What is a Memecoin?

Often driven by internet culture, viral trends, and speculative hype rather than fundamental utility, memecoins have obtained a unique place in the crypto market. Unlike traditional cryptocurrencies that aim to solve financial challenges, memecoins thrive on community engagement and social media influence.

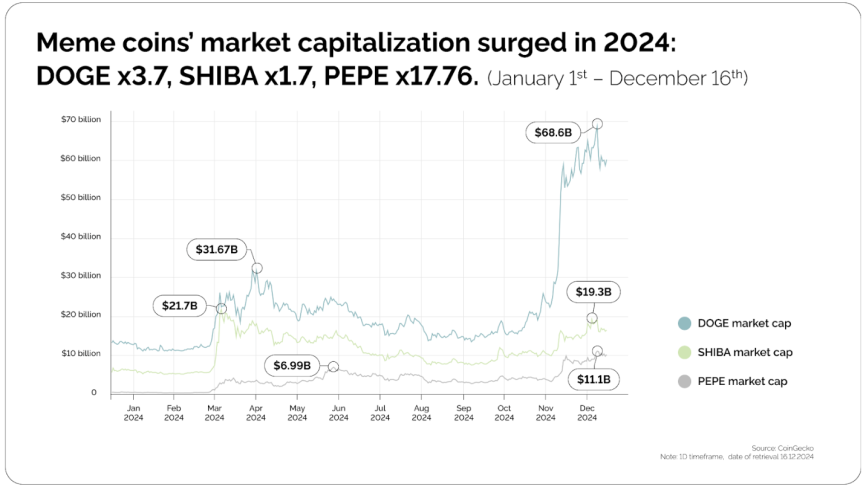

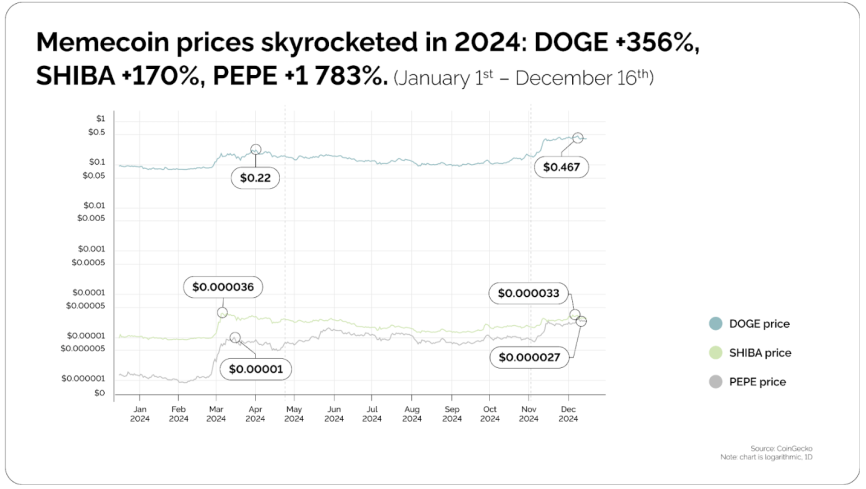

Let’s consider Pepecoin as an example. It’s one of the best memecoins of 2024 with a YTD growth of over 1960%. Despite having no intrinsic value supported by use cases, its price surged simply because of its connection to an iconic internet meme. This pattern repeats across many memecoins.

So, what makes memecoins attractive? Why do people invest in them despite the risks? Let’s break it down.

Table of Contents:

A Short History of Memecoins

Back in 2013, a coin emerged from the depths of the internet’s humor and curiosity: Dogecoin.

It all started as a joke — a parody of the already burgeoning cryptocurrency market. Created by software engineers Billy Markus and Jackson Palmer, Dogecoin featured the Shiba Inu dog from the “Doge” meme as its mascot. No one could have predicted that this lighthearted creation would lay the groundwork for what we now call ‘memecoins’.

Dogecoin’s appeal was its community-driven nature and its use as a “tipping” currency to reward internet users for good content. Despite its joke origins, Dogecoin’s popularity surged, and it even sponsored events like the Jamaican bobsled team’s journey to the 2014 Winter Olympics.

By 2020, the era of social media influence on cryptocurrency, Dogecoin had transformed from a joke to a symbol of financial rebellion. It was fueled by Reddit communities and celebrity endorsements, most notably by Elon Musk. His tweets sent the coin’s value soaring, demonstrating the raw power of internet culture on financial markets.

