Crypto Market Update – May 2024

Introducing the Crypto Payments Market Update – a new segment where we’ll round up all the most important crypto-happenings of the last month and look forward to the near future of the industry. Of course, there’s a mandatory meme segment at the end!

Key Points

- The market is rallying around the Ethereum Spot ETF. ETH dominance is continuing into summer.

- With over $25b in crypto transactions, UAE is becoming one of the world’s biggest crypto hubs.

- Tesla adds Dogecoin payment options while Elon Musk is acquiring various payment licenses for X.

- Deutsche Bank joins Project Guardian in the effort to tokenize regulated financial markets.

- Argentina shows a crypto-positive outlook after meeting with El Salvador’s Digital Assets Commission.

- Revolut launches a standalone crypto trading platform, Revolut X, for a potential audience of over 40 million.

- In regulatory news, the EU releases MiCa standards as the US continues to wrestle with the FIT21 act.

Crypto Market Entering June 2024

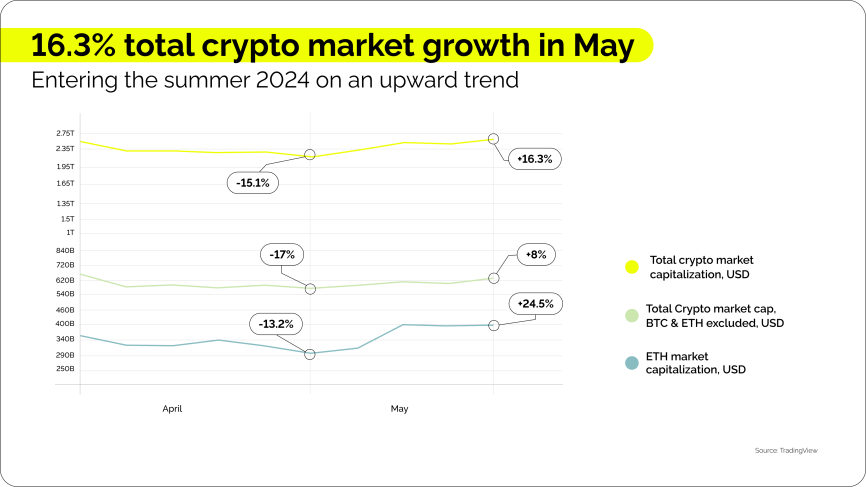

We’re going into the summer of 2024 on an upward trend, as the crypto market at large awaits the Ethereum Spot ETFs with bated breath:

Overall, May has been a month of stable growth for the industry – news about the ETF’s approval rallied the market, and it’s been witnessing over 50% ETH dominance at several points since then. This trend is expected to continue for the next month as individual firms get their SEC approvals.

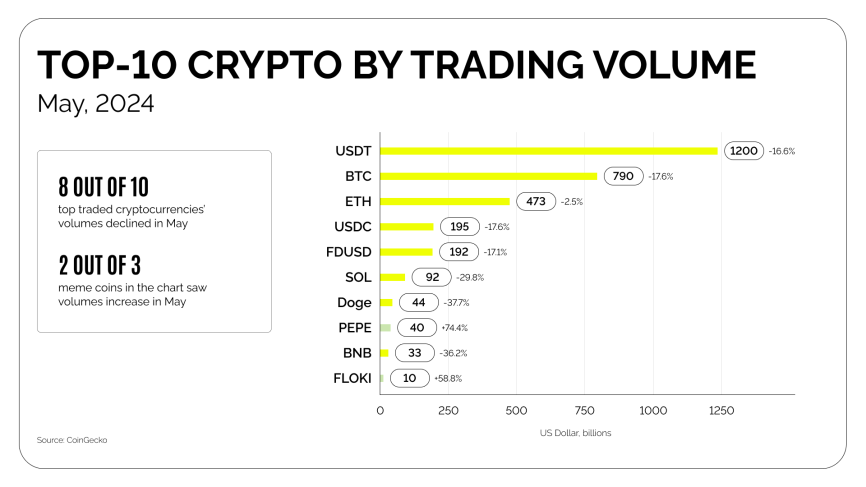

Let’s take a look at some of the top performers this month:

There are two interesting things here – Ethereum beating out BTC by volume at several points, showing clear anticipation of the spot trading ETF, and the PEPE topping the memecoin charts for the month when it comes to growth. Aside from that, stablecoins keep comprising above 91% of the daily market volume, continuing to prove their importance in the ecosystem.

Solana continues to perform favorably, experiencing a 17% rise in market cap during May and well on its way to making a big splash in trade. In general, the share of DeFi on the market is expanding as platforms mature and find new audiences in the growing crypto ecosystem.

Crypto News Rundown

It’s been an exciting month for crypto and DeFi due to the markets rallying, but what caused the rally in the first place? Let’s touch on the most important news of the month, starting with the obvious:

The ETH Spot ETF You Keep Hearing About

In the largest industry news, the US Security and Exchange Commission (SEC) finally approved spot Ether trading. Nine issuers, including BlackRock, are hoping to get in on the market. Individual ETF registration statements still need to be approved, which is expected to happen later this summer – some say as early as the end of June.

