How to start a crypto exchange: business roadmap & ready-made solutions

Table of contents:

The crypto industry continues to grow fast with trading volume across centralized exchanges alone exceeding $6 trillion in monthly volume in April 2025, according to CoinDesk report.

User interest in digital assets is steady despite market cycles. For entrepreneurs and financially backed individuals, it opens up a clear opportunity: launch a crypto exchange and take part in a global market with real demand.

It’s not obligatory to build from scratch to get started. Thanks to ready-made solutions and reliable partners, it’s now possible to launch a secure, legally compliant exchange faster and with less investment.

This guide outlines what it takes to launch a crypto exchange, but it’s not a blueprint or legal advice. Use it as a starting point, not a checklist.

Disclaimer: This content is for informational purposes only and does not constitute financial or legal advice. Participation in crypto business models carries regulatory and operational risks.

What you need to know before launching a crypto exchange

Many want to build the next Binance, but only a few know where to begin. The difference usually comes down to what happens before the first line of code. Of course, it’s about market research and thorough study.

Understanding the market landscape

User needs vary across regions. In developed markets, traders may expect advanced tools, charts, and deep liquidity. In emerging regions, speed, mobile access, and fiat gateways can matter more. Understanding how people in your target area interact with crypto will help shape your product and service stack.

It’s recommended to look at who’s already in the market and study the biggest players in your target region. Note how they attract users, what they charge, and what they offer. Identify what they miss. That gap may become your opportunity.

Defining your value proposition is a significant step before starting a crypto exchange business. Does your exchange aim for better pricing, local fiat support, or faster onboarding? It tells users why they should choose your platform.

It’s important to select target regions wisely. North America holds around 40% of the market share, with Europe and Asia growing rapidly. Knowing local preferences is a must. For example, emerging markets see strong demand for peer-to-peer and payment-first platforms.

Choosing the type of exchanges

- Centralized (CEX). The most common type. They hold user funds, match orders, and offer fiat support.

- Decentralized (DEX). Non-custodial. Trades happen wallet-to-wallet via smart contracts. Lower volume, but more control.

- Peer-to-Peer (P2P). Direct trades between users with protection. Often used in regions with limited banking.

- Instant Exchanges. Fast crypto swaps without holding funds. Simple, but limited in features.

Types of exchanges

CEXs offer speed, volume, and ease of use. DEXs give users control. P2P suits low-access markets. Instant exchanges are plug-and-play but limited. The choice depends on what your users care about most.

Setting the business goals

It’s also necessary to decide what will be the main target of your crypto exchange:

- Offer trading for digital assets

- Accept and convert crypto payments

- Generate revenue through fees

- Build branded tools for other businesses (B2B)

- Grow a user base for future services

Before choosing a solution, decide whether your main focus is volume, margin, or utility. That clarity will guide the technical and legal choices later.

Choosing the type of platform

Decide what to launch first:

- MVP. It offers basic swaps and wallets.

- Niche exchange. It focuses on select asset classes or user segments.

- Full trading platform. It may include order books, matching engine, and token listings.

Also, choose between a business wallet model or a full trading exchange. A business wallet supports merchant payments and easy conversions. A trading exchange adds matching engines, liquidity tools, and dashboards. Use your target market and business goals to guide that decision.

Legal considerations and compliance requirements when starting a crypto exchange business

Before building a crypto exchange, it’s a must to understand the legal framework. Regulations vary by region and affect everything from user onboarding to how funds are processed. Always seek legal counsel and verify local compliance obligations before launching.

Jurisdiction and licensing

The country and region where you register your company may affect your timeline, costs, and long-term growth.

Popular jurisdictions include:

- Lithuania. Fast setup, clear rules, access to EU banking.

- Estonia. Strong digital infrastructure, but licensing is stricter than before.

- UAE. Crypto-friendly, fast-moving regulatory environment.

- Hong Kong. Becoming more attractive for institutional and retail crypto trading.

When choosing where to register your exchange, three things matter most: who you’re serving, how much you’re ready to spend, and how fast you want to go live. If you’re targeting EU users, Lithuania or Estonia are popular options, as both offer clear crypto frameworks, and a VASP license in either can cost around €12,000.

