What Is an ASIC in Crypto?

An ASIC (Application-Specific Integrated Circuit) is a chip built to mine a specific cryptocurrency algorithm with maximum speed and efficiency.

Table of contents:

An ASIC (Application-Specific Integrated Circuit) is a custom-designed microchip built to perform one specific task. It executes a single algorithm with fast speed and energy efficiency.

In the context of blockchain networks, ASICs are primarily used to mine cryptocurrencies such as Bitcoin (SHA-256) or Litecoin (Scrypt).

ASICs are engineered exclusively for one mining algorithm. This single-purpose architecture allows them to deliver high computational power, lower energy costs, and consistent performance in high-load mining environments.

The Role of ASICs in Crypto Mining

ASIC miners serve as the backbone of many large-scale crypto mining operations. Their design enables them to perform cryptographic calculations at scale, which helps to validate transactions and secure blockchain networks.

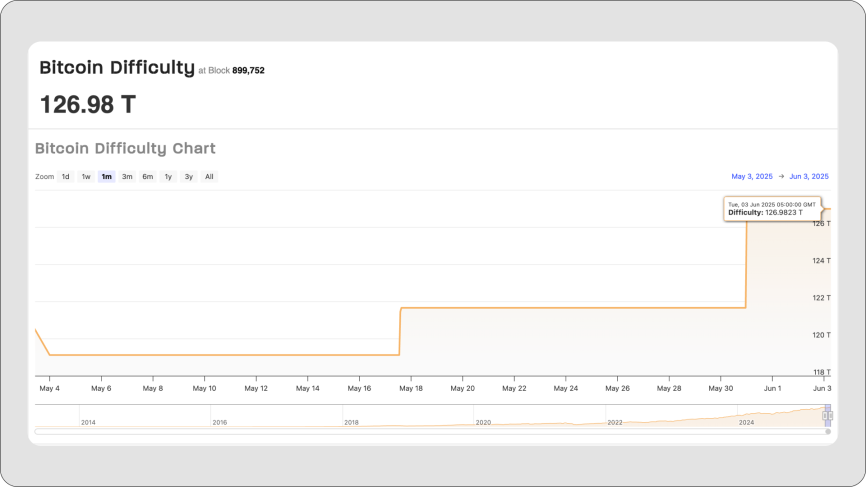

For example, in the Bitcoin network, where mining difficulty can exceed 120 trillion, the need for powerful, efficient computing is non-negotiable. ASIC devices are built to meet this demand with minimal operational overhead. They enable fast block validation, ensure high uptime, and maintain the integrity of decentralized networks.

In commercial mining farms, ASICs play a key role. Without them, sustaining profitability and competing in high-difficulty networks would be virtually impossible.

Why ASIC Mining Hardware Matters

ASIC miners deliver the highest hash rates available for a given algorithm. Their single-function architecture cuts out unnecessary components, which leads to more hashes per second and optimized power usage.

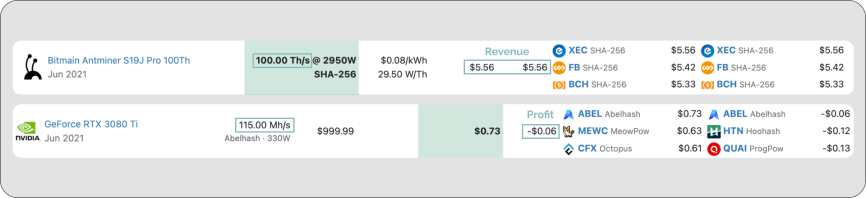

To illustrate: A Bitmain Antminer S19j Pro offers a hash rate of approximately 100 terahashes per second (TH/s). In contrast, a top-tier GPU like the NVIDIA RTX 3080 generates around 115 megahashes per second (MH/s). It would take nearly 1,000 GPUs to equal the output of just one ASIC device.

From an operational perspective, ASICs also win on energy efficiency. The Antminer S19 Pro, for example, uses about 3,250 watts. A six-GPU mining rig may consume over 1,200 watts while delivering significantly lower performance. This imbalance affects long-term costs and scalability.

As mining difficulty increases over time, ASICs help maintain consistent block times and network stability by keeping up with computational demands.

How ASIC Miners Operate

Each ASIC miner integrates hardware and firmware designed for a specific proof-of-work algorithm.

