Bitcoin vs Bitcoin Cash

Bitcoin (BTC) and Bitcoin Cash (BCH) may sound similar but they’re anything but. Bitcoin is the first cryptocurrency, while Bitcoin Cash was forked from its network and became its own blockchain.

By this point both the Bitcoin and Bitcoin Cash network are well-established in the world of crypto. In our introductory explainer, you’ll discover key differences between them and learn everything you need to know to accept BTC or BCH payments in your own business.

Bitcoin Jesus

This is the most common moniker of Roger Ver, one of the most prolific early investors in Bitcoin, one of the early investors in Ripple, BitPay and Kraken, and the ex-CEO of Bitcoin.com.

He was also arrested in 2024 for evading over 48 million dollars in taxes, failing to report the 131,000 Bitcoin that he still owns.

Roger Ver was one of the earliest and most vocal proponents of Bitcoin Cash – a solution that aimed to provide scalability to the blockchain.

The Bitcoin blockchain is considered the most secure: it has never been shut down, nor has it been hacked, but still faces barriers to widespread use. Slow transaction approval times, high transaction fees, volatility, and sustainability concerns are aspects that have highlighted problems with Bitcoin and its consensus mechanism, Proof of Work. Bitcoin Cash, which arrived in 2017, was one such solution.

Let’s explore the potential shortcomings of Bitcoin, the arrival of Bitcoin Cash and the problems it aimed to solve.

Bitcoin’s Hurdles

1. Bitcoin is slow.

The design of Bitcoin’s blockchain restricts the number of transactions per block due to a 1MB size limit. Initially, it severely constrained the number of transactions that could be processed, approximately every 10 minutes, to around 2,000. However, after introducing Lightning Network, the speed became near-instant since 2018.

The initial speed, or lack thereof, created a secondary problem.

2. Not all transactions are equal.

Not all transactions are equal, as users have the option to skip the queue by paying higher transaction fees, ensuring their transactions are prioritised in the mempool (the pool of unconfirmed transactions).

During peak periods when the network is congested, users are paying to be prioritised over the transactions of existing fee-payers, creating somewhat of a bidding war.

Transactions with no or low fees may be continuously overlooked and potentially never confirmed, making the fee unavoidable. This represents the second part of the issue, where high transaction fees make moving Bitcoin expensive.

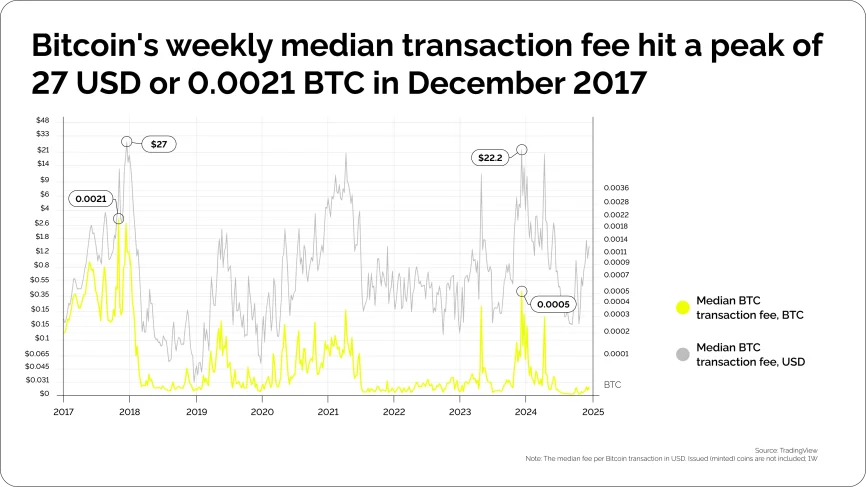

3. BTC Median Fee per Transaction

This bottleneck becomes particularly problematic as the network grows and more users transact, leading to significant scalability issues.

Source: TradingView, Median BTC fee/transaction

4. Volatility.

Bitcoin is not a collateralized asset, unlike stablecoins, which are often backed by tangible assets such as dollar reserves or short-dated treasury bonds. This means there is no underlying asset to support its value. Bitcoin’s value is largely driven by market demand rather than intrinsic value, which contributes to its volatility.

Additionally, many assume that the value of Bitcoin is significantly influenced by halving events, which occur approximately every four years and reduce the supply of new Bitcoins entering the market by halving the mining rewards. While these events are designed to limit the supply and potentially increase the value of Bitcoin, their impact may be overstated.

