How to buy Bitcoin with a credit or debit card instantly

Looking to protect your savings during the financial crisis? Buying Bitcoin is an attractive option since it could gain another 25% in 2021. But what’s the best way to buy BTC with a credit card? Read this guide from the CoinsPaid experts to find out.

Here are just a few of the common questions that we’ll answer in the guide:

- Where can I buy Bitcoin with a credit card?

- How to identify hidden fees?

- How long does the KYC take?

- Is it possible to buy Bitcoin with no verification at all?

- What’s cheaper – wire transfers or paying with a card?

- What’s the best app to buy Bitcoin with a credit card?

Where to buy bitcoin with credit card: 4 types of platforms

If you want to buy bitcoin with a credit card, for investment purposes or to make payments via a crypto payment gateway, you’re spoilt for choice. There are dozens of websites offering this service. They fall into 4 broad categories:

Exchanges (trading platforms).

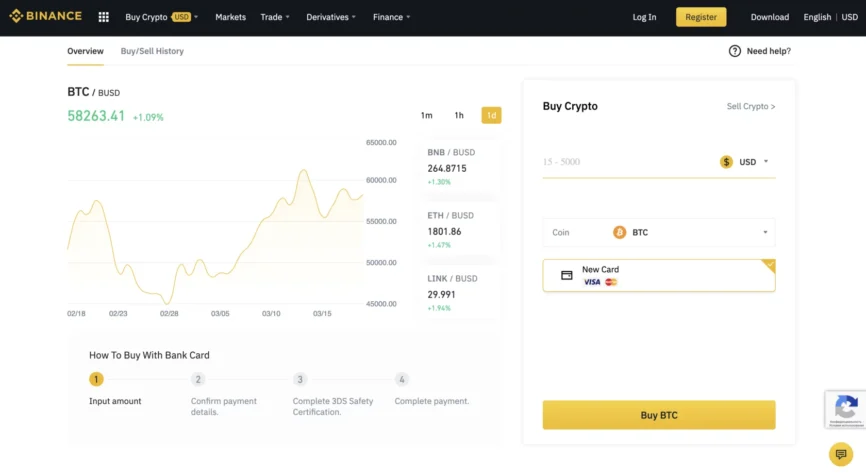

These platforms are designed primarily for active crypto trading, with lots of currency pairs, order books, and advanced order types like take-profit and stop-loss. Examples are Binance, Poloniex, Cex.io, and Currency.com. For those who simply wish to buy BTC with a credit card, they have an additional simplified interface. For instance, compare the two interfaces on Binance:

Binance trading interface

Binance fiat-to-crypto interface

Wallets.

These are apps like Coinbase, Crypto.com, and Trust Wallet. They are designed for storing and sending cryptocurrency, not for trading. You can still convert one crypto into another inside the wallet, but you can’t open limit orders, for example. If you’re not a trader, a wallet that lets you buy BTC with a debit card is probably better and easier than an account on Binance. The average fee is between 3% and 6%. By the way, soon CoinsPaid wallet will also allow you to buy Bitcoin with a credit & debit card.

“Grey zone” exchangers.

These are websites that exist in the grey zone, meaning that they accept just about any means of payment and sell dozens of cryptocurrencies, but their activities are completely unregulated. Most are based in Russia, CIS, or Estonia. Some have a license, while some aren’t even registered as companies. You can find them on the aggregator bestchange.com:

Bestchange interface

Most of these services have some form of a KYC: full name, email address, and phone number but they don’t require any scans or selfies. You can even find ‘grey’ exchangers that allow you to buy bitcoin with a credit card instantly and with no verification. However, remember that such services are also the least secure. You’ll have to transfer them the money and hope for the best because there’s no real guarantee that the exchanger will honor its part of the deal. Plus, they tend to offer unfavorable rates with high hidden fees. But if your main problem is how to buy bitcoin with a credit card and no verification, half-official exchangers are your only option.

P2P sites.

