The ETF Effect: How Bitcoin ETFs are Opening the Crypto Market to Institutional Investors

At the heart of the ETF lies the promise of asset diversification. Indeed, in purchasing an ETF share, you’re not just buying a slice of one company; you’re spreading your investment across an entire spectrum of assets. Whether it’s a bouquet of the top 500 U.S. companies or a medley of high-yield bonds, ETFs allow you to hold a mosaic of investments, diluting individual risks and painting a picture of financial prudence.

Let’s look at the SPDR S&P 500 ETF Trust, often called “SPY”. This ETF follows the S&P 500 Index, which includes 500 of the biggest U.S. companies from different sectors. When you buy a share of SPY, you’re not just investing in one company. You’re actually getting a tiny part of all 500 companies in that index.

ETFs like SPY can be bought and sold during the trading day, just like stocks. This makes investing flexible, which is really helpful in fast-changing markets. It allows you to quickly adjust your investments as needed.

The gradual approval of Bitcoin ETFs, the protagonists of today’s article, mark a significant development in the crypto market. After all, upcoming ETF inflows from existing crypto products, such as the Grayscale Bitcoin Trust (GBTC) are projected to be upwards of $36 billion. However, that’s not why we’re here today. Indeed, the approval of these ETFs is opening up the crypto market to banks, insurance companies, pensions, hedge funds and other kinds of institutional investors. A breach of this size is groundbreaking – and as such, we’d like to welcome to the stage the ETF effect.

ETFs and Their Natural Appeal to Institutional Investors

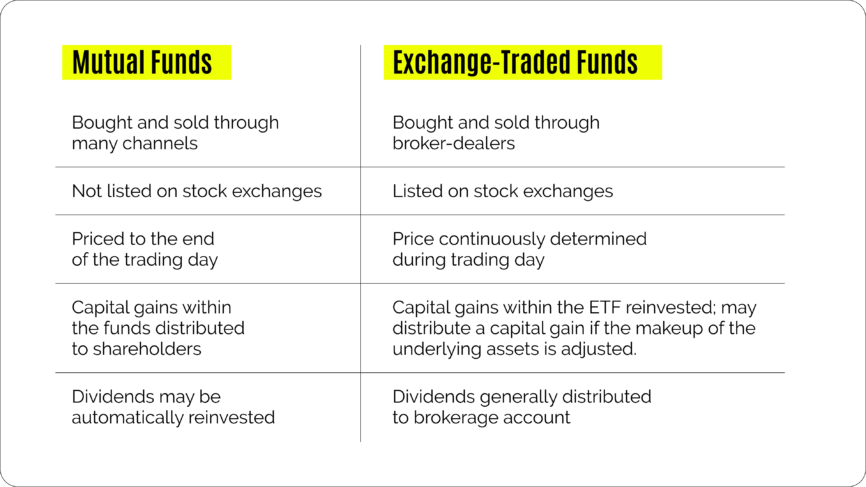

ETFs, or Exchange-Traded Funds, are baskets of investments (like stocks or bonds) and you can buy or sell them on stock exchanges, just like regular stocks. They are popular among both everyday and big investors because they are easy to use and efficient.

The way ETFs work is interesting. Big financial institutions, known as Authorised Participants (APs), help to keep the ETF running smoothly. They do this by handling ‘creation units’, which are just big bunches of ETF shares. These APs can either make new ETF shares by buying the investments that the ETF is supposed to track (creation), or they can get rid of ETF shares by trading them back to the fund in exchange for those underlying investments (redemption). This process helps the price of the ETF on the stock market stay close to its real value, which is based on the total value of all the investments it holds.

The real value of an ETF, known as its Net Asset Value (NAV), is calculated by adding up the value of all the investments in it and then dividing by the number of ETF shares. The market price of an ETF share is what people are willing to pay for it on the stock exchange during trading hours. This price can change during the day, based on how many people want to buy or sell the ETF, but it usually stays pretty close to the ETF’s NAV because of how creation units are managed.

"Bitcoin ETFs are a game-changer for institutional investors. They offer a regulated and accessible way to invest in crypto, opening the door for significant capital inflows, and pushing the entire market towards greater stability and legitimacy."