Considering that more than 94.79% (as of Dec 16) of all bitcoins have already been mined, the supply-side effect of these halving events on Bitcoin’s value is diminishing. As fewer new coins enter the system, the influence of halving on price becomes less significant in the face of other market dynamics.

5. In-built inefficiency

Then comes the in-built inefficiency. To maintain the 10-minute block time on the Bitcoin blockchain, every 2,016 blocks, which is around once every two weeks, the difficulty target is adjusted to either contract or expand the range of potential correct solutions for the creation of a new block.

Suppose new, faster ASICs surface in the market, or quantum computing finally makes its foray into blockchain mining—it won’t solve the immense amount of power needed to solve these problems as the difficulty will be increased indefinitely to ensure a 10-minute block cadence.

This means that the proof of work consensus mechanism, and therefore Bitcoin, is incredibly energy-inefficient and environmentally problematic. It is not a sustainable consensus mechanism when used at scale.

At its heart, Bitcoin vs Bitcoin Cash is all about scalability.

The Bitcoin Cash Network

Bitcoin Cash (BCH) was created in 2017 as a solution to emerging issues that Bitcoin faced, paving the way for what many saw as a return to Bitcoin’s original vision—a fast, accessible digital currency.

By 2016, transaction fees on the Bitcoin network had risen significantly, leading to concerns that Bitcoin was transitioning from a practical currency into a more passive, digital asset designed primarily for investment. Proponents of Bitcoin Cash argued that slow transaction times and high fees were hindering Bitcoin’s utility and adoption.

To address this, Bitcoin Cash increased the block size to 8 MB initially, and later to 32 MB (its current limit), which allowed more transactions to be processed faster and at lower fees. The latest BCH node client releases were published in December 2024, signalling ongoing development activity.

The core issue at the heart of the split from Bitcoin was block size. The Bitcoin blockchain has a 1MB limit on the amount of data each block can hold, which was seen as insufficient as transaction volumes increased. Some members of the Bitcoin community, including those behind Bitcoin Cash, advocated for increasing the block size to accommodate more transactions, thereby reducing fees and improving transaction speed. This led to the creation of Bitcoin Cash through a hard fork of the original Bitcoin blockchain.

This wasn’t the only Bitcoin hard fork – in 2014, Bitcoin XT appeared, followed by Bitcoin Classic and Bitcoin Unlimited in 2016. However, each of these currencies were discontinued due to their lack of popularity.

Other forks have also branched off, such as Bitcoin SV (BSV), which split from Bitcoin Cash in 2018 after disagreements over block size and governance. Earlier forks like Bitcoin XT, Classic, and Unlimited have faded, while smaller forks such as Bitcoin Gold and Bitcoin Diamond still exist but play a minor role.

Let’s do a side-by-side comparison to help us better understand what problems BCH was created to solve.

Bitcoin vs Bitcoin Cash: Key differences

(Sources: TradingView (1W open price, Dec 16), Messari)

| Bitcoin (BTC) | Bitcoin Cash (BCH) | |

|---|---|---|

| Block size | 1-4 MB, avg = 2 MB | Initially: 8 MB, now 32 MB |

| Consensus protocol | PoW | PoW |

| Coin supply | Fixed to 21M BTC | Fixed to 21M BCH |

| Openness to protocol alterations | Very conservative forks which did not affect the BTC nature | Continue to do forks and alterations |

| Decentralizations | Smaller block size ensures greater decentralisation | The more transactions encrypted in a block, the less decentralisation occurs |

| Security | Higher security: decentralisation and moderate alterations to the protocol | Lower security due to lower decentralisation and more invasive protocol alterations |

| Transaction time | ~7 transactions per second (1 block in 10 minutes) | Over 100 transactions per second |

| Adoption | Considered ‘Digital gold’ and store of value; used as a hedge against market volatility | Considered 'Digital cash’; more suitable for everyday transactions |

| Philosophy | Prioritises decentralisation and security | Prioritises faster and cheaper transactions |

| Smart contract support | Limited on base layer; Layer-2 or sidechains for advanced logic | CHIP-based virtual machines, ZK-proof support, and emerging smart contract capabilities |

| Price | $117,800 | $590 |

| Market Cap | $2.3T | $11.7B |

Bitcoin Cash was created to solve Bitcoin’s scalability issues, but as crypto has evolved, solutions like the Lightning Network and stablecoins have emerged as more effective alternatives.

