Why is crypto going up?

Table of contents:

Crypto is rising fast in 2025. Headlines show Bitcoin and Ethereum gaining strength again. The rally is not random. Several forces are driving it.

- On August 27, 2025, U.S. spot Bitcoin ETFs recorded $81.2 million in net inflows, though amounts vary greatly.

- In June 2025, Ethereum ETFs had a 14-day inflow streak, including a cumulative $743 million surge.

- BlackRock, Fidelity, and Galaxy Digital add weight and liquidity, meaning that institutional adoption grows.

- Bitcoin’s 2024 halving reduced supply. Ethereum staking locks up coins.

- Lower rate forecasts, dollar weakness, and inflation pressure fuel demand.

This mix of supply cuts, new products, and global conditions sets the tone for the year. The following sections explain why prices move the way they do and what keeps pushing crypto higher.

Key factors driving the crypto rally

Several forces work together to lift crypto prices in 2025. Markets respond to shifts in global economics, institutional moves, clearer rules, and major protocol upgrades. Sentiment also plays a big part, as news cycles and community activity fuel momentum. Have a look at the table below for a quick overview.

| Factor | Explanation | Example |

|---|---|---|

| Macroeconomics | Lower inflation, weaker USD, and expectations of Fed rate cuts support risk assets like crypto. | Fed signaled possible rate cuts → BTC surged. |

| Institutional adoption | Inflows into Bitcoin and Ethereum ETFs, companies adding BTC to treasuries. | BTC ETFs attracted $81M inflows, and ETH ETFs $307M in one week. |

| Regulation | Positive legal clarity in the US and Europe builds investor confidence. | SEC approvals for spot ETFs. |

| Technology | Network upgrades, staking, and scaling solutions make crypto more attractive. | Ethereum upgrades + staking yield growth. |

| Market sentiment | Social media hype, retail FOMO, and whale accumulation fuel short-term rallies. | BTC supply on exchanges <15% (supply crunch). |

Each of these areas deserves a closer look.

Macroeconomic environment:

- Inflation and rate outlook. Policymakers project two rate cuts in 2025. Year-end inflation is forecast at 3% and growth at 1.4%. Lower expected rates reduce real yields and increase demand for scarce assets such as Bitcoin.

- Fiat currency moves. A softer US dollar lifts demand from buyers priced in other currencies. That effect can shift flows into Bitcoin and other globally traded tokens.

- Store-of-value narrative. When real returns fall, some individuals reassign part of their allocation to assets that can hold value across borders. This idea adds demand pressure when supply tightens.

However, these forces do not guarantee gains. They do set conditions that can support sustained bids.

Institutional adoption:

- ETF demand and scale. Spot Bitcoin and new token ETFs now hold large amounts of assets under management. Over $50 billion in assets under management, with the US and European ETFs leading inflows. Big funds draw steady inflows and widen the buyer base.

- Corporate reserves. Public firms continue adding Bitcoin to their treasuries, while the US government holds over 198,000 BTC, as of August 2025. Reduced free float can amplify price impact.

- Market infrastructure. Companies like Deutsche Börse and BlackRock expand custody and trading services. Better infrastructure supports institutional entry.

Better market infrastructure reduces frictions around access, security, and reporting. Each step adds confidence and steadier liquidity during volatile sessions.

Regulation and legal clarity:

- Europe (MiCA). EU rules launched in 2024 provide a clear framework for stablecoins and service providers. Legal certainty reduces compliance risks for firms.

- United States. SEC approvals of spot Bitcoin ETFs mark a shift toward broader acceptance. More regulated products improve market access.

- Asia. Hong Kong and Singapore compete as crypto hubs. Licensing regimes attract exchanges and service providers.

Defined standards reduce uncertainty for product teams, compliance leaders, and boards. Clarity reduces the chance of abrupt policy surprises that could freeze capital plans. Merchants and payment companies benefit when partners follow consistent rules across regions.

Technological updates:

- Bitcoin halving. The April 20, 2024, halving cut the block reward to 3.125 BTC per block. That step halves new issuance from miners and slows supply growth.

- Ethereum supply dynamics. Proof-of-stake and protocol changes shift issuance and staking removes ETH from active circulation. Recent supply reports show those forces influence net daily supply.

- Layer-2 expansion. Scalability layers raise throughput and lower final settlement friction for merchant flows. More capacity brings more use cases on-chain.

These upgrades strengthen network effects that are hard to replicate.

Market psychology and sentiment:

- FOMO effect. The headlines about Bitcoin nearing $110,000 and Ethereum aiming at $7,000 often trigger retail inflows. Price milestones spark urgency among new buyers.

- Media cycle. Positive headlines and coverage amplify bullish narratives. Broad exposure pulls in new participants.

