What is Whitelist in Crypto?

A whitelist in crypto refers to a list of pre-approved users who are granted early access to token presales, NFT mints, or other blockchain events.

Table of contents:

Definition of a Crypto Whitelist

In cryptocurrency, a whitelist is a collection of approved wallet addresses that are granted priority access to blockchain-based events. These events include token sales, Initial Coin Offerings (ICOs), NFT mints, airdrops, and early entry to DeFi platforms.

Only individuals or entities that meet specific eligibility requirements can join the list. These criteria often involve identity verification, contribution to the community, or pre-defined investment thresholds.

Purpose of Whitelisting in Blockchain Projects

Whitelisting is a mechanism used by blockchain teams to manage access during high-demand events. It plays a significant role in maintaining integrity, especially during fundraising phases such as ICOs or token launches. By controlling participation, projects reduce the risk of automated bots, fake accounts, and unauthorized users gaining access.

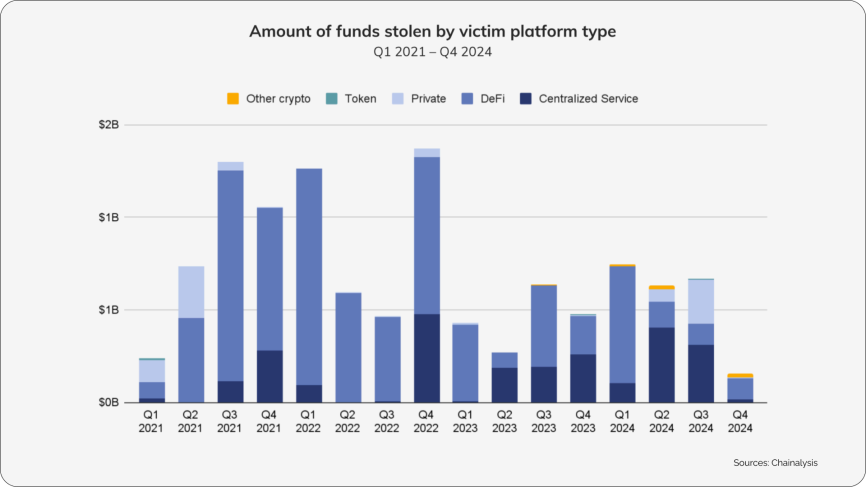

According to the 2025 Crypto Crime Report, DeFi platforms were the primary target of digital asset theft between 2021 and 2024.

It underlines the importance of risk mitigation tools like whitelists that help ensure a more secure and transparent distribution process.

Benefits of Whitelists for Projects and Participants

Whitelists serve distinct functions for different stakeholders.

For investors:

- Early access to limited token offerings or NFT drops.

- Preferential pricing and improved terms.

- Lower gas fees due to reduced network congestion.

Access before the public launch can increase the potential for return on investment, especially when demand goes up post-launch.

For developers and project teams:

- Greater control over who interacts with smart contracts.

- Prevention of network overload and fraudulent activity.

- Accurate forecasting of participation and demand.

By screening and pre-approving users, teams can create a safer, more predictable launch environment.

How Whitelists Operate in the Crypto Ecosystem

Whitelists are structured systems with defined entry requirements. They ensure only qualified participants get access to high-profile or early-stage crypto events. These restrictions contribute to fairness, transparency, and compliance.

What Are the Whitelist Criteria?

Projects determine eligibility using a range of criteria. Common requirements may include:

- Submission of personal details (name, email, wallet address).

- KYC (Know Your Customer) verification.

- Proof of community involvement or engagement.

- Following or promoting the project on social media platforms.

Applicants often need to join community channels such as Discord or Telegram, where updates and announcements are shared.

Once approved, the wallet address is authorized to interact with the smart contract tied to the event. All other addresses are excluded.

In some cases, whitelist access is exclusive. Early supporters, brand ambassadors, or strategic partners receive priority.

