What are Crypto Gas Fees?

Gas fees are the payments users make to blockchain validators (or miners) for processing and confirming transactions or actions on the network.

Table of contents:

Gas fees are the costs required to carry out transactions or operations on a blockchain. These fees go directly to validators who secure and maintain the network. Any on-chain action, whether it’s transferring tokens, using a decentralized app (dApp), or executing a smart contract, triggers a gas fee.

Gas reflects the computational power needed to complete these actions. The more complex the task, the more gas it consumes. Ethereum is a well-known chain that uses this model. Similar systems also exist on Polygon, BNB Smart Chain, and others.

On blockchains like Bitcoin or Solana, the term transaction fee is more common, though the principle is similar.

On Ethereum, gas fees perform the following functions:

- They reward validators for processing transactions.

- They prevent spam by making each action cost something.

- They prioritize operations during high-demand periods thanks to priority fees.

Since the Ethereum upgrade called EIP-1559, the gas fee structure has been divided into two components. The first is the base fee, which automatically adjusts according to current network demand and is permanently removed from circulation. The second is the tip, also known as the priority fee, which users can add voluntarily to encourage validators to process their transactions more quickly.

Users can define the maximum fee they agree to pay. If network activity is high, those willing to pay higher tips get processed first. Gas pricing is market-driven and fluctuates in real-time.

Note: Gas fees are separate from platform-level charges. CoinsPaid may apply additional service fees in accordance with its own pricing policy and terms of use.

How Do Crypto Gas Fees Work?

Each transaction on Ethereum and similar networks must include a gas fee. Without it, blockchains would become vulnerable to abuse and could not operate reliably.

Here’s a step-by-step breakdown:

- A user initiates an action. It can be a token transfer, swap, or smart contract call.

- They define a gas limit (maximum work) and gas price (payment per unit).

- The transaction goes to the mempool, the waiting area for pending transactions.

- Validators prioritize transactions offering the highest reward.

- The transaction enters a block and is confirmed on-chain.

Faster confirmations require higher fees. This structure creates a self-regulating system that keeps decentralized networks orderly and secure.

What Affects the Cost of Gas?

Gas fees vary constantly.

Three main factors influence the total cost:

- Network demand. When many users compete for space in the next block, gas prices surge. Congested periods can raise costs sharply, especially during token launches or market volatility.

- Transaction complexity. Simple transfers require less work – about 21,000 gas units. Smart contracts with multiple steps can consume over a million units.

- ETH price. Gas is paid in ETH. If ETH rises in value against fiat currencies, the cost of gas in dollars also increases, even if the gas price in gwei remains unchanged.

Basic formula:

Gas fee = Gas limit × Gas price (in gwei)

Example:

21,000 units × 20 gwei = 0.00042 ETH

During high-demand events, fees have spiked above $10,000 for a single transaction. In contrast, when activity is low, fees drop significantly, allowing more operations at a lower cost.

Understanding how gas works helps businesses plan transaction strategies and control blockchain operating costs.

How Can Gas Fees Be Reduced?

Frequent blockchain use can become expensive. Businesses that rely on smart contracts or dApps often look for ways to manage gas costs effectively.

Here are proven methods:

- Leverage Layer 2 networks. Solutions such as Arbitrum and Optimism process transactions off the main Ethereum chain. Results are then posted back on-chain, lowering cost and latency.

- Optimize smart contracts. Efficient code saves gas. Platforms that specialize in auditing and contract optimization help reduce unnecessary computation.

- Use low-traffic periods. Fees drop during quiet hours. Early mornings, weekends, and public holidays often show reduced congestion. Real-time tools, such as publicly available Ethereum gas trackers, can help identify optimal times. Businesses should ensure these tools are reliable and compliant with applicable standards.

- Batch transactions. Some DeFi platforms allow combining several actions into one transaction. This technique cuts overall gas use.

