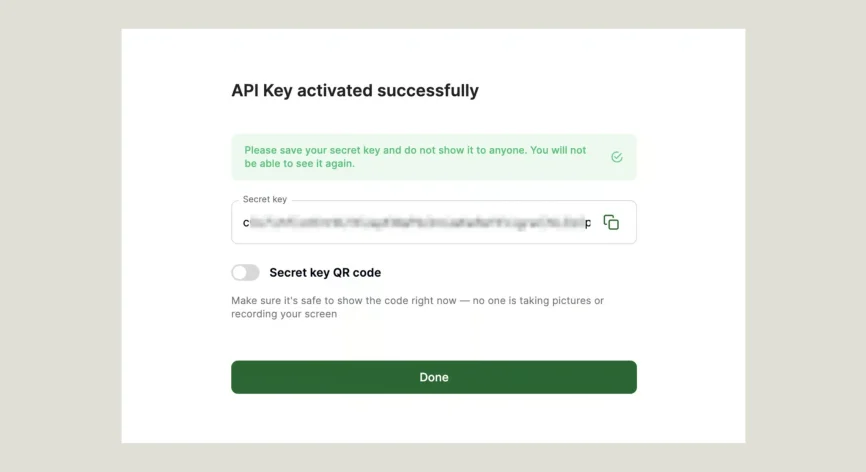

Sign up on the CoinsPaid platform to access your merchant dashboard. As a regulated provider, you’ll complete standard KYB verification for compliance.

- For CMS sites (WooCommerce crypto payments, Magento, Shopify crypto plugins, etc.), install the CoinsPaid plugin for instant setup.

- For custom websites or advanced needs, use the API integration to embed payments directly into your app or checkout.

Select the cryptocurrencies you want to accept, such as BTC, USDC, LTC, etc, and your payout currency (USD, EUR, or others). You can keep funds in crypto or enable automatic conversion to fiat, ensuring you always receive the exact amount charged.

Use sandbox mode or small test payments to confirm everything works: checkout flow, blockchain confirmation, and order status updates. For API integrations, double-check webhooks and callbacks.

Activate crypto checkout on your site and add a “Crypto Payments Accepted” badge so customers know they can pay in digital assets. Update your payment policy or FAQs to highlight the new option.

From there, you’ll track payments, conversions, and balances in real time through the CoinsPaid dashboard (with full support available during onboarding).

Case Studies / Use Scenarios

Across industries, businesses are starting to accept crypto payments on their websites because it solves real problems as explored today: high fees, slow settlements, and limited access to global customers. Let’s take a look at some examples:

E-commerce

Online retailers gain global reach by adding crypto checkout. Customers without credit cards can still pay instantly, while merchants avoid hefty cross-border card fees.

- NordVPN cut payment costs to around 1% by integrating Coingate’s crypto processing solution.

- Shopify merchants, Microsoft, Tesla, and Gucci also accept Bitcoin payments online (and stablecoins).

SaaS and subscription services

For SaaS companies, stablecoins make recurring billing simple across borders, while APIs allow crypto to embed directly into platforms.

- Dune Analytics reported a 40% rise in enterprise clients after adding crypto payments.

- A SaaS provider using TransFi reduced cross-border costs by 70% and sped up settlement times.

iGaming and online entertainment

Crypto is a natural fit for iGaming, where fast deposits and withdrawals drive player satisfaction.

- Chipstars integrated NOWPayments to process instant global transactions.

- SOFTSWISS pioneered crypto casino payments back in 2013 and remains a leader in blockchain gaming.

Digital services and freelancing

Agencies and freelancers use crypto to get paid faster and skip wire transfer fees.

- A 2023 survey showed 22% of freelancers have already been paid in crypto, with 38% open to it.

- HedgeGuard, using Fipto, cut payout times from several days to just a few hours.

Luxury and travel

- Mirai Flights, a private jet platform powered by CoinsPaid, grew revenue 30%, cut fees by 75%, and saw over half of clients pay in crypto.

