Token Vs Coin – Settling the Score

If you’re somewhat familiar with the digital asset market, you have probably noticed that two terms are often used to describe cryptocurrencies: coins and tokens. Many treat those terms as synonymous, but there are several distinguishing features worth mentioning.

"Coins are like the residents of the networks, while tokens are like their guests. Knowing the difference is key for anyone getting involved in crypto"

Alina Zabrodskaya

Customer Success Manager at CoinsPaid

Today, we demystify the differences between coins and tokens, examining their unique operational frameworks and the diverse roles they play in the digital economy.

Today, you’ll:

- Understand the core functionalities of tokens vs coins, and how their foundational differences shape their uses in the blockchain ecosystem.

- Discover the economic principles driving the value of tokens (‘tokenomics’) and coins (‘coinomics’), and how market dynamics, utility, and adoption influence their worth.

- Navigate through common misconceptions in the crypto space, clarifying the true nature of these digital assets.

By delving into these areas, readers will gain a comprehensive understanding of the crypto landscape, empowering them to make more informed decisions whether they are investing, developing, or simply exploring the fascinating world of digital currencies.

Overview of Coin vs Token

In the dynamic world of cryptocurrency, two types of digital assets reign supreme: tokens and coins. Both play pivotal roles in a cryptocurrency payment gateway system, but their functions, foundations, and utilities in the digital economy differ significantly.

Tokens in cryptocurrency are digital assets created on pre-existing blockchain platforms. They often represent an asset or a utility, and are used within specific ecosystems, such as decentralised applications (dApps) or for executing smart contracts. Tokens can be versatile, with some serving as digital representations of physical assets or as governance instruments in decentralised autonomous organisations (DAOs).

Coins, on the other hand, are digital currencies that operate on their independent blockchains. They primarily serve as digital money, facilitating transactions, acting as a store of value, and sometimes playing the role of a unit of account in their respective ecosystems. Examples include Bitcoin (BTC) on its own blockchain and Ether (ETH) on the Ethereum network.

Crypto Token vs Coin: Main Differences Expanded

The distinction is primarily rooted in their respective operational frameworks, which significantly influence their creation, function, and role in the broader digital economy. Let’s examine the key features of both coins and tokens.

Coins: The Foundation of Blockchains

- Native Blockchain: Coins are the original currency of a specific blockchain. For example, Bitcoin operates on the Bitcoin blockchain, and Ether operates on the Ethereum blockchain. This native status gives coins a fundamental role in their ecosystems.

- Resource-Intensive Creation: Establishing a new coin involves creating a whole new blockchain. This process demands significant technical expertise, computational resources, and ongoing maintenance to ensure network security and functionality. For instance, the creation of a new coin might necessitate the development of a unique consensus mechanism, such as Bitcoin’s Proof of Work or Ethereum’s transition to Proof of Stake.

- Primary Functions: In their ecosystems, coins typically serve three main purposes – as a medium of exchange, a store of value, and sometimes, a unit of account. This triad allows them to function similarly to traditional fiat currencies but in a decentralised digital realm.

Tokens: Versatile Assets on Established Platforms

- Built on Existing Blockchains: Unlike coins, tokens are developed on pre-existing blockchains. ERC-20 tokens like DAI and USDC are built on the Ethereum blockchain. They leverage the security and functionality of the underlying network but are not considered the native currency of that blockchain.

- Simplified Creation Process: The process of creating tokens is generally less resource-intensive than that of coins. Predefined standards such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens provide frameworks that developers can use to create tokens with relative ease. These standards ensure compatibility with the existing blockchain infrastructure and simplify the integration with wallets and exchanges.

- Diverse Use Cases: Tokens can represent a wide range of assets and rights, extending far beyond the traditional scope of a currency. For example, utility tokens can grant access to specific functionalities in a dApp, security tokens can represent investment in a project, and NFTs can signify ownership of a unique digital asset. This flexibility allows tokens to cater to various innovative and niche applications within the blockchain space.

Cryptocurrency Token vs Coin: Versatility vs Stability

The difference between the two terms lies not only in technical underpinnings, but also shapes their in the digital economy. Coins, as the foundational pillars of blockchain networks, provide stability and standardisation, while tokens introduce a level of versatility and innovation, enabling the development of complex applications and ecosystems within the existing blockchain frameworks.