Where the US goes, the rest of the market follows – it’s been a trend since the industry’s inception. As mentioned earlier, this move has already rallied the markets to the point of Ethereum’s dominance over Bitcoin in May – and this trend is likely to continue during summer as the second largest crypto gets some much-deserved attention.

The UAE Boasts Over $25B in Crypto Transactions

Speaking of hot summers, the crypto payments market in the UAE is showing a lot of promise. The Dubai Multi Commodities Centre (DMCC) recently released a “Future of Trade” report. In it, they mention over $25 billion in crypto transactions performed in the country in 2022 – supercharging the payment markets. This is a strong signal that both traditional and new businesses are adopting crypto in the financial hub of Dubai.

The DMCC expects expansions of the digital infrastructure in the UAE and beyond. Growth of Web3 even warranted a separate report – predicting everything from the Metaverse to DeFi to grow near-exponentially in the next decade. For example, the current DMCC forecast for DeFi is a projected rise from $13.6b in 2022 to $600b by 2032.

The Bitpanda crypto exchange has heard this message loud and clear, opening a Dubai office. Their recent partnership with Raiffeisen Bank makes them the ones to watch – bringing crypto payments to retail investors in over 55 bank branches and now expanding to the Middle East.

Tesla Adds Dogecoin Payment Options

Elon Musk’s love for meme coins and Dogecoin in particular has hardly been a secret. Early in the month, the coin got even more attention from him as Tesla introduced Dogecoin payments to their website. This announcement made DOGE one of the top performers early in the month, marking an almost 21% growth – it’s been performing well on the market for the entirety of May.

Memes or not, crypto payment options have become the norm for luxury automakers. Ferrari already accepts crypto, and many dealerships of more traditional companies are also on board with it. The market continues to expand as major enterprises offer customers new forms of payment.

Going further, Musk’s crypto-friendly decisions continue to set a positive trend for the market. There’s some well-founded speculation that X (formerly Twitter) might be next on the DOGE payments train, as they’ve already been acquiring payment licenses in various US states, counting 25 to this date.

Deutsche Bank and the EU Explore Tokenization

The Monetary Authority of Singapore (MAS) has been exploring decentralized finance for some time, and now they’ve enlisted the help of Deutsche Bank to do it. Project Guardian is expected to test the feasibility of tokenizing assets by introducing them to regulated financial markets.

The European Central Bank recently released a report in a similar vein centered around tokenizing financial instruments. Their goal is to make central bank money a more attractive means of settlement with the help of distributed ledger technologies.

Blockchain has been a topic of hot discussion among Central Banks and financial institutions for many years, and most of them are already in advanced stages of testing this technology. However, these strides toward tokenization appear to be getting more practical as they get closer to the implementation stage.

Latin America’s Crypto-Positive Outlook

Argentina has recently shown interest in collaborating with El Salvador in its journey of adopting Bitcoin as a legal tender. While so far this only meant meetings between their respective authorities on digital assets, El Salvador’s experience is of great interest to Argentinian regulators, who may be following a similar path amidst a generally turbulent economic period.

As this story develops, a Brazilian challenger, NG.CASH secures the highest Series A round for a Latin American fintech so far in 2024 – raising $12.5 million in May. They aim to offer prepaid cards, crypto investing services, and their own marketplace.

Zooming out a bit, crypto companies at large have raised a total of $723.18M in May according to data from Cryptorank, which is roughly 50% down from April. This can be explained by most of April’s investments being related to the BTC halving, and markets turning somewhat more conservative when it comes to startup funding.

Revolut Doubles Down on Crypto

Last but not least in the major crypto milestones of May 2024 – Revolut, a trading platform with over 40 million customers, has launched Revolut X – their standalone crypto-trading platform. The UK’s largest fintech company boasts an offering of over 100 cryptocurrencies, integrated with the MetaMask-powered Revolut Ramp.

Revolut’s crypto commitment is well-known in the industry, and a move like this is going to create a powerful pipeline to the market from a startup with an established audience. As the trading and exchange markets grow, so does the industry at large with more capital flowing into crypto assets.

The Regulatory Landscape in May-June

In the US, the Financial Innovation Technology for the 21st Century Act has passed the House, which is the furthest a crypto regulation has made it in the US legislative system so far. The bipartisan nature of the bill shows that US lawmakers are slowly gaining some form of consensus over the role of crypto in the country. However, whether the bill makes it all the way through the system is still unclear.

At the same time, the House also passed a bill that forbids the Federal Reserve from issuing a digital dollar CBDC without explicit authorization from the Congress. Caution around CBDCs is nothing new, however, this move could notably slow down the efforts of the Federal Reserve when compared to various Central Banks around the world.

In the EU, the European Banking Authority (EBA) has unveiled the final draft of their expected technical standards under MiCA. These included information requirements, criteria, and general expectations for crypto-asset service providers. It’s expected to help EU member states with comprehensive regulation of crypto, and MiCA as a whole continues to set an example for other legislators to follow.

Speaking of the EU, if you’re looking for a regulated and licensed crypto solution, give us a shout – we always stay on top of the latest standards and compliance expectations:

What’s Next for Crypto?