Max Krupyshev

CEO of CoinsPaid

For institutional investors, Exchange Traded Funds (ETFs) have always combined the diversification of mutual funds with the liquidity of stocks. They can be bought and sold at market prices throughout the trading day, providing flexibility and ease of access. Moreover, ETFs have lower expense ratios compared to traditional mutual funds, and due to their unique in-kind creation and redemption process, capital gains taxes are minimised too. This cost-effectiveness is particularly appealing to institutions managing large sums of money.

Enter the Bitcoin ETF

The story of Bitcoin Exchange Traded Funds (ETFs) is a compelling saga of innovation, regulatory challenges, and the gradual merging of the traditional financial sphere with the revolutionary world of cryptocurrencies.

- 2013: First Bitcoin ETF proposal

- 2016: Improved global regulatory stance

- 2021: First approved North-American Bitcoin ETF

- 2023: 13 asset managers file for Spot Bitcoin ETFs

- 2024: 11 spot Bitcoin ETFs are Approved by the SEC

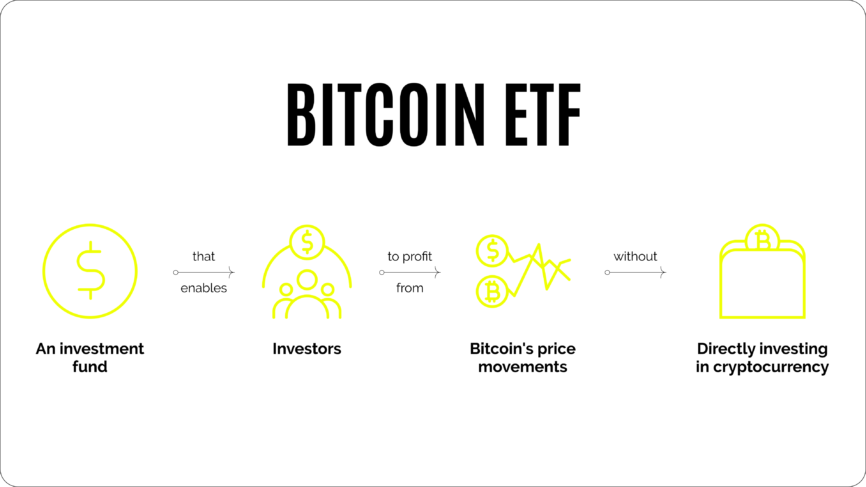

The concept of a Bitcoin ETF first entered the financial zeitgeist around 2013, a period when Bitcoin was beginning to gain significant attention from both the public and savvy investors. The idea was simple yet groundbreaking: to create an ETF that tracks the performance of Bitcoin, allowing investors to buy shares of the ETF and indirectly invest in Bitcoin without the complexities of managing cryptocurrency wallets and exchanges.

However, turning this concept into reality was no small feat. The primary hurdle was regulatory approval, especially from bodies like the U.S. Securities and Exchange Commission (SEC), which were cautious about the volatile nature of cryptocurrencies and their potential risks to investors. The initial proposals faced a series of rejections or delays, often citing concerns over market manipulation, liquidity, and the need for adequate consumer protections.

Despite these challenges, proponents of the Bitcoin ETF did not waver. They continued to refine their proposals, enhancing security measures, market tracking mechanisms, and compliance with regulatory standards. Over the years, the cryptocurrency market itself matured significantly, with improved infrastructure, greater liquidity, and increased institutional interest, which in turn made the idea of a Bitcoin ETF more palatable to regulators.

The real turning point came when the financial world began to recognize the potential of blockchain technology and the value proposition of cryptocurrencies. This shift in perception, combined with relentless efforts from various financial entities, finally led to the approval of the first North-American Bitcoin ETF in 2021 – The Purpose Bitcoin ETF.

“As of 2024, the SEC has given the green light to 11 exchange traded funds for bitcoin, opening the door to cryptocurrencies for many new investors”.

The recent approvals have marked a significant milestone in the history of finance. This represents a fusion of traditional investment structures with the new world of digital assets. For investors, this meant a new, regulated, and accessible way to participate in the crypto economy. For the cryptocurrency market, it signified a stamp of legitimacy and a gateway to broader adoption. And this goes for crypto payment gateway services.

