Crypto Use Cases Relevant for 2025

Abstract: Explore the revolutionary impact of cryptocurrencies and blockchain technology in 2025 across diverse sectors, from making global payments more efficient to reinventing finance and beyond.

Discover how these digital advancements are transforming payments, DeFi, gaming, and supply chain management, driving widespread adoption and offering unprecedented opportunities for businesses and individuals alike.

Introduction

In this era of rapid technological progress, the blockchain has evolved into a powerful force, transcending to a popular tool for transaction processing, laying the groundwork for innovative solutions like crypto payment gateway for businesses.

Think of the blockchain’s evolution as transforming from a quaint, cobblestone road in 2009 into a cutting-edge, expansive freeway in 2025.

In the beginning, the road was primarily traversed by black-market travellers looking to evade the watchful eye, along with the settlers of the surrounding land.

Traditional financial systems, akin to motorways built in the 70s, were more efficient comparables, even though they had their own flaws, such as cracks in the tarmac and inevitable traffic jams during rush hour.

However, slowly but surely, the cobblestone route revealed hidden advantages: a foundation of solid, chalky soil holding the prospect of stability, lower costs, and the promise of consistent upkeep. This sparked a transformative era, a decade of fervent development and innovation.

The blockchain of 2025 is nothing like its predecessor, now enhanced with multiple lanes for rapid and efficient travel, symbolising its improved speed, security, and cost-effectiveness. So, let’s delve deeper – what are crypto and the blockchain being used for in 2025?

Payments and Remittances

In 2025, the most significant application of cryptocurrency will undoubtedly be in payments and remittances. The 2025 PayFi Report shows that 35-36% of users choose crypto for gaming, everyday purchases, and travel bookings. This might not be surprising, but it represents a notable shift from earlier times.

"Crypto payments are changing the game for businesses. Beyond saving on fees, blockchain brings speed, security, and transparency that traditional systems just can’t match."

Previously, the primary motivations for buying crypto were either for investment purposes, hoping for future profits, or for anonymous transactions, which were sometimes associated with unauthorised activities on the dark web. The broad-based shift can be observed from the figure below.

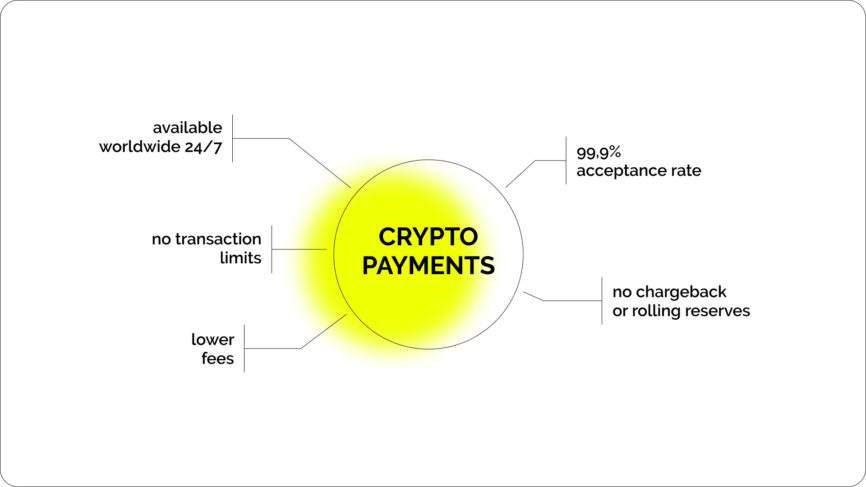

Indeed, the global financial system seems to be waking up to the benefits of the blockchain as a conduit for seamless and efficient payments. This is especially prominent against the backdrop of traditional payment methods, such as bank transfers or checks, which often involve intermediaries, resulting in delays and additional costs. Let’s take a closer look at some B2B blockchain benefits.

