The target was to streamline the financial reconciliation process.

A workforce management company teamed up with CoinsPaid to introduce real-time exchange rate tracking and automated chargeback reconciliation. With rising transaction volumes, the company needed a faster, more accurate way to manage financial reporting.

What is a business crypto account?

Accept over 20 cryptocurrencies, auto-convert into 40+ fiat currencies with SEPA/SWIFT withdrawals, and integrate easily with plugins for WooCommerce, Drupal, Magento, or via full API. Perfect for e-commerce, gaming, finance, travel and hospitality industries.

Access large-volume conversions through a licensed OTC desk, starting from €1M per trade, with no upper limits, ensuring corporate clients and enterprises always have access to liquidity.

Pay employees, affiliates, and global contractors in bulk through CSV uploads or automate payouts via API. Track all activity from a single dashboard, making it ideal for cross-border crypto transactions.

Keep funds safe with cold storage, whitelisted addresses, role-based permissions, and multi-step approvals. A fully audited business cryptocurrency wallet designed for corporate needs.

Built-in KYB/AML procedures, automated transaction screening, and Estonian licensing under provide a secure crypto account with AML/KYC that enterprises can trust.

Manage 20+ cryptocurrencies and settle into 40+ fiat currencies, making it a true multi-currency crypto account for global enterprises.

Protect your treasury from volatility with instant fiat settlement and fixed exchange rates at checkout.

Pay employees, affiliates, and suppliers in bulk using CSV uploads or automate via API – ideal for cross-border crypto transactions.

Accept crypto directly on your website or platform with plugins for WooCommerce, Drupal, Magento, and more, or build custom flows with a full API.

Enterprise-grade business cryptocurrency wallet infrastructure with cold storage, on-chain monitoring, 2FA, whitelisted addresses, and approval workflows.

CoinsPaid is an Estonia-licensed provider, with dedicated AML officers, KYC/KYB procedures, and continuous security audits.

Up to 1.5% per transaction, no setup or monthly fees, ensuring cost efficiency versus traditional banking.

A dedicated account manager plus round-the-clock technical support to keep your crypto for business operations running smoothly.

Why businesses choose CoinsPaid

Transactions confirmed in minutes with locked exchange rates, delivering instant settlements for bitcoin for business and other crypto payments.

Lower fees than banks, with transparent pricing under 1.5% and no hidden costs.

Accept 20+ cryptocurrencies and settle into 40+ fiat via SEPA/SWIFT, enabling a seamless cryptocurrency business account worldwide.

Award-winning provider, recognized as the Best Crypto-Payment Solutions Firm Europe 2024, trusted by hundreds of enterprises.

Ready-made plugins for WooCommerce, Magento 2, PrestaShop, OpenCart, and WordPress, plus a flexible API for enterprises needing custom integration.

A secure crypto account with AML/KYC protocols, multi-layer protection, giving businesses confidence in every transaction.