These devices include:

- Custom chips engineered for one hashing function.

- Firmware that fine-tunes efficiency and monitors stability.

- Onboard controllers to manage task execution.

- Power-efficient circuitry to reduce energy waste.

- Air-based or liquid cooling systems for thermal regulation.

- Ethernet ports for uninterrupted connectivity to mining pools.

Performance metrics such as hash rate, power draw, and internal temperature are monitored via control panels or remote dashboards. These tools allow operators to optimize output, reduce downtime, and extend hardware lifespan.

ASICs in Proof-of-Work Blockchain Networks

Many proof-of-work cryptocurrencies rely on ASIC mining. These include Bitcoin, Litecoin, Kaspa, and others. As network difficulty increases, general-purpose devices like CPUs and GPUs become inefficient. ASICs maintain competitiveness by offering the power needed to process complex algorithms rapidly and cost-effectively.

Each ASIC model supports only one algorithm. It ensures fast block confirmations and scalable transaction validation. The majority of industrial mining farms use ASIC hardware to secure their market position and maximize throughput.

Benefits and Limitations of ASIC Miners

While ASIC miners dominate in terms of efficiency, they do limit operational flexibility. Their cost and algorithm specificity can pose barriers, particularly for smaller or diversified mining setups.

Let’s estimate its strong and weak sides!

Advantages:

- Unmatched performance. ASICs deliver exceptional hash rates.

- Superior energy efficiency. They provide more hashes per watt than any alternative.

- Compact footprint. Units are standalone and space-efficient.

- Easy deployment. Plug-and-play setups reduce complexity.

- Operational consistency. Designed for long-term stability.

Limitations:

- Algorithm lock-in. Devices support only one mining algorithm.

- Capital intensity. Upfront hardware costs are high.

- Centralization concerns. Powerful ASICs favor large mining operations.

- Environmental demands. Devices generate heat and noise, which require specialized cooling and space.

Top ASIC Models for Cryptocurrency Mining

Below are widely spread models across various categories:

Bitmain Antminer S21 Pro

- Algorithm: SHA-256 (Bitcoin)

- Hash rate: 234 TH/s

- Power consumption: 3,510W

- Efficiency: 15 J/TH

- Release year: 2024

- Ideal for: High-performance Bitcoin mining operations

Bitmain Antminer L9

- Algorithm: Scrypt (Litecoin, Dogecoin)

- Hash rate: 16 GH/s

- Power consumption: 3,360W

- Efficiency: 0.21 J/MH

- Optimal for: Scrypt-based coin mining

Bitmain Antminer KS5 Pro

- Algorithm: KHeavyhash (Kaspa)

- Hash rate: 21 TH/s

- Power usage: 3,150W

- Efficiency: 150 J/TH

- Designed for: Kaspa and other KHeavyhash networks

MicroBT Whatsminer M66S Hydro

- Algorithm: SHA-256

- Hash rate: 298 TH/s

- Power draw: 5,513W

- Efficiency: 18 J/TH

- Specialty: Liquid-cooled operations with large infrastructure

Canaan Avalon A1566

- Algorithm: SHA-256

- Hash rate: 185 TH/s

- Power draw: 3,420W

- Efficiency: 18.49 J/TH

- Suitable for: High-throughput Bitcoin farms

Choosing an ASIC depends on the target algorithm, power efficiency, and infrastructure capacity.

ASICs have become the cornerstone of efficient cryptocurrency mining. They offer unmatched speed, power optimization, and algorithm-specific design tailored for scalable Proof-of-Work blockchains, which serve as the foundation for some crypto payment networks and decentralized applications.

Conclusion: what ASICs are and why they matter in crypto mining

ASICs are machines built to mine one algorithm with maximum efficiency. They have become essential in proof-of-work mining because they outperform GPUs in speed, energy use, and long term stability. While they can lower costs and secure networks, their lack of flexibility, high price, and environmental impact are real trade-offs.

Why ASICs matter:

- Scalability. Used in industrial farms to maintain profitability in high-difficulty networks.

- Stability. Help preserve consistent block times and network security.

- Cost efficiency. More hashes per watt means reduced long-term mining costs.

For competitive miners, ASICs are often the only viable option, but they also shape the mining landscape by concentrating power among those who can afford them.

Other Terms from the Crypto Industry