Bitcoin Cash: Good enough for 2025?

In theory, the Bitcoin Cash hard fork appeared to be a solution to a burgeoning blockchain issue. But that was in 2017, and now, in 2024, we can examine its evolution in practice.

Fortunately, at CryptoProcessing.com, we have access to some of the most up-to-date and accurate statistics regarding Bitcoin Cash transactions. We’ve compiled this data below, illustrating its prominence in terms of transaction numbers and overall transaction volume.

Cryptocurrency Transactions and Turnover Summary

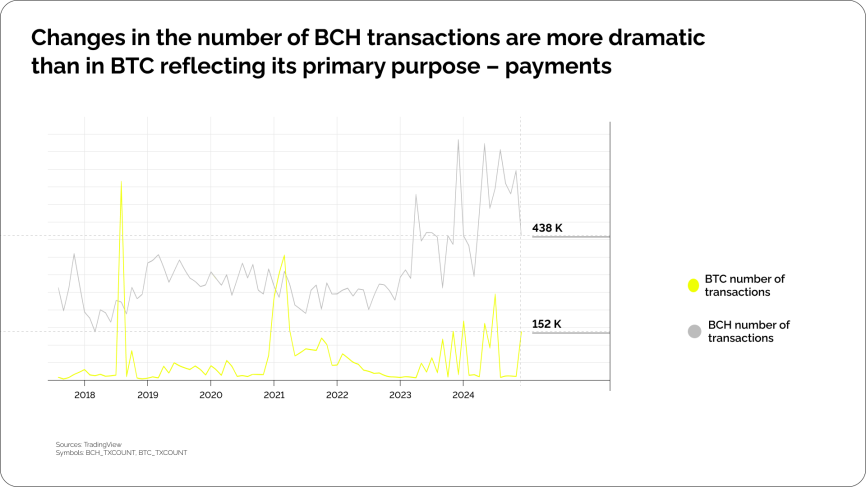

While Bitcoin Cash is still being traded, it lags significantly behind Bitcoin transactions and certain altcoins such as LTC and Dogecoin, accounting for just 1% of all payments processed.

Its unpopularity can be further explored by comparing its timeline with that of Bitcoin.

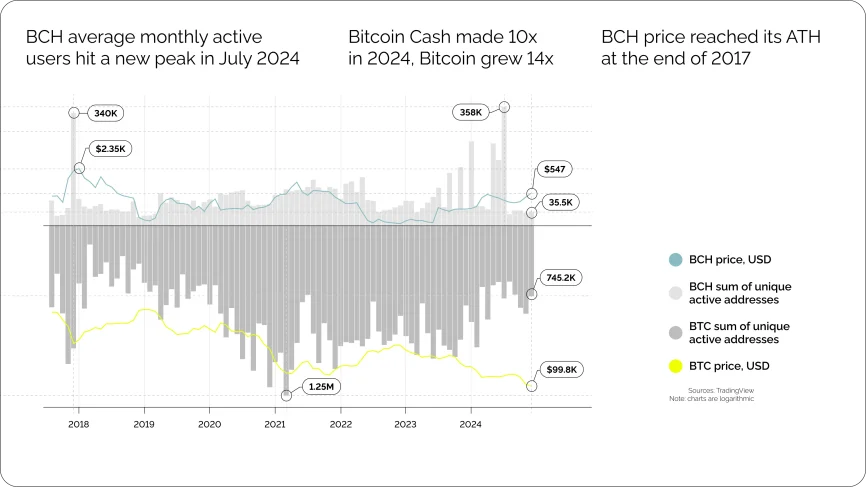

The price of BCH reached its all-time high on December 20, 2018, at over $3,700 USD.

