How to Move Crypto from Hot to Cold Wallet

Table of contents:

Why is it important to transfer cryptocurrency from a hot wallet to a cold wallet?

Before explaining how to transfer crypto from a hot wallet to a cold one, it is necessary to understand why the move matters. Hot wallets remain one of the most targeted systems in the crypto space. The numbers speak for themselves:

- Mt. Gox (2011) – $30,000 lost in a high-profile breach.

- Coincheck (2018) – $534 million theft due to a hot wallet breach.

- BitMart (2021) – $196 million lost from two compromised wallets.

- Bybit (2025) – $1.4 billion in ETH stolen after a private key leak.

These attacks all stemmed from a single point of failure: the hot wallet.

Unlike cold wallets, hot wallets connect to the internet. They don’t hold the crypto itself, they store the keys that authorize transfers. Once those keys are exposed, funds can vanish in seconds. Even platforms with advanced security have fallen victim.

Hot wallets are vulnerable because of how they operate:

- They are always online. It makes them accessible not just to users, but also to attackers scanning for weak points.

- Phishing is a common entry tactic. Once access is gained, keys or seed phrases can be pulled from system memory.

- Devices with USB debugging enabled open further doors, which allows attackers to extract sensitive data using memory analysis tools.

- There are also risks at the software level. Wallets built on outdated or poorly maintained libraries can be exploited without direct user interaction.

- In some cases, attackers use impersonation techniques, either posing as a trusted server or blocking the real one from starting, to hijack wallet operations through RPC manipulation.

Every vulnerability leads back to one fact: the private key must be protected. The best way to do that is to remove it from the internet entirely. That’s what cold wallets are for.

What to Know Before Moving Crypto to a Cold Wallet

Before transferring crypto to a cold wallet, preparation matters. Choosing the right digital asset, platform, and storage method provides businesses with secure funds storage and convenient usage.

Here are the key points to consider before transferring crypto to a cold wallet:

- The choice of digital asset. Start by deciding which cryptocurrency your business needs to manage. Crypto asset selection affects legal compliance, platform availability, and wallet compatibility. For example, in 2025, MiCA regulations across the EU restrict the use of privacy coins like Zcash (ZEC) and Dash (DASH) on licensed exchanges, which makes them impractical for many European businesses.

CoinsPaid offers support for over 20 cryptocurrencies selected with consideration of EU regulatory developments. You can accept crypto payments through its crypto business wallet, with the option to transfer funds to a secure cold wallet for long-term storage.

- Cold wallet for your business needs. Not all cold wallets support every token. Before making a transfer, it’s recommended to confirm that your cold wallet supports the crypto you hold. Some wallets like BitBox02 (Bitcoin only edition) and COLDCARD are limited to Bitcoin, while others handle a broader range of tokens like ETH, XRP, or BNB.

- Business location. Before choosing a cold wallet, check if it ships to the country where your business operates. For example, Ledger does not deliver to Syria, Morocco, Nepal, and over a dozen other restricted countries, making it unavailable in those regions.

- Essentials backup. Your seed phrase is the only way to recover your crypto. Losing it means losing access forever. Use multiple offline backups. Never take a photo of it. Never upload it to cloud storage.

Disclaimer: CoinsPaid does not guarantee regulatory compliance of any third-party tokens mentioned.

Next, we’ll walk through the exact steps to transfer your crypto securely.

How the Hot-to-Cold Wallet Transfer Works

Transferring crypto from a hot wallet to a cold wallet strengthens security by taking private keys offline. Cold wallets can generate keys within the device and store them securely. However, the process must be handled correctly to ensure full protection.

Step 1. Cold wallet setup. Initialize your cold wallet (or compatible hardware wallet). Generate a new wallet directly on the device – never import a seed phrase that has been exposed online. This ensures private keys remain offline.

Step 2. Receiving addresses generation. In the cold wallet, generate a receiving address for each network you’ll use (e.g., BTC, ETH).

Note: On Ethereum and other multi-token networks, one address can hold multiple assets (e.g., ETH, LINK).

Verify each address on the cold wallet device screen to ensure accuracy.