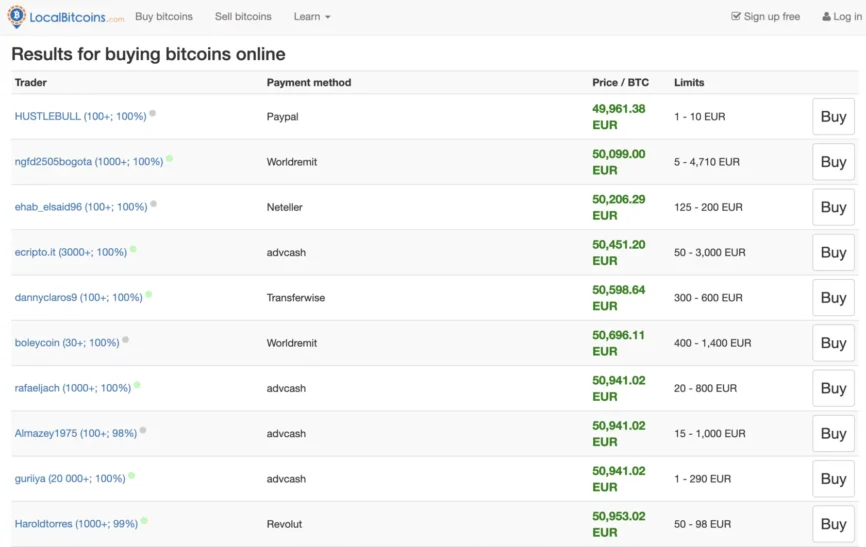

The most famous P2P crypto platform is LocalBitcoins. There you buy from individuals, not from companies, and there are hundreds of offers to choose from. Simply select your country, enter an amount and a currency, and pick ‘Credit card’ from the list of payment options.

LocalBitcoins interface

LocalBitcoins used to be a bastion of independence and anonymity. Just a couple of years ago, you could easily buy Bitcoins with a debit card and no verification. But in September 2019, the website introduced an obligatory KYC to comply with the law.

Is it possible to buy Bitcoin instantly with a credit card and no verification?

You’ll often see ad banners offering you to buy Bitcoin with a credit card instantly. But once you head over to the site, you’ll discover that the process isn’t instant at all. You’ll need to complete a KYC first, and that can be quite laborious! On any secure, regulated platform you’ll have to provide your full name and address, emails, plus a scan of your photo ID and your selfie holding the ID. Many sites also ask for proof of residency (like a utility bill or a bank account statement) and even a photo of the credit card.

On top of that, you’ll have to make sure that the scans and photos are of the correct format and size: no more than 2MB, no less than 700x700px, with all the letters clearly legible, and so on. We’ve even seen sites demand a selfie with the credit card in one hand and the ID in the other! (You’d need a third hand to make that selfie – or someone to take a picture of you.)

The whole process can take anything from 30 minutes to a whole day. If a document doesn’t fit the requirements, your KYC application will be rejected and you’ll need to send another file.

Why do crypto exchanges make it so difficult? Why not just let users buy Bitcoin with a credit card and no verification at all? The reason is that whenever fiat and cards are involved, there’s always an intermediary bank. And no bank will ever work with an exchange that doesn’t verify the identity of its customers. The risk of money-laundering and other illegal activity is too high. So any website that promises that you can buy bitcoins with a credit card instantly and with no verification is most likely a shady or even illegal operation.

Buying Bitcoin with a credit or debit card can be a quick and efficient way to step into the world of crypto. The key is to use a platform that balances ease of access with transparency, so you can avoid hidden fees and make the process smooth.

Max Krupyshev,

CEO of CoinsPaid

Watch out for hidden fees

Before you buy crypto with a credit card, make sure to check two things:

Credit card fee vs. wire transfer fee.

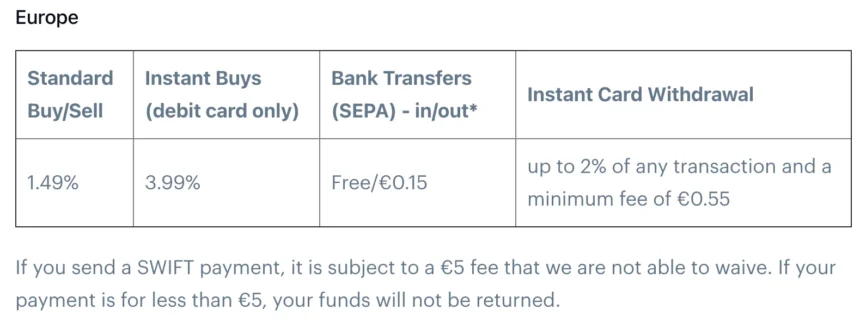

It can be much cheaper to send money from your bank account, especially in Europe with its SEPA system. For instance, here are the fees on Coinbase:

Coinbase fees (Europe)

As you can see, a SEPA transfer will cost you just 0.15 euros, while the debit card fee is a hefty 3.99%. Why? Mostly because of the acquiring bank’s commission.

Acquiring fees are a nightmare for any online merchant. They can exceed 3.5% and eat up half of one's profit margin. That's why so many merchants now start to accept payments in crypto: it allows them to save up to 70% on processing costs.

