What Is APR in Crypto?

APR (Annual Percentage Rate) in crypto refers to the projected annual return on digital assets based on simple interest, excluding compounding.

Table of contents:

APR (Annual Percentage Rate) in the crypto space refers to the projected annual return on digital assets, based on simple interest, excluding compounding.

APR offers a clear and straightforward way to evaluate returns without the complexity of compounding. It helps compare earnings across platforms and products in a consistent, standardized format.

The strong sides of APR in crypto include:

- Straightforward comparison. APR makes it easy to evaluate different DeFi platforms or services. Without compounding, calculations remain simple and transparent.

- Clear annual yield representation. Returns are projected over a 12-month period, which offers a clear picture of potential profit under current conditions.

The drawbacks of APR in crypto are:

- No compounding effect. APR does not include returns from reinvested rewards. It makes it less reflective of total potential earnings when compared to compound-based models.

- Variable rates in DeFi environments. Despite often being presented as fixed, APR may shift due to factors like liquidity levels, token utility, and governance updates.

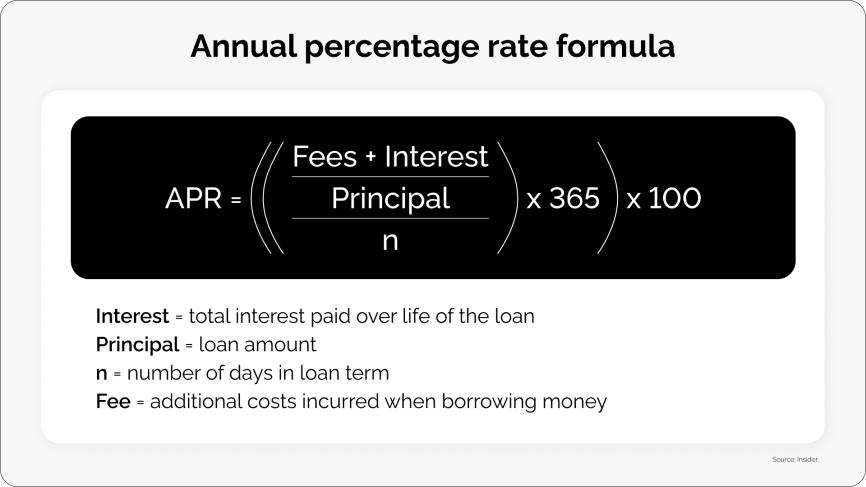

How Is Crypto APR Calculated?

APR in crypto is calculated based on simple interest. For instance, a 200 ETH deposit with a 10% APR earns 20 ETH over one year. After six months, that same position would generate 10 ETH.

Although the rate is often advertised as fixed, it may vary. Changes in platform policies, asset volatility, or market conditions can affect the actual return. Thus, it’s important to note, that APR figures should be viewed as projected rather than guaranteed.

What Influences APR in Crypto?

APR is dynamic and shaped by several factors:

- Asset type. Highly liquid assets like BTC and ETH usually offer lower APRs. Riskier or less-known tokens may command higher rates.

- Supply and demand. APR moves with market dynamics. Higher demand or reduced supply tends to lift rates, while excess supply can make them lower.

- Market volatility. Increased price fluctuation leads platforms to adjust APR to offset lending or liquidity risk.

- Platform models. Internal mechanics like token rewards or governance frameworks affect APR levels.

- Loan-to-Value (LTV) ratio. A higher LTV increases potential default risk, which leads to a higher APR.

Why APR Matters in Crypto

APR plays a foundational role in DeFi. It defines expected returns or borrowing costs over a one-year period using a clear, non-compounded model. This standardization is essential for analyzing and comparing protocols efficiently.

APR is also relevant in the context of crypto payments, where understanding borrowing costs or lending returns helps users evaluate the economic impact of using digital assets in payment-related protocols.

