What Is a Token in Crypto?

A token is a digital asset created on an existing blockchain that represents value, rights, or access within decentralized platforms.

Table of contents:

A crypto token is a digital unit of value created on an existing blockchain. Unlike cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), tokens are not native to the blockchain they live on. Instead, they are produced through smart contracts, most often on platforms like Ethereum.

Tokens can represent many things: digital access, ownership rights, or even physical assets. They play an important role in powering decentralized applications (dApps), enabling new digital economies, and facilitating peer-to-peer interactions in the Web3 space.

Types of Crypto Tokens

Crypto tokens can serve diverse purposes. Each type fits into specific roles across decentralized platforms and services. Below are common categories:

- Utility tokens (e.g., BAT, FIL, GLM). These tokens allow access to specific features, tools, or services within a blockchain project or application.

- Security tokens (e.g., Props, INX, BCAP). Security tokens represent ownership in real-world assets such as equity, debt, or real estate. They are subject to local securities laws and must comply with applicable regulatory requirements before being offered or traded.

- Stablecoins (e.g., USDC, DAI, XRP). Stablecoins are pegged to stable assets like fiat currencies or commodities. They are designed to reduce volatility and are commonly used for trading, payments, and preserving value.

- Non-fungible tokens (e.g., CryptoKitty, Bitcoin Ordinal, Quantum). Non-fungible tokens (NFTs) are unique digital assets that cannot be replicated or exchanged one-for-one. They are commonly used to prove ownership of digital collectibles, art, or media.

- Governance tokens (e.g., MakerDAO, Compound). Governance tokens allow holders to vote on decisions such as protocol upgrades or treasury allocation. They enable decentralized control within blockchain-based organizations.

- DeFi tokens (e.g., LINK, DOT, XLM). Used within decentralized finance systems, these tokens enable staking, lending, borrowing, and liquidity generation. Many also include governance features.

- Asset tokens (e.g., PAXG, PAX). These tokens are linked to tangible or intangible assets like gold, real estate, or intellectual property. They allow fractional ownership and increase liquidity.

- Wrapped tokens (e.g., wBTC, WETH, bLuna). Wrapped tokens mirror the value of a native cryptocurrency on a different blockchain, improving cross-chain compatibility.

- Meme coins (e.g., DOGE, SHIB, PEPE). Created primarily for community engagement or entertainment, these tokens often rely on viral trends rather than functional utility.

- Liquidity Provider Tokens (e.g., Sushi, Uniswap, PancakeSwap). Liquidity Provider (LP) tokens are issued to those who supply assets to decentralized liquidity pools. These tokens represent a share of the pool and can be redeemed or used in other protocols.

- Liquid Staking Tokens (e.g., stETH, rETH). Liquid Staking Tokens (LSTs) represent staked assets while allowing those assets to remain liquid. They provide ongoing staking rewards and can be used across DeFi protocols.

- Liquid Restaking Tokens (e.g., WEETH, LBTC, RSETH). Liquid Restaking Tokens (LRTs) are derived from LSTs and enable further yield generation through additional staking layers. They enhance capital efficiency within advanced DeFi ecosystems.

Token classification and regulations vary by country. This page is for informational purposes only and does not constitute legal or investment advice.

Token standards in crypto

Token standards define rules, protocols, and specifications that determine how digital tokens behave and interact within a blockchain. They ensure consistency, compatibility, and reliable integration across applications, wallets, and platforms.

The table below highlights key token standards and their purpose in major blockchain networks.

| Token standard | Blockchain | Function |

|---|---|---|

| ERC-20 | Ethereum | Standard for fungible tokens; enables integration with wallets and applications. |

| ERC-721 | Ethereum | Standard for unique, non-fungible tokens (NFTs) representing digital collectibles, art, and virtual assets. |

| BEP-20 | BNB Smart | Chain Token standard, similar to ERC-20, supports low-fee, fast transactions. |

| BEP-2 | BNB Beacon Chain | Defines token rules for operation within the BNB Beacon Chain ecosystem. |

| SPL | Solana | Standard for tokens on Solana. It ensures interoperability with wallets and smart contracts. |

The History of Crypto Tokens

Crypto tokens first appeared in 2012 with the creation of Mastercoin, an early protocol built on top of Bitcoin. Proposed by J.R. Willet, Mastercoin introduced the concept of issuing custom tokens and pioneered the Initial Coin Offering (ICO) model.

The token fundraising model gained traction between 2012 and 2016, culminating in the ICO boom of 2017. During this period, blockchain startups issued tokens to fund project development. While some teams delivered value, others fueled hype without long-term viability.

By 2018, the ICO market saw a sharp correction. This shift led to the emergence of Initial Exchange Offerings (IEOs), where token sales were hosted by crypto exchanges. IEOs aimed to bring more credibility and oversight to token distribution.

