What is pump and dump

A pump and dump happens when a group of individuals buys a cheap token and creates hype to get others to buy. As the price jumps, they sell their tokens, which causes the price to fall quickly. People who bought late end up with tokens that lose most of their value. It usually happens very fast and can cause serious losses.

Table of contents:

What is pump and dump in crypto?

A pump and dump is a form of price manipulation that targets low-value or low-volume crypto tokens. It starts when a group buys large amounts of a token and spreads hype to attract buyers. As interest grows, the price spikes. The group then sells off its holdings, crashing the price. Late buyers are left with tokens that lose most of their value.

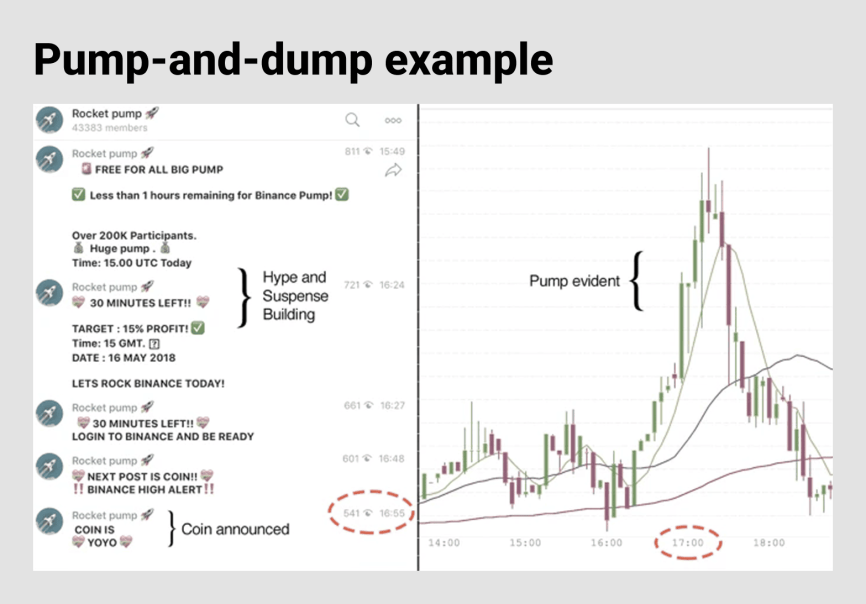

A pump and dump scheme often unfolds quickly, with prices rising and collapsing within minutes.

Visual representation of a pump and dump in crypto: price surge followed by a sharp crash.

In 2018, the University of New Mexico, in collaboration with Tel Aviv University and the University of Tulsa, conducted research that identified over 4,800 suspected pump-and-dump events within a six-month period. Many of them were organized via Telegram and Discord. In some cases, prices surged by as much as 18% in five minutes.

Common signs of a pump and dump may include:

- Sudden price spikes with no clear reason, sharp gains in minutes or hours

- Low-volume tokens that are easy to manipulate due to weak liquidity

- Aggressive marketing in Telegram groups, Reddit threads, or social media without real updates

- Unusual trading volume or large buy orders not backed by news or project developments

These patterns often point to coordinated efforts to mislead buyers and exit with profit. Many of the affected tokens lack real value or fundamentals and fail to recover after the dump.

How does pump and dump work?

Pump and dump schemes follow four main phases: pre-launch, launch, pump, and dump.

Here’s the breakdown of each phase:

- Pre-launch starts with creating hype around a nearly worthless token. Scammers use tactics like allowlists and pre-sales to attract early buyers. They often spread false news about big investors or companies backing the token. Posts create urgency, pushing people to buy quickly.

- During the launch, promoters bring in more buyers. These promoters, often with strong social media followings, use fear of missing out (FOMO) to convince others to join. Many buyers end up promoting the token themselves, spreading the hype further.

- The pump phase causes the token’s price to rise sharply. As more people buy in, the price climbs fast. It attracts even more late buyers who hope to profit.

- Finally, the dump happens when the scammers sell off their holdings at a high price. This flood of tokens causes the price to crash. Panic selling follows, but the tokens lose most or all of their value. The scammers keep their profits while most investors suffer losses.

The entire pump and dump cycle can take minutes, leaving little time for others to react. The example below clearly demonstrates it.

Pump-and-dump example: Telegram group ‘Rocket dump’ with 40,000+ members (left) and the resulting price spike of YOYO on Binance (right).

Where pump and dumps typically happen

Pump and dumps mainly occur in largely unregulated crypto markets. These markets offer many coin pairings, making low-value tokens easy targets.