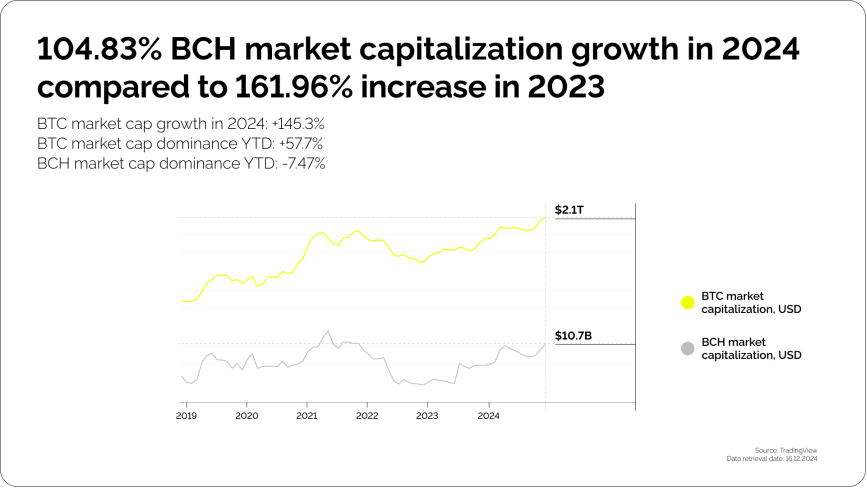

Now, it lingers below $550. This downward trend can be contrasted with Bitcoin’s gradual upward trend, reaching a record of over $106,000 this year. Moreover, while Bitcoin demonstrates a relatively stable and gradually increasing number of active addresses over time, Bitcoin Cash exhibits significant volatility. These two comparisons can be seen by observing the two graphs below.

Source: TradingView

Source: TradingView

Source: TradingView

Today, BCH’s most consistent adoption comes from merchants and services that value fast, low-cost settlement. It is used for microtransactions, peer-to-peer payments, donations, and certain travel industry payments. Bitcoin, by contrast, dominates in remittance via the Lightning Network, ATM availability worldwide, and DeFi integrations through wrapped BTC.

Better Alternative Solutions

Bitcoin Cash was a good solution – it’s the simple matter that better solutions became available with time.

Bitcoin Layer 2s

The Bitcoin Lightning Network was offered as another solution and was deployed on the mainnet in early 2018. Instead of the ‘hard fork’ solution, the lightning network was a separate blockchain built on top of the Bitcoin. Known as a ‘layer-2 blockchain’, it aimed to allow faster and cheaper transactions through creating channels. On these channels, people can directly exchange bitcoins with each other an infinite number of times, and only when the channel is closed does the outcome get recorded on the main blockchain. This significantly reduces traffic on the main network and makes Bitcoin more efficient for everyday transactions.

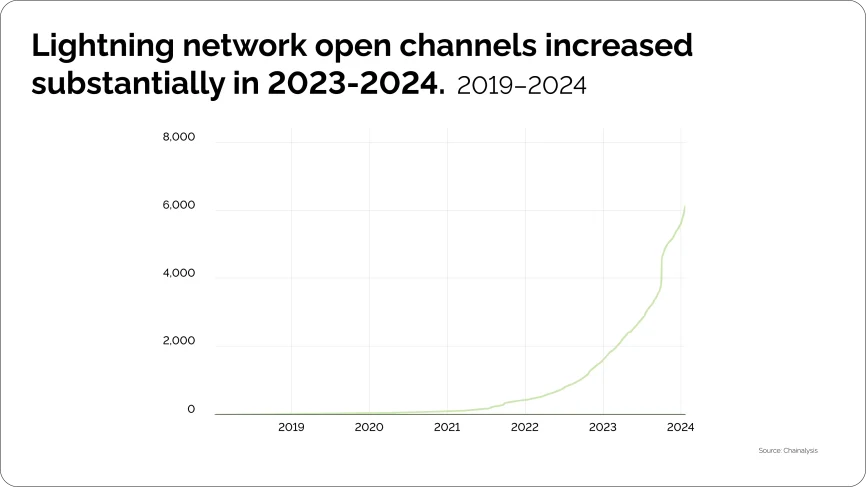

The Lightning network has made substantial progress, with growth in open channels climbing in 2023 into 2024.

Source: Chainalysis

When we compare this growth to Bitcoin cash’s decline, it’s clear that the lightning network quickly became a more popular solution to scalability.

Novel Layer 1s

Many developers, aware of Bitcoin’s shortcomings, returned to the drawing board to design a new and improved consensus mechanism. This effort culminated in the creation of Peercoin in 2012, which introduced the ‘proof of stake’ consensus mechanism.

Peercoin is still around, but it wasn’t a great poster-boy for PoS. In fact, the consensus mechanism only began to gain significant traction in the late 2010s with the emergence of new blockchain networks such as Cardano and Tezos. So, what makes PoS a good replacement for PoW?