- Lower costs. B2B transactions in crypto can occur directly between parties without the need for intermediaries like banks. This reduction in intermediaries translates to lower transaction fees, particularly for international payments.

- Faster settlements. Transactions using cryptocurrencies are processed faster compared to traditional banking systems. This is especially crucial for businesses engaged in global trade, as it speeds up the movement of goods and services.

- Global reach. Cryptocurrencies are not confined by geographical borders. This empowers businesses to trade internationally without the constraints of traditional financial systems.

- Enhanced security. Blockchain technology, the backbone of cryptocurrencies, offers robust security features. Each transaction is cryptographically secured and recorded on a decentralised ledger, reducing the risk of fraud or tampering.

- Simplified management of remote teams. As more and more businesses begin to open accounts in crypto and hold various digital currencies on their accounts, the opportunity of paying employees and freelancers in cryptocurrencies becomes available. This approach allows for borderless salary disbursements, making it especially convenient for remote workers or international teams.

- Transparent fundraising. Additionally, charities and non-profit organisations are increasingly accepting cryptocurrency donations due to the transparency and traceability of blockchain technology. Donors can verify how their contributions are utilised, enhancing trust.

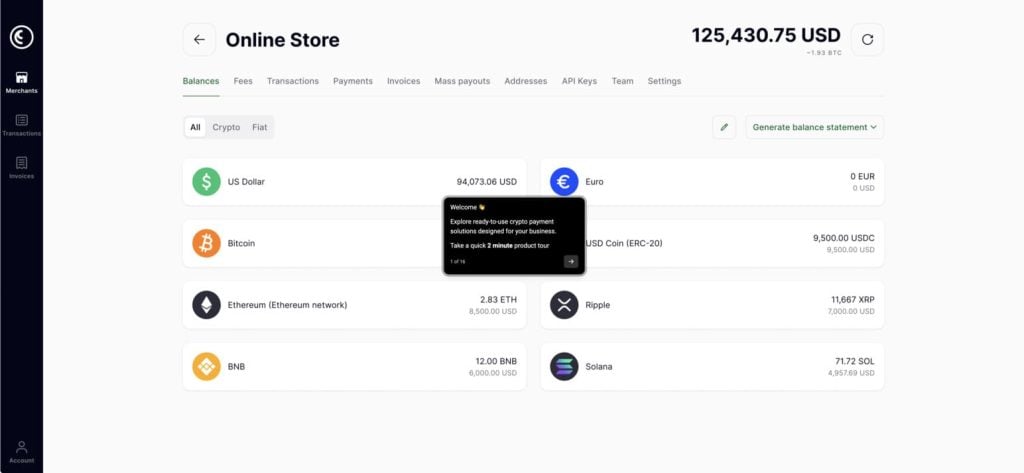

For these reasons and more, crypto payments and remittances are certainly on the rise in 2025. CoinsPaid offers a crypto payment gateway that can be integrated with many systems through API and plugins.

Stablecoin Adoption

Stablecoins like USDC are another asset type that is becoming widespread among retailers. Companies such as Walmart and Amazon now accept these digital currencies for payments, a shift made possible by the GENIUS Act. In addition, they are on the way to launching their own stablecoins. This adoption offers clear advantages for both businesses and customers:

- Retailers report a 2-3 % reduction in transaction fees compared to traditional payment methods.

- Payments using stablecoins are processed almost instantly, reducing delays associated with credit cards or bank transfers. Crypto business wallets allow accepting stablecoin payments with minimal delays.

- Customers can make purchases seamlessly across borders without worrying about currency conversion or high fees.

- By integrating stablecoins into everyday shopping, these companies help normalize crypto payments, encouraging broader adoption among consumers.

This trend signals a significant step toward the mainstream use of digital currencies, demonstrating that stablecoins are a practical solution for everyday transactions.

