Embrace the Era of the Bitcoin Payment Gateway in 2026

Partner with CoinsPaid – the best bitcoin payment processor – and experience a dramatic business transformation this year. Accept crypto payments online seamlessly, and convert them to over 40 fiat currencies.

Bitcoin and cryptocurrency aren’t just the future — they’re now. They’re cost-effective and far more secure than traditional bank cards. Ensure you accept bitcoin payments on your website with ease and precision.

Why should you consider accepting cryptocurrencies within your business?

- Global Reach: Cryptocurrency knows no borders. Engage customers from any corner of the world without worrying about currency conversions or cross-border fees.

- Lower Transaction Costs: Traditional banking systems and online money transfers usually involve higher fees and exchange costs, while cryptocurrency may minimise them.

- Near-Instant Settlement: The launch of Square Point of Sale apps in 2025-2026 will let customers pay with Bitcoin by scanning a QR code at checkout. Powered by Lightning Network technology, these payments settle almost instantly.

- Fraud Reduction: A payment made with digital assets cannot be reversed after the fact. This can protect businesses from potential losses caused by fraud.

- Access to a New Customer Base: Cryptocurrency adoption is on the rise. By accepting Bitcoin, businesses can tap into a new segment of potential customers who prefer to pay with crypto.

- Enhanced Privacy: Cryptocurrency transactions provide more anonymity than other forms of payment. Some customers may prefer the additional privacy this offers.

"Accepting cryptocurrency is important for future-proofing your business, sure. But, it’s also about tapping into a global market, cutting costs, and offering a more secure, efficient way to transact right now."

As Cointelegraph reports that it is estimated that Bitcoin payments will reach $3.7 billion by 2031. This crypto adoption reflects a forward-thinking mindset. By integrating cryptocurrency payments, businesses can showcase their commitment to innovative and customer-focused strategies.

Moreover, it’s easier than ever to convert cryptocurrency to fiat currencies, ensuring fluidity in business operations.

If you’re aiming to diversify your payment methodologies and open new avenues of revenue, now is the moment to embrace the cryptocurrency movement. Integrating a trusted system like CoinsPaid ensures you capitalise on this financial shift with utmost security and efficiency.

Why Choose CoinsPaid for Crypto Payments?

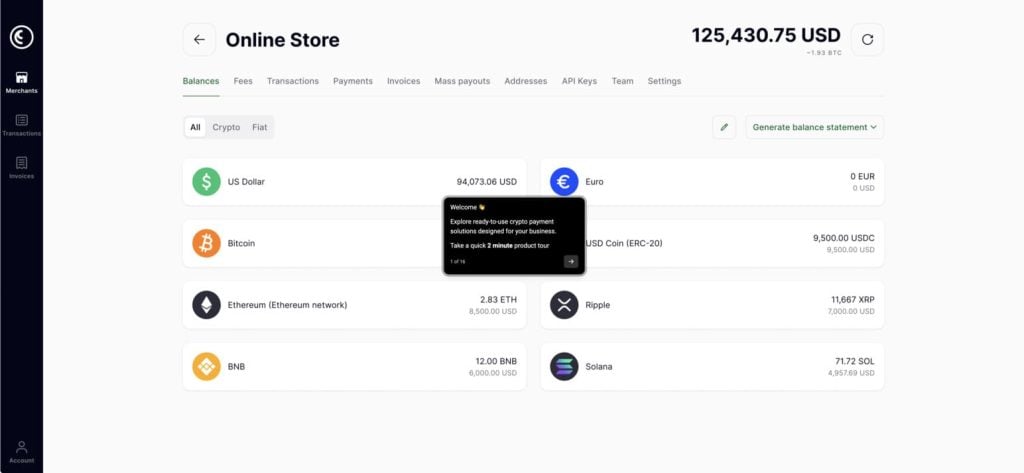

CoinsPaid’s CryptoProcessing stands out as a premier cryptocurrency payment gateway, offering businesses a secure, legal, and economical avenue to accept crypto transactions. Boasting over 9 years in the sector and catering to 800+ merchants, it meets diverse business requirements through its array of payment options.

CryptoProcessing.com accommodates 20 leading digital currencies, such as Bitcoin, Tether, Ethereum, and Litecoin. Additionally, it provides an immediate exchange to 40 conventional currencies, ensuring businesses can avoid holding cryptocurrencies. Withdrawals are streamlined, with funds directly transferred to merchants’ bank accounts.

Bitcoin Merchant Account Benefits

- Customer Value: We make it easy to accept cryptocurrency payments and prioritise delivering top-tier services.

- Currency Versatility: Accept 20+ leading cryptocurrencies and 40+ primary fiat currencies using our btc payment gateway.

- Real-Time Conversion: Instantly convert crypto to fiat and vice versa.

- Swift Transactions: Immediate transfers in BTC, ETH, BCH. Receive bitcoin payments instantly.

- Multiple Settlement Options: Fiat settlements available in 6 currencies through our cryptocurrency payment processing engine.

- Transparent Fees: Competitive rates between 0.8%-1.5% with no hidden charges.

- Exclusive Discounts: Up to 50% off for CPD token holders.

- Convenient Payments: QR codes and bitcoin payment links available for ease.

- Simplified Payouts: btc online payment distributions made simple to multiple addresses.

- Robust Security: Immediate alerts for any suspicious bitcoin payment system activity.

- Hassle-Free Integration: Integrate our bitcoin gateway and crypto payment API quickly and securely.

- Verified Cybersecurity: Our btc payment processor and systems have undergone rigorous security audits.

Bitcoin Payments in 4 Steps

Learn with a Free Demo: We’ll show you the power of our bitcoin payment provider and the advantages of crypto payment processing solutions.

Smooth Integration: A dedicated account manager ensures seamless btc payment solution setup.

Test and Launch: Showcase the “Pay with BTC” option on your site.

Boost Your Audience: Announce you accept bitcoin payments and altcoins. We’re here to assist every step of the way.

Why Giants like Microsoft & PayPal Embrace Bitcoin Payment Services

As of 2025, more than 15,000 companies accept Bitcoin. While names like Microsoft, Amazon, and Tesla are well-known, adoption now spans businesses of all sizes. On August 11, American convenience store chain Sheetz, with 700+ locations, announced it would accept Bitcoin and other cryptocurrencies, offering customers a 50% daily discount for crypto payments. Lomond School in Helensburgh will allow tuition fees to be paid in BTC, and global retail giant SPAR is trialing cryptocurrency payments in Switzerland, accepting Bitcoin via the Lightning Network at its Zug store.

BTC’s reach across sectors reflects the clear benefits it brings to payments:

- Cost-Effective: Enjoy up to 80% savings compared to card payments.

- Absolute Control: Access 100% of your funds with transparent transactions.

- Growing Audience: 300 million crypto holders worldwide, increasing threefold annually.

- Zero Chargebacks: Save considerable amounts annually with our cryptocurrency payment service provider.

- Increased Loyalty: 99% acceptance rate means happier customers.

- Stand Out: Gain a competitive advantage with our bitcoin merchant account services.

Our Payment Suite to Boost Conversions

- Channels: Accept bitcoin and crypto deposits effortlessly, allowing customer account top-ups at their convenience.

- Invoices & Payment Links: Settle bitcoin payments linked to a specific fiat amount within a defined timeframe.

- Plug and Pay: An industry-first: recurring crypto top-ups made easy.