What Is the Verification Process for Whitelist Access?

To be mentioned on a whitelist, users typically complete a formal registration process. It may involve:

- Connecting a crypto wallet.

- Filling out an application form.

- Providing identity documents for regulatory compliance.

Where required, KYC involves verifying the applicant’s identity through:

- Government-issued identification (passport or ID card).

- Proof of residence.

- Biometric verification or liveness checks.

For NFT projects, active community participation may be a deciding factor. Some projects only approve users who promote the project or stay consistently engaged in community channels.

What Are the Real-World Use Cases of Crypto Whitelists?

Whitelists are widely used across different sectors of the crypto space:

- Token sale whitelists. Pre-approved wallets gain access to purchase tokens before the public round.

- DeFi platform access. Early entry to staking pools, beta features, or governance rights may be limited to whitelisted addresses.

- ICO whitelists. Participants must pass the screening to invest during the initial offering stage.

- NFT whitelists. Only selected collectors are allowed to mint NFTs during the drop.

- Airdrop whitelists. Projects distribute free tokens to qualified users who have signed up or completed certain tasks.

What Are the Advantages of Whitelisting in Crypto?

Crypto whitelists offer several benefits:

- Access to discounted token prices.

- Reduced transaction fees and congestion during high-volume launches.

- Priority access to exclusive or limited-edition digital assets.

- Rewards for early community support and engagement.

- Improved user verification and reduced fraud risk.

- Security and transaction reliability.

In many cases, whitelist access also offers participation in governance processes, which gives the users influence over future project developments.

What Are the Limitations and Challenges of Whitelisting?

Despite all the benefits of whitelists in the crypto environment, it is not without drawbacks:

- Entry conditions may favor certain user groups, which creates concerns about fairness.

- Required personal data collection may conflict with decentralization values.

- Technical bugs or platform delays can block access for legitimate users.

- The manual verification process may be slow or prone to errors.

- Strict criteria may exclude valuable community members who fail to meet all requirements.

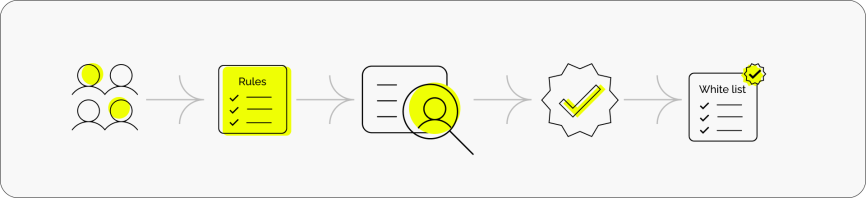

A whitelist workflow typically includes the following steps:

- user registration

- listing of eligibility requirements

- completion of KYC procedures

- approval of participants

- granting access to the specific blockchain event.

Whitelists function as a security and allocation tool in the evolving blockchain ecosystem. By regulating early access to sales, drops, and platform features, they help crypto projects build trust, reduce risks, and foster loyal communities. For serious participants, gaining whitelist access can unlock strategic advantages, both financially and operationally.

DeFi and regulatory whitelists

Whitelisting has become common in KYC-compliant DeFi platforms. Smart contracts often restrict access to users who have completed identity verification. This approach helps projects align with regulatory expectations, particularly in light of the EU’s 2023 MiCA framework and FATF guidance globally. While enforcement may vary by jurisdiction, limiting participation to verified users supports secure, transparent, and compliant decentralized finance operations.

Conclusion: whitelisting as secure access to blockchain opportunities

A crypto whitelist serves as an access control mechanism that ensures only verified or engaged users can participate in limited-access crypto events. Whitelisting enhances security, reduces bot interference, and promotes fair allocation of digital assets.

For project teams, whitelists help control participation and meet compliance requirements, including KYC obligations. For investors, they provide a structured and secure way to gain early access while ensuring transparency and adherence to regulatory expectations.

Other Terms from the Crypto Industry