What is stablecoin?

Stablecoins, launched in 2014, were designed to maintain value and reduce crypto price swings. Many are backed by fiat currencies like USD or EUR

Table of contents:

Stablecoins were introduced in 2014. They were created to maintain a fixed value over time and address the extreme volatility often associated with traditional cryptocurrencies. Many stablecoins are pegged to stable reference assets, typically national currencies, like the USD or EUR.

This digital form of money allows users to move funds on blockchain networks without dealing with market price fluctuations. Stablecoins combine the transparency, speed, and global accessibility of cryptocurrencies with the price reliability of fiat currencies.

Types of stablecoins

Stablecoins use different models to keep their value stable. These models define how the tokens are issued, managed, and backed. The main categories include fiat-backed, crypto-backed, commodity-backed, and algorithmic stablecoins.

Crypto-backed stablecoins

Crypto-backed stablecoins use digital assets as collateral. These systems rely on over-collateralization to absorb price swings in the underlying assets. For instance, to mint $100 worth of stablecoins, users may need to deposit $150 in cryptocurrencies.

Example: DAI is an example. Pegged to the USD, DAI is backed by Ethereum and other crypto assets. Smart contracts manage the collateral, execute liquidations when needed, and maintain the peg without central oversight.

This type of stablecoin supports decentralization and avoids dependency on fiat. However, its stability depends on the health of the crypto collateral and protocol governance.

Fiat-backed stablecoins

Fiat-backed stablecoins hold reserves in traditional currency or low-risk assets. Each token is tied to a real-world currency, often in a 1:1 ratio.

Example: USD Coin (USDC) is a fiat-backed token issued by Circle. Each USDC token is pegged to one USD. Reserves are held in cash and short-term government securities.

Fiat-backed stablecoins are simple to understand and widely used. However, trust in the issuer is essential, and reserve transparency varies. While some issuers offer detailed reporting, others have faced criticism for limited disclosures.

Commodity-backed stablecoins

Commodity-backed stablecoins represent real-world assets like gold, silver, or oil. Each token is backed by a specific amount of a physical commodity. The value reflects the market price of that commodity.

Examples include: PAX Gold (PAXG) and Tether Gold (XAUT), both backed by physical gold held in secure vaults.

These tokens allow users to gain exposure to physical assets through blockchain. They are often used by users or companies that seek a hedge against inflation or asset diversification within digital finance.

Algorithmic stablecoins

Algorithmic stablecoins use code instead of collateral to manage supply and demand. Smart contracts increase or reduce the number of tokens in circulation to stabilize the price.

If the token trades above the target price, the protocol mints more tokens to reduce upward pressure.

If the price drops, it removes tokens to reduce supply.

Examples include: Ampleforth (AMPL), USDD, and Frax, which uses a hybrid model, that combines partial collateral with algorithmic controls.

These systems aim to preserve value through automatic adjustments, but they can be complex and less predictable. Many algorithmic models remain in experimental phases, and some have failed to hold their pegs during periods of stress.

Business use cases for stablecoins

Stablecoins offer significant utility for companies operating in digital or global markets. Their ability to retain consistent value makes them ideal for real-world use cases across sectors.