In crypto trends, the anticipation of the Ether ETF is expected to keep dominating the markets, so we should expect a new surge of projects on the network. Between the Bitcoin ETF and the Ethereum ETF, crypto is increasingly becoming part of the financial system, reaping the benefits of increased demand. The BTC ETF also generally lowered the volatility to Bitcoin, so the same should be expected for Ethereum.

For crypto payments, the positive example of the UAE shows us what’s possible at crypto-positive financial hubs. Retailers, luxury brands, and digital service providers continue introducing crypto options to their audiences, with innovators like Musk at the forefront of both pushing the market forward – evangelizing meme coins does a surprising amount of good for the industry.

In DeFi trends, there’s a growing interest in integration with traditional financial systems. The rise of Solana and its attempts to bridge the gap between TradFi and DeFi creates a strong expectation for the next potential trend – symbiotic relationships between decentralized smart contracts and existing financial instruments. This could go anywhere from becoming a regulatory nightmare to the next big opportunity on the market.

June is likely to invigorate the interest in crypto as large financial institutions show strong interest in the market. The steadfast movement of FIT21 through the US regulatory pipeline is a strong indicator of the same trend – the inevitable growth of crypto and the ‘tokenization’ of the financial system at large – slowly but surely gaining dominance over payments and asset trading.

Overall trends going into summer:

- Ether dominance is expected to continue.

- Brands in major financial hubs keep adopting crypto payments.

- Blockchain startup investments are likely to pick up as markets rally.

- Crypto continues to march through financial institutions.

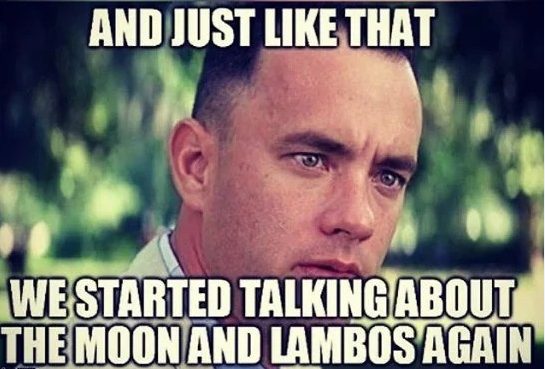

The Mandatory Meme Section

Many of the best memes of May have something to do with the impending ETH ETF as it rallies the markets:

Naturally, no conversation about Ethereum is complete without mentioning the logo:

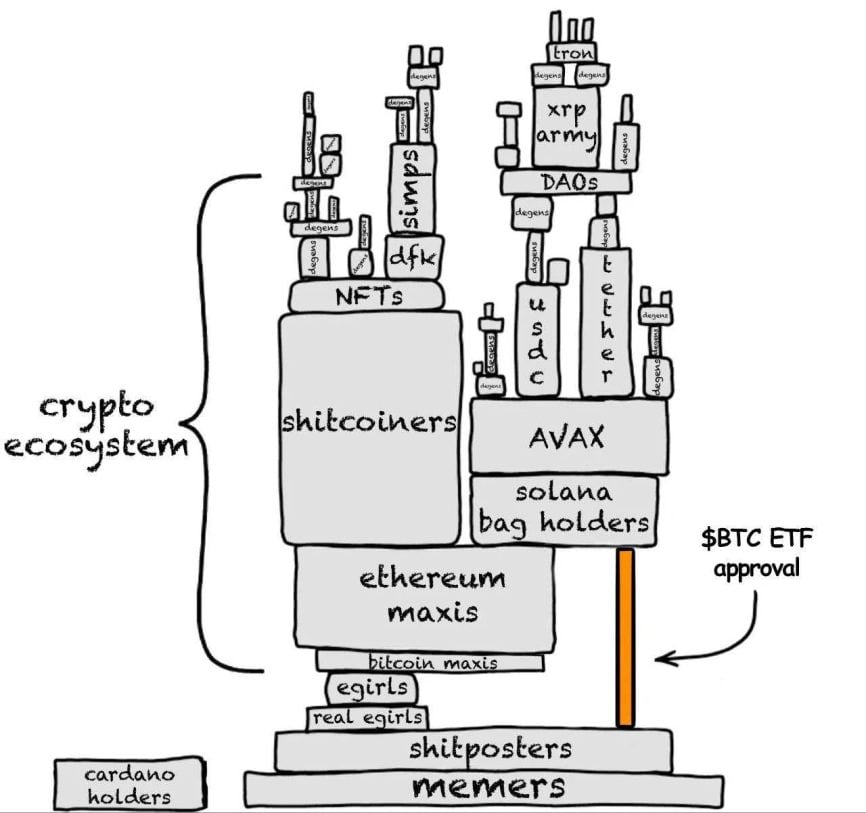

Memes about the fragile crypto ecosystem never get old, and this one may be the most illustrative of them all:

The ETH ETF approval may just create another propping point for the Jenga tower to hold!

We’ll be back with another market update next month. For now, if you happen to own a business – check out how we can help expand your audience and grow with the help of innovative crypto payment processing solutions.