- Community signals. Social media and influencers can shape crowd behavior. Trends can reinforce short-term momentum.

New all-time highs trigger coverage, which attracts more viewers and then more activity. Leveraged positions can push moves further when liquidations cascade.

Why is crypto going up? (Video)

Why Bitcoin is going up

One of the strongest drivers of Bitcoin’s rally is the supply crunch. Spot ETFs in the U.S. and Europe have absorbed large volumes of coins since launch. At the same time, corporate treasuries and even government holdings take more Bitcoin out of circulation. In 2025, public firms and private investors added more than 157,000 BTC to their holdings, representing over $16 billion at current prices. With fewer coins available on exchanges, the price becomes more sensitive to fresh demand.

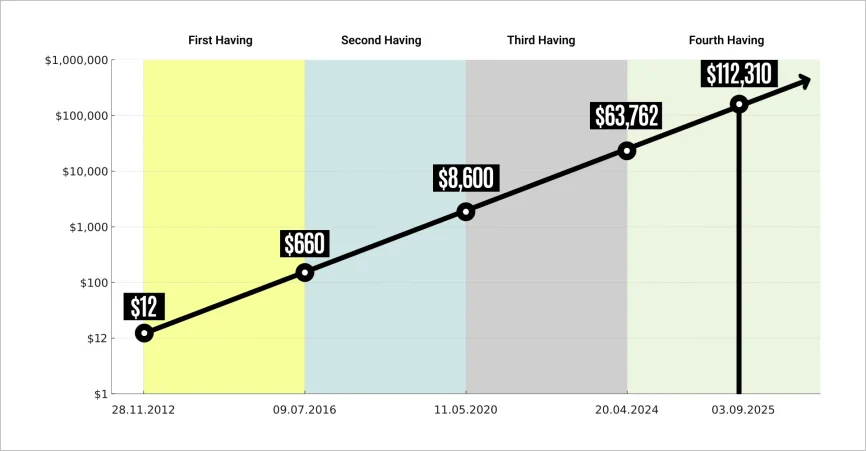

The 2024 halving added more pressure to the supply side. Block rewards dropped from 6.25 BTC to 3.125 BTC. Every cycle in the past has seen strong rallies follow halvings, and the current pattern aligns with that history. Reduced issuance, paired with steady or rising demand, supports the view that supply scarcity drives higher valuations. Thus, the price reached $112,310 on September 3, 2025, marking a 76% gain since the halving day of $63,762 on April 19, 2024.

Chart illustrating Bitcoin price surge following halvings

Institutional confidence also matters. Bitcoin remains the first choice for both retail and individual users. It is liquid, widely recognized, and backed by a growing number of regulated products. Asset managers, corporate leaders, and retail buyers often see it as the entry point to digital assets. This broad trust gives Bitcoin a stronger position compared to other cryptocurrencies during bullish cycles.

Why Ethereum and altcoins are rising

Ethereum’s rally is strongly linked to staking. Large amounts of ETH are locked by validators, reaching 34 million ETH staked in some periods. It reduces the liquid supply available on exchanges. When fewer coins are available for trading, market pressure can boost the impact of new demand.

Network upgrades also play their role. Ethereum’s shift to proof-of-stake and scaling improvements cut costs and improve efficiency. These changes make ETH attractive both as a utility for transactions and as an investment asset with yield from staking.

Institutional activity supports the trend. ETH ETFs have already drawn over $300 million in inflows this year. Such products expand access to Ethereum for funds and large investors, strengthening its credibility in the market.

At the same time, growth in DeFi, Web3 platforms, and blockchain gaming creates fresh demand for tokens beyond Bitcoin and Ethereum.

While these trends may influence market activity, they do not guarantee price increases or returns. Investors should assess risks independently.

Risks and volatility

Despite strong momentum, crypto markets remain volatile. Prices can rise quickly, but they can also fall with little warning.

Several factors contribute to this environment:

- Regulatory risks. Governments continue to shape how digital assets are treated. New rules may change how some tokens trade or how services operate. This uncertainty can trigger sharp moves when announcements hit.

- Market psychology. Investor sentiment often drives fast rallies. When hype builds, prices may move beyond fundamentals. If sentiment shifts, those gains can reverse just as quickly.

- Liquidity shocks. Even with ETFs and broader adoption, crypto markets can face sudden liquidity gaps. Thin order books in certain assets may magnify price swings.

- External events. Global news, cases of security breaches, or macroeconomic shocks can affect the crypto market. Reactions are often more extreme compared to traditional assets.

Disclaimer: This article is for informational purposes only. It does not provide financial advice. Crypto services may be restricted or prohibited in certain jurisdictions. Users are responsible for ensuring that access or use of CoinsPaid services complies with local laws and regulations.