Some jurisdictions move fast, approving licenses in just a few weeks. Others take much longer. Many founders start with a VASP or MSB license, depending on their region.

Talk to a legal expert. It can save you months and thousands of dollars in the long run.

AML, KYC, and data protection

No exchange can run legally without meeting anti-money laundering (AML) and knowing your customer (KYC) rules. It means collecting ID and proof of address, verifying each user, and keeping an eye on transactions for anything suspicious. It’s not a one-time task, regular checks and watchlist screenings are part of the job.

Most platforms don’t handle this in-house. It may be convenient to rely on third-party tools, which plug into your signup flow and handle verification with minimal friction.

Collecting user data brings another layer of responsibility. If you serve EU residents, you’re bound by GDPR. California has its own version – CCPA. The UK follows the DPA 2018. All of them demand that you store data securely, give users control over what you collect and publish a clear privacy policy.

Ignore these rules, and you risk serious fines or getting blocked in major markets.

Technical infrastructure of your future crypto exchange

Once the research is done and the legal side is under control, it’s time to deal with the technical foundation.

Buy or build?

SaaS works well if you’re aiming to launch quickly with standard features. They’re ready-made, tested, and supported. However, custom development may also be required. Let’s break down the difference between the two approaches.

| When SaaS makes sense | When custom development is better |

|---|---|

|

|

For many, the right choice is a hybrid: SaaS with custom features added.

Security essentials

Security isn’t optional when you aim to create a crypto exchange platform. It’s the first thing serious users look at.

Here are the basic security features a crypto exchange platform needs:

- Cold and hot wallets to split funds and keep most assets offline.

- 2FA and withdrawal whitelisting to block account takeovers.

- Regular audits with external teams to check your code and systems.

- Penetration testing to catch weaknesses before attackers do.

One breach can ruin trust. That’s why security needs to be part of the design from day one.

Common mistakes and risks to avoid

Many exchanges fail before they become popular because of some mistakes. Often, the problems start with decisions made early on.

Choosing the wrong jurisdiction

Some jurisdictions may slow down your launch with complex regulations and long approval times. Of course, it doesn’t mean they are bad. It just means that terms and costs are to be considered. For example, licensing in the US can take up to 24 months and cost over $170,000. Such delays can blow your budget and slow down your launch.

Underestimating compliance

Regulatory fines in crypto take place. Binance was fined $2 million by the FIU in 2024 for violating AML laws. Ignoring compliance risks hefty penalties and can lead to mistrust. Fixing these issues later can cost more than an upfront investment.

Security gaps

Security flaws, especially in access controls, remain a top threat. In 2024, access-control vulnerabilities were behind 75% of all crypto hacks. Simple mistakes like weak wallets or unchecked withdrawals allowed attackers to steal millions. Regular audits and penetration tests should be a routine part of your operations.

Why CoinsPaid makes sense for your crypto business

Getting a crypto exchange off the ground takes time, money, and serious technical effort. But there’s a faster, practical way. If you don’t want to spend months and hundreds of thousands building from scratch, CoinsPaid offers a proven solution.

Start faster with a SaaS platform

Our SaaS platform has been tested under real-world conditions and is designed to offer reliable infrastructure, but operational success depends on implementation, security practices, and regulatory compliance.

We’ll help you launch a crypto exchange with:

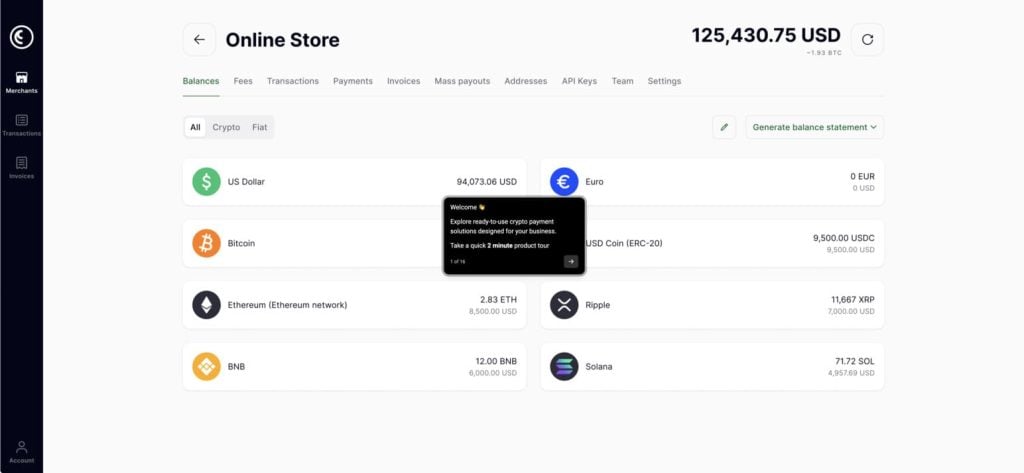

- A full crypto payment and exchange setup

- Support for 20+ cryptocurrencies and 40+ fiat currencies

- Built-in security: cold storage, 2FA, IP whitelisting

- Round-the-clock support and regular updates

You get a tested product, your own branding, and room to grow.

Your tech, your business

You’re in charge of marketing, clients, and operations. We provide the software and support – from onboarding to risk scoring.

It’s also possible to use APIs to plug into other systems, customize the features, or keep it lean and launch your MVP.

CoinsPaid affiliate program

If you have clients or a network interested in crypto, you can start earning without running your own exchange.

Just refer businesses, and we handle the rest:

- Commissions paid in fiat

- Promo tools and performance reports

- Monthly payouts

- Custom landing pages available

What’s the right choice for you?

CoinsPaid can offer flexibility in building a crypto business. Just think about what your target is, and we offer the optimal option.

| If you want to… | Recommended Option |

|---|---|

| Launch your own exchange and handle client flow | Crypto SaaS + Customization |

| Start with no development and low investment | Affiliate program with a custom referral page |

| Add crypto to an existing business | Crypto SaaS + Business wallet |

| Build a CEX-level platform from scratch | Third-party white-label + CoinsPaid as a payment gateway |

Crypto SaaS + Customization

It may suit founders who want a branded crypto exchange, without building from the ground up. Our crypto SaaS gives you the engine, as we help you launch fast, and focus on business development.

Affiliate program with a custom referral page

Not ready to launch your own product? No problem. Refer other businesses to CoinsPaid affiliate program and earn commissions in fiat. You get your own branded landing pages and full visibility into your performance. A tech team is not needed.

Crypto SaaS + Business wallet

Already running a business and want to support crypto transactions? This setup connects our infrastructure with your existing flow. Accept deposits, manage wallets, and support exchanges securely and legally, without hiring a blockchain team.

Third-party white-label + CoinsPaid as payment gateway

If your goal is a high-end exchange with deep customization and full trading logic, white-label software from a specialized vendor can be paired with CoinsPaid’s gateway. We handle compliance-grade payment infrastructure and you focus on the product layer.

With CoinsPaid, you get a flexible solution built to fit your goals, whether you’re just starting or scaling up. Let’s find the setup that works best for you.

Summary

Key Takeaways:

- Global crypto trading volume exceeded $6 trillion per month in April 2025, showing steady demand for digital asset exchanges.

- Entrepreneurs can now launch crypto exchanges faster and with lower costs using SaaS or white-label solutions instead of building from scratch.

- Legal compliance – including KYC, AML, and regional licensing – helps avoid regulatory risks and fines.

- Choosing the right jurisdiction, robust security architecture, and experienced partners determines long-term success.

- CoinsPaid offers turnkey infrastructure, supporting 20+ cryptocurrencies, 40+ fiat currencies, and built-in compliance tools for new exchanges.

What this means for your business

Launching a crypto exchange in 2025 no longer needs to be a huge project. It’s an attainable opportunity for fintech entrepreneurs, payment providers, and startups entering the digital asset market. With increasing regulation and rising user demand, businesses must balance speed, compliance, and scalability. The priorities are as follows: pick the right jurisdiction, design for security, and align on KYC/AML from day one. Working with the right provider, companies can quickly kickstart platforms that used to take months to create.

CoinsPaid offers white-label crypto payment gateway solutions along with licensing guidance, security infrastructure, and full partner support. Start your business with the help of scalable software and continuous technical assistance.