Crypto and Economic Crisis

The world isn’t in the best place economically. The global cost of living crisis together with tightening financial conditions and the lingering effects of Covid-19, is weighing heavily on our global economic outlook.

How the crypto space is reacting to these tremendous changes in the global economy.

How Is Crypto Reacting to the Global Economic Crisis?

Volatile cryptos have been decreasing in value

When times are tough, bets are hedged and spending is tightened. This means that riskier, more volatile assets are often sold by investors. Crypto is a highly volatile asset, largely due to the lack of sufficient collateralization. This means that their price either depends on the combination of technology advantages and prospects, marketing efforts and hype.

As for stablecoins, such assets are supported by ‘collateral’ in another cryptocurrency that is deemed to be more stable.

However, whereas volatile currencies such as Bitcoin and Ethereum shrank in value, we’re actually observing a growing stablecoin supply. Based on our internal analytics at CoinsPaid, there’s an increased corporate interest in stablecoins as a low-risk path to crypto investment. Cryptocurrencies such as USDT and USDC that have a 1-to-1 rate to the US dollar, have been experiencing a growing interest among businesses.

Investment in the crypto space is slowing

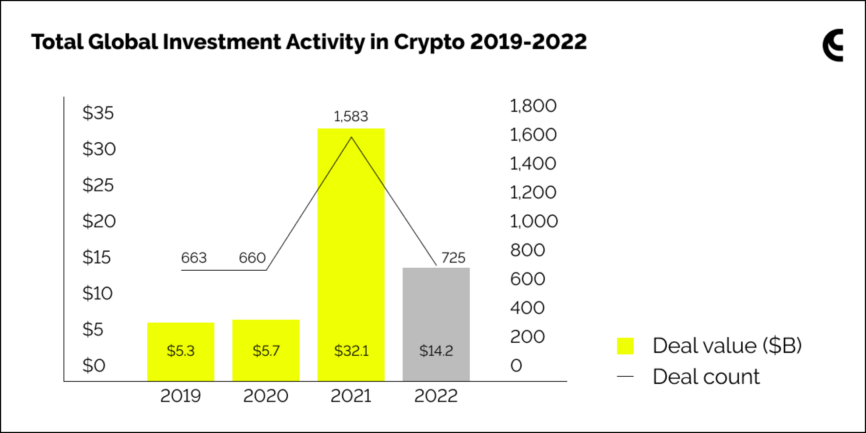

Statistics from KPMG show that global investments in cryptocurrency companies plummeted from USD $32.1 billion over the first half of 2021, to $14.2 billion over the same period in 2022. Of course, investors are much more likely to wait until the next bull run to dig deep, and a drop in investment should be expected in line with a global economic crisis.

However, this drop isn’t as significant as you might think. Interestingly enough, this is more or less in line with the reduction in the industry’s market capitalization. In addition, deal flow actually increased from 456 to 534, demonstrating that the number of projects gaining funding has actually grown. According to a new report, KPMG expects investors to move away from projects that focus on NFTs and other tokens, and toward projects focusing on developing blockchain infrastructure, especially those that integrate the blockchain into updating financial technologies.

Crypto adoption is on the up

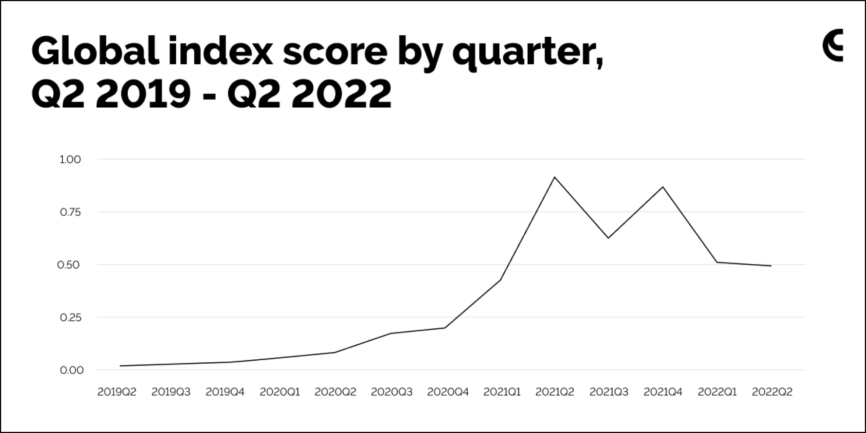

This is especially true for emerging markets. Notably, Vietnam, the Philippines, Ukraine and India take the top spots on the 2022 global crypto adoption index by Chainalysis. It seems curious that noting the diminishing demand for cryptocurrencies, we’re observing a growth in their use and adoption. Crypto.com estimates 300 million users of cryptocurrency worldwide. This is a 275% increase from their January 2021 figures. This is certainly plausible when we consider that price is not governed by how many people use crypto, but rather how much money is being pumped into the industry.