Decentralised Finance (DeFi)

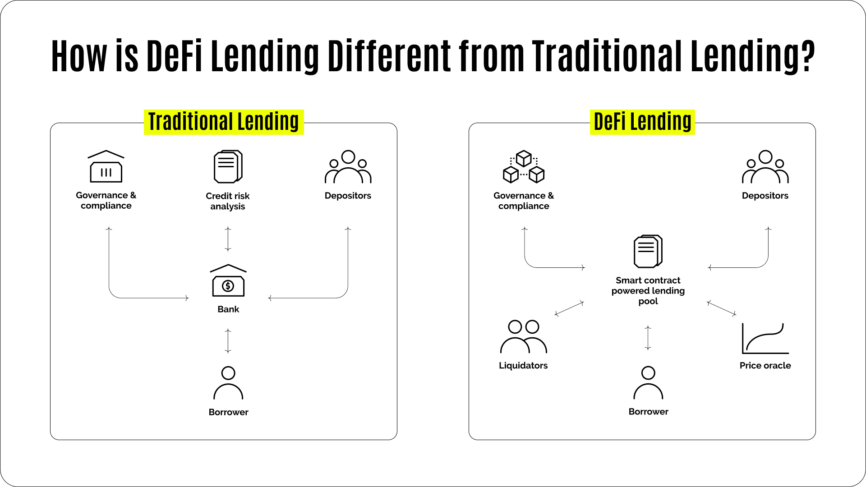

DeFi, or Decentralised Finance, can be likened to a farmer’s market in the world of finance. Just as a farmer’s market removes the need for middlemen like grocery stores, allowing buyers to directly purchase from producers, DeFi eliminates traditional financial intermediaries like banks and brokers. In this marketplace, financial services such as lending are conducted on a peer-to-peer basis using blockchain technology. Such a system can be illustrated in the following way.

As we observe this technology, it has matured significantly, offering more robust, secure, and user-friendly platforms. This evolution has made DeFi more accessible and reliable for the average user. Consequently, there’s a growing awareness and understanding of cryptocurrencies and DeFi among the general public. More and more people are becoming educated about how these systems work and the benefits they offer over traditional finance. As such, the DeFi industry is estimated to grow at a CAGR of 42.5% until 2030, with the market size expected to reach $231.19 billion.

We also should consider the economic factors drawing individual investors to DeFi – 2025 is not only set to be the year of ETF approval and the Bitcoin Halving, but it’s also a period of relatively low interest rates. Hence, DeFi presents more lucrative opportunities. For instance, staking and yield farming can offer significantly higher returns compared to traditional banking products.

Furthermore, DeFi platforms provide financial services without the need for a traditional bank account, making them accessible to a broader global population, including those in unbanked or underbanked regions.

Indeed, DeFi has the potential to include people who have historically been excluded from the traditional financial system, offering them services like lending and borrowing.

With the harvest in mind, there’s no doubt that crypto users are out to market this year.

Gaming and Virtual Economies

Whereas B2B crypto payments and Decentralised trading might not appeal to everyone, gaming, or more specifically, the ‘virtual economy’, attracts a much wider audience. The world’s largest virtual economy, as exemplified by ‘Roblox’, boasts almost 300 million active users globally. There’s a negligible difference in the user experience and payment flow between purchasing ‘Robux’, the game’s in-game currency, for an avatar outfit, and using ETH to buy an NFT.

However, the key difference lies in the fact that an NFT holds real-world value, and ETH can be traded for fiat currencies. Platforms like Artyfact or the Sandbox in 2025, which introduce concepts such as Play-to-Earn (P2E), are acting as gateways to cryptocurrency adoption, drawing more people into the crypto space. P2E games allow players to earn cryptocurrencies or digital assets like NFTs, which have real-world value. This transforms gaming from a simple hobby into a potential income source. GameFi, merging gaming with financial elements such as staking or trading in-game assets, makes games not only entertaining but also financially rewarding, attracting a diverse range of users from gamers to investors. As such, the global Play-to-Earn NFT Games market is projected to reach $6,324.54 million by 2031, with a CAGR of 21.3%.