What it means for businesses accepting crypto

Merchants now see benefits in offering crypto payments. Several trends highlight why:

- Integration of crypto payments can grow the user base. It opens the doors to more than 650 million people worldwide holding crypto in 2025. Besides, this audience grows each year.

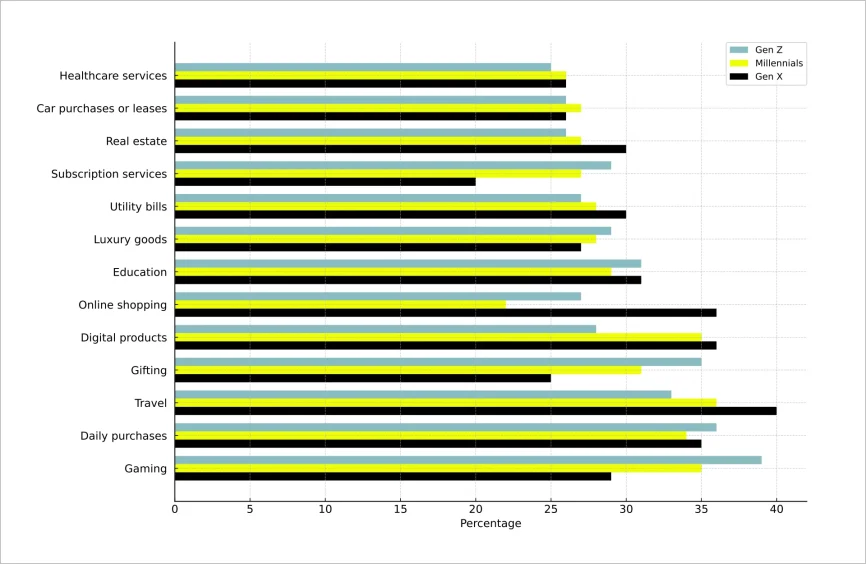

- Millennials and Gen Z show a strong interest in using digital assets for everyday purchases. In July 2025, Bitget Wallet Onchain Report highlighted that over 30% of Gen Z users spend crypto on daily purchases, bookings, and gaming.

- Accepting crypto opens access to a borderless, tech-savvy customer base. Merchants can reach new markets and stand out in competitive sectors.

Share of each generation that chooses crypto as a payment method across different industries.

How CoinsPaid supports merchants

CoinsPaid helps businesses accept crypto. As one of the long-standing providers in the industry, it combines regulatory oversight with a global merchant base.

Here’s why it’s worth working with us:

- Licensed provider. CoinsPaid OÜ is licensed in Estonia and operates under EU AML regulation.

- Instant conversion. Our solutions support 20+ cryptocurrencies and 40+ fiat currencies, which allows quick settlement and reduces exposure to price swings at checkout.

- Trusted network. We serve over 800 merchants across different regions. It gives new clients the advantage of working with a provider that already understands how to operate in multiple markets and industries.

Summary

Key Takeaways:

- Crypto prices are rising in 2025 due to institutional inflows, macroeconomic shifts, and supply constraints after Bitcoin’s halving a year before.

- Bitcoin ETFs in the U.S. and Europe attracted over $80M in daily inflows, while Ethereum ETFs added $743M in just two weeks.

- Regulatory clarity — from the U.S. SEC’s ETF approvals to Europe’s MiCA framework — boosts investor confidence.

- Technological upgrades like Ethereum’s staking model and Layer-2 scalability reduce costs and improve usability.

- Retail demand and positive sentiment amplify the rally, though volatility and regulatory changes remain ongoing risks.

What this means for your business

For businesses accepting crypto, this rally signals a broader shift toward mainstream adoption. Merchants can now attract over 650 million crypto users worldwide by enabling digital payments. As institutional players legitimize the market, the infrastructure supporting crypto transactions is becoming safer, faster, and more transparent. Integrating crypto payments today helps future-proof your business as the use of digital assets rapidly increases.

CoinsPaid helps merchants accept, manage, and convert crypto payments with ease. As a licensed Estonian provider, CoinsPaid offers instant crypto-to-fiat conversion, compliance-ready solutions, and access to 20+ cryptocurrencies and 40+ fiat currencies.

FAQ

The reasons behind are generally ETF inflows, strong institutional adoption, and reduced supply after the 2024 halving.

Markets move in cycles of rallies and corrections. Long-term adoption trends remain strong, but short-term volatility is part of the market.

No single group or authority controls prices. Market forces like supply, demand, institutional flows, macro conditions, and sentiment shape daily moves.

Scarcity with a fixed cap of 21 million coins, decentralization, strong security, and growing use by both institutions and retail participants define its value.