The reason for this growing adoption is likely to be fears over inflation — a crypto asset management firm, Grayscale, conducted a survey and found that the struggling global economy has translated to a growing desire to interact with crypto for over a quarter of those surveyed. Moreover, the economies listed in the 2022 crypto adoption index happen to be the same ones plagued by severe inflation over the year. Whereas it is a complex and costly procedure to open a bank account in a different currency, it takes only a few steps to purchase crypto, which by nature is much more mobile and accessible. All that’s needed is an internet connection and a smart device.

Crypto Payments Industry Remain Unaffected

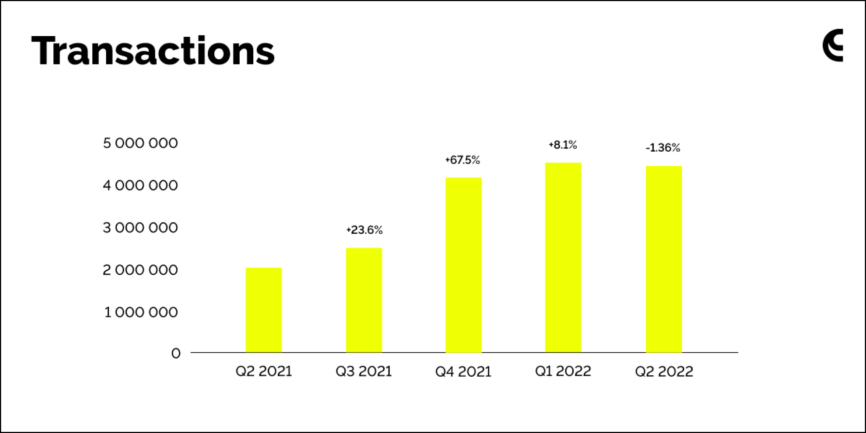

Although the global economic crisis has put immense pressure on the financial markets, crypto included, some digital asset sectors remain largely unaffected. The data shows that the cryptocurrency payments industry is still on the up despite the negative news sentiment.

With greater crypto adoption, desire for crypto-savvy merchants is on the rise too. With this desire comes greater interest in accepting crypto payments among businesses worldwide. This interest leads to research, which uncovers a whole host of benefits to accepting crypto as a payment medium:

- Fees can be reduced by up to 80%;

- Payments are instant, regardless of geography;

- Chargebacks and rolling reserves are eliminated;

- 24/7 access to funds.

Being the largest crypto payment gateway in the world by volume, CryptoProcessing by CoinsPaid processed 4.9 million transactions in Q3 of 2022. This is almost double the 2021 figure of 2.5 million. Regardless of the ‘crypto winter’, the number of payments are increasing — a fine sign of the health of the market.

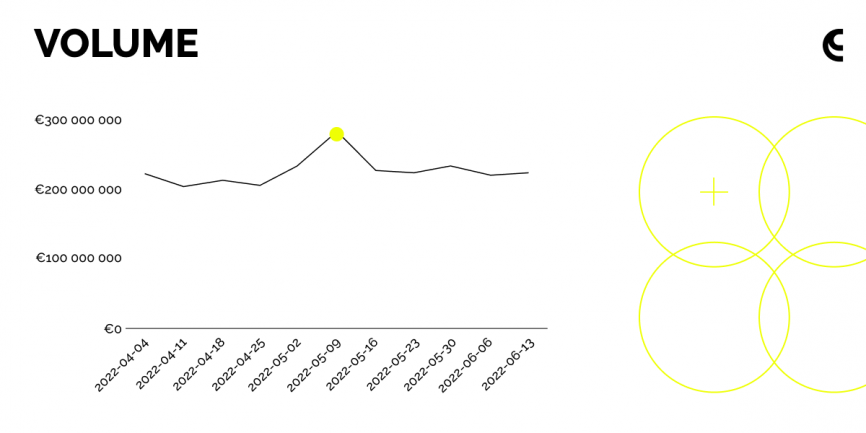

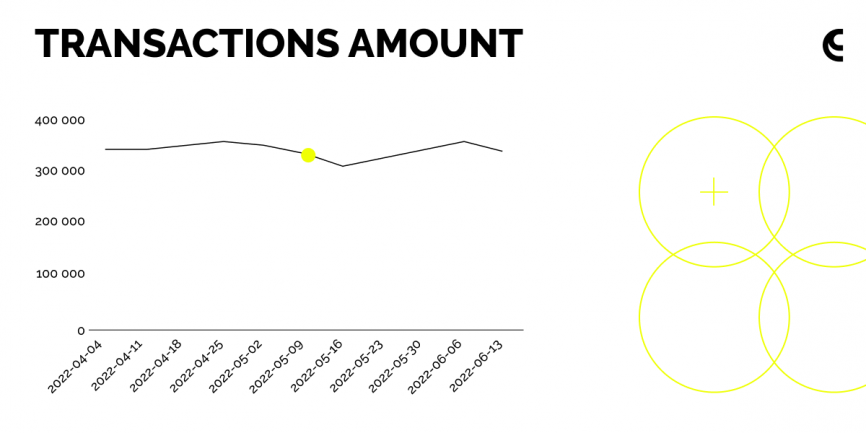

Moreover, we have studied how the negative events in the cryptocurrency industry affected our merchant’s crypto volumes. For instance, as it turns out, processed volumes were not affected at all by Terra Luna collapse. Check out the statistics below to see the actual figures:

Where Are Crypto and Blockchain Headed?

