What is a SaaS Payment Gateway?

SaaS, or Software as a Service, is a cloud-based solution where service providers host software applications. This implies the payment gateway is maintained by a provider, and to get access you only need the internet. SaaS solutions eliminate the need to install or update software on merchants’ systems. Instead, businesses can rely on a service provider to manage all technical aspects, including updates and compliance.

Table of contents:

You may think of a SaaS payment gateway as your automated, invisible assistant, handling all your online transactions while you focus on growing your business. These gateways take care of everything – payment authorisation, processing, and even dive into insightful analytics. SaaS platforms even integrate crypto payment gateways, adding digital currencies to their payment options.

How do SaaS payments work?

1. Account Setup

To start accepting payments through a SaaS payment gateway, a merchant must create an account with a SaaS payment gateway provider. This involves registering on the provider’s platform, providing necessary business details, and selecting a pricing plan that suits the business’s needs.

2. Transaction

First, a customer selects their desired subscription plan and then enters payment details into a secure gateway. The payment information is encrypted into a secure code, which is then sent to the payment processor. It requests authorisation from the issuing bank to check for the availability of funds. Once the transaction passes all security checks, the gateway will give a green light. The funds are then transferred from the customer’s account to the business’s account, completing the financial exchange.

The system schedules automatic deductions according to the chosen billing cycle—be it monthly or yearly—ensuring continuous access to the software without manual intervention. Each payment triggers an automated update, granting or renewing the user’s access to features based on their plan.

3. Analytics

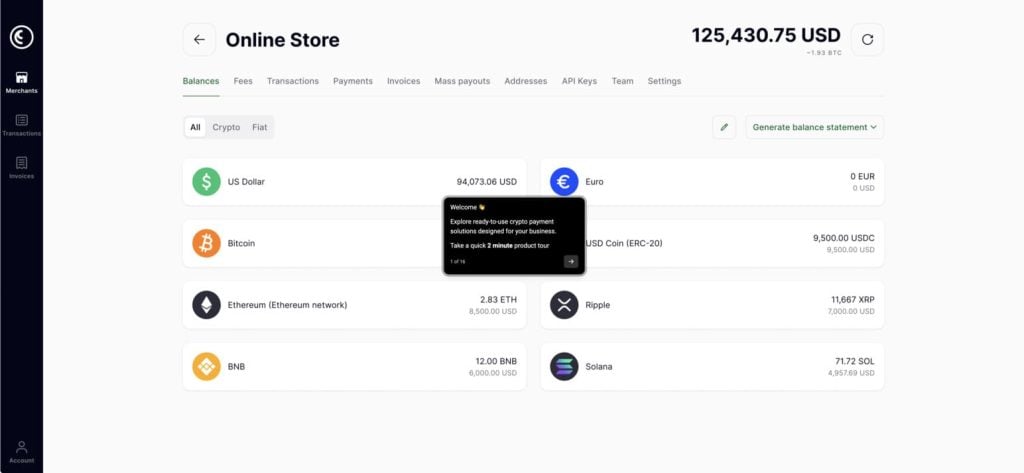

Merchants can monitor transaction statuses, track sales trends, and identify potential issues promptly. Invoices and transaction records are easily accessible, while customer support handles any billing issues or adjustments efficiently. This balanced process ensures a positive user experience and stable revenue.

In addition, merchants can generate detailed reports on transactions. This is especially useful when a business needs to estimate sales volume or the geographic distribution of customers. Also, with analytics tools, merchants can gain insights into users’ behaviour; for example, merchants can analyse the best-selling products or the most popular payment methods.

Features of SaaS Payment Gateways

1. Secure Transactions

SaaS payment gateways adhere to the Payment Card Industry Data Security Standard (PCI DSS). They also implement advanced fraud detection and prevention mechanisms. During transactions, sensitive payment data is encrypted to ensure customer information is protected and transmitted safely. 3D Secure adds an extra layer of security, requiring customers to authenticate themselves with their bank during the payment process.

2. Multi-Currency Support

Today’s businesses serve customers from around the world. For this reason, the payment gateway is expected to support multiple currencies, including fiat and crypto money. A SaaS payment gateway not only supports multi-currency but can also automatically convert payments into the merchant’s chosen currency.

3. Easy Integration

A truly effective payment solution should integrate with third-party systems to create a positive user experience. SaaS payment gateways support APIs, allowing them to integrate smoothly with various SaaS platforms and essential business tools like accounting and marketing software. The benefit is significant: integration with other systems automates some processes, minimises manual work, and improves the accuracy of records.

4. Cost Efficiency

Due to the subscription model of SaaS products, customers pay only for the services they use, eliminating large expenses. Merchants, on the other hand, benefit from a simple, single, and comprehensive solution that manages every aspect of transactions. Additionally, since there is no need for physical infrastructure, maintenance costs are significantly lower.

5. Scalability

As your business grows, so do your transaction volumes. SaaS payment gateway solutions are designed to scale effortlessly, ensuring that your operations can expand smoothly without compromising on performance or security. Gateways for SaaS solutions are built on robust cloud technology that can dynamically adjust to higher transaction loads, maintaining optimal speed and reliability. Whether a business is experiencing seasonal spikes in sales or a steady increase in customer base, these gateways automatically adjust their capacity to handle increased traffic.