Why Tokens Matter

This paragraph explains how tokens work in Web3. Tokens play an important role in the functioning of blockchain ecosystems. They provide a programmable way to transfer value, assign rights, and coordinate activity without central intermediaries.

In Web3 environments, tokens serve as the core components for everything from access control to economic incentives. They support the infrastructure behind decentralized applications and enable programmable logic for transactions, rewards, and governance.

For companies and platforms, tokens can unlock new business models. They help automate complex workflows through smart contracts, streamline operations, and support new ways to collaborate and raise capital.

Tokens are also central to Decentralized Autonomous Organizations (DAOs), where community governance is handled entirely through token-based voting systems.

How Tokens Work

Tokens are created and managed through smart contracts. On Ethereum, most follow established standards like ERC-20 (for fungible tokens) or ERC-721 (for NFTs). These standards ensure consistent behavior across crypto wallets, exchanges, and applications.

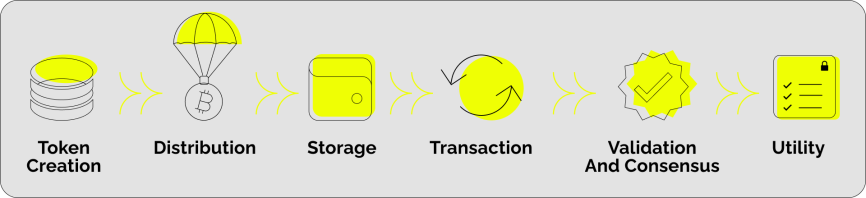

A token functions in the following way:

- Creation. Tokens are generated by deploying a smart contract. The contract defines supply limits, transfer rules, and other functionalities.

- Distribution. Tokens can be released through ICOs, airdrops, or incentives for participating in a blockchain network.

- Storage. Digital wallets, either software-based or hardware devices, hold and manage token balances.

- Transfer. When a token moves from one address to another, the blockchain verifies the sender’s balance and confirms the transaction.

- Consensus. Transactions are validated by the network and added to the blockchain using consensus protocols like Proof of Stake.

- Utility. Once issued, tokens can be used for a wide range of functions, including access control, trading, staking, and governance.

Crypto Tokens vs. Cryptocurrencies

Though often used interchangeably, crypto tokens and cryptocurrencies are different.

A cryptocurrency is the native digital asset of a blockchain. It secures the network, validates transactions, and often serves as a medium of exchange. Bitcoin and Ethereum are examples.

A crypto token, on the other hand, is built on top of an existing blockchain. It uses the network’s infrastructure to operate, but serves a distinct purpose, such as granting access, representing value, or enabling platform features.

Let’s see the difference between them:

1. Blockchain ownership

- Cryptocurrency runs on its own native blockchain (e.g., Bitcoin on the Bitcoin network).

- Crypto tokens are built on top of an existing blockchain, typically Ethereum.

2. Primary purpose

- Cryptocurrency functions as a digital currency used for payments, transfers, and value storage.

- Crypto tokens are used to access features, represent assets, or support governance and rewards in platforms.

3. Creation method

- Cryptocurrency is generated through mining (Proof of Work) or staking (Proof of Stake).

- Crypto tokens are created via smart contracts deployed on an existing blockchain.

4. Control and governance

- Cryptocurrency is fully decentralized and governed by network consensus.

- Crypto tokens may be managed by a decentralized protocol or a centralized team, depending on their structure.

5. Value drivers

- Cryptocurrency is influenced by market demand, network adoption, and supply dynamics.

- Crypto tokens may include algorithmic controls, fixed supplies, or be pegged to real-world assets.

Conclusion: crypto token explained

Being programmable digital assets, tokens operate through smart contracts and can represent value, access, or rights within decentralized platforms and applications.

Tokens support many use cases. Their flexibility makes them important for the growth of decentralized economies and digital business models.

The table below outlines common token types, examples, and their functions:

| Token type | Example | Function |

|---|---|---|

| Utility tokens | BAT | Access platform features or services |

| Security tokens | Props | Represent ownership in real-world assets |

| Stablecoins | USDC | Maintain a stable value for payments or savings |

| NFTs | CryptoKitty | Represent unique digital assets or collectibles |

| Governance tokens | MakerDAO | Vote on protocol decisions and upgrades |

| DeFi tokens | LINK | Enable staking, lending, borrowing, or yield farming |

| Asset tokens | PAXG | Fractional ownership of physical or digital assets |

| Wrapped tokens | wBTC | Mirror value of a cryptocurrency on another chain |

| Meme coins | DOGE | Used for community engagement or entertainment |

| Liquidity provider tokens | Sushi | Represent a share of a liquidity pool |

| Liquid staking tokens | stETH | Earn staking rewards while remaining tradable |

| Liquid restaking tokens | WEETH | Generate extra yield by staking across layers |

In short, tokens are the building blocks that make decentralized finance, digital ownership, and blockchain-based businesses possible.

Other Terms from the Crypto Industry