Understanding Tokenomics and Coinomics

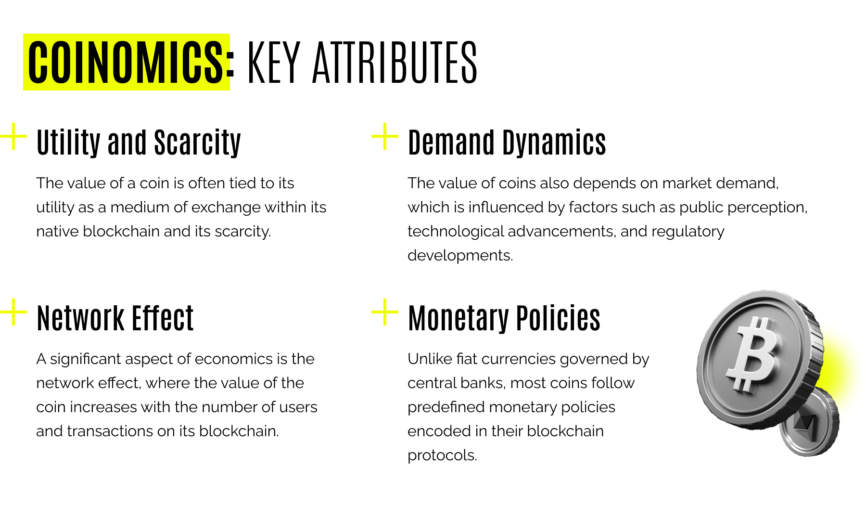

Indeed, when discussing the issue of differentiating digital coins and tokens, the economic factor is fundamental to understanding their value. Coins derive their value from their utility, scarcity, and demand within their native blockchain network. Bitcoin, for instance, gains value from its capped supply and its role as a digital alternative to traditional currencies.

Tokenomics, however, can be more complex due to the diverse functionalities and purposes of tokens. The value of a token can hinge on its utility within a dApp, its role in governance, or its representation of an underlying asset. Factors such as token supply, distribution mechanisms, and real-world utility significantly impact their valuation.

Common Misconceptions

- “Wait, there are other cryptocurrencies besides Bitcoin?”Many people think all cryptocurrencies operate like Bitcoin or Ethereum. However, while these are foundational coins of their blockchains, serving primarily as digital currencies, tokens like ERC-20s or NFTs have different purposes. Tokens can represent assets, stake in a project, or digital collectibles, among other things.

- “Bitcoin has increased in price, so other cryptocurrencies will as well”.Another misconception is that all cryptocurrencies inherently hold value. In reality, the value of coins and tokens is not intrinsic; it is determined by market dynamics (supply and demand), user adoption, and their utility. A cryptocurrency’s worth is linked to its acceptance, the problem it solves, or the unique features it offers.

- “Why can’t I stake my Curve DAO token to earn Bitcoin mining rewards?”There’s often a misunderstanding that coins and tokens are interchangeable and similar in their roles. However, coins are native to their blockchain and usually function as digital money, while tokens are built on existing blockchains and offer a broader range of functionalities.

- “Terra Luna collapsed, so will USDT…”People sometimes assume that all tokens and coins offer the same level of security and stability. However, the security of a cryptocurrency depends on its blockchain’s architecture, and stability is often a function of market adoption and investor sentiment, which can vary greatly. For example, algorithmic stablecoins are much more vulnerable to collapse than fully-collateralized ones.

- “Crypto isn’t legal in my country and never will be…”There’s a belief that the regulatory environment for cryptocurrencies is clear and consistent. In reality, regulatory stances on coins and tokens can vary significantly by country and change over time, affecting their adoption and use.

What Is the Difference Between a Coin and a Token: Conclusion

The realms of digital tokens and coins are as diverse as they are intricate. Understanding their differences is crucial in navigating the ever-evolving landscape of digital finance.

Coins, with their native blockchain foundation, offer stability and a traditional monetary role, while tokens introduce flexibility and innovation, enabling a myriad of applications beyond mere currency.

As the cryptocurrency market continues to mature and expand, the importance of discerning the nuances between tokens and coins becomes paramount for investors, developers, and enthusiasts alike. This knowledge not only helps in making informed decisions but also opens up avenues to participate effectively in the burgeoning world of decentralised finance and beyond.