Impact on the Crypto Market

In a November 2023 survey, Coinbase found that:

- 64% of institutional investors in cryptocurrencies are planning to boost their investments over the next three years

- 45% who haven’t invested yet are considering starting within the same timeframe.

Additionally, platforms like CME Group have observed a significant increase in institutional engagement, with a record number of large Bitcoin interest holders. This trend suggests that institutional investors are expected to be increasingly active in the cryptocurrency market, particularly through Bitcoin ETFs in 2024, signalling a maturing market that could lead to broader stability and adoption of cryptocurrencies.

The first reason is that Institutional investments bring substantial capital inflows, increasing the overall market capitalization of cryptocurrencies. This influx of funds enhances liquidity, making the market more resilient to large trades or sudden price movements. Speculative estimates argue that institutional investors could bring tens to hundreds of billions of dollars into Bitcoin ETFs over a few years as the market matures and more institutional investors allocate a portion of their portfolios to cryptocurrencies.

Moreover, these investors typically take a longer-term approach compared to retail investors, who may be more prone to speculative and volatile trading behaviours. This maturity can lead to more stable pricing and reduced volatility. Let’s not forget that the requirements of institutional investors for robust, secure, and compliant platforms have driven improvements in the market infrastructure of cryptocurrencies. This includes enhanced trading platforms, custody solutions, and risk management tools – all of which contributes to the aforementioned.

Institutional participation has also accelerated the push for clear regulatory frameworks. As institutions are bound by strict compliance and regulatory standards, their involvement necessitates a more regulated and transparent crypto market. This also goes lengths to lending credibility and legitimacy to the asset class. This acceptance is pivotal in breaking down barriers to mainstream adoption, making cryptocurrencies a more integral part of the global financial system.

Bitcoin ETFs Repeating the Path of Gold ETFs?

A similar trajectory was observed in the gold market following the approval of gold ETFs in the early 2000s. Before the introduction of gold ETFs, investing in gold was predominantly done through physical holdings or futures contracts. The approval of gold ETFs revolutionised this market, providing a more accessible and liquid means for investors to gain exposure to gold. This led to a significant increase in the price of gold, as seen in a widely referenced chart illustrating its growth post-ETF listing.

The gold ETF case serves as a potential marker for growth in the cryptocurrency sector, especially with the introduction of Bitcoin ETFs. Like gold ETFs, Bitcoin ETFs offer a more accessible and liquid investment option compared to traditional methods of investing in cryptocurrencies. The approval and subsequent interest in Bitcoin ETFs are expected to draw in more institutional investors, mirroring the gold market’s response to its ETFs. This comparison not only underscores the potential for substantial capital inflow and market growth but also highlights the transformative impact of introducing mainstream investment vehicles into alternative asset classes.

Volatility as the Main Challenge for BTC ETFs

While the narrative of regulated ETFs fostering increased institutional investment, market stability, and broader crypto adoption holds strong, it’s crucial to acknowledge the challenges and risks that come along with this investment avenue.

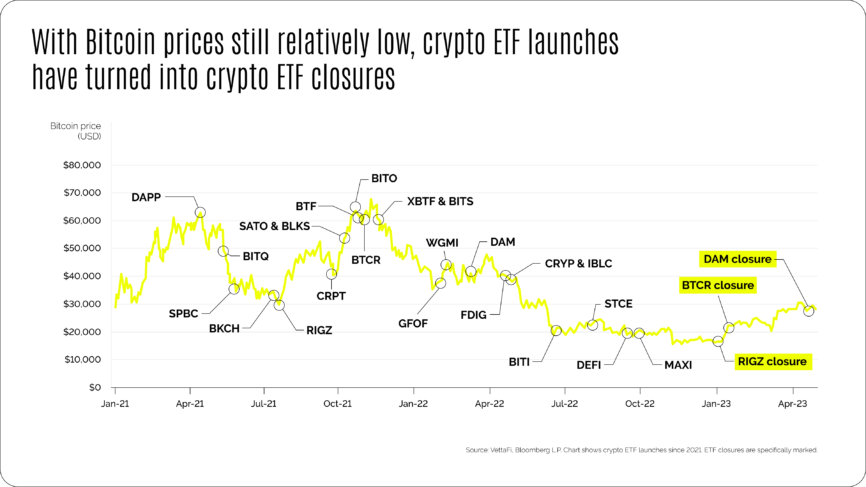

Of course, one of the most pronounced risks in investing in Bitcoin ETFs is their inherent price volatility. Bitcoin and, by extension, Bitcoin ETFs, are subject to sharp price fluctuations, which can be driven by a range of factors from regulatory news to macroeconomic trends. This volatility can be particularly challenging for institutions that are accustomed to the relatively stable returns of traditional asset classes.