This wave of enthusiasm led to a new generation of memecoins, each aiming to replicate that same success.

Shiba Inu (SHIB) launched in August 2020 as the “Dogecoin killer”. It embraced Dogecoin’s success with a strong community and plans for ShibaSwap, a decentralized exchange.

The hype grew and more memecoins emerged, from SafeMoon to CumRocket, fueled by viral marketing and speculation rather than real use cases.

Now comes Pepecoin, inspired by internet culture and the “Pepe the Frog” character. Despite its whimsical nature, Pepecoin captured the attention of investors looking for the next big hit.

The journey of memecoins has been a rollercoaster, mixing humor, community, and finance in unique ways. While often seen as speculation, their cultural impact is clear.

Whether chasing the next big token or watching the trend, memecoins show how the internet shapes value and markets.

Memecoins Vs Cryptocurrencies – What’s the Difference?

Memecoins are minted just like any other cryptocurrency. For example, if they are minted on Ethereum, the process involves deploying a smart contract that defines the token’s properties according to the ERC-20 standard. The smart contract specifies the token’s name, symbol, total supply, and functionalities such as transfer, approval, and allowance. The differences therefore can be defined as ‘soft’.

There aren’t just ‘memecoins and cryptocurrencies,’ though. It’s better to define them as ‘memecoins’ and ‘the rest.’ To illustrate this, we’ve provided a table below that categorizes the different kinds of cryptocurrencies with their respective market caps.

| Category | # of Coins | Market Cap |

|---|---|---|

| Proof-of-Work | 142 | $2.20T |

| Proof-of-Stake | 119 | $771B |

| EVM | 90 | $670B |

| SEC Alleged Securities | 59 | $474B |

| U.S. Dollar Stablecoin | 84 | $203B |

| Centralized Exchange | 72 | $133B |

| Cosmos SDK | 61 | $131B |

| DeFi | 1107 | $131B |

| CeFi | 55 | $120B |

| Meme | 1257 | $120B |

| Dog-Themed | 109 | $87.66B |

| Governance Token | 299 | $82.32B |

| DAO | 303 | $65.74B |

| NFTs | 887 | $47.54B |

| Decentralized Exchange | 343 | $46.79B |

| DePIN | 149 | $44.46B |

| AI | 372 | $34.33B |

Source: Messari

1. Utility and technological differences

Mainstream cryptocurrencies are designed with significant utility in mind. They often address critical issues like scalability, security, and usability within the blockchain ecosystem. For instance, layer 2 solutions like Optimism and TAIKO aim to enhance Ethereum’s functionality by making transactions faster and cheaper without compromising on security. TonCoin, on the other hand, integrates blockchain with messaging platforms, creating a seamless and secure user experience.

Memecoins, in contrast, have a value that is predominantly driven by community hype and internet culture rather than technological advancements or utility. Pepecoin and Shiba Inu are mostly valued for their viral popularity and speculation.

2. Differences extend to community and hype

Mainstream Cryptocurrencies certainly benefit from a strong community. However, the value of these cryptocurrencies is primarily anchored in technological innovation and real-world applications. Their growth is sustained by practical utility and ongoing development within the blockchain space.

Memecoins have a value that leans heavily on the enthusiasm of their community, trends on social media , and celebrity endorsements. Dogecoin and Shiba Inu exemplify this dynamic, where their popularity spikes based on the latest tweet or viral trend, rather than any underlying technological progress.

The WallStreetBets subreddit, which had gained fame for its role in the GameStop stock saga, was a prime example of this enthusiasm in action. The subreddit’s community started promoting DOGE, aiming to push its price to $1, which led to a 142% price surge in 2021.

The approval of Ethereum Spot ETF adds another interesting dynamic. Memecoins native to the Ethereum network surged along with the overall price of ETH – which shows a strong relationship between native networks and memecoins. PEPE and MOG jumped respectively 11% and 45% on the week of the ETF’s approval, reaching lifetime heights at the time.

"Memecoins might seem, quite literally, like a joke, but their ability to leverage viral communities and offer faster, cheaper transactions makes them an attractive payment option for businesses, despite the risks of high volatility and speculation."

3. Suitable investment perspectives should be applied

Mainstream cryptocurrencies are often viewed as long-term investments due to their robust technological foundations and potential for real-world applications. Investors consider these assets as key to the future of digital finance and technology.

