Sanctions in the Age of Cryptocurrency: Challenges and Strategies

Sanctions have long served as a pivotal tool in the global arsenal to enforce norms, deter illegal activities, and maintain international order. However, the rapid advancement and adoption of digital currencies have introduced sophisticated challenges to the traditional implementation of these economic measures. Now, more than ever, the effectiveness of sanctions depends on our ability to adapt to the nuances of technology and finance, marking a significant shift in the geopolitical landscape.

Today, we delve into the recent strategic moves by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and explore the broader implications of digital currencies on the global stage. We’ll examine the double-edged sword of digital assets, the innovative efforts to tighten compliance, and the crucial balance between fostering technological advancement and ensuring the digital economy does not become a haven for those looking to circumvent the law.

From Sanctioned Banks to Crypto Transactions: Unpacking the Latest Updates by OFAC

On March 25, 2024, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) made headlines with a significant announcement that underscored the shifting battlefield of economic sanctions. In a decisive move against the Russian Federation, the U.S. imposed targeted sanctions on thirteen entities and two individuals operating within Russia’s growing tech and financial sectors.

The individuals and entities hit by these sanctions were not chosen at random. They were identified as key players in a sophisticated network designed to leverage digital currencies and technologies to sidestep the economic restrictions imposed by the U.S. What makes this action particularly noteworthy is the focus on the misuse of digital currencies – a sector that has exploded in size and significance over the past decade.

To put the situation into perspective, consider the rapid growth of the digital currency market. From a niche interest dominated by tech enthusiasts, it has grown into a global market projected to reach $11.71 billion by 2030. This exponential growth has not only democratised financial transactions worldwide but also introduced new avenues for circumventing traditional financial controls.

The sanctions against these Russian entities and individuals highlight a critical vulnerability in the global sanctions regime – the ease with which digital currencies can be used to launder money, finance illegal activities, and evade economic sanctions. According to a 2023 report by the Global Financial Integrity group, illicit financial flows facilitated by digital currencies have surged by over 300% in the last five years alone, underscoring the urgency of adapting sanctions enforcement to the digital age.

The U.S. Treasury’s OFAC, in targeting these entities, is adapting its strategies to meet these new challenges. By focusing on the digital currency space, the U.S. is not only aiming to block the financial lifelines that sustain unlawful activities but also setting a precedent for how digital finance can be regulated and monitored on a global scale. This approach is a clear indication that regulatory bodies like OFAC are evolving, developing more nuanced and technologically savvy methods to enforce international laws and protect the integrity of the global financial system.

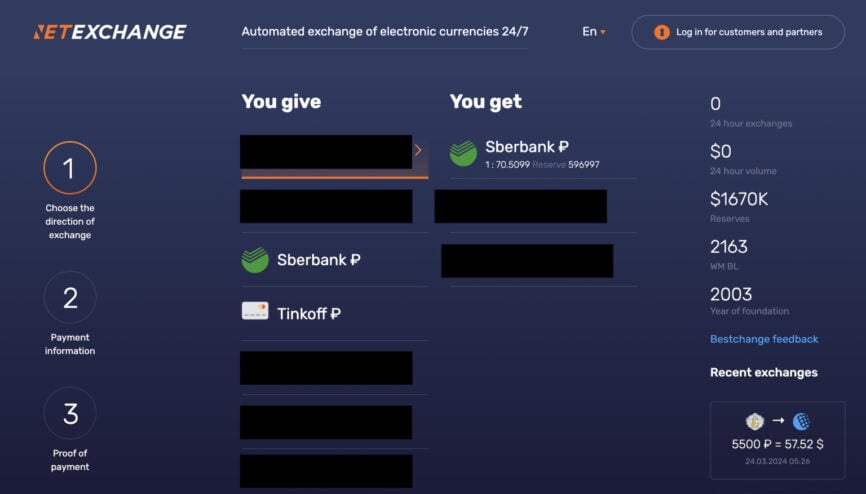

Chainalysis provides a compelling example of such violations: the screenshot clearly depicts a direct breach of sanctions through accepting payments from sanctioned banks. This development also indicates an intensification of regulatory oversight within the cryptocurrency sector, particularly targeting platforms that could, either unintentionally or deliberately, facilitate the evasion of sanctions or other illegal financial activities.

A Walk Down Sanctions History Lane

Sanctions, a strategy for enforcing international norms and deterring illegal activities, are undergoing a significant evolution. Historically, sanctions have been a direct approach, targeting nations or entities through economic and trade barriers. For example, the United Nations Security Council’s sanctions against Iraq in 1990, following its invasion of Kuwait, included extensive economic, military, and trade embargoes, along with aviation and maritime restrictions and an asset freeze, aiming to isolate Iraq internationally and compel its withdrawal from Kuwait.

According to the latest report by the Global digital currency market is now estimated to reach $8.2 trillion by the end of 2024, up from the previous estimate of $6 trillion by the end of 2023. This significant growth in the digital economy continues to reshape the landscape of sanctions enforcement, as the agility and anonymity of digital currencies pose new challenges for regulatory bodies in implementing traditional economic sanctions.

This transformation is marked not just by the sheer volume of digital transactions but also by the inventive ways these digital platforms can be used to evade traditional sanctions. As of 2024, an estimated 20% of international financial transfers are executed using cryptocurrencies, introducing new challenges for regulatory bodies worldwide. The agility of digital currencies, coupled with the anonymity they can offer, poses a sophisticated challenge to the implementation of sanctions that were, until recently, straightforward in their application. Today, the effectiveness of these sanctions hinges on adapting to the rapid advancements in technology and finance, reflecting a broader shift in the geopolitical chess game.