Key functions of APR in crypto:

- Standardization of benchmarks for DeFi earnings

- Optimization of capital allocation through fixed return structures

- Improved product evaluation enabled by transparent yield metrics

- Representation of reward mechanics in decentralized platforms

- Simplification of comparisons by removing compounding variables

- Strengthening of platform credibility through clear financial terms

APR vs. APY in Crypto

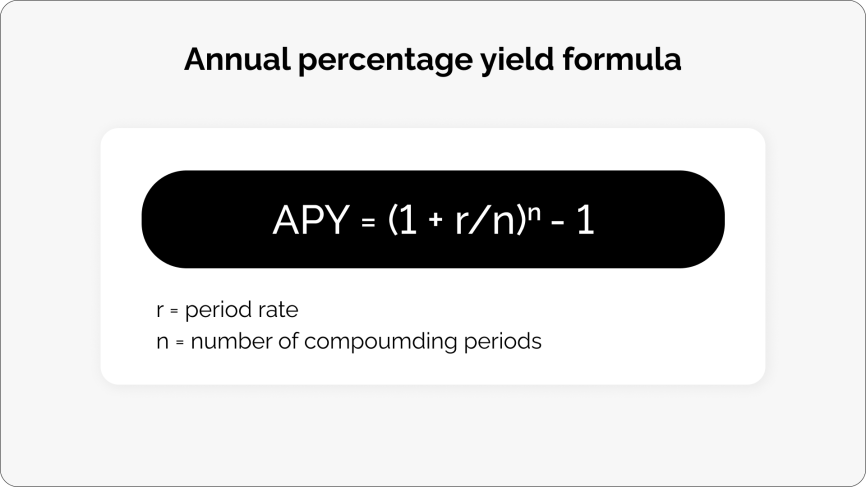

Being used to measure returns in crypto, APR and APY use different methods. APR is based on simple interest and excludes reinvestment effects. APY, on the other hand, includes compound interest and calculates earnings based on reinvested rewards.

Assuming familiarity with the APR formula, let’s now see the APY formula:

APR remains the standard for products that offer fixed rates, while APY is more common in strategies involving reinvestment.

Here’s a comparison of the key differences between APR and APY:

- Calculation method

APR uses simple interest without reinvesting returns.

APY includes compound interest, accounting for reinvested earnings over time. - Complexity

APR is straightforward and easy to calculate.

APY varies depending on payout frequency and reinvestment schedules. - Common use cases

APR is typically applied to fixed-rate lending, staking, and basic DeFi products.

APY is often used in auto-compounding protocols and dynamic yield strategies. - Yield accuracy

APR provides a basic projection of potential returns.

APY reflects actual earnings by incorporating compounding effects. - Focus

APR emphasizes simplicity and clarity.

APY offers precision and a more realistic view of long-term returns.

Where Is APR Applied in Crypto?

APR is a key metric across various areas in DeFi, especially where simple, non-compounding returns are used to track yield or cost.

In lending platforms, APR shows the annual return for those who supply capital and the borrowing cost for those accessing funds.

Across DeFi protocols, APR applies to staking, yield farming, and liquidity mining programs that offer fixed-rate rewards.

Within liquidity pools, APR measures the base return earned by contributing tokens to decentralized exchanges.

Role of APR in DeFi Ecosystems

APR is a fundamental metric in DeFi that influences how users engage with protocols. It helps define the reward logic behind staking, lending and liquidity mining, and offers a simple, non-compounding view of potential returns.

Typical APRs range from 3% to 7%. However, they may rise under certain market conditions. Rates adjust based on governance decisions, token supply, and user activity.

While high APR can attract participants, it often signals higher risk, especially in newer or untested protocols. Thus, a high APR can be a reward metric and a risk indicator in DeFi.

Future Trends Shaping Crypto APR

The future of APR in crypto is driven by advancements in blockchain infrastructure. As protocols become faster and more efficient, platforms may introduce improved APR models. Automation through smart contracts can enable real-time updates, which makes APR adjustments more accurate and timely. Additionally, AI-powered systems may dynamically adjust APR based on live market conditions.

As DeFi grows, APR mechanisms may become more flexible and transparent.

Conclusion: what APR means in crypto and why it matters

In crypto, APR shows the projected yearly return or borrowing cost based on simple, non-compounding interest. It is used to compare yields across DeFi platforms and to measure base returns in staking, lending, and liquidity pools.

APR depends on factors like:

- Asset type and market demand

- Platform mechanics and tokenomics

- Loan-to-Value ratios and volatility

- Governance decisions and user activity

APR isn’t always fixed, which means it is always necessary to monitor changes in the market and other parameters influencing APR. While a higher APR may offer greater returns, it can also signal greater risk, especially in less-established protocols.

Future developments may bring real-time APR adjustments, AI-driven yield optimization, and more flexible APR models — all contributing to a more dynamic and transparent DeFi experience.

Other Terms from the Crypto Industry