Memecoins, on the other hand, are typically seen as speculative investments. While they can offer quick returns, they come with high volatility and risk, driven more by market sentiment and hype than by intrinsic value. Investors in the future of memecoins are betting on the next viral sensation, rather than on sustained technological innovation.

Paying in memes

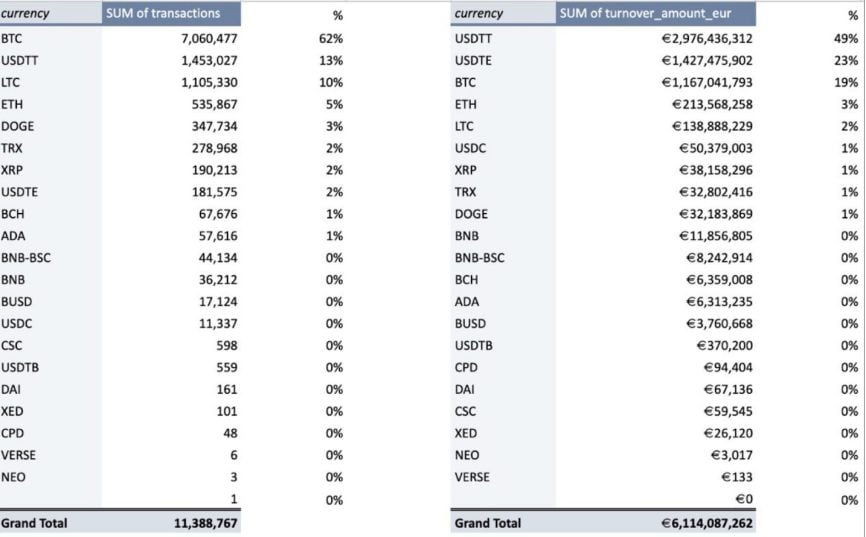

One similarity that we omitted was that both types of assets can be used for payment. For instance, at CryptoProcessing, we openly accept Dogecoin alongside Bitcoin. After all, with demand comes supply.

Dogecoin is now accepted by over 1,400 companies, including major names like Tesla and SpaceX, likely due to Elon Musk’s enthusiastic endorsements.

Meanwhile, numerous online platforms and stores now accept SHIB, tapping into its strong community base.

It’s not just the best memecoins either – several smaller projects have seen their tokens adopted by payment processors across the world:

- BabyDoge Coin is valued for its low transaction fees and swift transfer speeds.

- Floki Inu, a utility-driven memecoin, is now accepted by select online retailers.

- Geo-specific memecoins like Monacoin< are popular in Japan as a payment method on select e-commerce platforms.

Beyond meeting the demand for payments in memecoins, many are minted on innovative blockchain networks, which often result in lower transaction fees compared to traditional cryptocurrencies like Bitcoin. Networks such as Ethereum and the Binance Smart Chain provide the robust security needed for these transactions.

Furthermore, memecoins typically boast large, loyal communities. Accepting memecoins helps businesses attract these communities, growing their customer base and market reach.

Final thoughts

A fitting conclusion to this exploration of memecoins would be to address the fundamental question: are memecoins worth it?

There are strong arguments on both sides.

Memecoin enthusiasts argue that these digital assets are as trustworthy as any other cryptocurrency. They point out that the best memecoins> like Shiba Inu and Dogecoin have demonstrated significant staying power and long-term potential. Additionally, they believe that the viral nature of memes can effectively onboard new users to the world of cryptocurrency, serving as an accessible entry point to Web3 for many.

On the other hand, critics highlight the inherent risks associated with memecoins. They point out that many memecoins lack intrinsic value and utility, with their worth tied inseparably to the popularity of the underlying meme. This makes them highly volatile and susceptible to market manipulation.

Memecoin projects are often associated with rug-pull scams, where developers take investors’ funds and abandon the project. With over three hundred memecoin projects listed on Coingecko and likely< thousands more, many are driven by hype and marketing rather than real innovation.

Memes play a central role in our culture and have the ability to unite communities. Memecoins can be seen as a web3 version of this cultural phenomenon.

In any memecoin Telegram group, the community’s enthusiasm and humor are evident, which creates a strong sense of connection. This sense of community is powerful and should not be underestimated.

Nevertheless, the advice is – keep the stablecoins in toncoin, not in memecoins, for Pepe’s sake.