"Sanctions enforcement must adapt to Web3. While crypto brings tremendous opportunities, it also requires a sophisticated approach to ensure that it’s not misused to bypass global laws. The future of compliance is about balancing innovation with regulation."

Mario Fabbrocini

Strategic Customer Success Manager at CoinsPaid

Digital Assets: A Double-Edged Sword

The most recent sanctions bring to the forefront a critical and complex issue: the meteoric rise of digital currencies in the world of global finance.

This digital financial revolution offers unparalleled opportunities for innovation, financial inclusion, and economic growth. However, it also presents a significant challenge: the potential for these assets to be used as tools for evading the sanctions that help maintain international order.

The use of digital currencies to sidestep sanctions isn’t just a theoretical concern. New data reveals numerous instances where entities under sanctions managed to move substantial amounts of money across borders using cryptocurrencies, effectively bypassing the traditional financial system. These transactions often leave a faint trail, making it difficult for regulators to track and stop them.

Moreover, the decentralised nature of many digital currencies means that they don’t pass through the centralised banking systems where checks and balances can be more easily enforced. This decentralisation is a boon for privacy and autonomy but a significant hurdle for regulators. For instance, peer-to-peer exchanges can facilitate the transfer of funds without the need for a traditional financial intermediary, complicating the enforcement of sanctions.

This challenge is compounded by the rapid innovation within the crypto space. New technologies and platforms are constantly emerging, each with its own implications for privacy, security, and the potential for misuse. For example, the advent of privacy coins, which offer enhanced anonymity for transactions, and decentralised finance (DeFi) platforms, which allow for the creation of complex financial instruments without centralised control, add layers of complexity to the regulatory landscape.

Addressing the dual nature of digital assets – balancing their potential for positive impact against the risk of misuse – requires a multifaceted approach. Regulatory bodies worldwide, including the Financial Action Task Force (FATF) and national agencies like the U.S. Securities and Exchange Commission (SEC), are working to develop and implement regulations that can keep pace with the fast-evolving digital finance sector. These efforts aim to ensure that digital finance can thrive but not at the expense of international security and law.

The recent round of sanctions is a clear signal that the international community is aware of the challenges posed by digital assets and is taking steps to address them. By targeting entities that misuse digital currencies for sanction evasion, regulators are not only working to uphold international law but also to secure the integrity and future of the digital financial system. This balancing act between innovation and regulation is critical to ensuring that the digital economy remains a force for good, fostering growth and innovation while safeguarding the principles of international cooperation and security.

Tightening the Grip on Compliance

In a concerted effort to counteract the challenges presented by digital finance, the U.S. and its international partners are escalating their regulatory efforts. This tightening of compliance standards spans the entire digital finance ecosystem, with a keen focus on platforms that could, either by neglect or design, facilitate the circumvention of sanctions. This rigorous approach is a testament to the seriousness with which regulatory bodies are now treating the potential misuse of digital assets.

One illustrative example of this heightened vigilance is the action taken against specific Russia-based blockchain companies. These entities were penalised for conducting transactions with banks that are under sanctions, a move highlighted by the blockchain analysis firm Chainalysis. Such breaches are not trivial oversights but significant violations that underscore the potential for digital currencies to undermine international sanctions.

The implications of these sanctions extend beyond the immediate penalties imposed on the offenders. They serve as a clear warning to all participants in the digital finance sector about the consequences of failing to comply with international regulations. The message is clear: inadvertent or intentional assistance in sanction evasion will not be tolerated.

This initiative is part of a broader strategy to adapt regulatory frameworks to the realities of modern finance. As digital currencies become more ingrained in global commerce, the tools and methods for ensuring compliance must evolve. This includes leveraging advanced technologies for monitoring transactions, developing new legal frameworks that account for the unique properties of digital assets, and fostering international cooperation to enforce these regulations effectively.

For instance, regulatory agencies are increasingly using sophisticated blockchain analysis tools to trace the flow of digital currencies and uncover illicit activities. These tools can identify patterns of transactions that may indicate attempts to launder money or evade sanctions. Furthermore, governments are working together more closely than ever before, sharing information and coordinating actions to close the loopholes that have allowed digital assets to be exploited for unlawful purposes.

In addition to regulatory enforcement, there is a growing emphasis on educating companies operating within the digital finance space. By increasing awareness of the legal obligations and potential risks, regulatory bodies aim to prevent compliance breaches before they occur. This proactive approach is crucial for maintaining the integrity of the financial system and ensuring that the digital economy remains a positive force for global development.

Wrapping up – Our Steps at CoinsPaid

As we draw conclusions, it’s evident that the digital transformation of finance is reshaping the traditional landscape of economic sanctions. This shift, driven by the meteoric rise of digital currencies, necessitates a reevaluation of enforcement tactics to address new challenges head-on.

As the future of global finance unfolds, the collaborative efforts across governments, financial institutions, and technology sectors will be pivotal. Together, they hold the key to developing a regulatory framework that not only addresses current digital dilemmas but is also versatile enough to adapt to future innovations.

Reflecting on our own developments as a company, we are challenged with adapting our solutions so that they are both relevant and complementary to the evolving landscape.

Indeed, we are continually advancing our transaction monitoring system and utilising sophisticated tools that allow for immediate tracing of cryptocurrency origins and alert us in the case of illicit sources.

Simultaneously, we maintain stringent adherence to verification standards for both our clients (KYB) and our partners. This dual approach not only minimises our own risks but also protects our clients from potential exposure. Through these measures, we aim to ensure compliance with international regulations while safeguarding our operations and client interests against the backdrop of an increasingly scrutinised crypto landscape.

We understand that failure to comply with these stringent regulations could not only result in severe penalties but also damage reputational trust, underscoring the critical role of compliance in sustaining operations within the legally permissible boundaries of the global financial system.