While this scam has existed since crypto’s early days, the rise in new traders has expanded the number of potential victims. Many newcomers miss warning signs, which attract scammers.

Exchanges that list many low-volume coins are often targeted for pump and dump schemes, since the tokens are easier to manipulate and oversight is limited.

What are the red flags of a pump and dump?

Spotting a pump and dump requires attention and a healthy dose of doubt. Watch for these key warning signs:

- Sudden price and volume spikes. A sharp rise in price without any clear news is a red flag. For example, in 2021, the token Squid Game (SQUID) surged over 230,000% within days before crashing to nearly zero. It gained attention due to its name, borrowed from the popular Netflix series, and misleading claims of a play-to-earn game. But the project had no official ties to the show and offered no real product. Such rapid price and volume surges often signal manipulation. Legitimate projects usually show steady growth backed by real updates.

- Questionable token allocation. The way tokens are spread matters. If most tokens go to a few holders, they can sell large amounts at once, crashing the price. Look for full supply details, founders’ shares, and any lock-up or vesting periods. It’s possible to use blockchain explorers to verify.

- Unclear founder background. Transparency about the team behind a project is another important point to consider. Projects linked to anonymous or unverifiable founders have a higher chance of being scams. Scammers often reuse tactics or identities. Checking the founders’ history can help avoid these traps.

- Suspicious social media activity. Pump and dump schemes heavily rely on social media. Platforms like Telegram, X, and Discord are common places where these scams organize. Groups that promote pump and dump tokens often have thousands of bot accounts to inflate hype. It’s better to look for disabled comments, disproportionate follower-to-engagement ratios, and a flood of complaints or spam. Genuine communities encourage open discussion, unlike scam groups.

Why pump and dumps are dangerous

Pump and dump schemes cause real damage. Many people buy in during the hype, only to be left with tokens that quickly lose almost all their value. It leads to heavy financial losses for those caught in the cycle.

Beyond individual losses, these scams shake confidence in the crypto market. They fuel the view that cryptocurrencies are unstable and risky, which can scare off serious investors and slow industry growth.

At CoinsPaid, we support awareness around known cryptocurrencies to reduce exposure to high-risk tokens. However, we do not endorse any particular digital asset or offer investment advice. Our commitment is to create a safer and more transparent space for everyone involved.

You should always carefully choose which assets to accept as crypto payments on your site or through PoS terminals.

How to avoid a pump and dump

Pump and dump schemes often target new or thinly traded cryptocurrencies. It’s important to stay cautious and avoid making decisions based on hype.

Avoid buying coins or tokens because of social media tips or sudden price jumps. These are common tactics used to lure people in.

Research every project thoroughly. Look into the coin’s background, the team behind it, and its market activity. Separate real information from hype.

Following these simple rules helps users and companies to avoid a pump and dump:

- Don’t buy based on a single tip, especially from social platforms.

- Ignore ads or websites that promise quick profits.

- Avoid participating in pump and dump trades. Such manipulation can harm everyone involved.

- Remember that no investment is risk-free. Anyone who claims otherwise is likely to mislead you.

Staying informed and cautious remains the right way to protect yourself in the crypto world.

Is pump and dump illegal?

Pump and dump schemes are illegal in many countries, including the US and EU regions. Securities laws in these regions explicitly ban market manipulation.

It is important to understand the difference between natural market activity and manipulation. Genuine trading reflects supply and demand, backed by real factors. Pump and dump schemes rely on artificial hype to move prices quickly and unfairly.

For businesses that accept crypto assets, it matters. Accepting unstable or questionable tokens can expose merchants to sudden losses or reputational damage. Choosing well-known and trusted cryptocurrencies helps lower this risk.

"Accepting cryptocurrency is important for future-proofing your business, sure. But, it’s also about tapping into a global market, cutting costs, and offering a more secure, efficient way to transact right now."

This statement reflects the personal opinion of the CEO and does not constitute financial advice.

People and businesses should make decisions based on clear data, not emotions or fear of missing out. Letting hype lead can result in bad calls and major losses.

Conclusion

A pump and dump is a manipulative scheme where a group inflates the price of a cheap token through hype, then sells their holdings at the peak, causing a price crash. Late buyers suffer losses, while early insiders profit. This tactic is common in unregulated crypto environments and poses a serious financial risk to both individuals and businesses.

Understanding how these schemes work and how to spot them is crucial for anyone interacting with digital assets—especially companies accepting crypto as payment or using tokens in their operations.

Other Terms from the Crypto Industry