Max Krupyshev

CoinsPaid CEO

Of course, you’ll have to wait for a day or two at least for the wire transfer to be processed. But if you want to save money, it’s better to use a bank account rather than buy bitcoin with a debit card.

Exchange rate.

If the fee is attractively low, it can be because the commission is included in the exchange rate – and thus hidden from you. As an experiment, we compared quotes on several sites at the same time on October 30, 2020. Binance was selling for $13,096, the best offer on BestChange.com was $13,633, on CoinMama it was 13,865, and on LocalBitcoins it was 14,213! This means that the LocalBitcoin seller’s price is 8.5% higher than on Binance – that’s quite a hidden fee!

Buying Bitcoin with a debit card: is there any difference?

So far we’ve discussed how to buy Bitcoins with a credit card. But what if all you have is a debit card?

The good news is that almost all exchanges that accept credit cards also allow you to buy bitcoin with a debit card instantly. However, some regional types of debit cards may not be accepted. For example, Coinmama accepts Visa and MasterCard debit cards, but not American Express or Discover.

The fees and KYC rules will usually be the same for debit and credit cards. Thus, on a transparent and legal platform, you won’t be able to buy Bitcoin with a debit card and no verification.

Credit or Debit card?

If you have both a prepaid card and a credit card, it’s probably better to buy bitcoin instantly with a debit card – at least if you live in the US or Canada. North American banks sometimes block crypto-related transactions coming from credit cards. In Europe, both types of cards work equally well, but we still advise you to try the prepaid card first.

Can I buy bitcoin with a credit card using a currency other than USD and EUR?

Not all of us have a dollar or euro account. Luckily, most platforms offer several options. For example, on Coinbase you can instantly buy bitcoin with a credit card using GBP, CAD, SGD, and a few others. The undisputed champion is Binance. It accepts 45 fiat currencies, including Peruvian sol, Russian ruble, and Kenyan shilling.

5 of the best sites to buy bitcoin with a credit card

We’ve told you how to buy bitcoin with a credit card, now let’s take a look at a few places where you can do it. Note that none of the options is perfect – there’s always a caveat, be it high fees or limited geographic coverage. A reminder: soon we’ll add the option to buy BTC with a card in our CoinsPaid wallet, with lots of supported currencies and countries!

1. Coinbase

Coinbase logo

We’ve told you how to buy bitcoin with a credit card, now let’s take a look at a few places where you can do it. Note that none of the options is perfect – there’s always a caveat, be it high fees or limited geographic coverage. A reminder: soon we’ll add the option to buy BTC with a card in our CoinsPaid wallet, with lots of supported currencies and countries!

Pros

- Credit card deposits are supported in the EU, US, Canada, and 10+ more countries.

- You can buy 30+ coins.

- Good reputation – established back in 2012.

Cons

- 3.99% credit card fee.

- Setting up & verifying an account can take several days.

- Few payment options.

2. Paxful

Paxful logo

Pros

- Hundreds of offers (similar to LocalBitcoins).

- 300+ payment options, including PayPal and Amazon gift cards.

- You can trade up to $1,000 providing only your email and phone number.

Cons

- Hidden fees included in the price by sellers.

- If you live in Europe or Canada, you must verify your ID and US users must also verify their address.

3. BitPanda

Bitpanda logo

Pros

- Low card deposit fees (1.50%).

- Free wire deposits.

- Many payment options – cards, wire transfer, Skrill, Neteller, Sofort, Giropay, etc.

Cons

- Fees aren’t transparently listed.

- 1.49% premium on every trade, including crypto conversions (included in the price).

- Limited support outside of the EU.

4. Binance

Binance logo

Pros

- Total fees (transaction + spread) is around 3% – lower than on Coinbase.

- Over 30 fiat currencies are supported.

- High weekly deposit & withdrawal limits.

Cons

- In some countries, only Visa is accepted, in others only MasterCard.

- The service is not available in the US.

5. Bitstamp

Bitstamp logo

Pros

- Works in about 75 countries.

- Free SEPA deposits (wire transfer fee of 0.05%).

Cons

- Not available in the US.

- 5% credit card fee.

- Accepts only cards and bank transfers – no PayPal and other e-wallets.

Closing thoughts

The price of Bitcoin has increased from $7,200 to $13,700 in 2020, but there’s still a lot of growth potential. Many analysts say that it will go over $20,000 in 2021. Thus, if you are looking for a way to protect your savings during the global economic crisis, Bitcoin is a good option.

If you’ve never bought crypto before, it can seem confusing and complicated. But in reality, buying Bitcoin with a credit card is easy. True, you’ll have to spend some time on verification, but once you’ve passed it, the whole process takes less than a minute. As for the potential gains, they are more than worth it.