Validators in a Proof of Stake system are selected to create new blocks based on their stake in the network (i.e., the amount of cryptocurrency they hold and are willing to “lock up” as collateral), rather than their ability to solve cryptographic puzzles. This shift dramatically reduces the energy consumption of the blockchain. Additionally, since PoS systems typically process transactions more quickly and efficiently, they are capable of handling higher transaction volumes.

Furthermore, since Ethereum’s transition to Proof of Stake in 2022, an event known as “the merge,” Proof of Work has been slowly gathering dust.

Today, building projects on chains such as Cosmos and Polkadot is increasingly logical, as they address the shortcomings of Bitcoin at a Layer 1 level.

Stablecoins

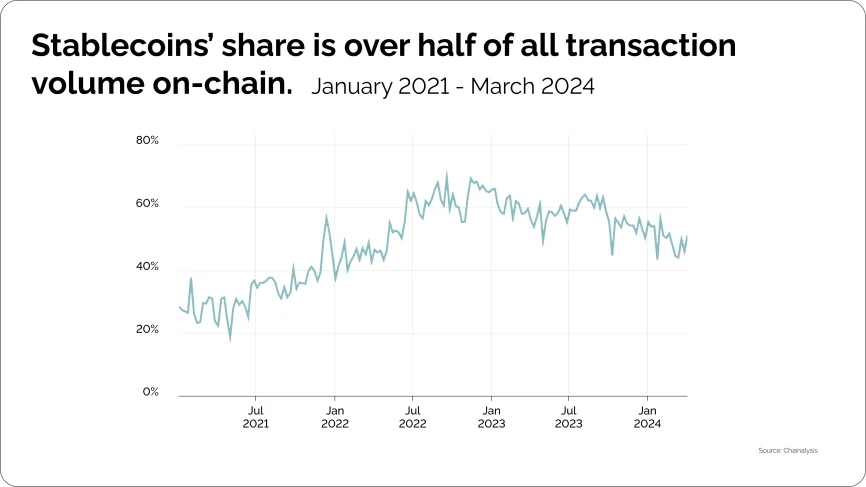

Although stablecoins don’t offer the same potential for gains as major cryptocurrencies like Bitcoin and Ether, they have become the most widely used type of cryptocurrency, accounting for more than half of all transaction volume.

Stablecoins are a type of cryptocurrency whose value is pegged to an asset, such as a fiat currency (e.g., the US dollar) or a commodity (e.g., gold). In addition, some might be algorithmically collateralized or backed by other cryptocurrencies. This ‘pegging’ is designed to maintain a stable price and reduce the volatility often associated with traditional cryptocurrencies.

While stablecoins have not addressed all the challenges associated with proof of work systems, they have provided a means to mitigate the volatility inherent in traditional cryptocurrencies. Moreover, they are built on newer, faster, and more cost-effective blockchain platforms such as Tron.

The graph below illustrates the rising prominence of stablecoins by showcasing recent data on their growing share of transaction volume.

Source: Chainalysis

Wrapping Up: Why Bitcoin is Still King

Today, we spent a while picking apart the shortcomings of Proof of Work that Bitcoin Cash aimed to solve. So, you’re likely wondering – aside from BHC’s demise, why is Bitcoin still such a popular cryptocurrency?

If you go ahead and ask ChatGPT, or if you’re a denizen of the 00’s, Jeeves, you’ll likely get the book answer.

Bitcoin has the first mover’s advantage. In other words, it was the first cryptocurrency to be successfully implemented. This early start allowed it to gain widespread recognition and adoption before other digital currencies emerged, establishing a strong brand identity.

Also, over the years, Bitcoin has proven to be secure and resilient against attacks, which has built a significant level of trust among investors. Its security is underpinned by a robust and vast decentralised network of miners and nodes, after all.

However, I believe it has much more to do with the sentiment users have about Bitcoin being the chain that started it all. It commands respect, much like how one would respect a senior for their lifetime achievements.

Whether that respect justifies the hefty price tag, only time will tell — but I think not.

As we’ve explored, while Bitcoin remains dominant for now, stablecoin usage is growing exponentially as more people are able to capitalise on the benefits of blockchain without the volatility. Also, as USDT will always equate to one dollar, its popularity is not always apparent through a quick search on Coinmarketcap.