6. Customisation

SaaS Payment Gateways allow businesses to customise payment pages to reflect their brand’s identity. This includes changing colour schemes and adjusting the layout to match the overall design of the website. Also, merchants can design payment workflows; for instance, businesses can set up recurring billing for subscription services, offer split payments, or implement one-click payments for returning customers.

7. Reporting and Analytics

Advanced analytics tools help merchants monitor sales trends and customer behaviour. By examining data on top-selling products, peak purchasing periods, and the geographic distribution of their audience, businesses can optimise their marketing strategies. Detailed financial reports may also provide sales volumes, revenue breakdowns, chargebacks, refunds, and more.

Why is a SaaS payment gateway important for business?

Imagine a scenario where every transaction is smooth, secure, and effortless—this is what a SaaS payment gateway offers. By adopting such a gateway, businesses can strengthen their payment processes, expand their market reach, and concentrate on growth without worrying about managing complex payment systems. Find more details about what makes SaaS payment gateways an indispensable tool in today’s competitive market below.

1. Cloud-Based Nature

Cloud-based software eliminates the need for physical infrastructure and significantly reduces maintenance and total costs for users. Unlike traditional payment systems that require substantial upfront investment in hardware and software, payment gateways for SaaS services typically involve minimal initial costs, making them accessible to start-ups and small businesses. Additionally, businesses automatically get the latest features and updates.

2. Enhanced Security & Data Protection

Data security is a critical factor influencing customers’ choices. Businesses utilising SaaS payment gateways can maintain customer loyalty and trust, as these gateways apply advanced encryption and tokenisation techniques to secure sensitive payment data. This ensures that customer information is protected from potential breaches during transmission and storage.

To reduce the risk of chargebacks and financial losses, gateways are equipped with sophisticated fraud detection tools that use machine learning algorithms. These help identify and block fraudulent transactions in real time. Finally, these gateways comply with rigorous security standards (PCI DSS), which enhance security and customer trust.

3. Improved Customer Experience

One of the key advantages of a SaaS Payment Gateway is its ability to process a wide range of payment methods, including traditional credit and debit cards as well as newer options like digital wallets (e.g., PayPal, Apple Pay) and cryptocurrencies. This flexibility is crucial for businesses looking to cater to a diverse customer base and quickly adapt to changing payment trends.

Customisation allows merchants to localise their businesses to different markets. This means that besides implementing various payment methods, you are able to integrate multiple languages and currencies. If you use these features wisely, you can easily align with the business’s goals and vision as well as improve customer satisfaction.

4. Ease of Integration with Other Systems

As SaaS payment gateway solutions come with APIs, gateways can be seamlessly integrated with a merchant’s already existing software, such as CRM. When integrated, payment processing is synchronised with other business operations and allows for real-time updates.

5. Detailed Reports

SaaS reporting tools are optional but highly recommended, as they provide insights into sales trends, payment methods, customer behaviour, and more. Businesses can analyse these reports to make informed business decisions and optimise payment strategies.

6. 24/7 Customer Support

Typically, SaaS payment gateway providers offer round-the-clock support to assist businesses with any issues or queries. This ensures minimal downtime and continuous operation.

Conclusion

A SaaS payment gateway is a cloud-based solution that simplifies how businesses accept payments. Unlike traditional systems that require local installation, a SaaS gateway runs online, is maintained by a third party, and is accessible from anywhere. This setup enables businesses to manage online payments efficiently without worrying about technical maintenance or compliance burdens.

These gateways process recurring billing, offer real-time analytics, support multiple currencies (including crypto), and are built to scale with business growth. Whether you’re running an eCommerce store, a subscription service, or a global B2B SaaS platform, a SaaS payment gateway offers the security, flexibility, and automation needed to maintain smooth operations and improve the customer experience.

F.A.Q.

The SaaS (Software as a Service) business model is based on providing software as a service via the internet, often through a subscription. Customers pay to subscribe to a service rather than purchasing and installing software on their own hardware. Revenue is generated through recurring subscription fees, which can provide predictable income streams and scalable growth for businesses.

A customer pays a recurring fee—monthly or annually — and gets access to a suite of software tools. On the scheduled date, an automated system effortlessly deducts the payment from their account, renewing their access to the software. In essence, a SaaS payment gateway for subscription billing is a kind of financial manager, ensuring smooth and consistent payment collection while reducing administrative burden.

Yes, SaaS payment gateways are good at managing recurring payments. The gateway ensures timely invoicing and payment collection so that merchants never have to worry about late or missed payments.

To select the best SaaS payment gateway, ensure it supports necessary payment methods, including credit/debit cards, digital wallets, and cryptocurrencies. Look for automated recurring billing and flexible subscription management capabilities. If you are going to integrate the gateway with your CRM, seek a gateway that seamlessly integrates with existing software. Additionally, consider gateways that offer a smooth checkout process and payment options tailored to your market.

Other Terms from the Crypto Industry