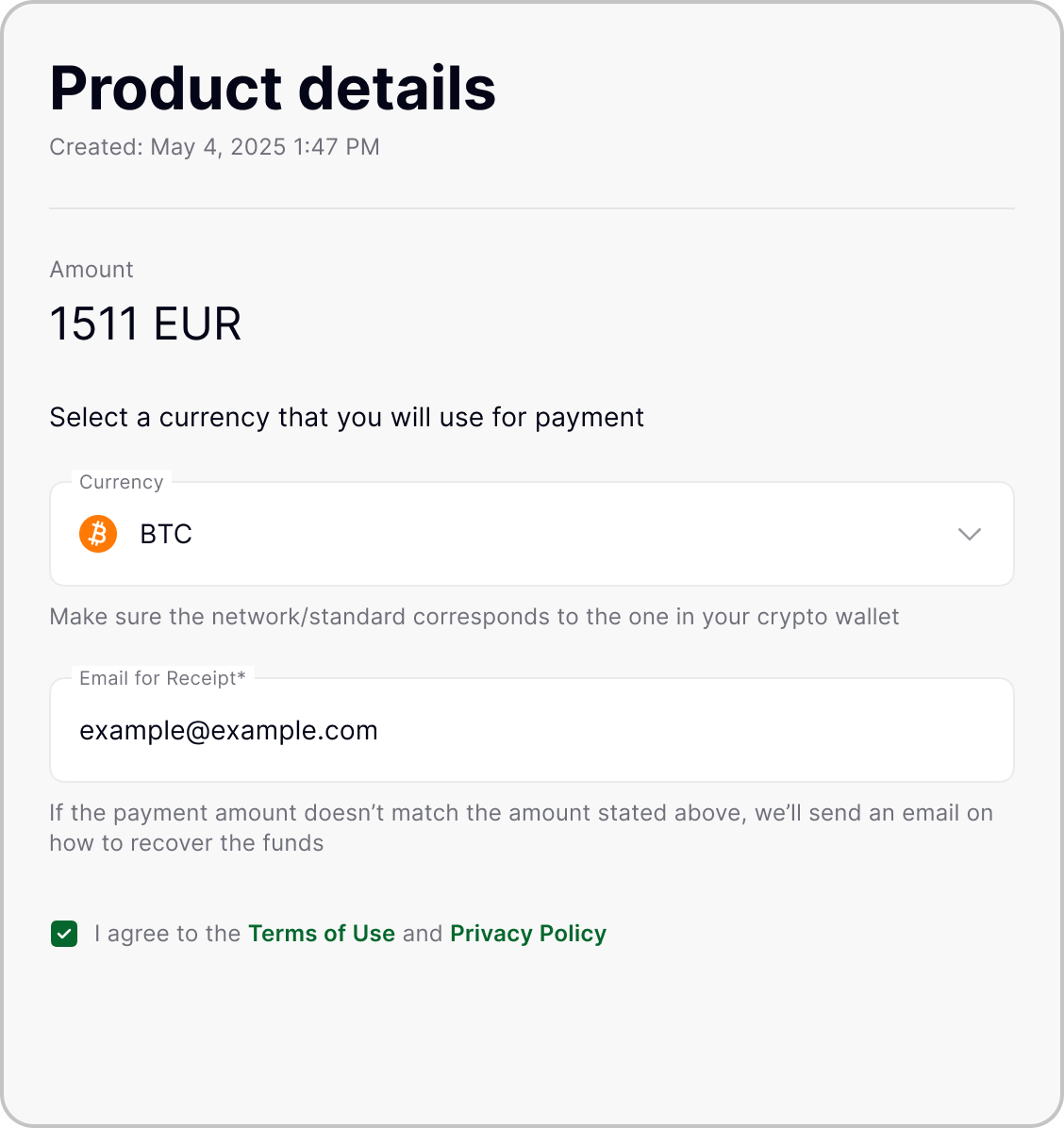

How to Open Crypto Account in 4 Steps

Submit your company documents and sign the agreement to activate your corporate crypto account.

Start with a no-code business cryptocurrency wallet, install a plugin for WooCommerce, Magento, PrestaShop, or OpenCart, or connect through the full API.

Choose from 20+ supported coins and 40+ fiat currencies, and set automatic conversion with fixed exchange rates for stability.

Begin receiving, sending, and managing transactions from your dashboard. Add mass payouts as your operations grow, making it a flexible crypto account for business.

Boost your business with crypto

Who needs a business crypto account?

Download the Report ↓

What’s Inside:

- Key market metrics and adoption trends

- Regional insights for strategic planning

- Benefits and risks of crypto payments

- How leading companies stay compliant and secure

| Characteristic | Business Crypto Wallet | Business Crypto Account |

|---|---|---|

| Main function | Secure storage and manual transfers; best for low-frequency, manager-controlled payments. | Full management of company crypto flows across payments, treasury, conversions, and reporting. |

| Accepting client payments | Limited or manual acceptance (e.g., payment links or direct transfers); no checkout plugins. | Fully supported checkout with hosted/API flows and plugins for WooCommerce, Magento, PrestaShop, OpenCart, Drupal, Joomla, and Shopify. |

| Conversion to fiat | Manual actions and bank withdrawals only. | Automatic conversion rules with instant settlement into 40+ fiat currencies, plus manual options for flexibility. |

| User roles | Basic team access for operational use. | Advanced role system with owner, accountant, and admin permissions, plus approval limits for security. |

| Reporting & compliance | Payment records for reconciliation; KYB required on onboarding. | Comprehensive dashboards, exportable reports, AML/KYC screening, and fully licensed operations. |

| Mass payouts | CSV-based batches (up to 100 per run) from the dashboard. | CSV and API-driven mass payouts with live monitoring – ideal for affiliates, employees, and contractors. |

| API for business | Typically not required; limited integration options. | Full REST API for payments, payouts, treasury, and reporting – built for crypto accounts for enterprises. |

| Plugins & CMS | Not applicable. | Official plugins for WooCommerce, Magento, PrestaShop, OpenCart, Drupal, Joomla, and Shopify. |

| Licensing & security | EU-regulated product with 2FA and secure custody practices. | Licensed secure crypto account with AML/KYC, role-based access, whitelists, and multi-step approvals. |

Customer success stories powered by our crypto solutions

FAQ

Yes, CoinsPaid is a legal, Estonia-licensed crypto provider, that follows strict AML/KYC procedures, making it a secure crypto account with AML/KYC controls suitable for regulated corporate use.

The cryptocurrency business account supports 20+ digital assets, including Bitcoin, Ethereum, and USDC, and settlements in 40+ fiat currencies such as USD, EUR, and GBP via SEPA or SWIFT. This makes it a true multi-currency crypto account for international business.

Yes. You can run mass payouts for salaries, affiliate commissions, or contractor payments. Payments can be uploaded via CSV or automated with the API, making it ideal for cross-border crypto transactions.

No. Opening a crypto business account is as simple as submitting company documents for KYB verification. You can start with a no-code business cryptocurrency wallet and scale into plugins or APIs as your needs grow.

Yes. The system offers automatic conversion with fixed rates at checkout, protecting you from volatility. Funds can be settled directly into your bank account in fiat.

Yes. CoinsPaid provides OTC and liquidity services with competitive rates for trades starting from €1M, ensuring enterprises get the best value on high-volume conversions.

Yes. The corporate crypto account includes both CSV-based and API-driven mass payouts, letting you manage global payroll and vendor payments from one dashboard.

Yes. The crypto account for business integrates easily with online platforms. Plugins are available for leading CMS systems, and APIs allow connections to CRMs, ERPs, and custom workflows.

Yes. CoinsPaid offers official plugins for WooCommerce (WordPress), Shopify, Adobe Commerce/Magento, PrestaShop, OpenCart, Drupal, and Joomla – perfect for businesses seeking a bitcoin merchant account or a full crypto for business checkout.

Yes. Enterprises can connect via REST API for payments, payouts, reporting, and treasury management, making it a flexible solution for crypto accounts for enterprises.

Transactions are confirmed in minutes, with exchange rates locked at the moment of payment. This ensures fast, predictable settlements for bitcoin for business and other crypto payments.

Yes. The digital asset account for business includes 2FA, role-based access, multi-step approvals, whitelisting, and customizable transaction limits for maximum security.