- Travala, a travel booking site, reported that 77% of bookings in 2024 were paid in crypto.

What are crypto payments solving today?

Here are a few more ways integrating crypto payments can make a difference:

- High cost of cross-border transfers: International bank wires are slow and expensive, often taking days and costing 2-7% in fees. By contrast, no-intermediary crypto payments settle in minutes with minimal blockchain fees.

- Chargebacks and fraud: Card transactions can be reversed through chargebacks, which are often abused (chargeback fraud). Crypto payments are irreversible once confirmed on the blockchain, giving merchants certainty that funds won’t be clawed back.

- Payment restrictions: PayPal and card issuers may block certain transactions or regions. Crypto is borderless and permissionless. Anyone with internet access can pay, opening new markets that were previously hard to reach.

- Limited local solutions: In underbanked regions, customers may not have access to cards or reliable banks. A crypto wallet is enough to transact, allowing businesses to serve customers excluded by traditional finance.

Traditional vs. crypto payments with CoinsPaid

| Factor | Traditional Payments (Cards, Banks, PayPal) | Crypto Payments with CoinsPaid |

|---|---|---|

| Speed | 2-5 days for wires; card batches in 24-48h, limited by banking hours | Seconds to minutes, 24/7/365 |

| Fees | 2-7% plus hidden costs, especially cross-border | <1.5%, transparent rates, no hidden fees |

| Chargebacks | High fraud and dispute risk | Immutable blockchain payments, no chargebacks |

| Currency Options | Mostly local fiat; FX adds extra cost | Accept 20+ cryptocurrencies, settle in 40+ fiat currencies |

| Volatility | N/A (fiat stable, FX fluctuates) | Locked-in exchange rate; instant fiat conversion |

| Compliance | Varies by provider, rigid processes | Built-in KYC/AML checks, real-time risk scoring |

| Integration | Complex APIs or third-party providers | Ready CMS plugins + developer-friendly API |

| Setup Costs | Bank accounts, monthly fees, equipment | Free setup, no monthly fees, only per-transaction charge |

| Support | Limited hours, slow responses | 24/7 support + dedicated account manager |

Implementing crypto payments on your website with CoinsPaid means faster settlement, lower fees, no chargebacks, and access to a truly global customer base. It’s a no brainer.

“Crypto payments fix problems businesses struggle with every day. Slow settlements, high cross-border fees, and chargebacks. With a gateway, funds clear in minutes, exchange rates are locked, and merchants reach customers in markets cards can’t cover. We’re solving real payment pain right now.”

FAQ

Yes. Accepting cryptocurrency payments is legal in most countries. By using a regulated provider like CoinsPaid, which is EU-licensed and follows strict KYC/AML rules, you can accept crypto legally and securely.

When a customer selects crypto at checkout, your site (through a crypto payment gateway) generates a wallet address or QR code. The customer pays, the blockchain confirms it within minutes, and the gateway notifies your site. Funds can then be auto-converted into fiat or left in crypto, depending on your settings.

No. Merchants don’t need a license to implement crypto payments on a website, the gateway handles compliance. CoinsPaid, for example, is licensed to process payments, so businesses operate under its regulated framework.

The fastest option is a plugin. CoinsPaid offers free integrations for WooCommerce, Magento, OpenCart, and other CMS platforms. Install, connect your account, and you can start accepting 20+ cryptocurrencies at checkout. For custom sites, an API is available.

Yes. With CoinsPaid, you can set your account to instantly convert incoming crypto into fiat (USD, EUR, and 40+ others). This locks in the exchange rate at the moment of purchase, protecting you from volatility.

When processed through a secure provider, crypto payments are highly safe. Transactions are verified on the blockchain, and gateways like CoinsPaid add extra protections such as fraud monitoring, AML checks, and two-factor authentication. Customers also don’t enter card details, reducing data breach risks.

Crypto improves cash flow since payments clear in minutes, not days. With auto-conversion, funds are ready to use instantly. Platforms like CoinsPaid also provide dashboards, reports, and exportable statements, making accounting straightforward.