Unlock XRP Payments: Use Ripple for Secure Transactions

Unlock the potential to accept XRP payments and ensure smooth monetary transactions with XRP, often mistakenly dubbed as Ripple. XRP is not just an alternative but also a swift and affordable solution compared to Bitcoin. Dive into this guide as we walk you through sending XRP, tapping into its capabilities for online payments, and decoding the complexities surrounding its future.

A Guide to XRP Payments: Insights and Tips by CoinsPaid

Deciphering Ripple and XRP

Contrary to popular misconception, Ripple and XRP are distinct:

Ripple: A nod to the settlement network and the transfer mechanism hailing from Ripple Labs, Inc. XRP: The potent digital currency that pulsates on the XRP Ledger.

While ‘XRP’ is the accurate terminology, for the ease of our readers, we might use ‘Ripple’ sporadically in this guide.

Comparing XRP and BTC in Online Payments

The digital realm is awash with Bitcoin transactions. But XRP is emerging as a contender, renowned for its speed and affordability. Completing in mere seconds and costing less than a penny, it’s clear why businesses are flocking to accept Ripple payments. For crypto beginners, XRP can be an economical gateway.

Setting Up XRP: Wallets vs. Exchanges

Venturing into XRP? Secure a dedicated blockchain wallet. Given its unique blockchain, the XRP Ledger, it’s essential to note that Bitcoin addresses won’t gel with XRP. Wallets that have seamlessly integrated and accept XRP include Abra, Atomic Wallet, Edge, and Guarda Wallet.

Don’t forget the 20 XRP Reserve: The XRP Ledger mandates a non-retrievable reserve to stave off unnecessary address proliferation that could overwhelm the blockchain.

For exchanges, the 20 XRP rule doesn’t apply, thanks to shared addresses. It’s a boon for minimal transactions but remember, it’s not the safest haven for sizeable cryptocurrency hoards.

Purchasing XRP Using a Bank Card

Join the XRP bandwagon effortlessly using credit cards via stalwarts like Binance, Coinbase, CEX.io, and more. Plus, CoinsPaid du Business Wallet, a premier Ripple payment processor, has your back too.

Still, bear in mind the necessity for identity verification (KYC) – it’s the norm. Equipping yourself with details about transaction fees can also save you from unexpected expenses.

Understanding XRP Address Formats and Destination Tags

Equip yourself with knowledge about the:

- Regular Address (r-address): Essential for XRP transfers.

- Destination Tag: The key for transactions involving shared addresses on exchanges.

- X-address: An innovation by Ripple that’s gradually gaining traction.

Transferring XRP

Once you’ve got a grip on addresses and tags, sending XRP becomes a breeze. Just ensure you’re equipped with recipient details, maintain an XRP buffer beyond the 20 XRP reserve, and key in data accurately.

Making Online Purchases with XRP

The digital marketplaces that accept Ripple are burgeoning. The upper hand XRP has over conventional payment avenues is its stellar acceptance rate. Employ trusted ripple payment gateways like CoinsPaid to assure a hassle-free transaction journey.

The Future of XRP: Potential Hurdles

While XRP holds promise, it’s not without its set of challenges:

- Ripple’s stranglehold on the lion’s share of XRP.

- Legal tussles with the U.S. Securities and Exchange Commission (SEC).

- The advent of state-backed digital currencies.

Yet, Ripple’s recent legal triumphs and their roadmap featuring smart contract integration are rays of hope.

Accept Ripple Payments with ease and capitalize on its unique offerings. With a sprinkle of insight, XRP can easily be your top pick for digital transactions.

Why should you consider accepting XRP?

Global Reach: XRP operates beyond geographical constraints. Engage with customers globally without the hassle of currency conversions or cross-border fees.

Lower Transaction Costs: Traditional banking methods and online transfers often come with fees and exchange rates. Accepting XRP can help in minimising these expenses.

Fraud Reduction: Once a payment is made with XRP, it’s irreversible. This secures businesses from potential losses due to fraudulent activities.

Access to a New Customer Base: The popularity of XRP is growing. By embracing XRP as a payment method, businesses can cater to a niche segment that prioritises this digital asset.

Enhanced Privacy: Transactions with XRP provide greater anonymity compared to most payment methods. This level of privacy might be favoured by many customers.

Accepting XRP reflects a progressive approach. Incorporating XRP payments not only showcases your business as innovative and customer-centric but also places you at the forefront of financial evolution.

Furthermore, with the increasing ease of converting XRP to traditional currencies, business operations remain seamless.

If you’re looking to broaden your payment channels and explore untapped revenue streams, now is the time to integrate XRP. Partnering with a reliable platform like CoinsPaid ensures you make the most of this digital currency transition securely and efficiently.

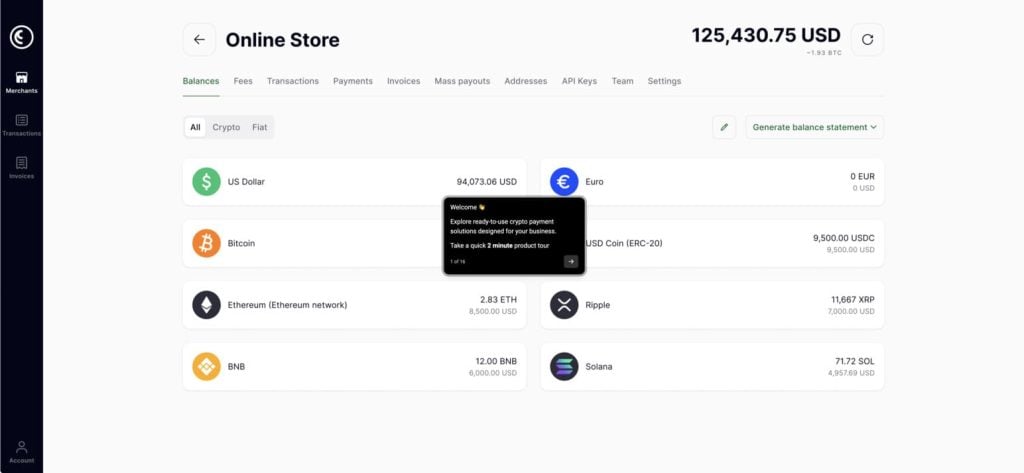

Why Select CoinsPaid as Your Go-to Crypto Payment Partner?

Positioning itself at the pinnacle of the crypto payment landscape, CoinsPaid provides businesses with a trustworthy, compliant, and economical mechanism to manage crypto exchanges. With nearly a decade in the industry and collaboration with over 800 esteemed merchants, it adeptly tailors to a spectrum of business preferences with its comprehensive payment solutions.

CryptoProcessing.com embraces a selection of 20 prominent digital currencies, like Bitcoin, Tether, Ethereum, and Litecoin. In addition, it offers instantaneous conversions to 40 global currencies, ensuring businesses remain unburdened by holding onto cryptocurrencies. Withdrawing is a breeze, effortlessly channelling funds straight into the designated merchant banking accounts.