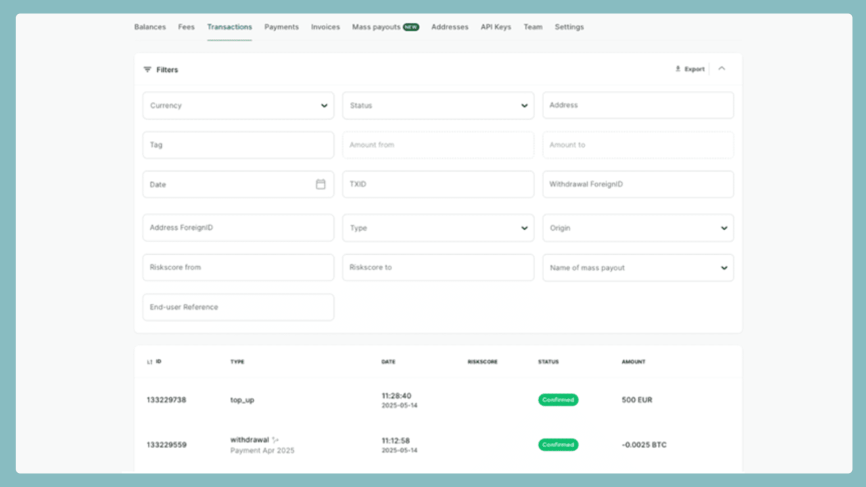

Step 3. Access your hot wallet. Log in to your CoinsPaid hot wallet. Select the digital asset you want to move.

If you use a secure crypto wallet for business by CoinsPaid, you can set a transfer threshold within your merchant account. This limit defines how much crypto stays available for operational needs, such as customer payouts or supplier settlements. Once the balance exceeds the limit, the assets automatically move to the cold wallet to reduce online exposure risks.

Step 4. Initiate the transfer. Paste the new cold wallet address into the recipient field. Choose the correct network. Confirm the gas fee and transaction details.

Step 5. Approve and send. Complete any required security steps to confirm the transaction. Most blockchains process transfers within a few minutes.

Step 6. Verify the transfer. Open your cold wallet to confirm that your assets have arrived. You can also check the transaction status using the blockchain transaction ID.

How to Avoid Mistakes When Sending Crypto to a Cold Wallet

Sending crypto to a cold wallet requires precision. Even small mistakes can result in lost funds because cryptocurrency transactions are irreversible, which means that the transaction cannot be canceled once sent.

Follow these five simple steps to avoid risk:

- Generate a new key offline. Never use one created on an internet-connected device.

- Confirm the cold wallet address using a second trusted channel.

- Start with a small test transfer. Wait for confirmation before sending more.

- Double-check the address, token, amount, and fee on all devices. Approve only if everything matches.

- Watch for clipboard malware. Compare the pasted address with what appears on your cold wallet screen.

Hot Wallet vs. Cold Wallet: Which One Do You Need?

Crypto wallets come in two forms: hot and cold. The key difference is internet access. Hot wallets stay online. They are useful for daily transactions, client payouts, or real-time settlements. However, they carry higher security risks due to constant connectivity.

Cold wallets stay offline. They store private keys on physical devices, protecting assets from hacks and malware. This setup works better for long-term storage or holding large balances.

| Feature | Hot wallet | Cold wallet |

|---|---|---|

| Internet access | Online | Offline |

| Security level | Moderate risk | High protection |

| Usage | Payouts, daily use | Tresury, long-term storage |

| Access | Instant | Manual access needed |

| Hacking risk | Higher | Minimal |

For business operations, using both types is beneficial.

Expert Insight: Cold Storage Done Right

“Cold wallets redefine how businesses secure their digital assets. While blockchain offers speed and transparency, cold storage adds a critical layer of offline protection that online systems can’t match.”

How Long Does It Take to Transfer Crypto to Cold Storage?

Transferring crypto to a cold wallet usually takes a few minutes. Many blockchains confirm transactions from seconds to 20 minutes.

The exact time depends on the blockchain’s current load, the network fee you pay, and the number of required confirmations. Paying a low fee during peak hours can delay the transaction. Cold wallets do not affect the speed. They receive assets once the blockchain confirms the transaction.

When choosing a network, consider these factors:

- Ethereum: Average confirmation time is 3 minutes. Network fees start from $0.27, but fees can spike above $20 during congestion.

- Bitcoin: Confirmation usually takes up to 20 minutes with an average fee of $0.19, depending on network demand.

- Tron: Transactions are confirmed in 3 seconds, with fees often about $0.31, making it very cost-effective for frequent transfers.

Choose the network that best fits your priorities for speed, cost, and security.