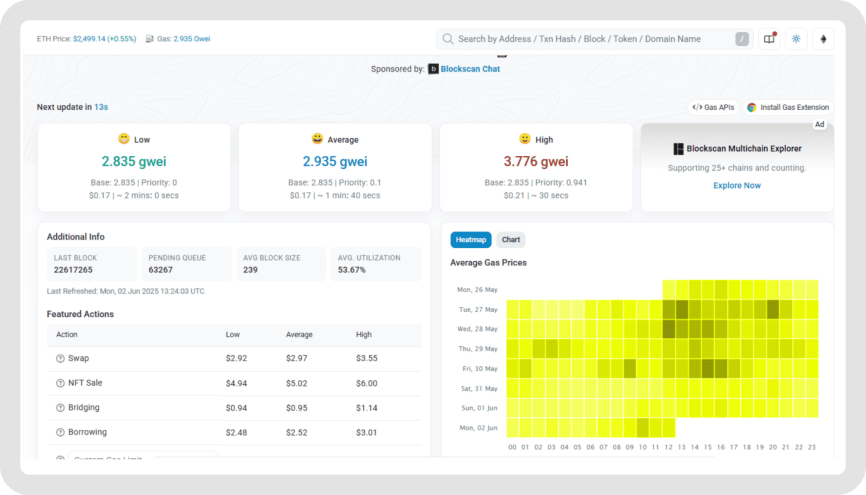

- Monitor live gas prices. Using dashboards that show current gas prices helps businesses schedule transactions at better rates.

Which Crypto Networks Have the Lowest Gas Fees?

For businesses that launch crypto payment services using a ready-made crypto SaaS platform, gas fees can have a direct impact on scalability and profitability. Choosing networks with lower transaction costs helps maintain healthy margins and delivers a smoother experience for end users.

Here is a comparative view of major blockchain networks with varying gas fees:

- Ethereum uses a Proof of Stake model and handles between 14 to 45 transactions per second, with fees ranging widely from $1 to over $150, depending on network congestion.

- Solana combines Proof of Stake with Proof of History to achieve a high throughput of around 65,000 transactions per second, while keeping average transaction fees around $0.00025, based on public blockchain data. However, actual fees may vary.

- Polygon, a scalable Proof of Stake network, processes up to 7,000 transactions per second and typically charges between $0.002 and $0.01 per transaction.

- BNB Smart Chain operates on a Proof of Staked Authority consensus, processes about 100 transactions per second, and offers fees ranging from $0.005 to $0.10.

- Avalanche, built on Proof of Stake, supports approximately 4,500 transactions per second and maintains average transaction fees near $0.01.

Fees may vary based on current network activity. Still, some blockchains consistently offer lower and more predictable transaction costs.

Networks with the lowest gas costs

- Nano (NANO). Zero fees. Its unique block-lattice structure eliminates transaction costs entirely.

- Stellar (XLM). Average fee: $0.00001. Ideal for cross-border payments and fast settlements.

- Ripple (XRP). Average fee: $0.0002. Focused on global transfers with low-cost execution.

- Solana (SOL). Average fee: $0.00025. Offers rapid processing and low fees at scale.

- Algorand (ALGO). Flat fee: $0.001. Efficient and fast, built for consistent throughput.

- NEAR Protocol (NEAR). Around $0.001. Built for scalability with low gas as a core feature.

- Polkadot (DOT). Around $0.002. It supports cross-chain communication with low-fee models.

- Stratis (STRAX). Fixed fee: $0.001. This is an enterprise-focused blockchain with predictable costs.

- Zilliqa (ZIL). Around $0.01. It uses sharding for efficient processing of dApps.

- Litecoin (LTC). Fees range between $0.03 – $0.04. It’s known for its fast and low-cost transactions.

- Bitcoin Cash (BCH). Average fee: $0.0024. It’s built for peer-to-peer payments with minimal cost.

Gas fees are a core component of how blockchains operate. They keep networks secure, incentivize participation, and allocate resources fairly. For businesses, understanding how gas fees work and choosing the right networks makes a measurable difference in cost efficiency.

Conclusion: why gas fees are important in crypto operations

Gas fees are an important part of how blockchains work. They are meant to support security, prioritize transactions, and reward validators.

Fees may vary across networks, from Ethereum’s dynamic model to near-zero-fee alternatives like Solana and Stellar. Infrastructure choices, contract design, and Layer 2 solutions influence transaction costs and speed.

Key points about gas fees:

- They determine transaction speed and priority.

- They affect the cost of using different networks.

- They reward validators who maintain the blockchain.

Understanding gas mechanics is important for analyzing network efficiency and planning blockchain operations.

Disclaimer: Gas fees and blockchain transaction costs are variable and depend on network conditions, platform design, and market factors. This page is for informational purposes only and does not constitute financial advice or a recommendation of any specific network.

Other Terms from the Crypto Industry