Payments

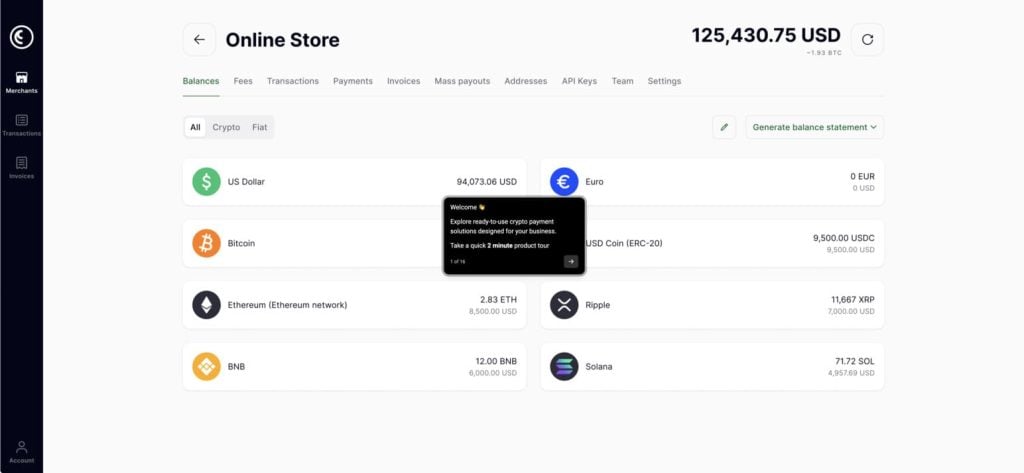

Businesses use stablecoins to receive and send payments through crypto payment gateways without relying on credit card networks or bank transfers. This method may reduce transaction fees and avoid chargebacks in many cases. Transactions are settled quickly, and merchants receive full payment without intermediaries.

For example, eCommerce stores, SaaS providers, and marketplaces that seek faster cash flow and lower operational costs can accept payments through a business wallet. It also expands access to customers in regions underserved by banking systems.

Settlements

In B2B environments, stablecoins simplify settlements. Companies that operate across multiple time zones can move funds 24/7 without delays. Traditional settlement systems depend on banking hours and clearing periods, while blockchain-based payments operate without downtime.

A financial institution or OTC desk (over-the-counter trading desk) dealing with large-volume digital asset transactions may use stablecoins to settle trades securely and efficiently. Stablecoins help reduce counterparty risk while maintaining liquidity across jurisdictions.

International transfers

Sending money through banks or remittance services often takes several days and includes high fees.

With stablecoins, businesses and individuals can send digital assets worldwide within minutes. It can make operations possible in markets where access to banking is limited or unreliable.

Remote teams can be paid via stablecoins into wallets with appropriate security practices in place, which offer immediate access to funds and quick conversion options if needed. This speed and flexibility support cross-border teams and independent contractors.

Payroll and contractor payouts

Many companies pay remote teams and freelancers in stablecoins. It can provide consistent value delivery regardless of local currency fluctuations.

Stablecoins support real-time crypto payments, reduce foreign exchange complications, and ensure timely compensation. Contractors can convert their earnings into local currencies or hold them on-chain for later use.

This use case is growing across digital media, content creation, and global freelance platforms.

Access to decentralized finance

The predictable value of stablecoins allows DeFi applications to function without volatility.

For platforms operating on blockchain, stablecoins reduce conversion risk and improve operational efficiency. They are also widely used in decentralized exchanges (DEXs), derivatives, lending platforms, and yield farming systems.

Stablecoins make DeFi more accessible and practical for real-world applications through price certainty.

Advantages of stablecoins:

- Stablecoins provide a fixed-value asset that avoids the volatility of traditional cryptocurrencies. This predictability supports practical use in business transactions.

- Many stablecoins trade on major exchanges and platforms. Users can convert them quickly and at a low cost.

- Stablecoin transactions are confirmed in seconds. This speed improves cash flow.

- Businesses can access customers, partners, and services worldwide without waiting for bank clearance, as stablecoins operate across borders.

Risks and limitations

- Many stablecoins rely on a central issuer. It can create a single point of control and introduce regulatory and trust issues.

- Not all issuers disclose reserve details. Lack of transparency can undermine confidence in a token’s value.

- Global regulators continue to examine stablecoin operations. Rules on reserves, redemption, and reporting may evolve.

- Stablecoins do not offer price growth. Their design is focused on stability, not capital gains.

Conclusion

Stablecoins are digital currencies designed to maintain a consistent value, typically pegged to fiat currencies like the USD or EUR. Introduced in 2014, stablecoins solve one of crypto’s biggest challenges: price volatility. By combining the reliability of traditional currencies with the efficiency of blockchain, they are widely used in payments, settlements, international transfers, and DeFi applications.

Different types — fiat-backed, crypto-backed, commodity-backed, and algorithmic — offer varying benefits and risk profiles. Whether you’re an eCommerce business, a SaaS platform, or a global employer, stablecoins allow you to move funds quickly, avoid high fees, and reduce currency risk across borders.

Mention of third-party stablecoins is for informational purposes only and does not constitute endorsement or partnership by CoinsPaid.

Other Terms from the Crypto Industry