It’s quite easy to look at the headlines each day and come to the conclusion that crypto is on its way out. That’s because price is the first thing that people look at. Scratch the surface a little and you’ll find a shocking revelation — the underlying technologies of decentralisation and the blockchain are not only here to stay, but are gaining traction faster than ever before. Let’s take a look at three notable trends.

Post pandemic, there’s pressure for decentralisation. As such, demand for payments on the blockchain is expected to skyrocket. The clunky smoking mega-machine of centralisation seems to be on its way out, and the recent pandemic has a part to play. With many health services being pushed to the brink, patients were forced to track down their own health records from a range of different doctors and insurers, all the while making sure that this information is correct and up-to-date.

"In times of economic uncertainty, businesses are increasingly looking for low-risk paths to crypto investment. Stablecoins, due to their price stability and resilience in volatile markets, are seeing a growing demand."

With a decentralised system, patients wouldn’t have to worry about such problems – information could be kept in a private, streamlined and user-friendly exchange that would result in less confusion for medical professionals and insurers, and ultimately, better care for patients.

Moreover, the pandemic pushed the workplace online. More and more people are now moving abroad as they are no longer required to live in an expensive city. This means demand for decentralised financial services is on the up. Employees are looking for a stable payment medium with the cross-border potential of cryptocurrencies and stablecoins are taking centre stage as a result.

Transparency and regulation is coming, pushing more trust into the industry. The FTX collapse has been branded as a stake to the heart of the crypto industry. However, it’s much more likely to be a ‘ripping off the plaster moment’. The FTX debacle set an example of the bandits in crypto’s wild west, and crypto companies are now falling in line. According to Grayscale’s survey, around 79% of Americans are looking for clearer regulation when it comes to crypto – there’s certainly pressure for regulation in the US, while in the UK, the recent Financial Services and Market Bill aims to “establish a safe regulatory environment for stablecoins – which may be used for payments.” More transparency is needed in the realm of cryptocurrencies and it’s coming, albeit slower than we’d like.

At this point, it would be vital for the crypto industry players to get in line with the inevitability of regulation to provide security for their customers. Thus, CoinsPaid is an EU-licensed crypto services provider that fully complies with the AML and KYC policies. Moreover, we have 2 blockchain risk scoring systems in place to detect any suspicious transactions, as well as cold storages for safely storing the clients funds.

Speaking about client’s funds — unlike FTX and many other crooked companies, CoinsPaid never uses client’s funds for operational and investment purposes. Our merchants retain 100% access to their money at all times which can be further withdrawn to the regular fia bank accounts.

Better regulation has led to more companies getting involved with offering crypto as a payment medium to increase their cross-border transactions – a trend we expect to continue as the industry becomes more transparent over time.

Summary

If you take one thing away from this article, let it be this — the market capitalization of the crypto industry is not a valid indicator of its true value. Scratch a little deeper and you’ll see that while the flowers of the industry have been cut down by the global economic crisis, roots are spreading deep and wide. As soon as the snow melts, flowers will sprout like never before.

Key Takeaways:

- Global economic growth slowed from 6.0% in 2021 to 3.2% in 2022, marking one of the weakest performances since 2001. Inflation surged globally to 8.8%, with countries like Turkey and Argentina facing rates above 80%.

- As riskier assets were sold, crypto market capitalization dropped 65%, yet stablecoins such as USDT and USDC saw rising demand due to their resilience and 1:1 fiat peg.

- Global crypto investment fell from $32.1 billion (H1 2021) to $14.2 billion (H1 2022), but deal volume increased by 17%, showing that while valuations shrank, innovation continued.

- Emerging markets including Vietnam, the Philippines, and India lead global adoption – driven by inflation fears and easier access to crypto compared to traditional banking systems.

- Despite “crypto winter,” the crypto payments sector remains strong – CoinsPaid alone processed 4.9 million transactions in Q3 2022, nearly double the 2021 figure.

- Stablecoins and blockchain infrastructure are gaining traction as businesses seek low-risk entry points and long-term digital finance solutions.

What this means for your business

Market cycles come and go – while speculative trading has cooled, the real-world crypto use keeps growing, led by stablecoins and B2B payments. In uncertain times, businesses pick licensed partners, strong controls, and faster settlements. Compliance becomes key, and as regulatory frameworks improve, crypto adoption is expected to accelerate in B2B transactions, eCommerce, and fintech. Businesses that embrace licensed partners and blockchain payments now will be better positioned to thrive as the situation develops.

CoinsPaid helps companies navigate the economic turbulence with a compliant, secure, and fast crypto payment infrastructure. Stablecoins remain among the most popular choices during market downturns – retaining the value of assets they’re pegged to, which is convenient for businesses.