Moreover, the integration of cryptocurrencies into online gambling and sports betting platforms (iGaming) provides benefits like security, and faster transactions compared to traditional fiat currencies. This has led to an increase in the adoption of cryptocurrencies in the iGaming sector.

Indeed, we’re witnessing a significant expansion in the areas where crypto is being used, which in turn is driving its wider adoption.

Supply Chain Management

If we compare this use case to the other three we’ve studied, Supply Chain Management distinctly stands out. Although Supply Chain Management seems an unlikely contender for crypto use cases, blockchain technology has become increasingly prevalent in the industry. Indeed, data suggests that the blockchain offers significant improvements in transparency, efficiency, cost reduction, and security against counterfeiting.

So, let’s start with tracking. Blockchain technology enables real-time tracking of goods as they move through the supply chain. This transparency ensures all parties involved have up-to-date information. Moreover, smart contracts that automatically execute agreements under specific conditions reduce the need for intermediaries.

IBM’s blockchain-based platform for food traceability is currently used by numerous food suppliers, including Nestle and Dole, to track the supply chain journey of perishable goods. This enhances food safety and reduces waste.

Similar to our other examples, cost reduction also plays a significant role. The use of smart contracts and other blockchain-based tools helps automate many supply chain processes, reducing manual tasks and associated costs. For instance, Maersk, a global shipping leader, has implemented blockchain technologies to automate and simplify its complex supply chain operations, leading to cost savings.

Another benefit relates to blockchain’s immutable ledger, ensuring records cannot be altered retroactively. This feature is crucial in combating counterfeit products. Luxury brands like Louis Vuitton and Prada have joined the Aura Blockchain Consortium to ensure the authenticity of their products by tracking their supply chain on the blockchain.

Tokenization of real-world assets (RWA)

Tokenization converts traditional assets such as stocks, bonds, and real estate into blockchain-based digital tokens. It can improve liquidity, transparency, and access for a wider range of investors.

Analysts estimate that tokenization could unlock up to $2 trillion in global assets by 2030, driven by efficiency gains and broader market participation.

Major financial institutions are exploring tokenization. BlackRock has publicly discussed blockchain solutions for digitizing bonds and funds. Platforms like Robinhood are working on fractionalized ownership for real-world assets, including real estate and collectibles, enabling global trading of previously illiquid markets.

AI Tokens and blockchain integration

AI tokens combine blockchain and artificial intelligence, supporting decentralized AI applications and services.

The AI token sector has seen rapid interest from investors, with some reports showing market capitalization surges of several billion dollars in 2025.

Projects such as Fetch.ai (FET) and SingularityNET (AGIX) gain popularity in 2025, as they are designed to solve real-world problems.

Investment firms and early adopters are increasingly backing AI token projects, anticipating long-term growth as AI and blockchain technologies converge.

Download Free Report ↓

What’s Inside:

- Crypto adoption in marketing

- Which crypto coins and tokens to accept

- Crypto payment types

- Integrating crypto payments

- After integration

Conclusion

Many of the most important blockchain use cases in 2025 stem not from speculation on volatile assets like Bitcoin, but from the practical value the technology delivers. Lower fees, faster transactions, stronger security, and greater transparency remain the main benefits. But the range of applications now goes far beyond payments and DeFi.

Blockchain supports enterprise-scale IoT systems, enabling secure, automated data exchange between connected devices. It strengthens global supply chains, as seen in projects by IBM, Walmart, and Mercedes, where tracking and verification are handled in real time.

Governments and institutions are exploring secure voting platforms, reducing fraud risks, and improving trust in elections. In parallel, digital identity solutions built on blockchain are giving individuals more control over their personal data while making verification easier and safer for businesses.

These advancements underline a key reality: blockchain has evolved into a foundational technology with uses across industries and public infrastructure. And in many areas, we are still in the early stages of adoption. The next wave may change how we authenticate, transact, and interact globally.