Furthermore, the performance of Bitcoin ETFs is intrinsically linked to the price of Bitcoin. In scenarios where the price of Bitcoin experiences a significant drop, the ETFs tracking them could also see a decline in value. As such, with 2023 being yet another year of the bear market, it has also been one of Bitcoin ETF closures.

However, institutional investors are approaching Bitcoin ETFs with a focus on investment rather than trading.

Diversification and Regulation to Negate Volatility

Recognizing the nature of ETFs as investment tools, institutions are diversifying their portfolios, using Bitcoin ETFs as a means to integrate cryptocurrency exposure into a broader investment strategy. This approach helps dilute potential volatility specific to Bitcoin by balancing it with a range of other asset classes. In this context, the emphasis is on the security and stability that ETFs offer, particularly as they are backed by investment funds that provide a safeguard against risks like exchange scams – a notable advantage over direct crypto exchange investments.

In addition to diversification, establishing robust risk management protocols remains essential. This involves a deep understanding of the market, including liquidity risks, and a regular review of the investment’s performance against its risk profile. However, this is done with a long-term investment horizon in mind, rather than short-term trading objectives.

Adopting a long-term investment perspective is particularly relevant for institutional investors, who typically have the capacity to withstand market fluctuations over time. This approach is less about reacting to short-term market movements and more about steady, strategic asset growth.

Furthermore, it’s important to contextualise the volatility associated with Bitcoin. When compared to active ETFs, and even some passive ones like QQQ – an ETF comprising shares of tech giants such as Apple, Google, and Amazon – Bitcoin’s volatility is not necessarily more significant. For instance, QQQ has experienced periods of turbulence that were more pronounced than those of Bitcoin. This suggests that the perceived volatility of Bitcoin is more a matter of hype than a reflection of its actual market behaviour when compared to other underlying assets.

In addition, the global landscape of Bitcoin ETFs is set to expand. Soon, Hong Kong providers are expected to list their ETFs on their exchange, which ranks among the top 5-6 in the world. This development will further integrate Bitcoin into mainstream financial markets, offering additional opportunities for institutional investors to engage with cryptocurrency through a regulated and familiar investment vehicle.

Given the cryptocurrency market’s rapid evolution, continuous monitoring of market trends, regulatory changes, and technological advancements is essential. This ongoing vigilance helps institutions stay informed and adapt their investment strategies accordingly.

It is important to note that while there is talk of significant capital inflows into Bitcoin ETFs, the reality is that major institutional players may require time to restructure their strategic models to incorporate these new investment vehicles. This process of integrating Bitcoin ETFs into their policies is not instantaneous and reflects the careful and deliberate approach that characterises institutional investment behaviour.

Final Thoughts

The journey of Bitcoin ETFs from a simple idea in 2013 to a reality in 2021, and their subsequent impact on the market, underscores a pivotal shift in investment strategies and market perceptions. These ETFs have opened the floodgates for substantial capital inflows from institutional investors, infusing the cryptocurrency market with enhanced liquidity and maturity. The estimated tens to hundreds of billions of dollars that could flow into Bitcoin ETFs over the coming years are a testament to the potential scale of this transformation.

Institutional investors’ gravitation towards these ETFs, despite their inherent risks and recent history of market volatility and ETF closures, is a sign of the growing confidence in the stability and longevity of cryptocurrencies as an asset class. The strategic measures adopted by these investors, including portfolio diversification, robust risk management, a long-term investment horizon, and vigilant market monitoring, demonstrate a sophisticated and calculated approach to navigating the crypto space.

Let’s not forget that regulated Bitcoin ETFs are instrumental in driving the push for clear regulatory frameworks, improving market infrastructure, and lending credibility and legitimacy to cryptocurrencies.

The new Bitcoin ETFs in 2024 are more than just investment vehicles; they represent the fleet of a new financial epoch, with institutional investors at the helm.